$1.5 billion.

This is how much Citadel Securities paid to brokers for their order flow.

And it still made $6.7 billion in revenues by doing that.

How do Robinhood and Citadel monetize “commission-free” retail orders, and how are we paying for it?

Let's find out 👇

This is how much Citadel Securities paid to brokers for their order flow.

And it still made $6.7 billion in revenues by doing that.

How do Robinhood and Citadel monetize “commission-free” retail orders, and how are we paying for it?

Let's find out 👇

2/ First, let’s put ourselves in the shoes of Robinhood and imagine that we start our own brokerage business!

We'll create an awesome-looking, irresistible app where clients can trade stocks.

Since we cannot charge fees and commissions, how do we earn money?

We'll create an awesome-looking, irresistible app where clients can trade stocks.

Since we cannot charge fees and commissions, how do we earn money?

3/ Hmmm... Let's focus on the infrastructure instead.

How will we execute our clients' orders? Can we not just send them to an exchange?

Sure, but it’s not going to be cheap.

In addition to registration and membership costs, exchanges also operate a transaction fee structure.

How will we execute our clients' orders? Can we not just send them to an exchange?

Sure, but it’s not going to be cheap.

In addition to registration and membership costs, exchanges also operate a transaction fee structure.

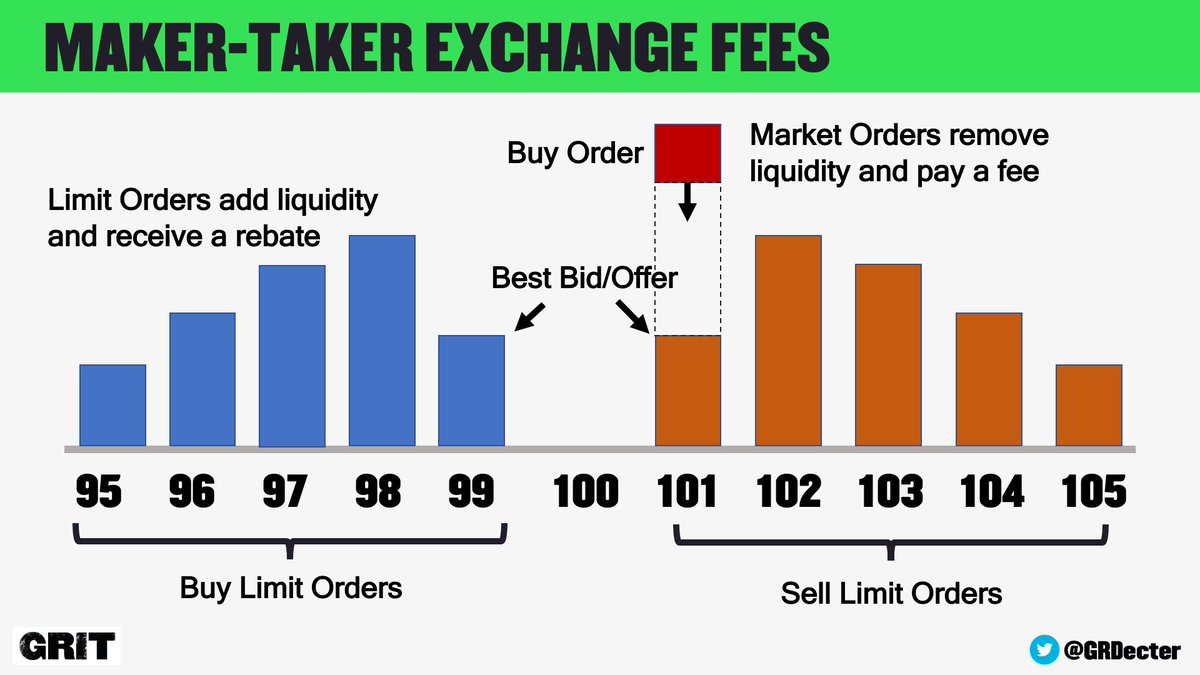

4/ These are the maker-taker fees and are designed to reward liquidity providers and penalize liquidity takers.

For example, a Limit Order adds liquidity, and it will incur a rebate from the exchange.

However, a Market Order removes liquidity and will incur a fee.

For example, a Limit Order adds liquidity, and it will incur a rebate from the exchange.

However, a Market Order removes liquidity and will incur a fee.

5/ The exchange pays slightly less on rebates and claims slightly more on fees, making a spread every time a market order takes out a limit order.

So market orders represent an additional cost for us, making exchanges a very costly option to route client orders to.

So market orders represent an additional cost for us, making exchanges a very costly option to route client orders to.

6/ Luckily, there’s this company, called Citadel, which kindly agreed to help us with client orders.

Not only they will execute our order flow, but they will also pay us!

So generous of them! They probably want to support a new business.

Not only they will execute our order flow, but they will also pay us!

So generous of them! They probably want to support a new business.

7/ Anyways.

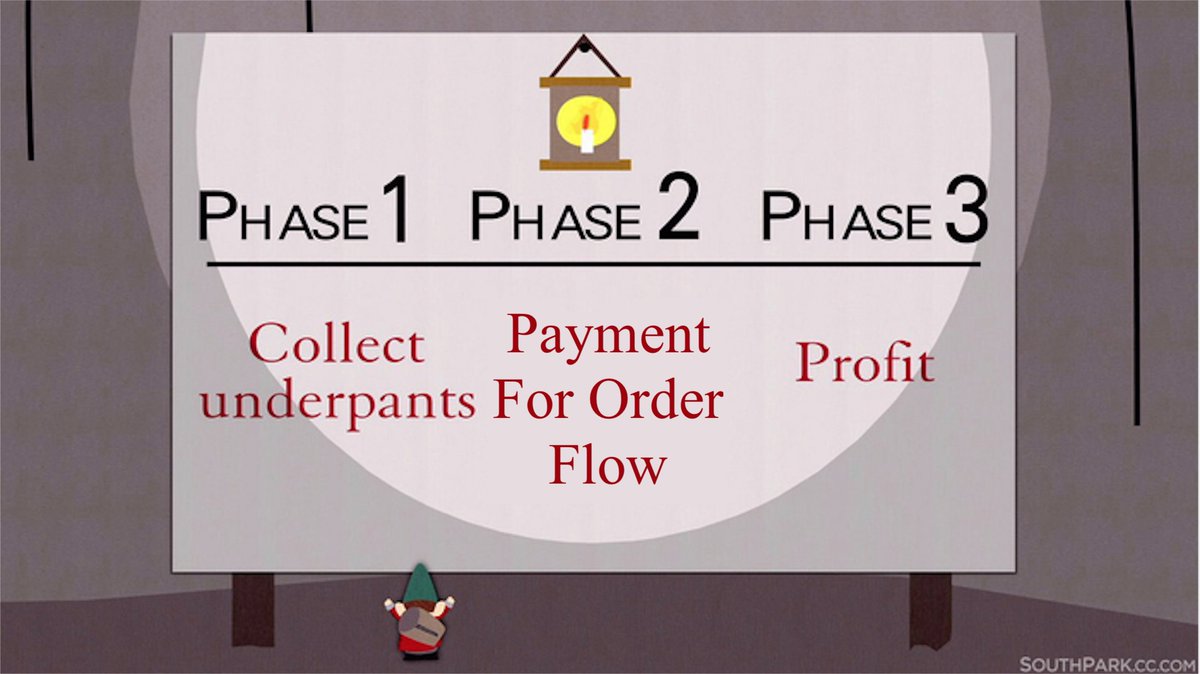

Now we've solved two problems at once! Not only we offloaded our client order execution to someone else, but we also found a new revenue stream!

And this revenue stream – called Payment For Order Flow (PFOF) – is at the core of Robinhood’s business model:

Now we've solved two problems at once! Not only we offloaded our client order execution to someone else, but we also found a new revenue stream!

And this revenue stream – called Payment For Order Flow (PFOF) – is at the core of Robinhood’s business model:

8/ Moreover, PFOF can also result in better execution prices for our clients.

How?

For example, let's assume 1,000 clients want to buy and 1,000 clients want to sell a particular stock.

The exchange bid/offer is shown as $99-$101 (customers sell at $99 and buy at $101).

How?

For example, let's assume 1,000 clients want to buy and 1,000 clients want to sell a particular stock.

The exchange bid/offer is shown as $99-$101 (customers sell at $99 and buy at $101).

9/ Citadel can 'internalize' these orders instead and fill the buy orders at $100.50 and execute the sell orders at $99.50, earning a $1 spread in the process.

A fraction of that dollar will be paid back to us in the form of PFOF as a reward for sending the orders to Citadel.

A fraction of that dollar will be paid back to us in the form of PFOF as a reward for sending the orders to Citadel.

10/ So what is the issue then?

If everyone wins, why is there so much debate around PFOF?

Why has Robinhood initially not disclosed PFOF as one of its revenue streams?

If everyone wins, why is there so much debate around PFOF?

Why has Robinhood initially not disclosed PFOF as one of its revenue streams?

11/ Imagine our client instructed us to purchase 100 shares of Tesla at a market price.

How do we decide who's going to execute this order?

Internally, we can see the following market quotes from our partners.

Who should this order go to?

How do we decide who's going to execute this order?

Internally, we can see the following market quotes from our partners.

Who should this order go to?

12/ The best (cheapest) price comes from Wolverine. If we prioritize our fiduciary duty and optimize for best execution, then this is where the order should go.

However, we also have a duty to our shareholders to maximize their value, which means we need to optimize for profit.

However, we also have a duty to our shareholders to maximize their value, which means we need to optimize for profit.

13/ And this is the primary concern with PFOF practices - it creates a conflict of interest.

Do clients get the best execution, or do brokers optimize order routing for their own interests?

Let’s have a look at Robinhood order routing report (required under SEC):

Do clients get the best execution, or do brokers optimize order routing for their own interests?

Let’s have a look at Robinhood order routing report (required under SEC):

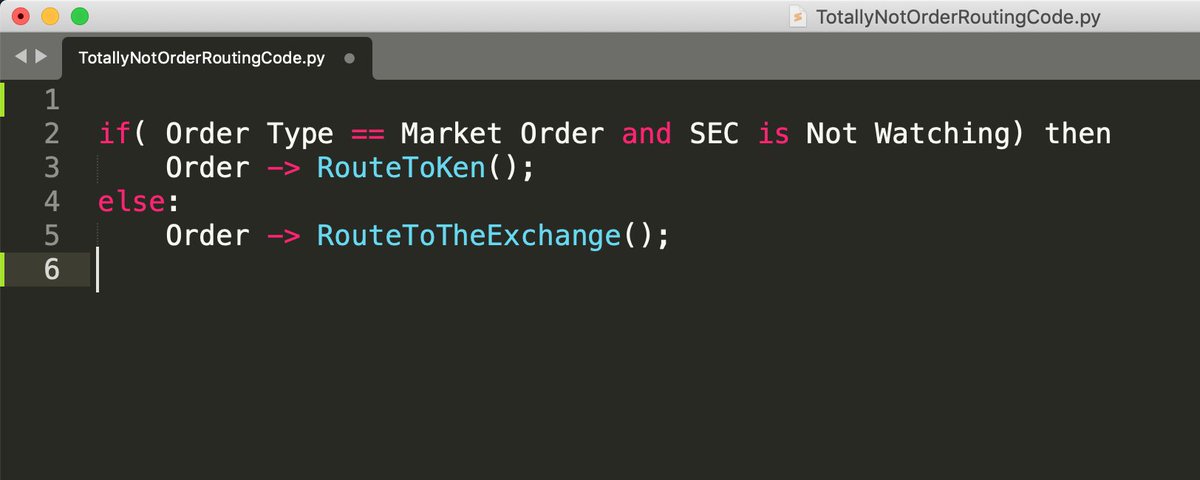

14/ There must be a specific algorithm that decides how these orders are split between venues.

It's not clear if Robinhood purposefully optimized for PFOF rebates instead of execution quality, but one thing is sure - Robinhood paid $65 million to settle the SEC investigation.

It's not clear if Robinhood purposefully optimized for PFOF rebates instead of execution quality, but one thing is sure - Robinhood paid $65 million to settle the SEC investigation.

15/ We can find another certainty about order routing practices by looking at brokers with exchange access, like Fidelity.

As per their Q3 2021 report, almost none of the Market Orders made their way to NYSE or NASDAQ! It seems that only Limit Orders are routed to the exchanges.

As per their Q3 2021 report, almost none of the Market Orders made their way to NYSE or NASDAQ! It seems that only Limit Orders are routed to the exchanges.

16/ I wonder why that is...

Remember we mentioned that exchanges penalize liquidity-taking market orders and pay for liquidity-providing limit orders?

Exactly! Why route a market order to the exchange and pay for it if Fidelity can send it to Citadel and get paid instead?

Remember we mentioned that exchanges penalize liquidity-taking market orders and pay for liquidity-providing limit orders?

Exactly! Why route a market order to the exchange and pay for it if Fidelity can send it to Citadel and get paid instead?

17/ If a market order comes in, it will be prioritized for a rebate regardless of the execution quality on the exchange!

So the question is – should we be concerned about that?

The government and SEC certainly are.

Are the retail traders?

So the question is – should we be concerned about that?

The government and SEC certainly are.

Are the retail traders?

18/ Thank you so much for taking the time to read this!

I hope you found it valuable.

If you enjoyed this thread, please sign up for our newsletter to make sure you won't miss the next one!

gritcapital.substack.com/welcome

I hope you found it valuable.

If you enjoyed this thread, please sign up for our newsletter to make sure you won't miss the next one!

gritcapital.substack.com/welcome

19/ And follow GRIT AMBASSADOR (and former Goldman Sachs Quant) @perfiliev for more educational threads about stocks, options and other topics within the incredible world of financial markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh