HUGE NEWS: The Impact Management Platform (a network of ALL major sustainability standard setters) launched today w/a website that embeds sustainability Thresholds & Allocations throughout (including a dedicated Landing Page.)

See @r3dot0 analysis here:

r3dot0.medium.com/reporting-stan…

See @r3dot0 analysis here:

r3dot0.medium.com/reporting-stan…

https://twitter.com/impmgmt/status/1460868003323650053

@r3dot0 This move comes after two decades of standard setters increasingly dropping the ball on integrating sustainability thresholds & allocations at the core of sustainability reporting standards/ guidelines.

So we welcome them finally picking up the ball and ALL now running with it!

So we welcome them finally picking up the ball and ALL now running with it!

@r3dot0 "At its launch today, the Impact Management Platform (IMP) unveiled a new website with a standalone page devoted to Thresholds and Allocations that explains just how to apply these necessary elements of sustainability measurement, management, and reporting.”

@r3dot0 Thresholds & allocations are the key concepts 1st suggested in the Sustainability Context Principle introduced in GRI's 2nd generation (G2) of Sustainability Reporting Guidelines in 2002.

History of Thresholds & Allocations: sustainableorganizations.org/TA-Timeline.pdf

G2: r3-0.org/wp-content/upl…

History of Thresholds & Allocations: sustainableorganizations.org/TA-Timeline.pdf

G2: r3-0.org/wp-content/upl…

@r3dot0 Susty Context calls for assessing “the performance of the organisation in the context of the limits & demands placed on economic, environmental, or social resources at a macro-level.”

“limits & demands” = thresholds

org performance / macro-level resources points to allocations

“limits & demands” = thresholds

org performance / macro-level resources points to allocations

@r3dot0 Thresholds & allocations are also embedded throughout IMP’s “wheel” of actions organizations can take to measure, manage and report their sustainability impacts (especially when it comes to the “Assess Impact” stage).

impactmanagementplatform.org/get-started/or…

impactmanagementplatform.org/get-started/or…

@r3dot0 Thresholds & Allocations are also a PRIMARY focus of the excellent video animation on the About page of the IMP website.

vimeo.com/644743370

impactmanagementplatform.org/about/

vimeo.com/644743370

impactmanagementplatform.org/about/

@r3dot0 IMP’s embrace of thresholds & allocations represents a watershed, hope-filled moment, precisely because the Platform consists of the very players who have, until now, been diluting the rigor of sustainability reporting...

@r3dot0 Earlier this month, the IFRS launched its International Sustainability Standards Board (ISSB) that fails to embrace the core tenets of sustainability, such as thresholds & allocations as well as inside-out impact and risk assessment.

lse.ac.uk/granthaminstit…

lse.ac.uk/granthaminstit…

@r3dot0 Earlier this year, the Global Sustainability Standards Board (GSSB) released the GRI Universal Standards that eviscerated the Susty Context Principle by removing requirements to assess performance — despite pleas to retain this vital performance standard!

r3-0.org/wp-content/upl…

r3-0.org/wp-content/upl…

@r3dot0 These stances of ISSB and GSSB both fly in the face of guidance on the IMP Thresholds & Allocations landing page, creating confusion for sustainability standard users, who are now confronted with two legitimate options:

@r3dot0 1) Demand that IMP members now walk their talk by aligning their own standards w/IMP guidance on thresholds & allocations; or

2) Apply the IMP thresholds & allocations guidance & ignore the elements of the various sustainability standards that contradict this consensus guidance.

2) Apply the IMP thresholds & allocations guidance & ignore the elements of the various sustainability standards that contradict this consensus guidance.

@r3dot0 The IMP Thresholds & Allocations landing page walks users thru a step-by-step explanation of thresholds 1st, then allocations

The explanation uses the Doughnut visualization conceived by @KateRaworth to introduce the concepts of ecological ceiling & social foundation thresholds

The explanation uses the Doughnut visualization conceived by @KateRaworth to introduce the concepts of ecological ceiling & social foundation thresholds

@r3dot0 To add allocations to the mix, the IMP Landing Page uses the example of greenhouse gas emissions, where the global threshold must be “downscaled” to the organizational level via “fair and just allocations.”

@r3dot0 The Available Thresholds section of IMP's Thresholds & Allocations Landing Page links to external resources for further guidance, incl @SBT_Network & @UNRISD Sustainable Development Performance Indicators.

impactmanagementplatform.org/thresholds-and…

impactmanagementplatform.org/thresholds-and…

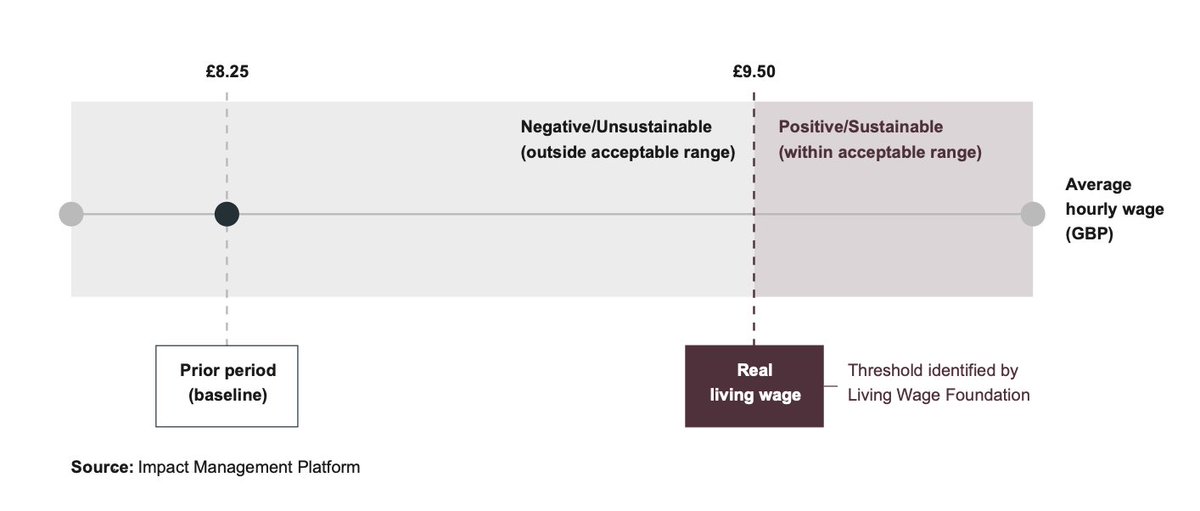

@r3dot0 @SBT_Network @UNRISD The Landing Page also uses the example of Living Wages to illustrate an instance where allocations are not required, as paying sufficient wages is not a shared burden, but one that falls exclusively on the employer.

@r3dot0 @SBT_Network @UNRISD IMP adopted this approach to thresholds & allocations in part due to its participation in the piloting of a set of thresholds-based (& transformation-based) sustainability indicators in a project hosted by @UNRISD & managed by @r3dot0 (w/ support from @mwmce)

@r3dot0 @SBT_Network @UNRISD @mwmce IMP’s embrace of thresholds & allocations represents a HUGE STEP in the right direction for the future of sustainability reporting that warrants applause!!

@r3dot0 @SBT_Network @UNRISD @mwmce The path is now paved for ALL the sustainability reporting standard setters in the Impact Management Platform to advance authentic, rigorous sustainability reporting in ways that reflect real-world impacts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh