Admitting your mistakes as an investor is crucial. It makes you:

✅Accountable

✅A better investor.

In that light, when @BrianFeroldi and I reviewed Peloton in June 2021, I liked it so much that I bought shares.

Since then, it dove 60%.

$PTON

Here's what I'm doing⤵️

✅Accountable

✅A better investor.

In that light, when @BrianFeroldi and I reviewed Peloton in June 2021, I liked it so much that I bought shares.

Since then, it dove 60%.

$PTON

Here's what I'm doing⤵️

First, I need to REVIEW MY REASONS FOR BUYING

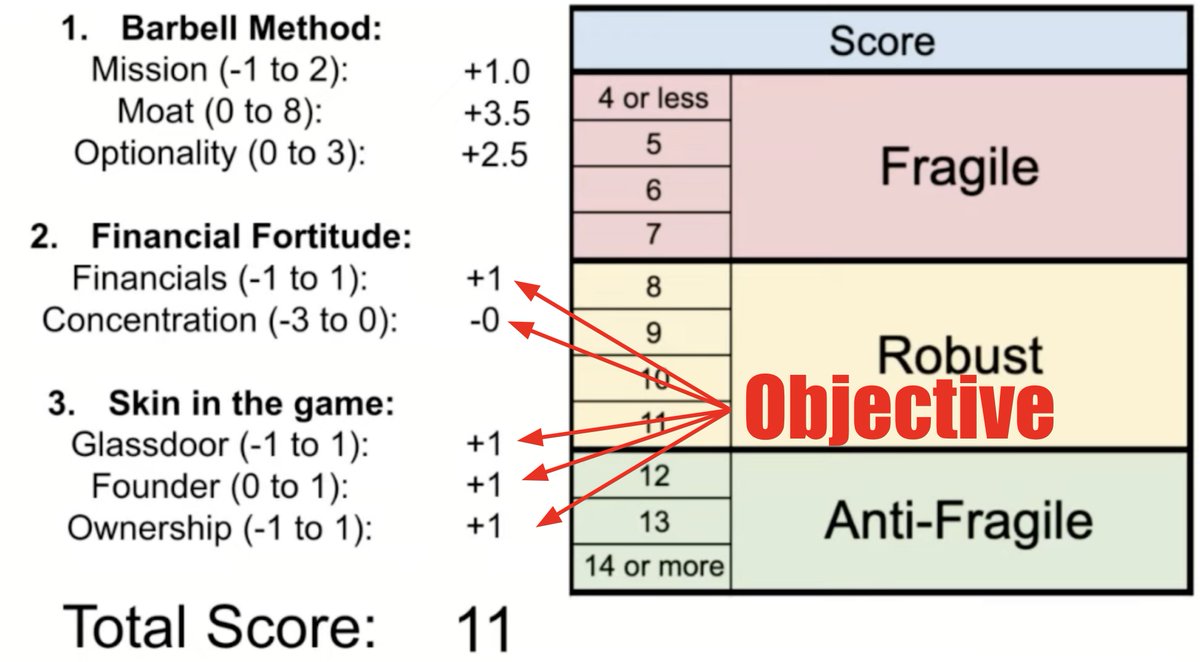

Because of our YouTube channel, this is pretty easy. Can just pull up the results of my framework, and immediately make changes to the OBJECTIVE variables

Because of our YouTube channel, this is pretty easy. Can just pull up the results of my framework, and immediately make changes to the OBJECTIVE variables

Right off the bat, I know there's NO meaningful change to:

1⃣ Concentration Risk

2⃣ Glassdoor Reviews

3⃣ Founder's Role

4⃣ Insider Ownership

🔴Finances, however, changed a ton -- which lowered the company's score to a 9 overall

1⃣ Concentration Risk

2⃣ Glassdoor Reviews

3⃣ Founder's Role

4⃣ Insider Ownership

🔴Finances, however, changed a ton -- which lowered the company's score to a 9 overall

More importantly, however, we need to evaluate the SUBJECTIVE variables of:

🏰MOAT: Peloton's sustainable competitive advantages

🔛 OPTIONALITY: The ability to create to revenue streams to fulfill the company's mission.

For the purposes of this segment, I'll focus on MOAT

🏰MOAT: Peloton's sustainable competitive advantages

🔛 OPTIONALITY: The ability to create to revenue streams to fulfill the company's mission.

For the purposes of this segment, I'll focus on MOAT

In June, I gave $PTON credit for:

✅Network Effect (Weak): communities on platform

✅Switching Costs (Medium-Strong): Credit Card used to pay subscriptions

✅Brand (Strong)

✅Counter-Positioning (Medium): Against Gyms

✅Network Effect (Weak): communities on platform

✅Switching Costs (Medium-Strong): Credit Card used to pay subscriptions

✅Brand (Strong)

✅Counter-Positioning (Medium): Against Gyms

In revisiting my original thesis, however, I realized:

I DID A SUB-PAR JOB RESEARCHING THE CURRENT BUSINESS DRIVERS.

If we look at where Gross Profit comes from, we see that it's primarily NEW BIKES / TREADMILLS, which are lower margin and faltering

I DID A SUB-PAR JOB RESEARCHING THE CURRENT BUSINESS DRIVERS.

If we look at where Gross Profit comes from, we see that it's primarily NEW BIKES / TREADMILLS, which are lower margin and faltering

More importantly, the VAST MAJORITY of subs margin comes from CONNECTED FITNESS subs.

🟢Connected = REQUIRE a bike or treadmill

🔴Digital = DO NOT require them

I like 🔴 more than 🟢

The problem: 🟢is MUCH more important than 🔴

🟢Connected = REQUIRE a bike or treadmill

🔴Digital = DO NOT require them

I like 🔴 more than 🟢

The problem: 🟢is MUCH more important than 🔴

That means BUYING THE BIKES (low moat and one-off purchase) is way more important that I originally appreciated, as the connected fitness subs don't come without them.

What's worse, while PRODUCT growth is SLOWING, CHURN is rising

What's worse, while PRODUCT growth is SLOWING, CHURN is rising

On top of that, if the brand was a powerful as I thought, we wouldn't see this type of an increase in sales & marketing while sales a slipping

If all of this sounds confusing, @BrianFeroldi and I made a video which makes it easier to digest here

And if you like content like this, be SURE to subscribe to our channel (TOTALLY FREE) where we produce 3-4 videos EVERY WEEK

youtube.com/brianferoldiyt…

youtube.com/brianferoldiyt…

Thus, I've made the decision to SELL my $PTON shares.

$PTON could be a GREAT investment going forward. A recovery in sales trends could be HUGE.

But:

😕Financial Fortitude swung from ANTI-FRAGILE to FRAGILE

😩MOAT is narrower than I thought.

$PTON could be a GREAT investment going forward. A recovery in sales trends could be HUGE.

But:

😕Financial Fortitude swung from ANTI-FRAGILE to FRAGILE

😩MOAT is narrower than I thought.

• • •

Missing some Tweet in this thread? You can try to

force a refresh