Partner @avenir_growth, where I invest in startups. Honorary head of data science.

Here to bring some analytical irreverence.

Views my own.

4 subscribers

How to get URL link on X (Twitter) App

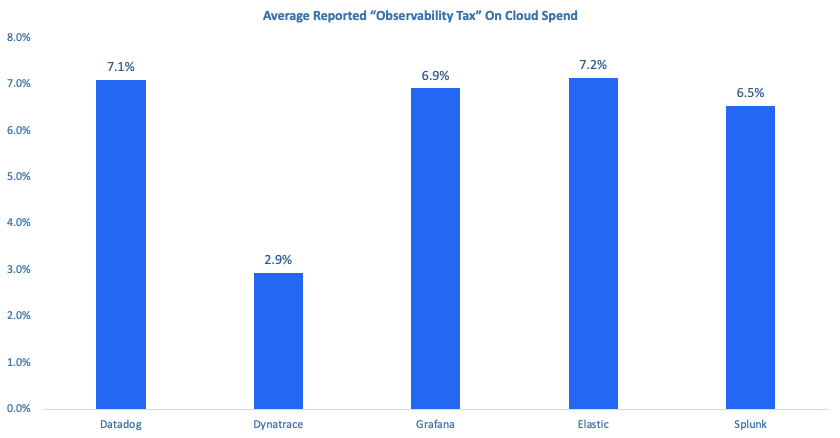

2/ Buyers report an average of a ~7% "observability tax" on cloud spend. This was the lowest by far for Dynatrace customers for reasons that aren't quite clear to me:

2/ Buyers report an average of a ~7% "observability tax" on cloud spend. This was the lowest by far for Dynatrace customers for reasons that aren't quite clear to me:

1/ Multiples started higher than in all but the early-2021 correction. There's still ~24% downside to the average "bottoming" multiple.

1/ Multiples started higher than in all but the early-2021 correction. There's still ~24% downside to the average "bottoming" multiple.