Fineotex Chemicl (FCL) conducted their concall for Q2 FY 22

Here are the conference call highlights 👇🧵

Here are the conference call highlights 👇🧵

Business Update:

• Process of initiating the production (started on Nov 9) at Ambernath plant in Mumbai.

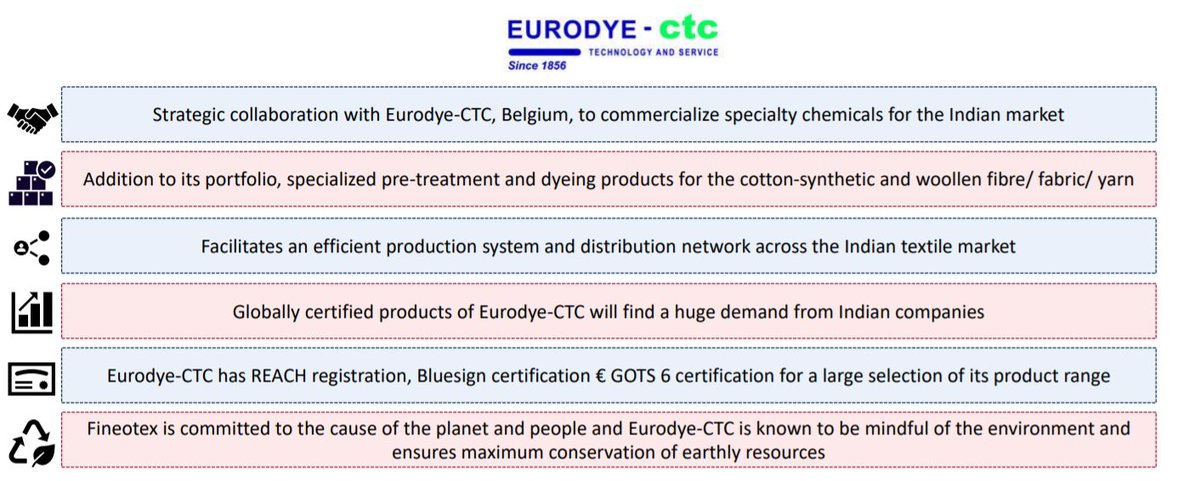

• Entered a strategic partnership with a Belgium-based co. in the textile chemicals (Eurodye-CTC).

• Got licensed from Hohenstein which will llow FCL's product in US.

• Process of initiating the production (started on Nov 9) at Ambernath plant in Mumbai.

• Entered a strategic partnership with a Belgium-based co. in the textile chemicals (Eurodye-CTC).

• Got licensed from Hohenstein which will llow FCL's product in US.

Eurodye-CTC:

• Eurodye-CTC is strong with their product for cotton, synthetic wool, fiber, fabric.

• They already have customer in India, which will help increasing business product of FCL.

• Current focus with CTC remain Sri Lanka & further expand in different geographies.

• Eurodye-CTC is strong with their product for cotton, synthetic wool, fiber, fabric.

• They already have customer in India, which will help increasing business product of FCL.

• Current focus with CTC remain Sri Lanka & further expand in different geographies.

Cleaning and Hygienic segment:

• Recruited 15 marketing people, & have >30 distributors.

• FCL has 41 products in the pipeline. Co. is currently focusing on institutions where packing sizes 5 liter.

• Earlier as hotels & multiplex were not opened up so there were issue.

• Recruited 15 marketing people, & have >30 distributors.

• FCL has 41 products in the pipeline. Co. is currently focusing on institutions where packing sizes 5 liter.

• Earlier as hotels & multiplex were not opened up so there were issue.

FCL's Product Edge:

• Total cost of pre-treatment dyeing, printing, finishing, which has 25 different functional chemicals contribute only 3% cost to the user.

• Mgmt expect Eurodye to contribute same kind of EBIDTA as of FCL (18-20%).

• Total cost of pre-treatment dyeing, printing, finishing, which has 25 different functional chemicals contribute only 3% cost to the user.

• Mgmt expect Eurodye to contribute same kind of EBIDTA as of FCL (18-20%).

Diversification:

• Top-10 customers are contributing only 30% of revenue (which was 33% in Q1).

• Top-10 products contributes 20% of sales.

• Top-10 customers are contributing only 30% of revenue (which was 33% in Q1).

• Top-10 products contributes 20% of sales.

Expansion:

• Once the Ambernath facility kicks off FCL will again plan for CAPEX. In January co. will start planning for new CAPEX which can be commercialize in FY23.

• In Ambernath with in CAPEX of 27cr, FCL is looking for 150cr of turnover.

• Once the Ambernath facility kicks off FCL will again plan for CAPEX. In January co. will start planning for new CAPEX which can be commercialize in FY23.

• In Ambernath with in CAPEX of 27cr, FCL is looking for 150cr of turnover.

Raw Material:

• Top 10 raw materials contribute 20-22% of total

purchase. (top 10 includes Stearic acid, diamine ethoxylation,surfactant, diamine AEEA, acrylamide, sorbitols, sodium glucokinase.

• 60:40 domestic:overseas

• Most of the RM is commodity product, so FCL have edge

• Top 10 raw materials contribute 20-22% of total

purchase. (top 10 includes Stearic acid, diamine ethoxylation,surfactant, diamine AEEA, acrylamide, sorbitols, sodium glucokinase.

• 60:40 domestic:overseas

• Most of the RM is commodity product, so FCL have edge

Margin:

Crude price had impacted the cost, but it is not visible due to

- Right Product mix (high margins product offering)

- Passing on the prices to the customers

- Reshuffle the production capacity with more profitable product

- Working with a number of alternate RM supplier

Crude price had impacted the cost, but it is not visible due to

- Right Product mix (high margins product offering)

- Passing on the prices to the customers

- Reshuffle the production capacity with more profitable product

- Working with a number of alternate RM supplier

Cash Flow:

• Cash Flow seems impacted due to industry structure.

Cos like Raymond, VTL, Welspun, ArvindCo have a practice to pay in 90 to 120 days. While due to supply chain disruption, inventory has gone up (in order to meet surplus demand).

• Cash Flow seems impacted due to industry structure.

Cos like Raymond, VTL, Welspun, ArvindCo have a practice to pay in 90 to 120 days. While due to supply chain disruption, inventory has gone up (in order to meet surplus demand).

• Co. can increase its payable days but FCL is not delaying payment, to get adequate rice discount.

• FCL is already cash rick co.

• Co. already has good line of credit from the banks, which will help for organic growth.

• FCL is already cash rick co.

• Co. already has good line of credit from the banks, which will help for organic growth.

For more discussion on Equity research and OI analysis

Subscribe to our telegram channel 😃

Link 🖇:

T.me/thetycoonminds…

Subscribe to our telegram channel 😃

Link 🖇:

T.me/thetycoonminds…

• • •

Missing some Tweet in this thread? You can try to

force a refresh