1/ Institutional Investors and Stock Return Anomalies (Edelen, Ince, Kadlec)

"At the one-year horizon, institutions have a strong tendency to buy overvalued stocks (anomalies' short legs) and which have particularly negative ex-post abnormal returns."

papers.ssrn.com/sol3/papers.cf…

"At the one-year horizon, institutions have a strong tendency to buy overvalued stocks (anomalies' short legs) and which have particularly negative ex-post abnormal returns."

papers.ssrn.com/sol3/papers.cf…

2/ SIH = sophisticated institutions hypothesis (agents trading in a way that exploits anomaly return predictability)

"We assign anomalies to seven broad categories, choosing the one from each category with the most reliable alpha (highest t-statistic) during our sample period."

"We assign anomalies to seven broad categories, choosing the one from each category with the most reliable alpha (highest t-statistic) during our sample period."

3/ "Because our central hypothesis centers around how institutional investors modify their portfolios as stocks take on anomaly characteristics, we examine changes in holdings rather than levels. We focus on the number of institutions holding a stock rather than % shares held."

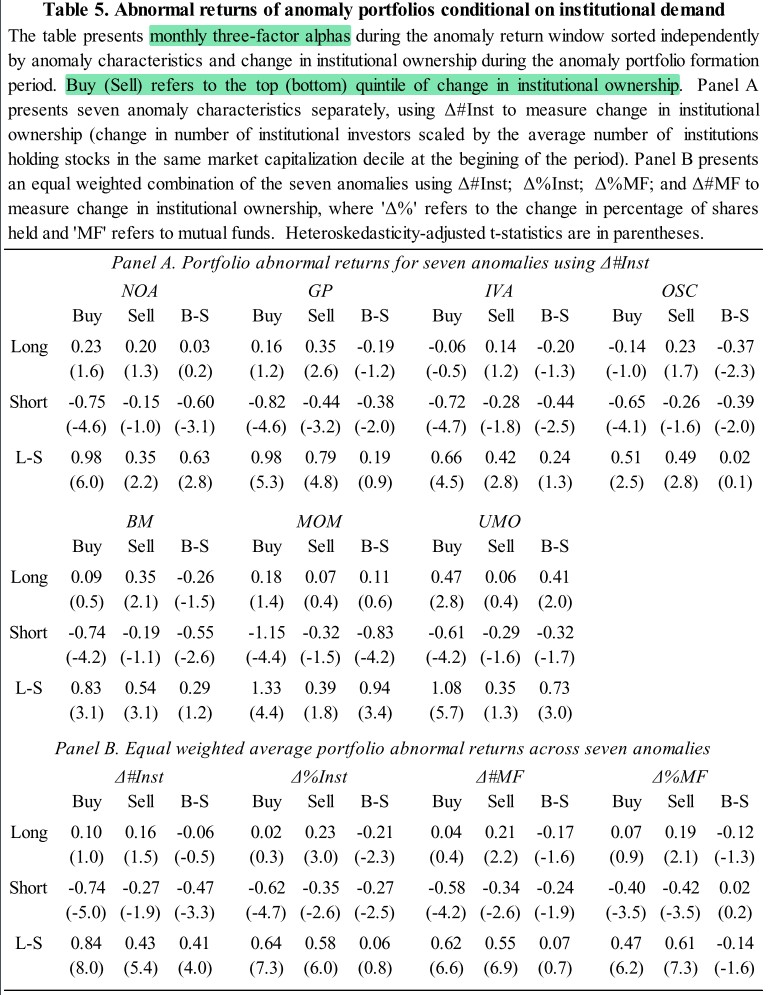

4/ "In aggregate, institutions generally do not exploit anomalies. Rather, in the majority of cases, their trading runs contrary to anomaly prescriptions. (We do find isolated support for the sophisticated institutions hypothesis in the case of momentum.)"

5/ "Anomaly stocks that institutions buy underperform those they sell in 11 out of 14 portfolios. This poor performance is concentrated in the anomaly short-leg stocks that institutions buy, which earn significantly negative abnormal returns for all seven anomalies."

6/ "Short-leg stocks institutions buy do not differ from the long-leg stocks they buy. However, long-leg stocks institutions sell are less liquid than short-leg stocks sold.

"This does not offer a compelling explanation for their contrary trading pattern or resulting returns."

"This does not offer a compelling explanation for their contrary trading pattern or resulting returns."

7/ "If institutions reversed positions, they might capture shorter-horizon positive abnormal returns and avoid longer-horizon negative abnormal returns.

"However, there is no reliable evidence of reversal in ∆#Inst during or immediately preceding the anomaly return window."

"However, there is no reliable evidence of reversal in ∆#Inst during or immediately preceding the anomaly return window."

8/ "The negative long-horizon relation subsuming the positive short-horizon relation – particularly for anomaly short legs – suggests that the short-horizon positive relation may reflect price pressure from persistent institutional trading as opposed to informed trading."

9/ "Long-horizon changes in number of institutional investors are negatively related to future stock returns, due both to institutions’ adverse exposure to anomaly characteristics and to a direct negative effect independent from the anomalies.

10/ "We also find that the positive relation between institutional demand and stock returns documented by earlier studies is largely orthogonal to anomalies and short-lived."

11/ "Mutual fund inflows typically go towards expansion of existing positions. Hence, flow-induced price pressure should be more closely related to ∆%Inst (reflecting adjustments to both existing positions and new & closed positions) than ∆#Inst (only new and closed positions).

12/ "New and closed positions appear more relevant to future returns than adjustments to ongoing positions, casting doubt on flow as the cause.

"The long-horizon negative relation between institutional demand and future returns does not appear to be due to investor flow."

"The long-horizon negative relation between institutional demand and future returns does not appear to be due to investor flow."

13/ "The long-horizon ∆#Inst that negatively relate to abnormal returns also negatively relate to earnings announcement returns. This suggests that institutions’ long-run contrary demand for anomaly characteristics may be partly due to faulty earnings expectations."

14/ "Institutions’ contrary preference for anomaly stocks extends to large-cap stocks, whereas both the short-term continuation and long-term price reversals from their trading _orthogonal_ to anomaly characteristics appears to be limited to micro-cap stocks."

15/ "Institutions’ contrary preference for anomaly stocks has not diminished over time despite increasing awareness of the anomalies.

"Notably, the positive predictive power of short-horizon institutional demand documented by earlier studies seems to have dissipated over time."

"Notably, the positive predictive power of short-horizon institutional demand documented by earlier studies seems to have dissipated over time."

16/ "A large body of literature portrays institutions as sophisticated, but the relation between their demand and anomalies is more consistent with a causal than an arbitrager role.

"The place to look for an economic force big enough to distort asset prices is institutions."

"The place to look for an economic force big enough to distort asset prices is institutions."

17/ Related research:

Anomalies and News

"Analysts are normally wrong stocks' expected returns. Over pessimism/over-optimism could contribute to anomaly returns."

Robust Beauty of Improper Linear Models in Decision-Making

Anomalies and News

"Analysts are normally wrong stocks' expected returns. Over pessimism/over-optimism could contribute to anomaly returns."

https://twitter.com/ReformedTrader/status/1163204613333327872

Robust Beauty of Improper Linear Models in Decision-Making

https://twitter.com/ReformedTrader/status/1442724335123193859

18/ Who are the Sentiment Traders? Evidence from the Cross-Section of Stock Returns and Demand

https://twitter.com/ReformedTrader/status/1463940613112418316

19/ Momentum, Reversals, and Investor Clientele

https://twitter.com/ReformedTrader/status/1468764357261611008

20/ Role of Shorting, Firm Size, and Time on Market Anomalies

https://twitter.com/ReformedTrader/status/1121175521369284608

21/ Who Drove and Burst the Tech Bubble?

https://twitter.com/ReformedTrader/status/1469511945292189698

• • •

Missing some Tweet in this thread? You can try to

force a refresh