For those following the Evergrande situation, there is one special commentator who deserves singling out.

The "former Fitch analyst" Dr Marco Metzler is the key man. He is a veritable fount of misinformation and bad analysis. And he is absolutely prolific. Today he had this out.

The "former Fitch analyst" Dr Marco Metzler is the key man. He is a veritable fount of misinformation and bad analysis. And he is absolutely prolific. Today he had this out.

The "recent DMSA study" to which he refers, where he concludes that there must be massive CDS exposure to Evergrande, is today's press release.

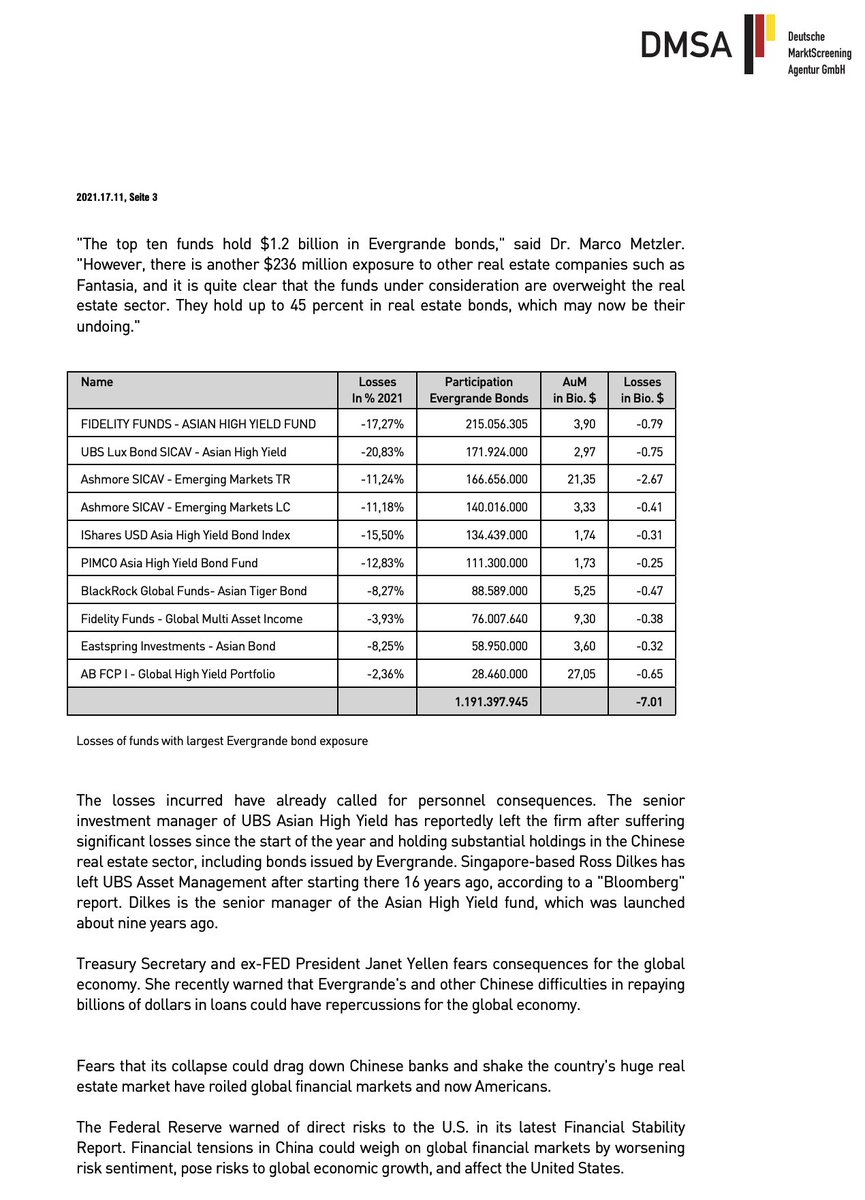

It shows that Asian high yield bond funds held (and still hold) Evergrande bonds. Some are active, some are passive.

It shows that Asian high yield bond funds held (and still hold) Evergrande bonds. Some are active, some are passive.

The first bit:

Top 10 Evergrande holding funds have lost $7bn this year. They own Evergrande which trade at 25cts on the dollar. Fitch says they are going to 5cts, therefore there is 20cts left, therefore they will lose $2bn more.

If they'd owned $10bn of EG to start 2021...

Top 10 Evergrande holding funds have lost $7bn this year. They own Evergrande which trade at 25cts on the dollar. Fitch says they are going to 5cts, therefore there is 20cts left, therefore they will lose $2bn more.

If they'd owned $10bn of EG to start 2021...

...Maybe.

Bonds go from 95 to 25, lose $7bn. Go to 5, lose another 20% of face or $2bn.

That, however runs into problems with the next paragraph.

The first section tells you that these funds would lose another $2bn.

The second says they have $1.2bn to lose.

Bonds go from 95 to 25, lose $7bn. Go to 5, lose another 20% of face or $2bn.

That, however runs into problems with the next paragraph.

The first section tells you that these funds would lose another $2bn.

The second says they have $1.2bn to lose.

If they have to lose $9bn but only report having $1.2bn, they must have 10x the exposure elsewhere.

He makes the mistake of face value vs current market value. His source (he uses Bloomberg HDS) clearly states it.

He hasn't bothered to look at any of the funds he listed.

He makes the mistake of face value vs current market value. His source (he uses Bloomberg HDS) clearly states it.

He hasn't bothered to look at any of the funds he listed.

You can download the holdings of #5 here. There are more Chinese real estate bonds in there than you can shake a stick at. All you have to do is rank by price in ascending order.

blackrock.com/sg/en/products…

blackrock.com/sg/en/products…

If you do so, the lowest-priced 50 in orange are all real estate or three Sri Lankan Sovs. The next 50 (bonds trading below 83) are MOSTLY but not all real estate.

They were something like 75-80% of China HY issuance earlier this year. They were a huge part of Asian HY.

They were something like 75-80% of China HY issuance earlier this year. They were a huge part of Asian HY.

But could it be CDS?

Not here. No CDS exposure listed. Other funds? I checked a few, no other CDS exposure.

In fact, it's easy. Mutual funds, sicavs, ETFs would not. Period.

Indeed, maybe it is... "other real estate exposure"

[gasps in Evergrande]

Not here. No CDS exposure listed. Other funds? I checked a few, no other CDS exposure.

In fact, it's easy. Mutual funds, sicavs, ETFs would not. Period.

Indeed, maybe it is... "other real estate exposure"

[gasps in Evergrande]

But what about the GS number of $158bn in market-wide CDS exposure to Evergrande?

I have not seen or heard of such a report. GS *did* put out a report in late September, "GS estimates Evergrande potential off-balance sheet liabilities and contingent liabilities of RMB 1 trln."

I have not seen or heard of such a report. GS *did* put out a report in late September, "GS estimates Evergrande potential off-balance sheet liabilities and contingent liabilities of RMB 1 trln."

And RMB 1 trillion is within 1% of US$158bn.

But while CDS are off-balance sheet risk, and Evergrande off-balance sheet liabilities are also off-balance sheet, they are not the same thing.

Conflating the two tells you all you need to know about him. Beyond amateur.

But while CDS are off-balance sheet risk, and Evergrande off-balance sheet liabilities are also off-balance sheet, they are not the same thing.

Conflating the two tells you all you need to know about him. Beyond amateur.

In the Evergrande off-BS totals are, of course, the WMPs. There are even bond guarantees like the Jumbo Fortune Enterprises bond. There may be more like that.

But the vast majority are mortgage guarantees and cooling off/buyback guarantees. These may be huge, but they are

But the vast majority are mortgage guarantees and cooling off/buyback guarantees. These may be huge, but they are

collateralised with the actual properties and in the mortgage guarantees, they are protected by buyer assets. No leave-the-keys-in-the-mailbox walkaways in China.

How about the $158bn of CDS?!

They don't exist. Yes, CDS exposures exist, but nowhere near that size.

How about the $158bn of CDS?!

They don't exist. Yes, CDS exposures exist, but nowhere near that size.

I mention all this because if you search 'Evergrande' on twitter, there are a bunch of widely-shared "news" articles which are reprints of his press releases.

Most are disinfo, the analysis beyond bad, and the "studies" are something which would cause you to fire an intern.

Most are disinfo, the analysis beyond bad, and the "studies" are something which would cause you to fire an intern.

I personally expect EG defaults (or restructures so badly it looks like it), but the similarities end there.

As an addendum, 'experts' who re-post Metzler's content may not be the experts they profess to be.

oops. meant They were something like 75-80% of [the] China HY *index* earlier this year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh