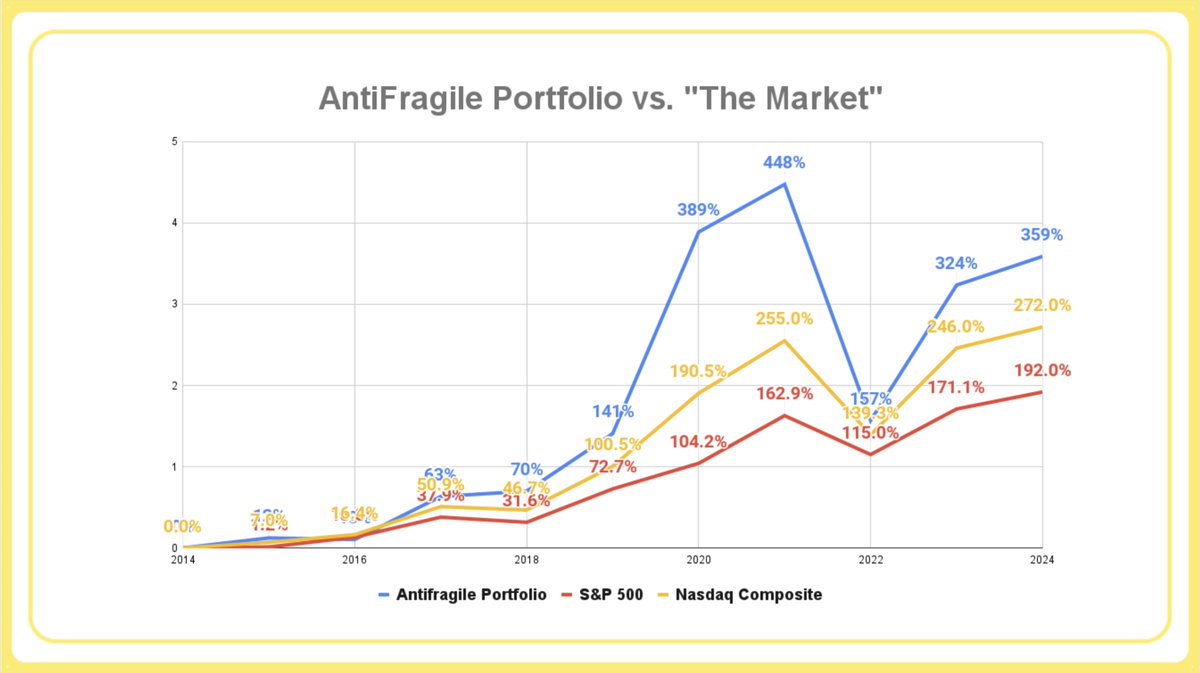

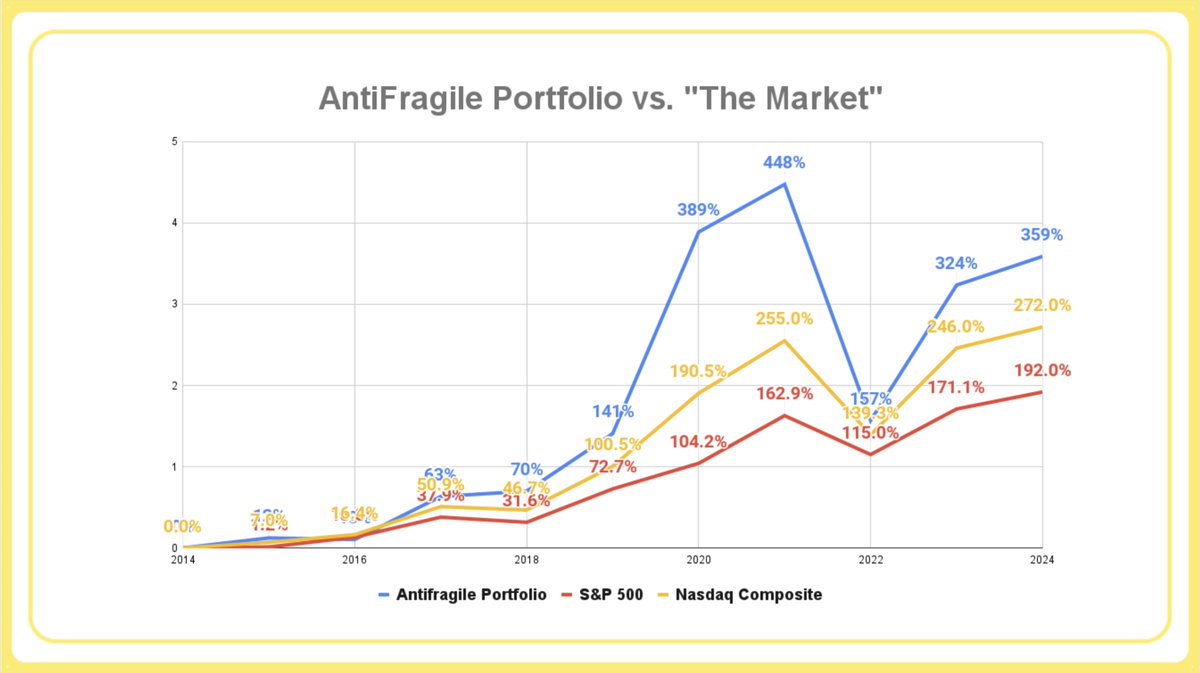

"The Anti-Fragile Investor" | I demystify the stock market | My portfolio: https://t.co/w0anZAuv92

39 subscribers

How to get URL link on X (Twitter) App

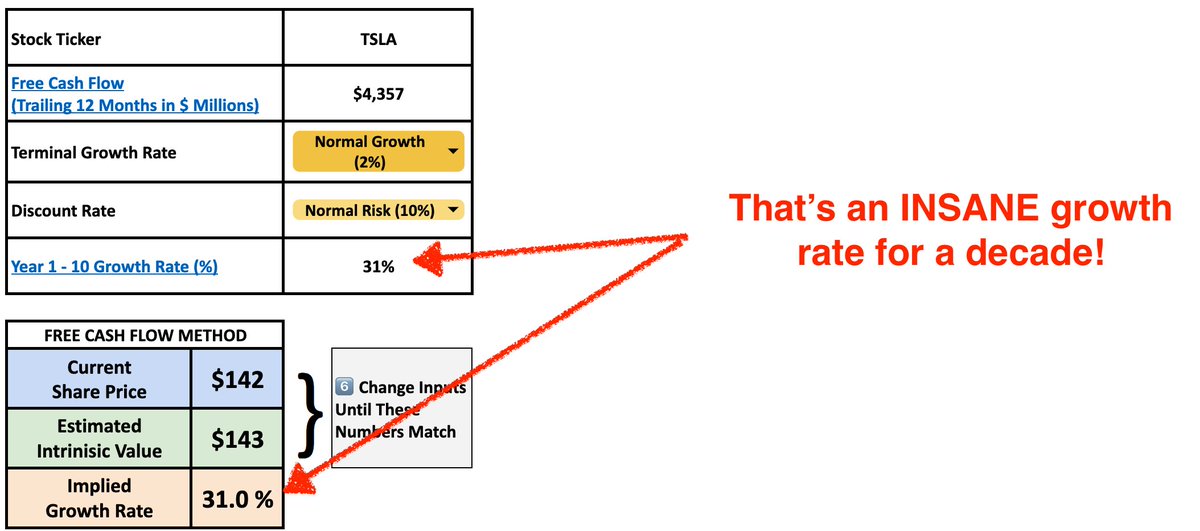

The stock: DataDog (DDOG)

The stock: DataDog (DDOG)

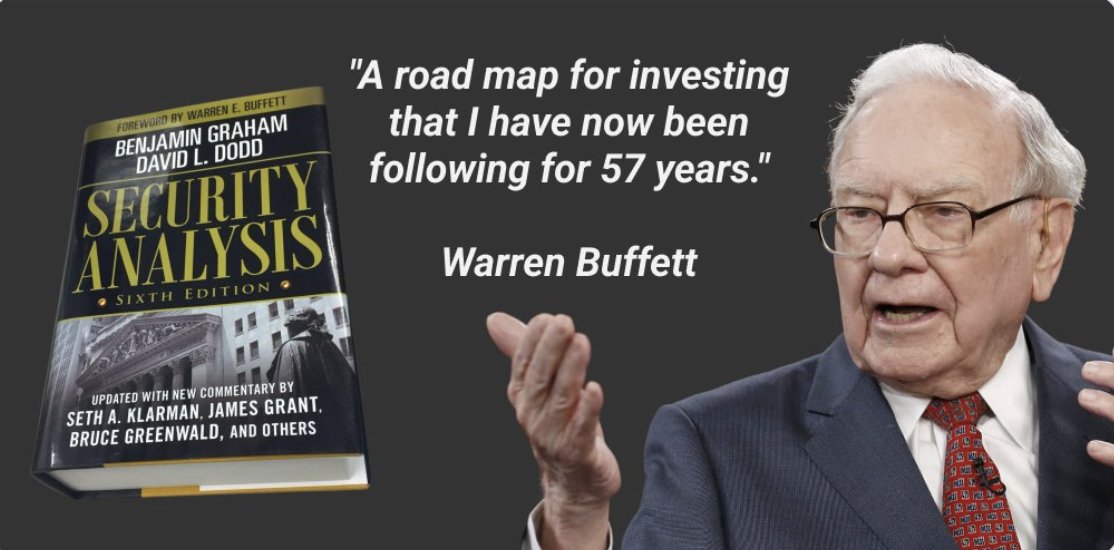

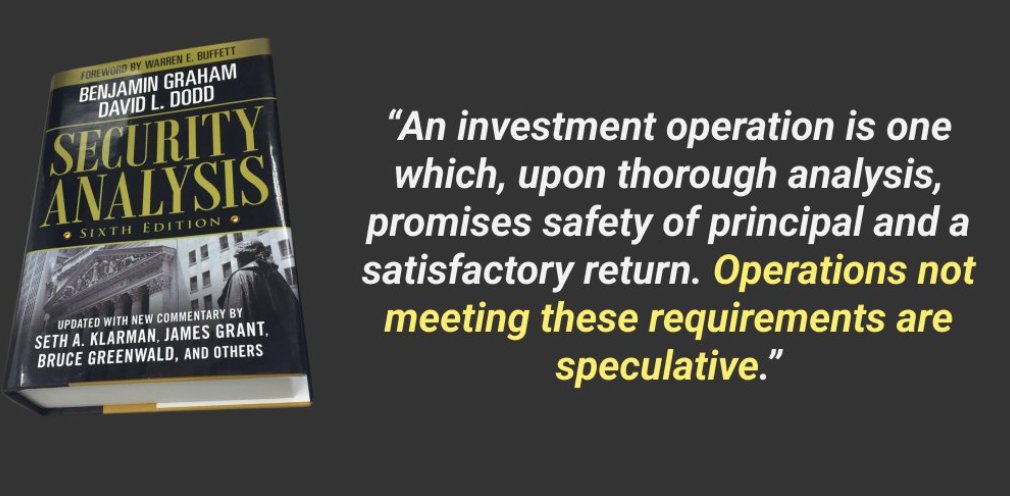

1. Investing versus speculating

1. Investing versus speculating

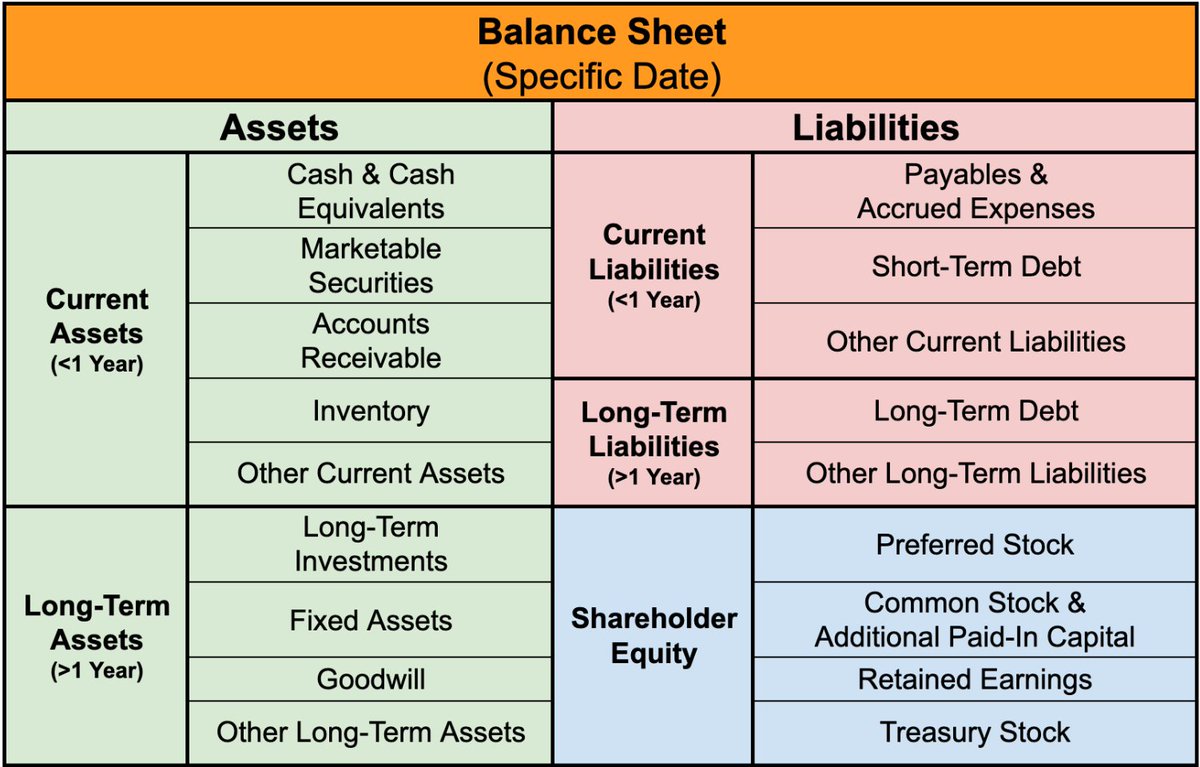

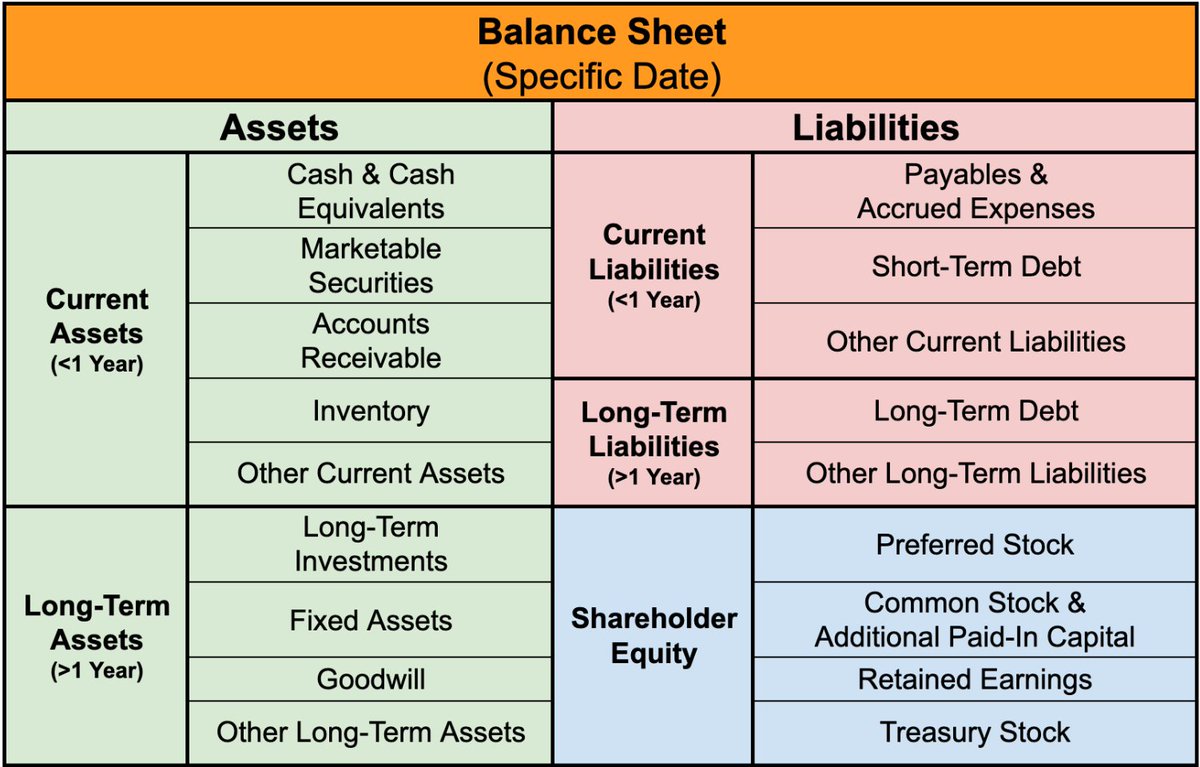

The balance sheet is one of the 3 major financial statements.

The balance sheet is one of the 3 major financial statements.