1/7

*MERKEL SAYS CORONAVIRUS PANDEMIC IN GERMANY IS `DRAMATIC'

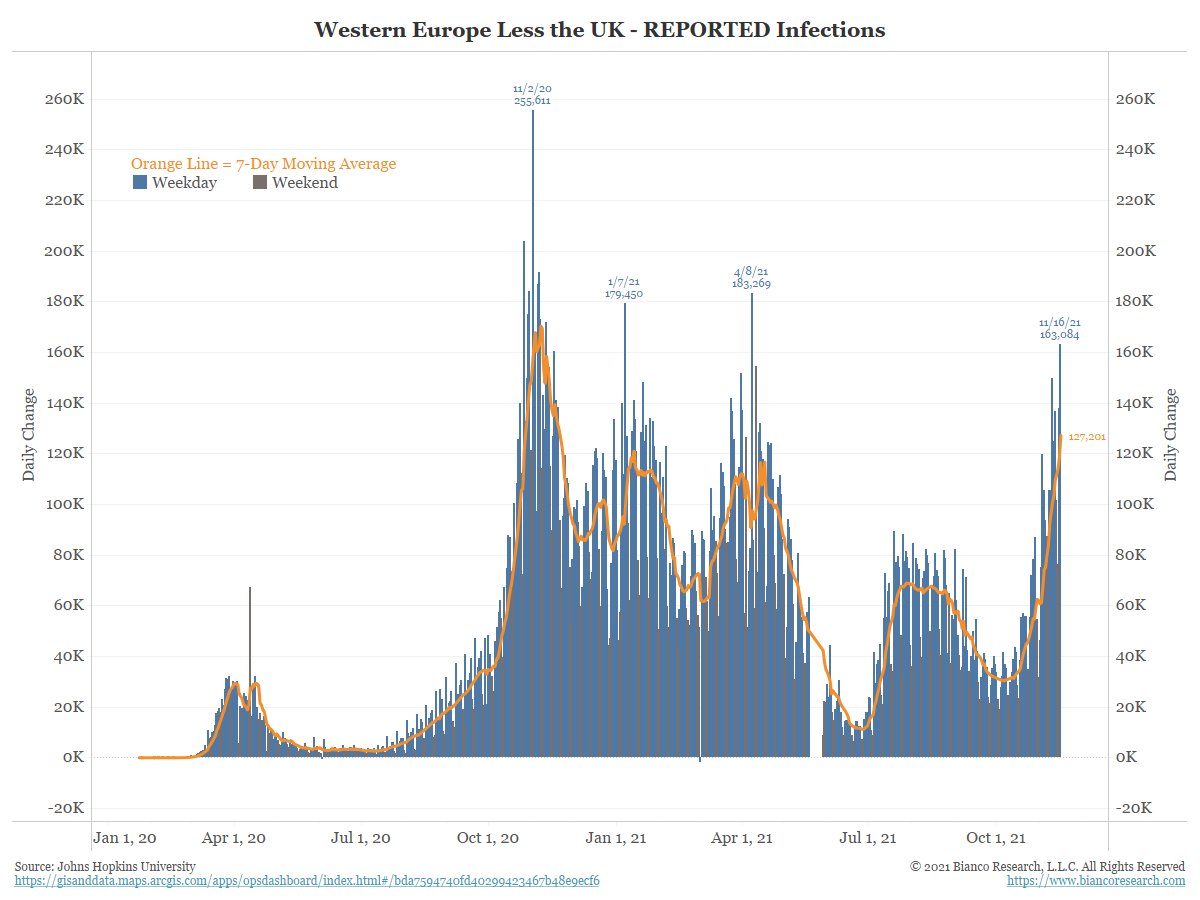

It is the highest ever daily count (blue bars) and 7-day average (orange), and still going vertical.

*MERKEL SAYS CORONAVIRUS PANDEMIC IN GERMANY IS `DRAMATIC'

It is the highest ever daily count (blue bars) and 7-day average (orange), and still going vertical.

6/7

COVID trends in Western Europe (blue) and the US (orange).

Sometimes the U.S. leads (2020), sometimes Europe leads (first half of 2021).

But what seems to be constant is when cases surge in one area, as is the case in Western Europe now, the other area eventually follows.

COVID trends in Western Europe (blue) and the US (orange).

Sometimes the U.S. leads (2020), sometimes Europe leads (first half of 2021).

But what seems to be constant is when cases surge in one area, as is the case in Western Europe now, the other area eventually follows.

All the European countries that have COVID raging higher have significantly higher vaccination rates than the US (black).

And so does Japan and COVID has almost disappeared.🤔

And so does Japan and COVID has almost disappeared.🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh