$ADYEY at a glance

In this thread I will try to summarise one of the strongest value propositions in the payment Industry: Adyen.

Without further a do, let’s get started!

/THREAD/

In this thread I will try to summarise one of the strongest value propositions in the payment Industry: Adyen.

Without further a do, let’s get started!

/THREAD/

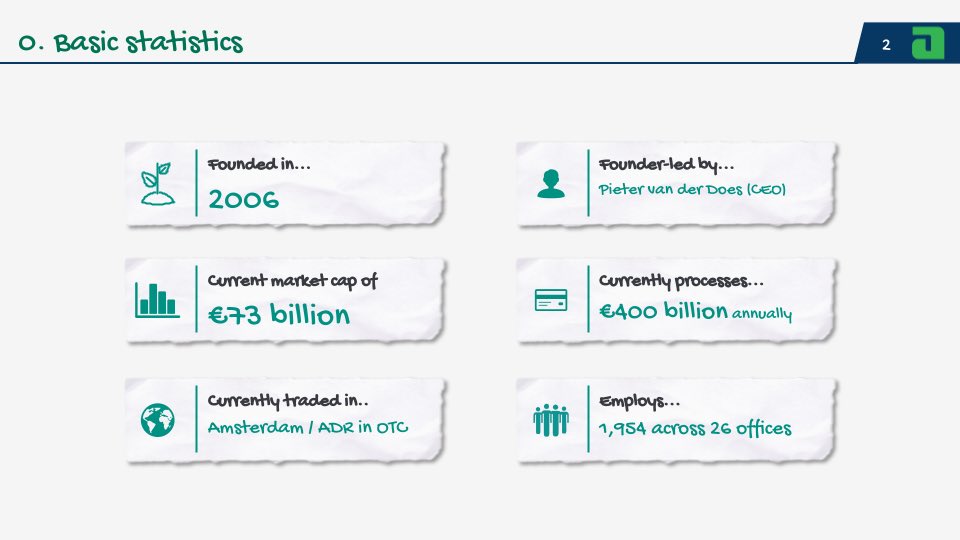

1/ Starting with some basic info

The company was founded in 2006 under the name “Adyen” which means “A new beginning” in Surinamese.

Adyen currently processes around €400 billion annually and has a market cap of $73 billion, being traded in Amsterdam and OTC in the US

The company was founded in 2006 under the name “Adyen” which means “A new beginning” in Surinamese.

Adyen currently processes around €400 billion annually and has a market cap of $73 billion, being traded in Amsterdam and OTC in the US

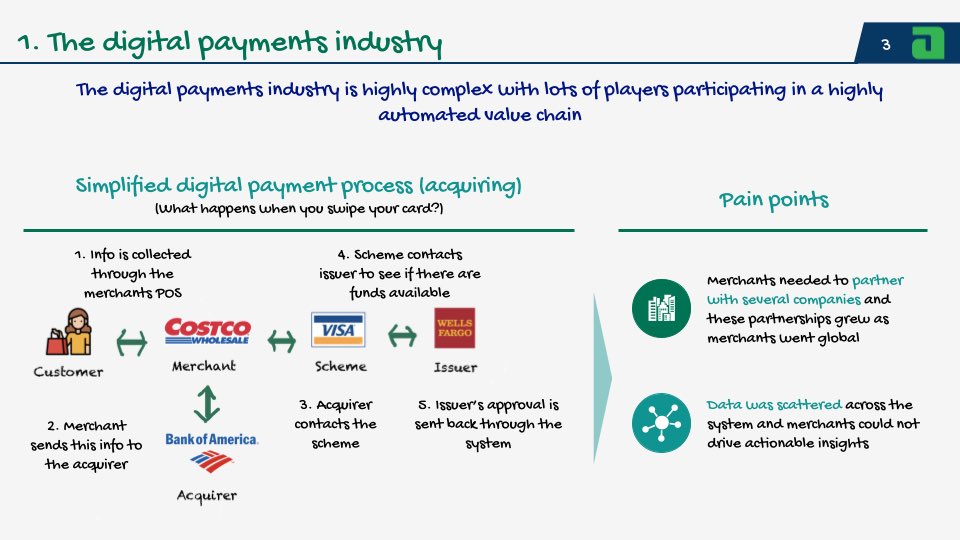

2/ To understand Adyen’s value proposition it’s important to understand the pain points of the traditional pmts system.

Merchants had to partner with many companies to accept payments and this generated disperse data that drove little actionable insights

Merchants had to partner with many companies to accept payments and this generated disperse data that drove little actionable insights

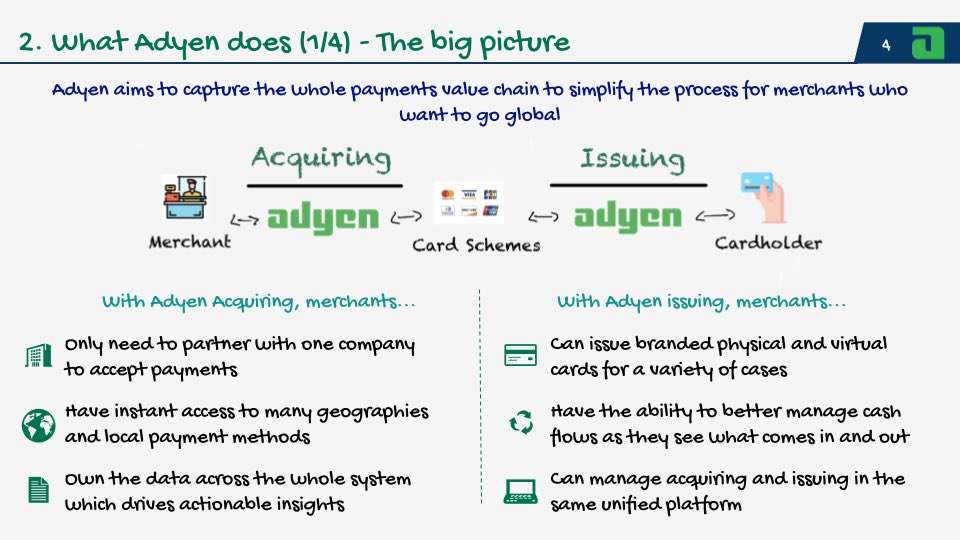

3/ Adyen aimed to solve these pain points by capturing as much of the value chain as possible, both in the acquiring and issuing side.

This allowed large merchants to partner just with one company (Adyen) and to manage payment processing in a platform where data was unified

This allowed large merchants to partner just with one company (Adyen) and to manage payment processing in a platform where data was unified

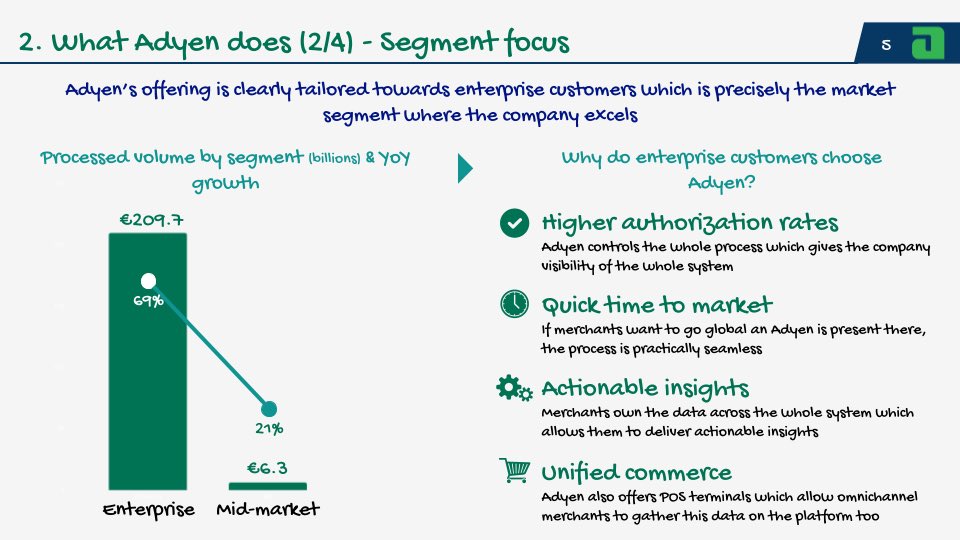

4/ This value proposition helped Adyen excel in enterprise as it solved many of large merchants’ pain points

The enterprise segment continues to drive growth despite coming from a larger base due to the advantages for large enterprises described in the slide below

The enterprise segment continues to drive growth despite coming from a larger base due to the advantages for large enterprises described in the slide below

5/ The company follows a land and expand model where it typically starts working with a customer in one geography and then expands across other geographies and channels

Most of the volume growth is currently being driven by merchants already on the platform

Most of the volume growth is currently being driven by merchants already on the platform

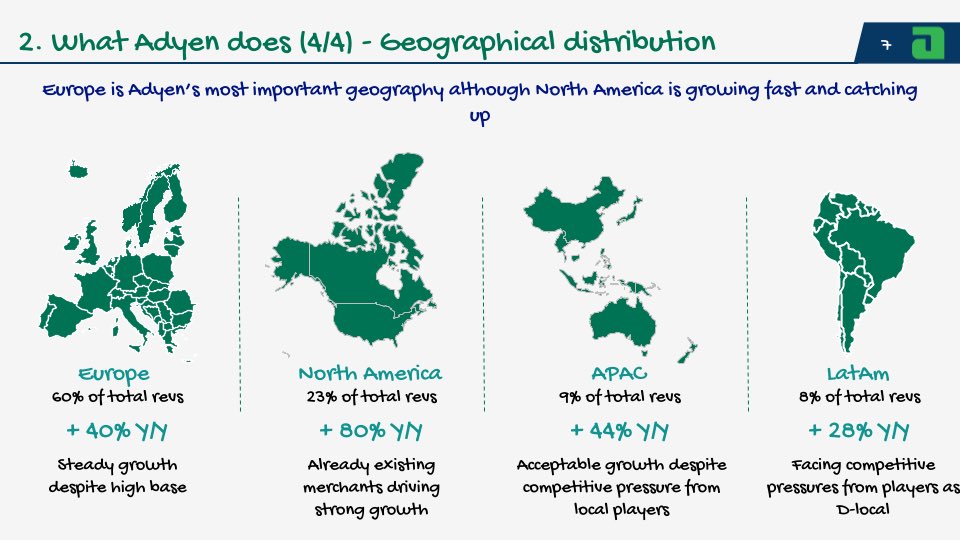

6/ Adyen is dominant in Europe although it’s quickly growing in the US due to its existing customer base giving more domestic volume to the company

In emerging economies Adyen is still in the process of acquiring all relevant licenses to compete favourably against incumbents

In emerging economies Adyen is still in the process of acquiring all relevant licenses to compete favourably against incumbents

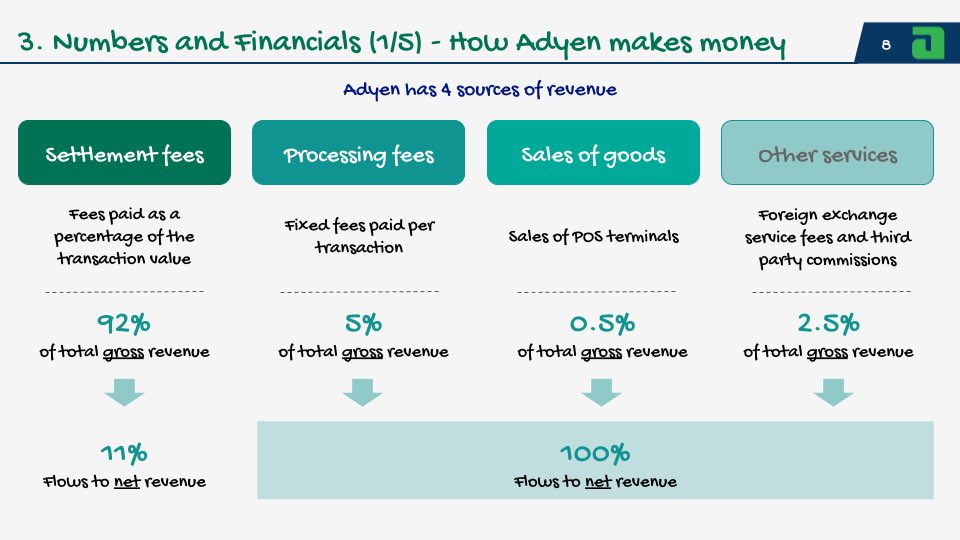

7/ The company has 4 sources of revenue

Settlement fees make up most of gross revenue although the majority is paid to financial institutions who act as intermediaries

The rest of the sources flow directly to net revenue as there are no intermediaries involved

Settlement fees make up most of gross revenue although the majority is paid to financial institutions who act as intermediaries

The rest of the sources flow directly to net revenue as there are no intermediaries involved

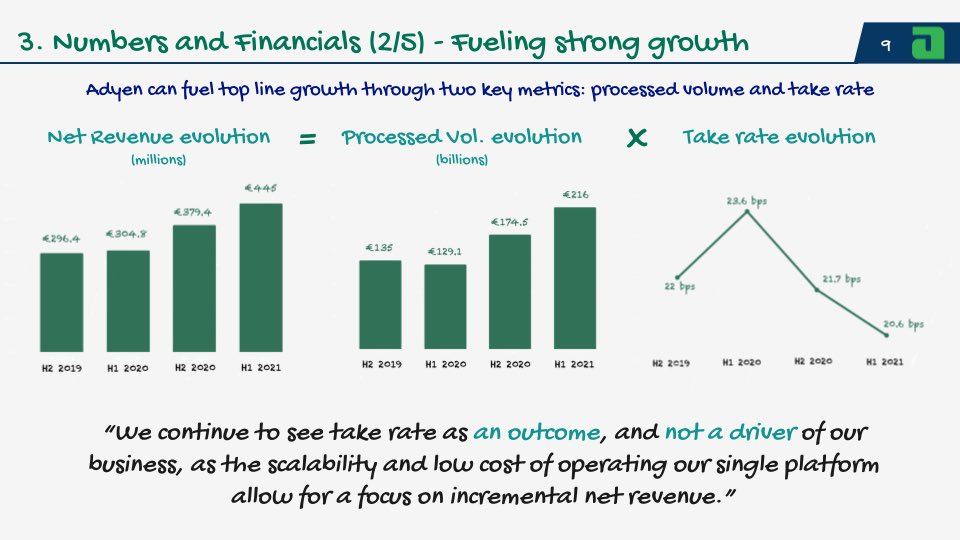

8/ Net revenue is a function of processed volume and take rate.

Adyen’s strategy to grow net revenue has clearly been laid out by mgmt., focusing on incremental processed volume at the expense of take rate

The more volume you bring as a merchant, the cheaper Adyen becomes

Adyen’s strategy to grow net revenue has clearly been laid out by mgmt., focusing on incremental processed volume at the expense of take rate

The more volume you bring as a merchant, the cheaper Adyen becomes

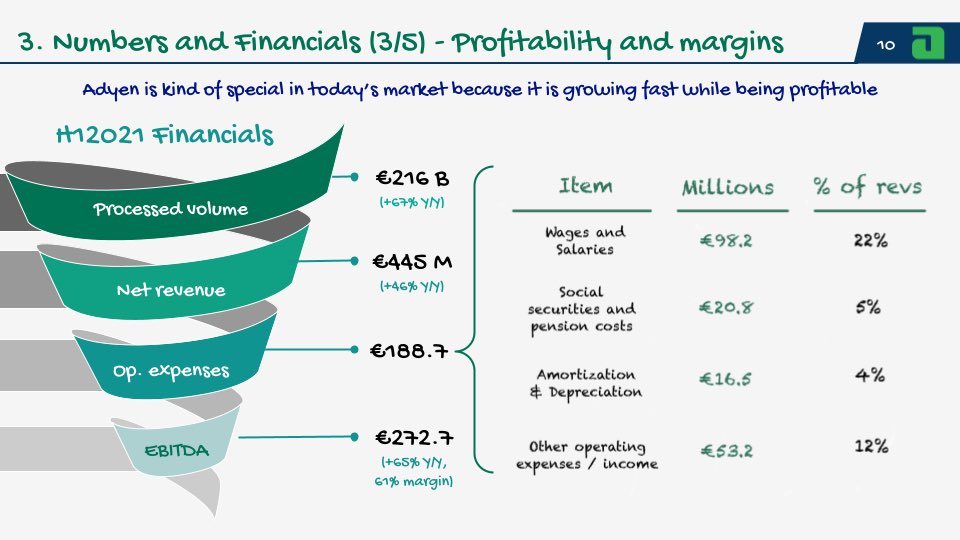

9/ Adyen is growing its top line fast while being profitable (61% EBITDA margin calculated over net revenue)

The platform is CapEx lights which allows the company to enjoy such great margins without sacrificing growth

The platform is CapEx lights which allows the company to enjoy such great margins without sacrificing growth

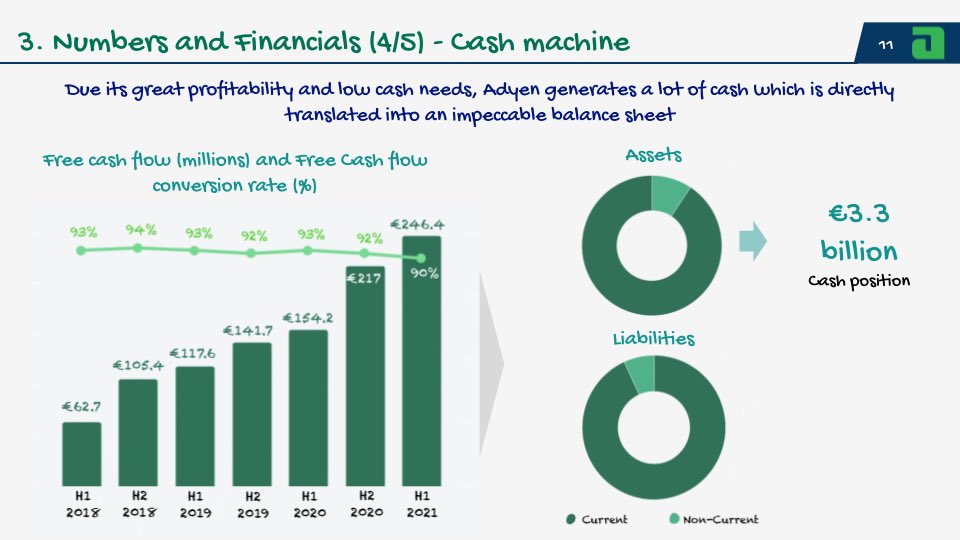

10/ Adyen is profitable on an accounting basis and has very low cash needs, combination which converts the company into a cash machine.

The company converts 90% of EBITDA into cash and this has allowed the company to enjoy a hefty cash position with no debt.

The company converts 90% of EBITDA into cash and this has allowed the company to enjoy a hefty cash position with no debt.

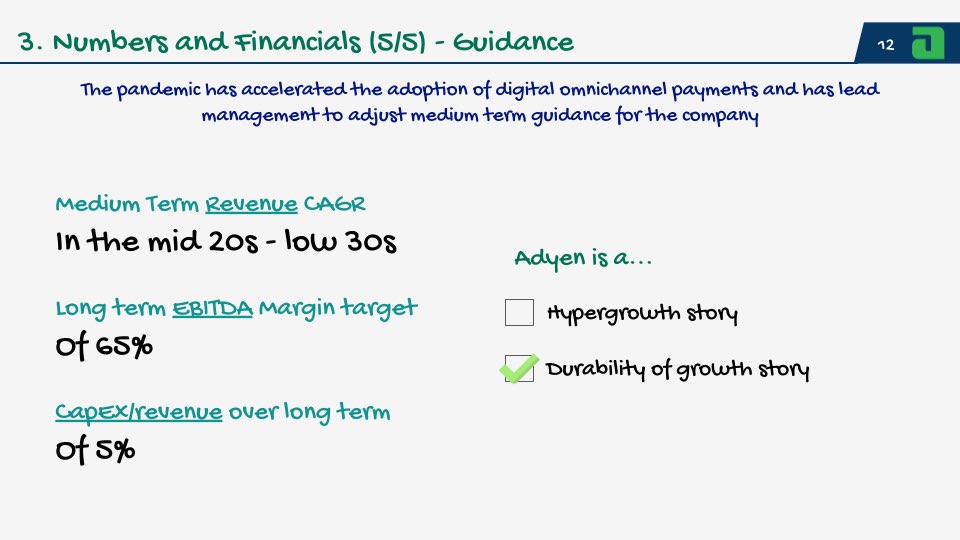

11/ Management, who has historically been conservative, is guiding for strong growth over the medium term.

This growth will not come at the expense of margins as 65% EBITDA margins (over net revenue) are expected over the long term.

For me Adyen is a durability of growth story

This growth will not come at the expense of margins as 65% EBITDA margins (over net revenue) are expected over the long term.

For me Adyen is a durability of growth story

12/ Adyen is managed by a small team of 6 managers.

These managers put a lot of focus on company culture to create an environment where every employee has the Adyen formula ingrained in them.

Having 2,000 employees, every candidate must meet a manager before joining 😲

These managers put a lot of focus on company culture to create an environment where every employee has the Adyen formula ingrained in them.

Having 2,000 employees, every candidate must meet a manager before joining 😲

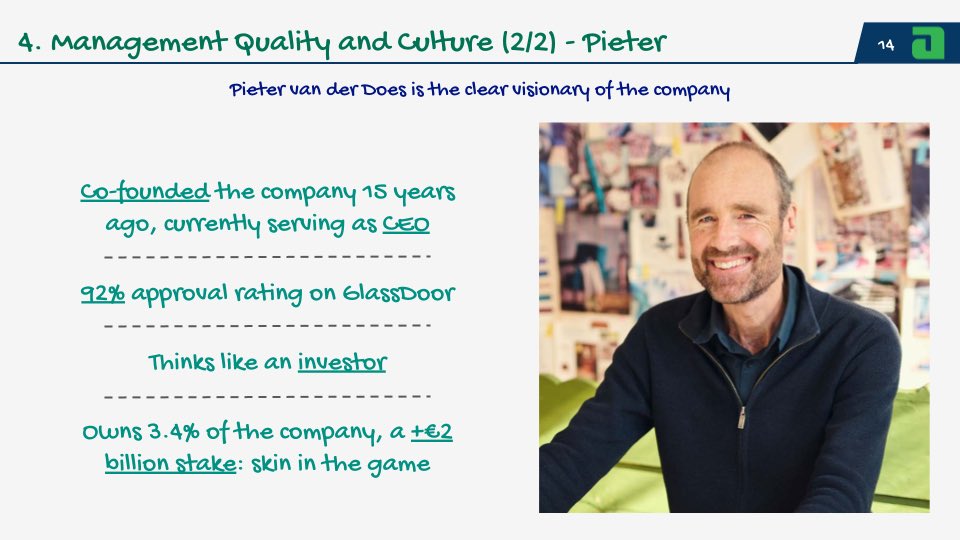

13/ From these managers there is clearly an outsider: Pieter van der Does.

Pieter leads the company that he co-founded 15 years ago and in many ways thinks as just another Adyen shareholder. This might be due to his +€2 billion stake in the company

Pieter leads the company that he co-founded 15 years ago and in many ways thinks as just another Adyen shareholder. This might be due to his +€2 billion stake in the company

14/ Since day 1, Adyen followed quite an unusual strategy for a disruptor as it directly targeted the high-end of the market

Due to this unusual strategy the company traditionally faced incumbents and still lays far away from traditional disruptors such as Square

Due to this unusual strategy the company traditionally faced incumbents and still lays far away from traditional disruptors such as Square

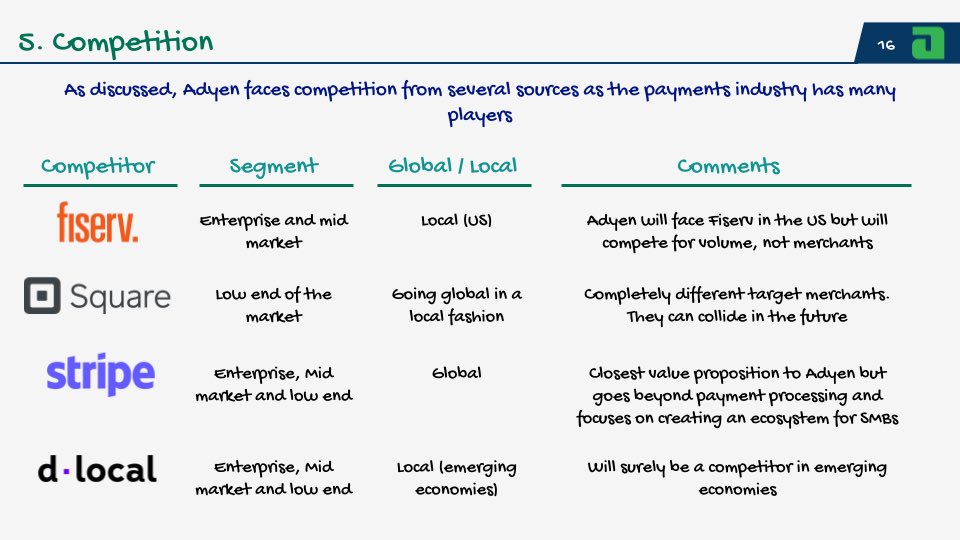

15/ In the slide below you can find some of Adyen’s competitors with some of my comments related to how the company competes against them

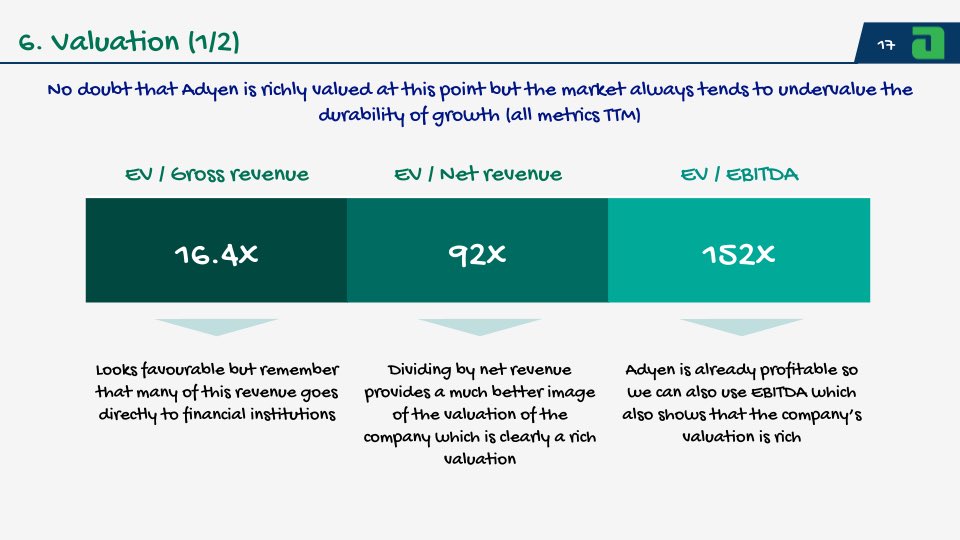

16/ Adyen is richly valued, there is no doubt about this.

Looking at the P/S ratio can be misleading as gross revenue is used for this ratio & most of it goes directly to financial institutions

As the company is profitable, we can use EBITDA ratios to see that it’s expensive

Looking at the P/S ratio can be misleading as gross revenue is used for this ratio & most of it goes directly to financial institutions

As the company is profitable, we can use EBITDA ratios to see that it’s expensive

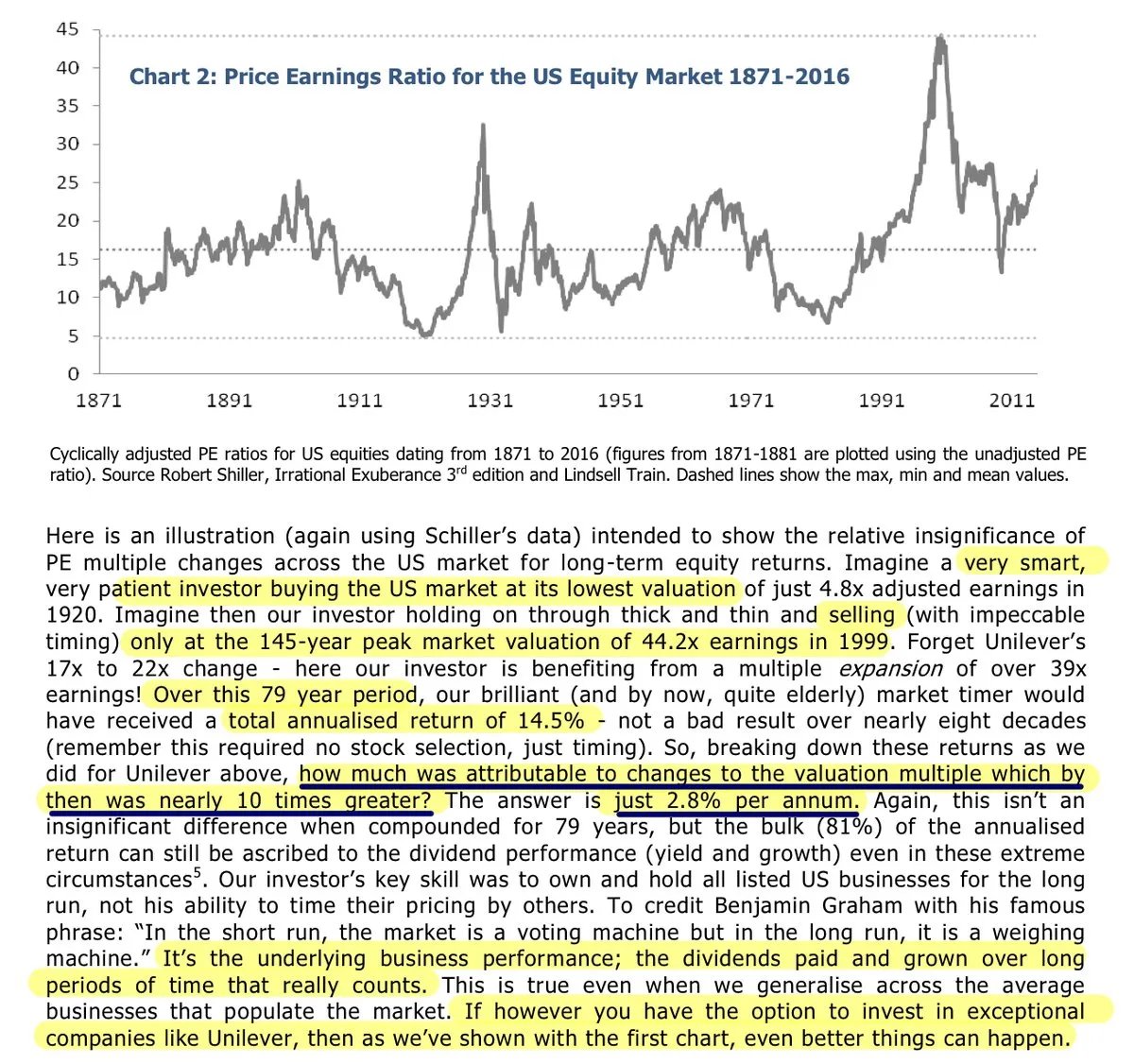

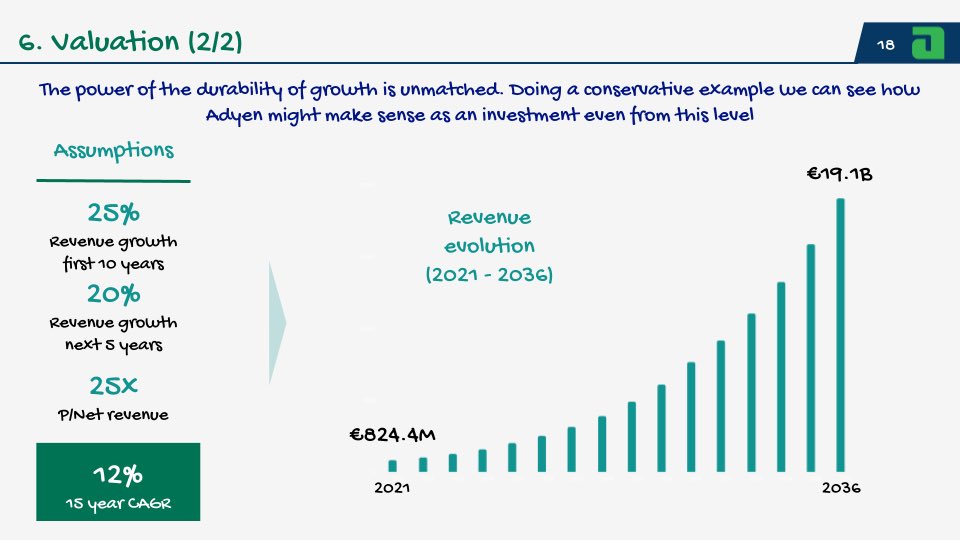

17/ However, doing a quick example and being conservative in the growth estimates that the company can achieve we see that from these levels Adyen might be a good long term investment

12% CAGR considering conservative growth and the P/Net revenue compressing more than 4x

12% CAGR considering conservative growth and the P/Net revenue compressing more than 4x

18/ There are many points that make Adyen a high quality company but I decided to go in depth into one of them: high quality customers

19/ No doubt that the company’s customer list is one of the most important aspects of the business

These customers can allow Adyen to comfortably achieve its growth targets without needing to add one single customer

How? Through 3 different sources:

These customers can allow Adyen to comfortably achieve its growth targets without needing to add one single customer

How? Through 3 different sources:

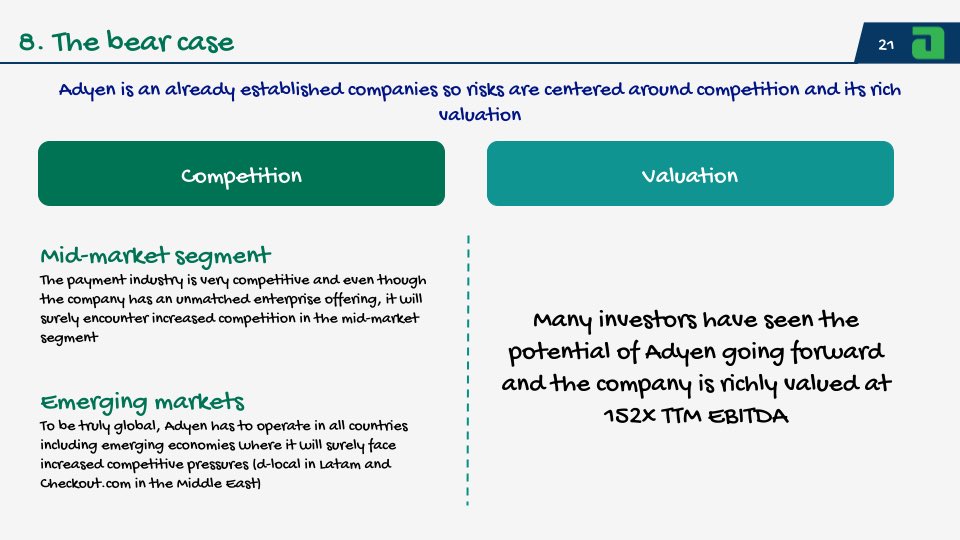

20/ Of course, as with any investment, there is also a bear case.

In the case of Adyen I’d say that the bear case is quite limited which would explain why it trades at such a hefty valuation

In the case of Adyen I’d say that the bear case is quite limited which would explain why it trades at such a hefty valuation

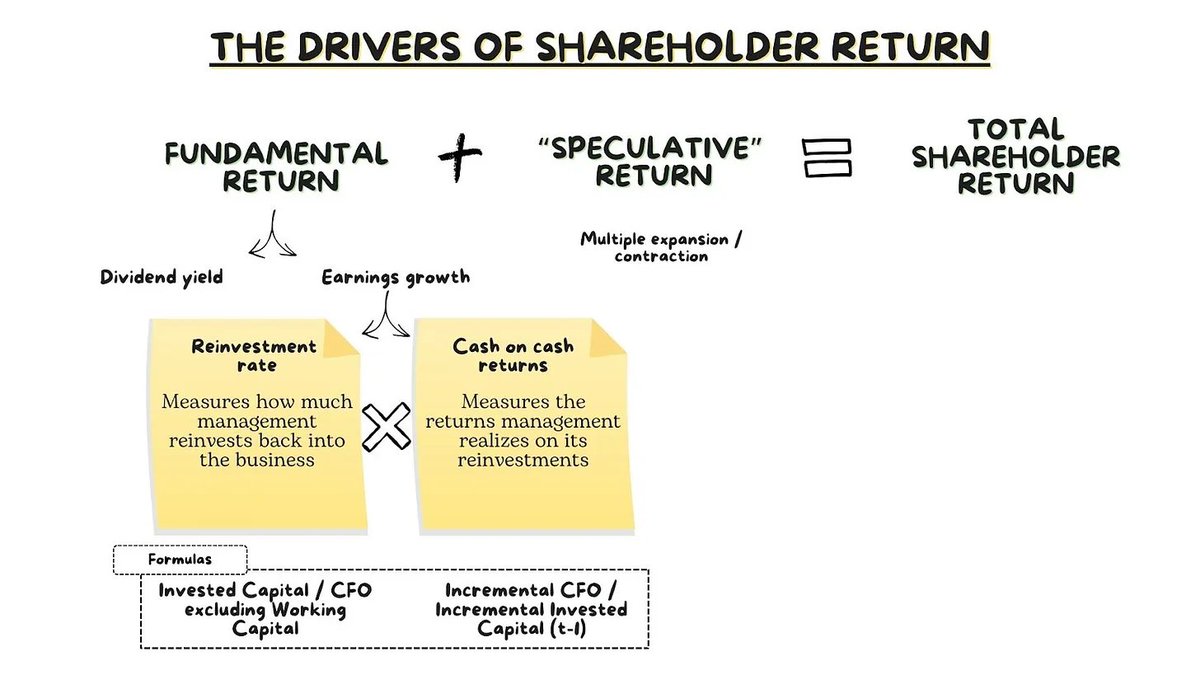

21/ My final thoughts on Adyen! I think that the company is a durability of growth story and we know that historically the market has not done a good job at pricing these types of companies

I am scaling in very slowly into my position because I am aware that valuation is rich

I am scaling in very slowly into my position because I am aware that valuation is rich

22/ If you enjoyed the thread please RT the first tweet of the thread

You can access the full presentation here:

docs.google.com/presentation/d…

Stay well!

You can access the full presentation here:

docs.google.com/presentation/d…

Stay well!

Maybe this thread interests you guys

@FromValue @LiviamCapital @Caleb_investTML @BahamaBen9 @plantmath1 @MazwoodCap

@FromValue @LiviamCapital @Caleb_investTML @BahamaBen9 @plantmath1 @MazwoodCap

• • •

Missing some Tweet in this thread? You can try to

force a refresh