Today's personal consumption data gives the most detailed picture of where consumers are now.

And the answer is: overall consumption is back, the goods-services disconnect is still large, but mostly that is because goods are high and rising even while services partly recover.

And the answer is: overall consumption is back, the goods-services disconnect is still large, but mostly that is because goods are high and rising even while services partly recover.

Here is real spending on goods and goods. Note that real services spending has been *rising* even while services spending is recovering.

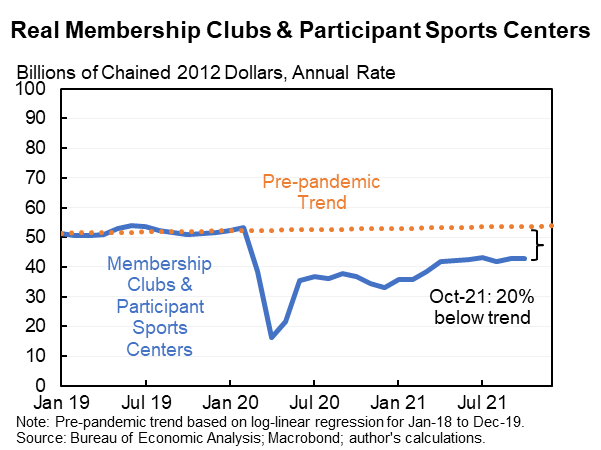

Look at spending on sporting equipment, guns & ammunition vs. membership clubs and sports center. The former is high and the later is low. But the goods spending is still rising even while the services is roughly flat.

And my favorite, people kept buying a lot in supermarkets even as their restaurant spending returned to normal. I've tweeted about that before.

https://twitter.com/jasonfurman/status/1449093123058057217?s=20

Also remember that the biggest shortfall in services is health. This isn't quite the same as people choosing not to go to gyms or manicures. And may not have the same obvious micro substitution. Although even ex health and nonprofits (which are in PCE), services below trend.

So overall the composition shift is clearly part of the story (people buying goods instead of services). But it's only part--as goods spending keeps rising while services is flat or recovering. So there is also a big demand increase (is screamingly clear in the nominal data).

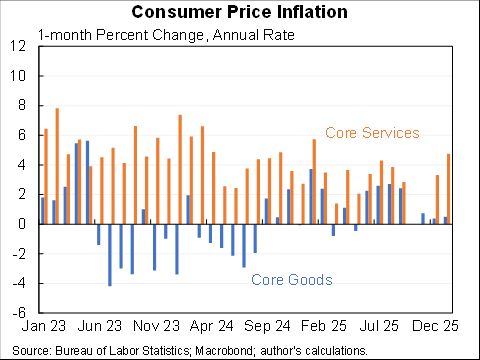

We do still have an issue with the composition of consumption in our economy. As it shifts we're likely to see some falloff in goods inflation and some rise in services inflation. I expect that will mean lower inflation overall but is not obvious.

In fact, in Q3 the biggest shortfall in the economy was not consumption (which gets most of the attention) but business investment. With new orders so high this investment gap also may be closing rapidly.

Finally, here is a full table about what is up or down relative to trend in the consumption components--and how those contribute to the overall numbers. Enjoy!

• • •

Missing some Tweet in this thread? You can try to

force a refresh