Olympique Lyonnais’ 2020/21 accounts cover a season when they finished 4th in Ligue 1 and reached the Coupe de France quarter-finals, but did not participate in Europe after the previous season ended early in March due to COVID-19 with #TeamOL in 7th place. Some thoughts follow.

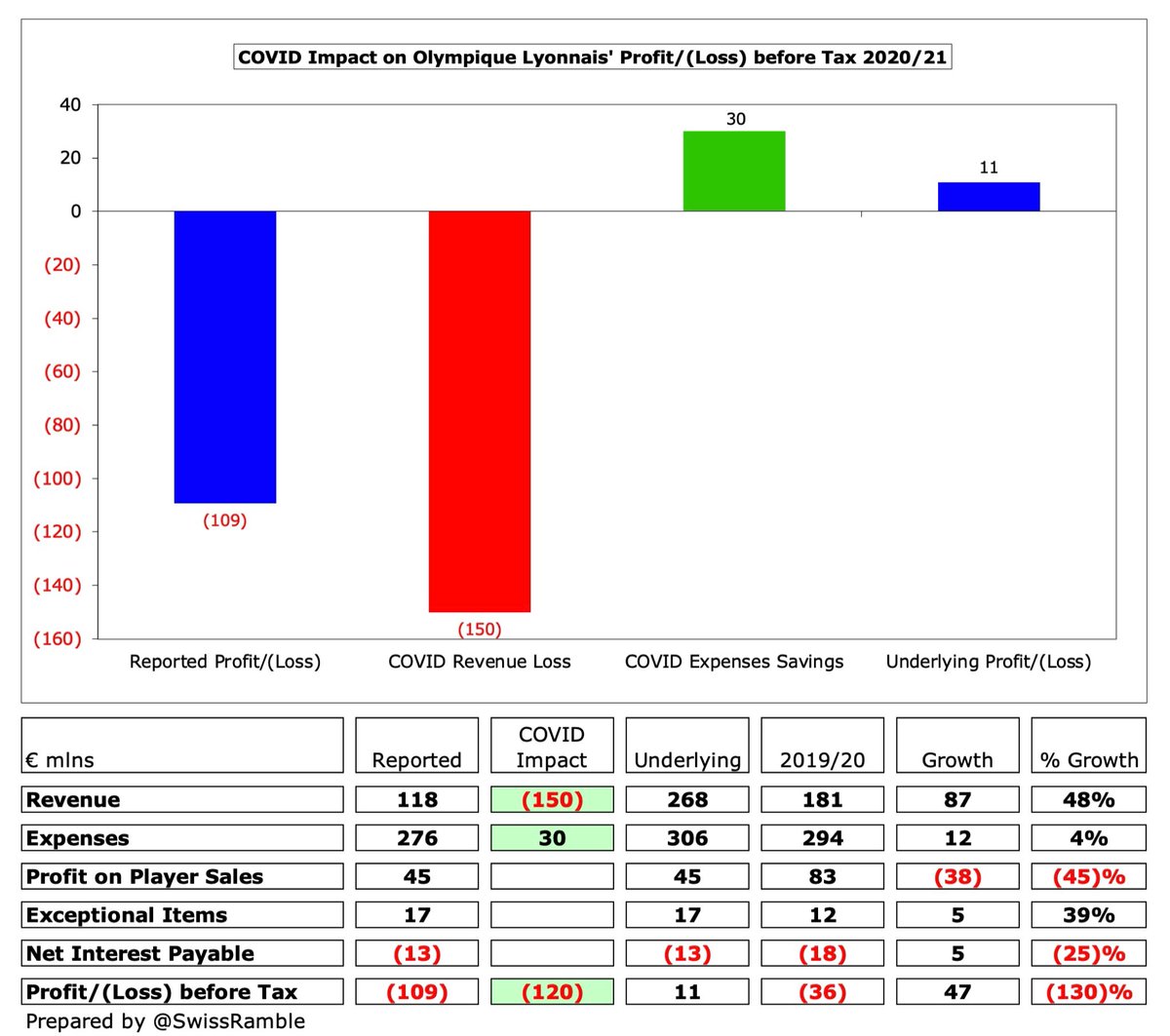

Due to a combination of COVID and no European competition, #TeamOL pre-tax loss increased from €36m to €109m, as revenue fell €63m (35%) from €181m to €118m and profit on player sales dropped €38m from €83m to €45m. Partly offset by €18m (6%) decrease in operating costs.

#TeamOL revenue fall was driven by gate receipts, down €34m (94%) from €36m to €2m, and broadcasting, down €29m (29%) from €98m to €69m. Commercial held up pretty well, only slipping 1% to €47m. Including player trading, revenue dropped €94m (35%) from €272m to €177m.

Despite lower revenue, #TeamOL wages rose €2m (1%) to €134m and player amortisation increased €3m (5%) to €57m. However, other expenses cut €22m (26%) to €63m and interest down €5m to €13m. Exceptional items of €17m included government aid plus ticketing compensation.

#TeamOL €109m loss was only surpassed by PSG €125m in 2019/20, though Marseille were only just behind at €98m. Most French clubs post small profits or losses, but the figures will be worse in 2020/21, as they will include a full year of the pandemic.

#TeamOL have estimated the direct and indirect revenue loss from COVID as €150m, including gate receipts €31m, Mediapro’s default and the shortfall arising from the absence from 2020/21 Champions League. Partly offset by €30m cost savings, giving a net €120m adverse impact.

Of course, all football clubs have been significantly hit by the effects of the pandemic, so #TeamOL €107m loss after tax is by no means the largest in Europe. In fact, it is much lower than Inter €246m, Juventus €210m, Roma €185m and especially Barcelona €481m.

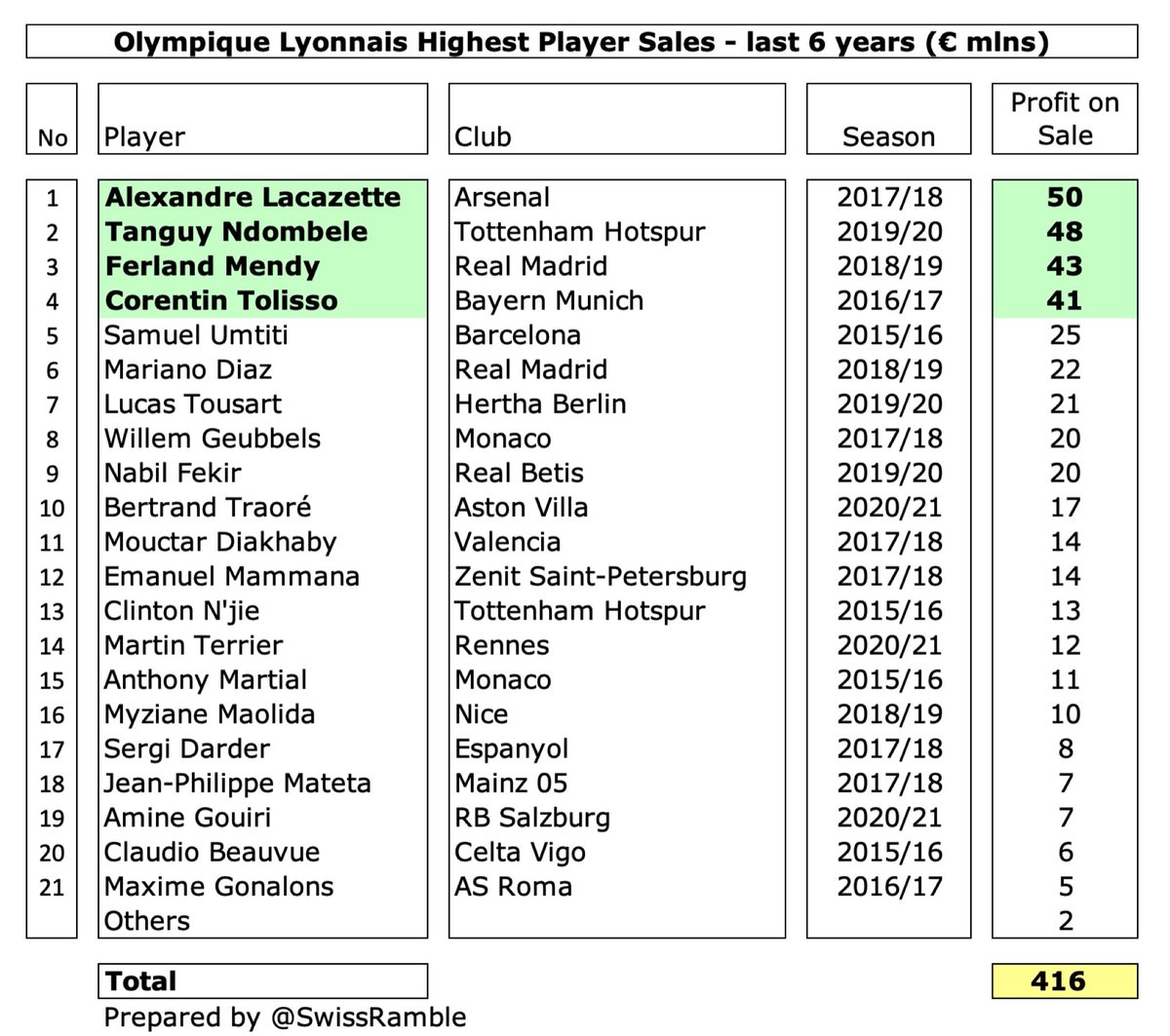

#TeamOL figures were boosted by €45m profit from player sales, mainly Bertrand Traoré to #AVFC €16m, Martin Terrier to Rennes €12m, Amine Gouiri to Nice €7m and sell-on fees €12m, though this was down from prior year €83m. Highest in France in 2019/20 was Lille €125m.

After four consecutive years of profits, #TeamOL have now reported losses two years in a row, amounting to €145m (2019/20 €26m and 2020/21 €109m). The club expects to “reap the gradual benefit of more normal conditions” in 2021/22 as fans return to the stadium.

#TeamOL have made significant profits from player sales, including €416m in the last 6 seasons, averaging €69m a year. Their strategy is “based on a top notch academy recruitment of very talented young players and an ability to unlock their sporting and economic potential.”

The only club in France that has done better financially with player sales is Monaco, who made an incredible €644m in the five years up to 2020. However, #TeamOL €371m is well ahead of the rest, e.g. PSG €293m, Lille €268m and Bordeaux €126m.

#TeamOL player sale profits have been based on steady business, as opposed to one mega transaction, with four deals above €40m: Lacazette to #AFC €50m, Ndombele to #THFC €48m, Mendy to Real Madrid €43m and Tolisso to Bayern €41m. Sales proceeds for 2021/21 already €40m.

#TeamOL EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation) fell to €(34)m in 2021, the first time it has slipped into negative territory since the new stadium opened in January 2016. Excluding player sales, dropped to minus €79m, one of the worst in France.

#TeamOL operating loss (without player sales) widened from €113m to €158m, excluding exceptional items. Obviously not great, but still better than Monaco €198m and PSG €178m, despite being the only club whose figures reflect a full year of the pandemic.

#TeamOL revenue has nearly halved since 2019 (pre-COVID), falling €103m (46%) from €221m to €118m, driven by broadcasting €53m, match day €40m and commercial €10m (mainly events).

The #TeamOL challenge is highlighted by PSG’s stratospheric €459m revenue growth since they were acquired by QSI in 2011. As a result, Lyon’s €118m is miles below PSG €560m (2020). Marseille could be second highest in 2021, as they will be boosted by Champions League money.

#TeamOL dropped one position to 18th in the 2019/20 Deloitte Money League, which ranks clubs globally by revenue, with their €181m placing them between Everton €212m and Napoli €176m.

#TeamOL gate receipts slumped €34m (94%) from €36m to just €2m, as ticketing activities “came to an almost complete halt”. In a normal season, OL match day revenue would only behind PSG in France following the move to the Groupama Stadium.

#TeamOL average attendance of 47,299 in 2019/20 (pre-pandemic) was the third highest in France, only behind Marseille 52,804 and PSG 47,554, so they will be delighted that fans were able to return in Ligue 1 at the start of the 2021/22 season.

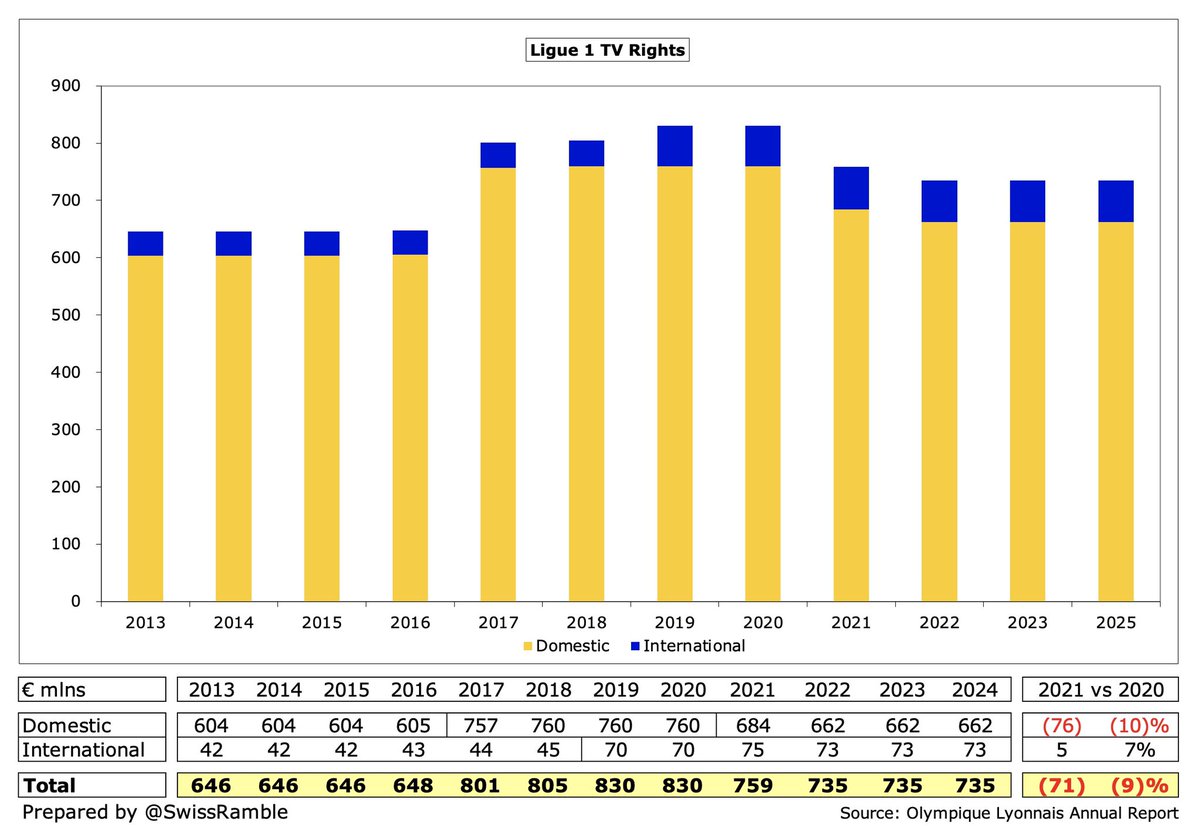

#TeamOL TV income fell €29m (29%) from €98m to €69m. Domestic up €9m (28%) from €33m to €42m, thanks to more games played (38 vs. 28) and higher league finish (4th vs. 7th). UEFA TV money down €38m (58%) from €65m to €27m (revenue deferred from 2019/20 CL later stages).

#TeamOL earned €42m from Ligue 1 TV deal in 2021, despite Mediapro default. Money distributed per the 50-30-20 rule: 50% equal share (30% fixed, 20% according to club licences); 30% league standing (25% current season, 5% 5 previous seasons); and 20% media profile.

French domestic TV rights should have increased by 60% in 2020/21 from €760m to €1.2 bln, but Mediapro could not meet their payments, so the new deal was cancelled. Canal+ and Amazon picked up those rights, leading to revised annual total of €662m, i.e. less than previous deal

This is a major issue for #TeamOL comparing TV rights in other major leagues. The revised €735m for #Ligue1 (including international rights) is the only one less than €1 bln, miles below Premier League €3.6 bln, La Liga #2.0 bln, Bundesliga €1.4 bln and Serie A €1.3 bln.

#TeamOL missed out on qualification for Europe after 2019/20 season was prematurely ended (due to COVID) when in 7th place, with a big impact on revenue, e.g. in the Champions League PSG earned €111m, Marseille €47m and Rennes €33m; in Europa League Lille €18m and Nice €12m.

European qualification (particularly Champions League) is extremely important for #TeamOL, who earned an impressive €221m from Europe in last 5 seasons, despite zero in 2021, only surpassed in France by PSG €441m. Includes €91m from 2020 when they reached CL semi-final.

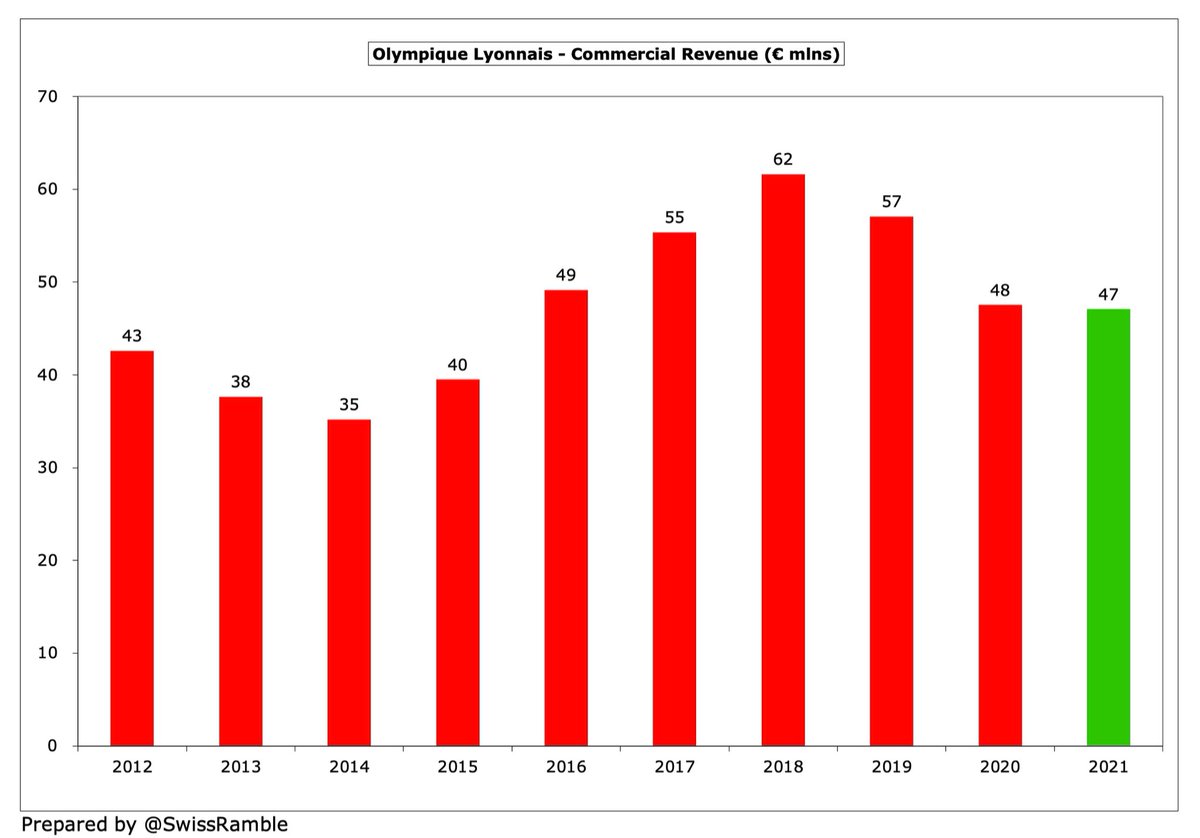

#TeamOL commercial revenue held up, slipping just €1m (1%) from €48m to €47m, as new partnerships led to sponsorship & advertising rising €5m to €47m to offset €6m fall in events to €1m. Merchandising sales were resilient, so brand-related income only down €2m to €12m.

#TeamOL €47m commercial income is just below Marseille’s €50m, but, like every other club in France, this pales into insignificance compared to PSG’s extraordinary €390m.

#TeamOL benefited from two new 5-year sponsorship agreements in 2020/21: Emirates replaced Hyundai as shirt sponsor for a reported €20m, while Adidas have extended their kit deal at €10m. Groupama stadium €4m naming rights also extended to 2022.

#TeamOL wages rose slightly from €132m to €134m, due to €7m increase in bonuses for reaching 2019/20 Champions League semi-final (games played in 2020/21 accounting year), partly offset by €5m reduction in fixed costs (including some staff on furlough).

#TeamOL €134m wages are the second highest in Ligue 1, though less than a third of PSG’s staggering €414m. Still ahead of Monaco €121m, Marseille €118m and Lille €90m (all 2019/20 figures).

Following the steep decline in revenue, #TeamOL wages to turnover ratio increased (worsened) from 73% to 113%. This was a very healthy 59% in 2019 before COVID struck. Now one of the highest in Ligue 1, though still below the 2020 figures of Monaco 194% and Bordeaux 134%.

#TeamOL player amortisation, the annual cost of writing-off transfer fees, increased by €3m (5%) to €57m, which means that this expense has quadrupled in just four years from €14m in 2017. Now third highest in Ligue 1, behind PSG €142m and Monaco €88m.

#TeamOL average annual gross transfer spend has increased to €68m in last 5 years, including €29m in 2021, mainly Lucas Paqueta from Milan €22m, though well down from prior year €153m. However, averaged €13m net sales in this period, including €31m in 2021 after €60m sales

#TeamOL gross debt rose €103m from €227m to €330m, reflecting two new government-guaranteed loans, which increased other financial liabilities to €174m, though stadium debt fell €13m to €148m. Cash increased €37m to €70m, so net debt was up €66m from €194m to €260m.

Largely as a result of investment in the new stadium, #TeamOL gross debt of €330m is by far the highest in France, well ahead of Lille €61m, Saint-Etienne €40m and Bordeaux €38m, though other clubs’ figures will surely increase when they publish their 2020/21 accounts.

#TeamOL interest payment doubled in 2021 from €6m to €12m, though this is still well down from the peak of €31m in 2017, thanks to various refinancings. During the last 10 years, the club has had to pay out €91m in interest.

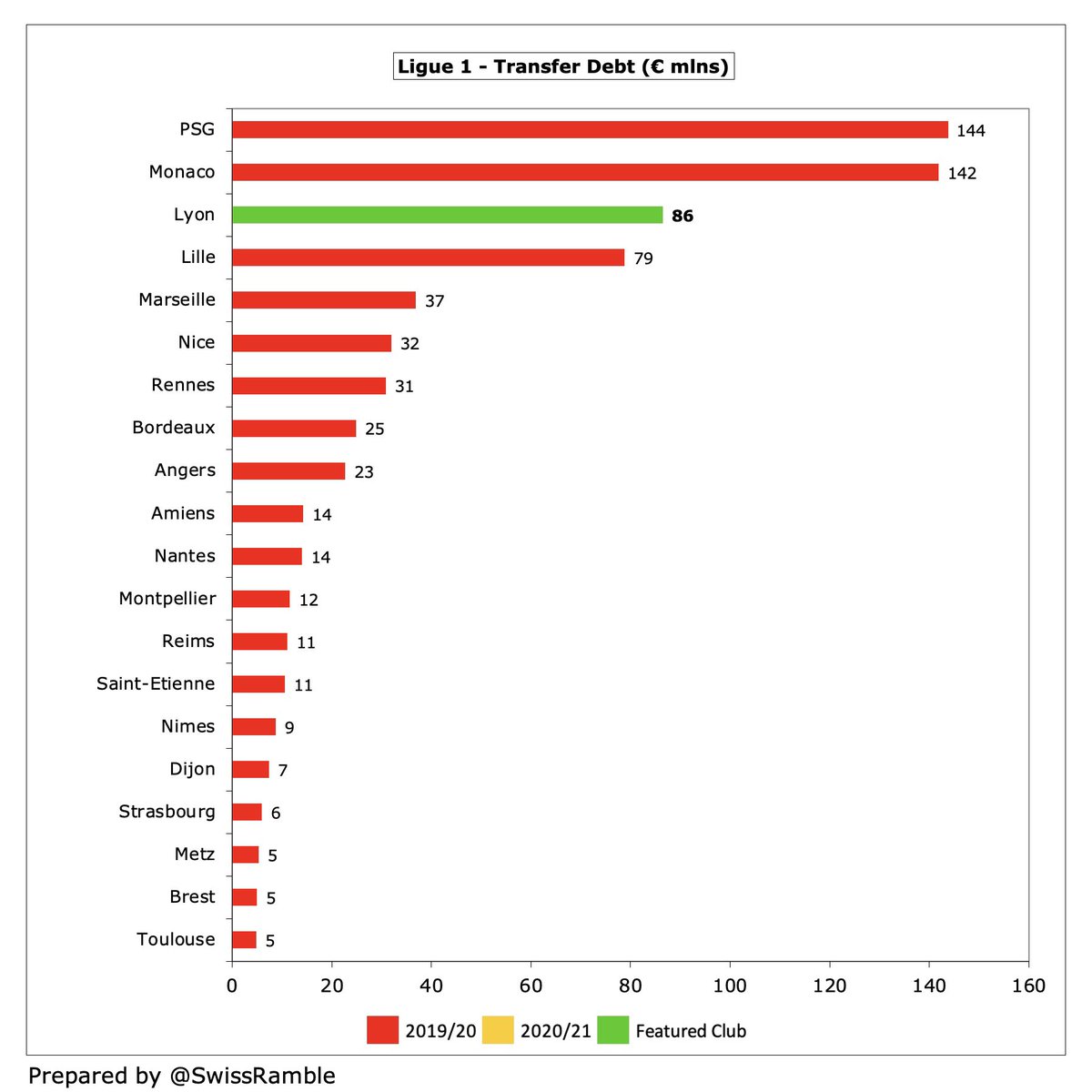

#TeamOL did reduce transfer debt from €136m to €86m, though still their second highest ever. The amounts owed to Lyon by other clubs rose from €34m to €43m, resulting in net transfer payables of €43m. Two French clubs have more transfer debt: PSG €144m and Monaco €142m.

After adding back £79m non-cash items and £46m working capital movements, #TeamOL had £16m negative operating cash flow, but then spent £27m on players (purchases £78m, sales £51m), interest £12m and capex £7m. This was funded by £101m external loans.

As a result, #TeamOL cash balance increased by €37m from €33m to €70m, only surpassed in France by PSG €73m. As a rule, French clubs hold a higher cash balance than, say, English clubs.

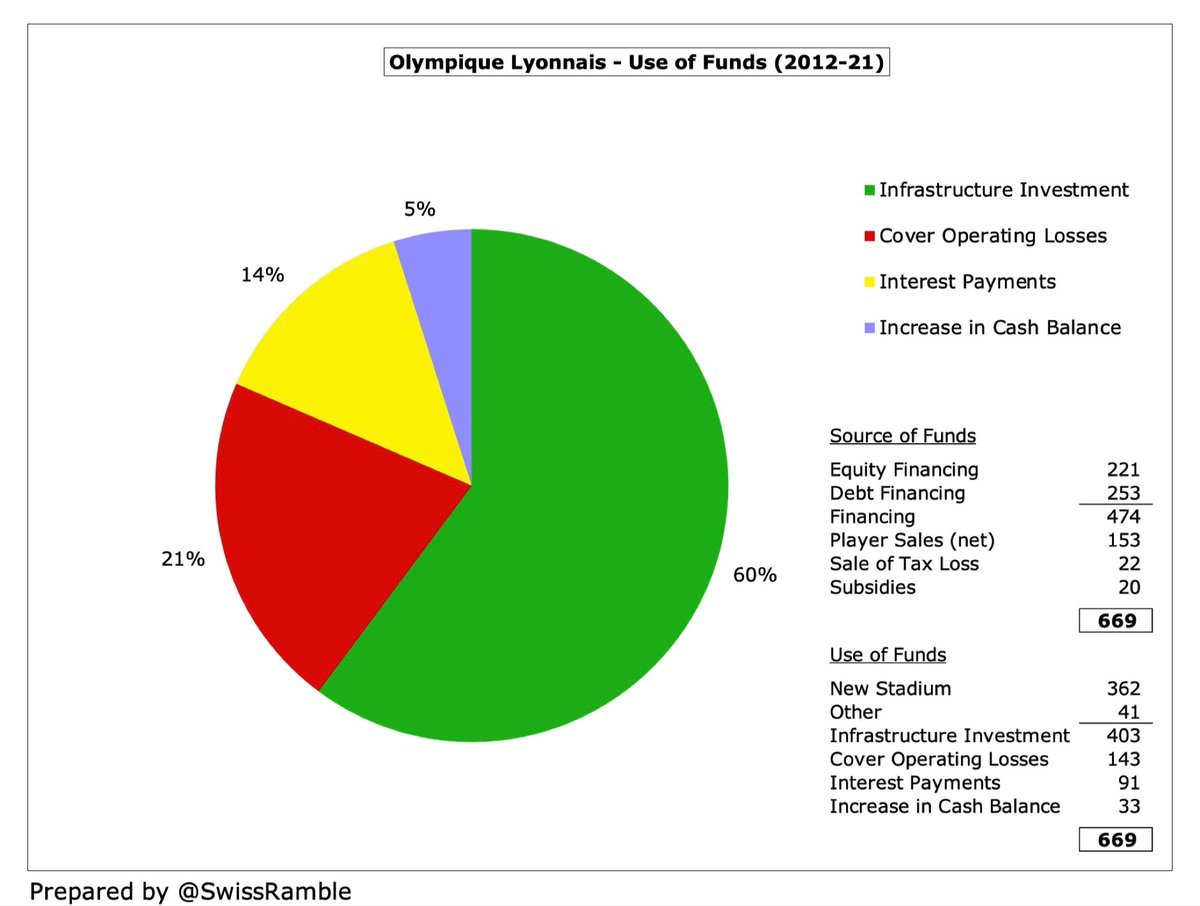

In last decade #TeamOL spent over €400m on infrastructure, including €362m on new stadium. This has been funded by €253m loans and €221m of new equity. Player sales (net) of €153m have largely covered €143m operating losses, though there were also €91m interest payments.

#TeamOL “remain confident” of achieving €420-440m revenue (including player trading) and €100m EBITD, though delayed by a year to 2024/25, partly from building a new events venue near the stadium and developing a leisure & entertainment complex in OL Valley (€141m investment).

COVID has clearly hit #TeamOL hard, including the early end to the 2019/20 season preventing them from making a challenge for European qualification, while the transfer market has been depressed. They will hope to bounce back under the guidance of new coach Peter Bosz.

• • •

Missing some Tweet in this thread? You can try to

force a refresh