It's done! Here's the final thread in my scaled SaaS investing framework series. I saved my favorite topic for last: how to recognize extensible products that will create durable growth, with a few famous case studies. 🧵👇

1/ There are two ways products can be extensible: they can be natively flexible or "centers of gravity" that eventually attract other features/functionality into their orbits. I'll give a case study for each.

2/ A natively flexible product is one that can be easily repurposed to solve other problems. The canonical example of this is ServiceNow ($NOW). Many aren't familiar with this story, but the initial concept behind ServiceNow was to build a cloud-based app development platform.

3/ In a prescient decision, the early team chose to focus on IT Services Management as a big, vulnerable market suited for the sort of workflow management platform they were building. This was so successful that by the IPO, $NOW was bucketed as an ITSM vendor.

4/ However, that initial product vision (and the intrinsic flexibility of being built around "enterprise workflows") gave ServiceNow a natural way to expand into new areas like security, HR, legal, and customer support. Here's a chart from 2018 showing the early stages of this:

5/ Today, 42% of net new ACV comes from non-IT segments, and even within IT the product has expanded dramatically into ops management, security, etc. It turns out that workflows are everywhere and despite being an "ITSM company", ServiceNow was always a workflow platform.

6/ Contrast this with another all-time great SaaS company. Workday and ServiceNow were peers when I started investing in SaaS in 2015: similar scales, growth, valuation. But $WDAY had a challenge- its expansion area, financials, was not that adjacent to the core HCM product.

7/ The key underlying concept for its ERP product was financial data, not people data. Rather than repurposing a platform, Workday needed to build almost an entirely new one. Even the buyer was a different C-level executive.

8/ Workday has made a ton of progress and financials is a slow burn category- I've no doubt it will be successful. Still, from the spring-2014 highs, Workday is up 3x vs. ServiceNow up 10x. $NOW's platform extensibility is the main factor behind this.

9/ One trick to check if a product is extensible is to see if there are any customers/users who "go rogue" and use a product off spec. You'll find Monday.com, Smartsheet, Servicenow, Jira et al used in creative ways the designers could hardly have imagined.

10/ Aside from flexibility, another way a company can attract incremental functionality to its platform is by occupying a "center of gravity" in the constellation of data/compute services that are needed for a business to get work done.

11/ Just like wisps of matter in a void, some software features "attract" each other. The benefits of a common UI, the same underlying data model, the same customer support team, bundled pricing, etc. can outweigh the benefit of buying "best in breed" for each function.

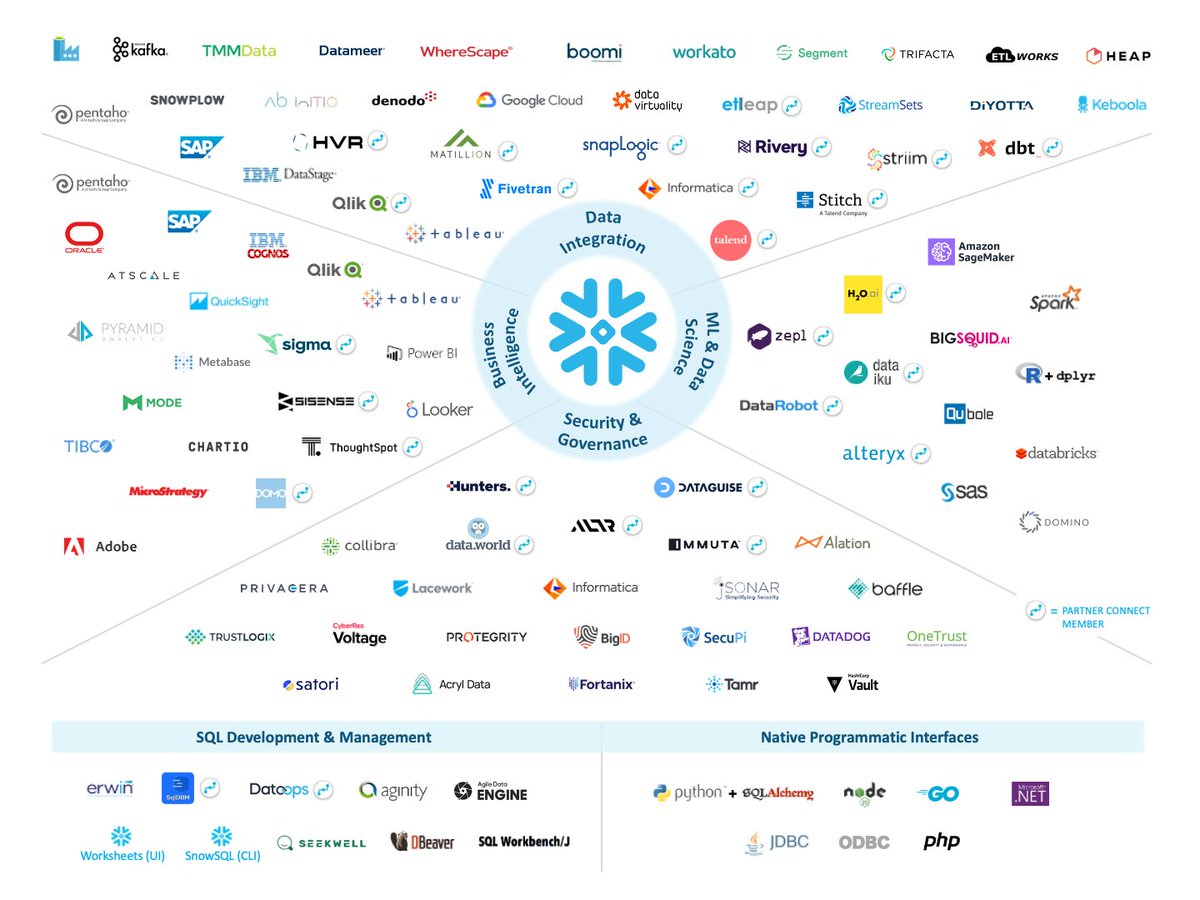

12/ As an example, consider Snowflake. $SNOW becomes the central place where critical business data lives for its customers. This is the product-gravity equivalent of being a black hole. Everything from ETL to data manipulation tools to visualization is on the event horizon.

13/ You can almost see the gravity in this chart- not only have multiple $1bn+ companies been built on/around Snowflake, but the company has an incredible opportunity to build out incremental features/functionality at the edges.

14/ It has chosen to monetize its position by building products/services that encourage usage of the core platform. That's a smart play- it's always difficult to compete with free and there's huge room for the core to grow.

15/ There's also a sort of data gravity at play- once a company has a critical mass of its data on Snowflake, it makes more sense to add the rest. The data exchange takes this principle across companies. Maybe the world would be better off if most data lived on Snowflake! ❄️

16/ So how can investors recognize products that are centers of gravity? Some signs I look for:

1) The company owns a vertical ($VEEV)

2) Startups rush to build around the edges ($SNOW)

3) It occupies a key layer of the stack ($SHOP)

4) New modules are rapidly adopted ($DDOG)

1) The company owns a vertical ($VEEV)

2) Startups rush to build around the edges ($SNOW)

3) It occupies a key layer of the stack ($SHOP)

4) New modules are rapidly adopted ($DDOG)

17/ One question I love to ask to vet this out: "What's the next feature that you're excited to release?" followed by "What share of your customers is it a fit for?" If the product is a true center of gravity, the first answer will come quickly and the second will be "most."

18/ One final point- almost all scaled public software companies benefit from this to some degree, and they are not just pulling in existing software use cases but also absorbing tasks that were previously completed manually by people.

19/ As an industry, SaaS is uniquely well-positioned to supplement and eventually replace big chunks of knowledge work, leading to decades of above GDP growth (and less menial work for us!). This is the crux of why I expect the sector to be a bigger part of the economy over time.

20/ I'll flesh that out in a future thread, but first I'm going to take a stab at thinking through how crypto/DAOs will impact SaaS. Happy investing!

Note: None of this is investment advice. :)

Note: None of this is investment advice. :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh