Equity Analyst researching high-quality companies at Best Anchor Stocks and Invirtiendo en Calidad.

Spanish account: @InvEnCalidad

6 subscribers

How to get URL link on X (Twitter) App

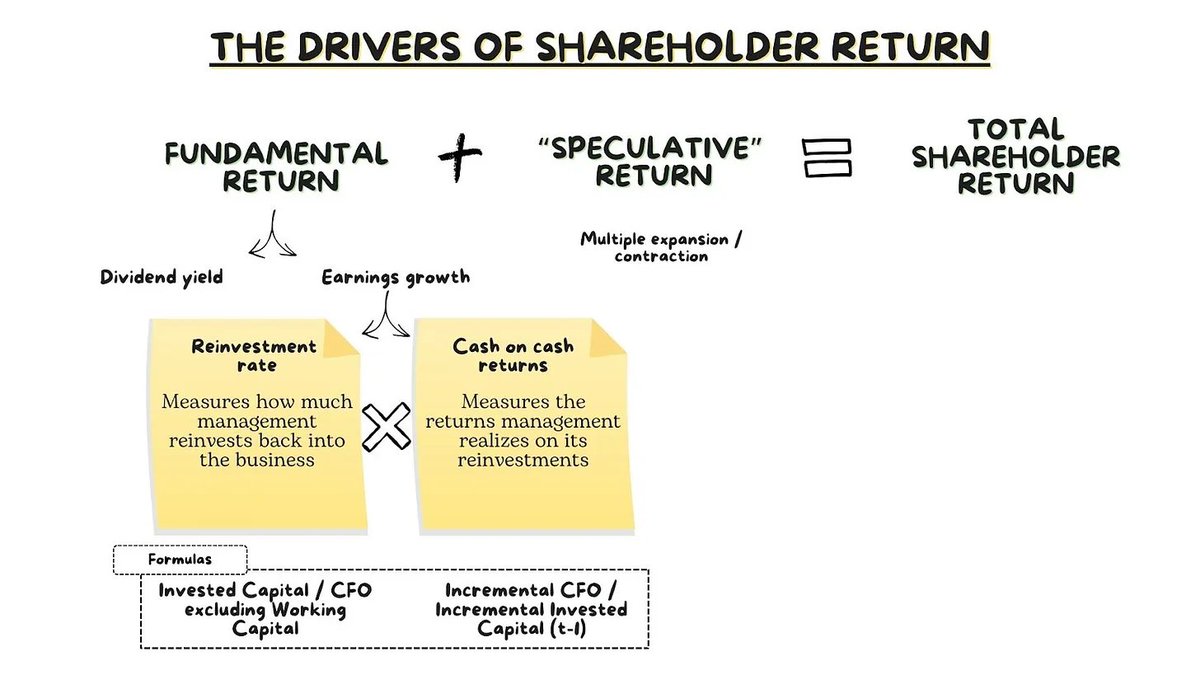

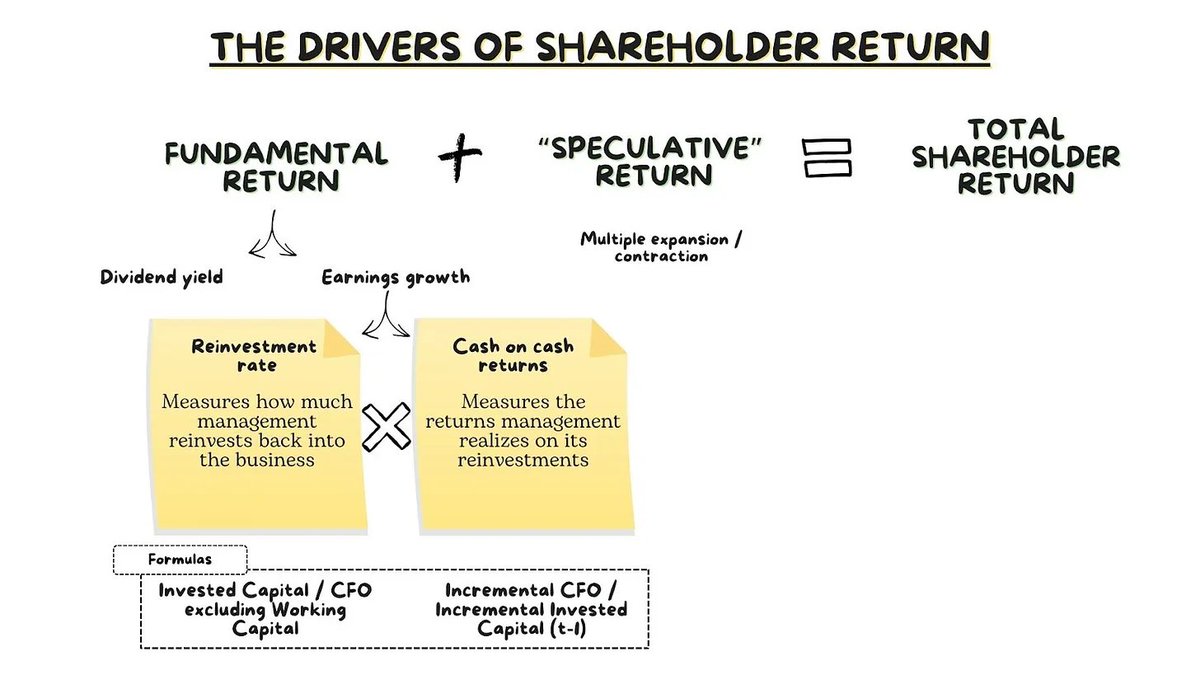

2/ Total Shareholder Return (TSR) is a function of two inputs:

2/ Total Shareholder Return (TSR) is a function of two inputs:

2/ It started like most investing journeys do: with a desire to “beat the market.”

2/ It started like most investing journeys do: with a desire to “beat the market.”

2/ We’re taught that PE = Price / Earnings. Easy enough.

2/ We’re taught that PE = Price / Earnings. Easy enough.

2/ Stevanato operates in the pharma value chain, but it doesn’t make drugs: it makes what injectable drugs go into: glass vials, syringes, and cartridges (i.e, containment solutions)

2/ Stevanato operates in the pharma value chain, but it doesn’t make drugs: it makes what injectable drugs go into: glass vials, syringes, and cartridges (i.e, containment solutions)

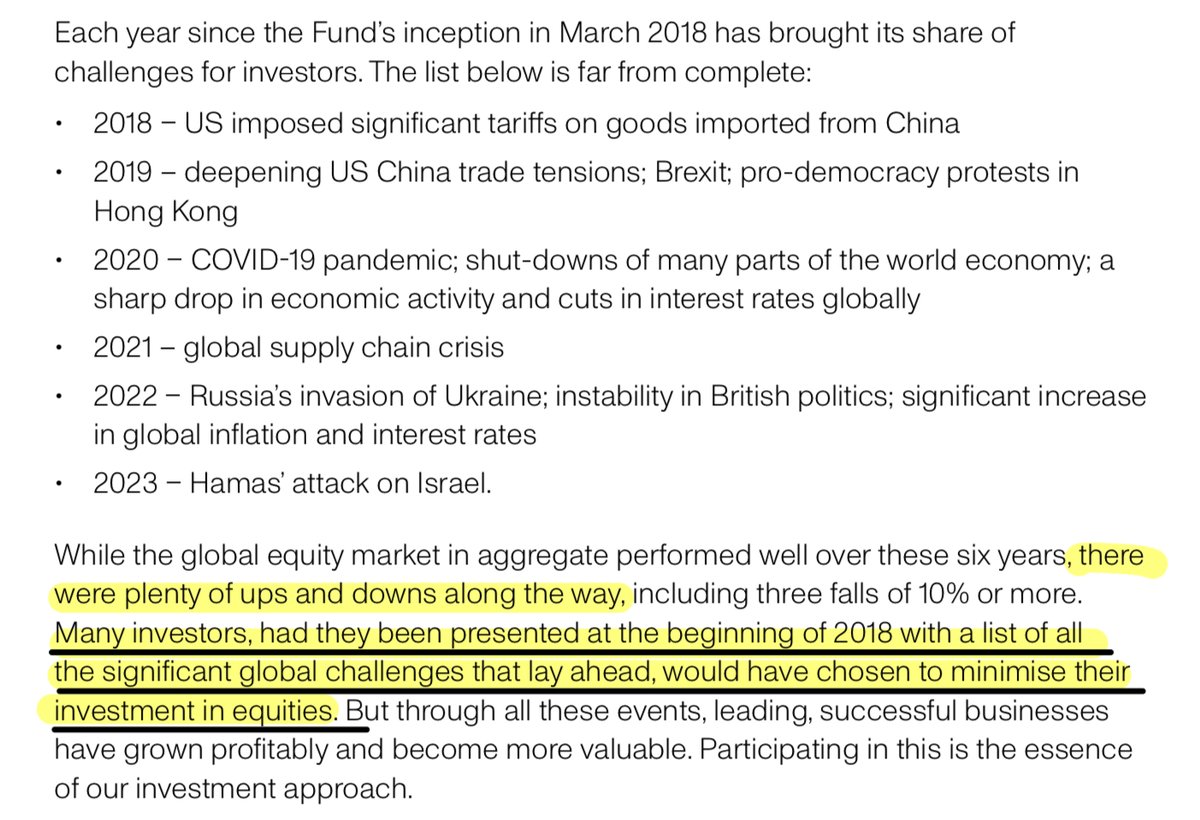

2/ Stock market did well since the inception of the fund (2018) despite all the obstacles that lay ahead.

2/ Stock market did well since the inception of the fund (2018) despite all the obstacles that lay ahead.

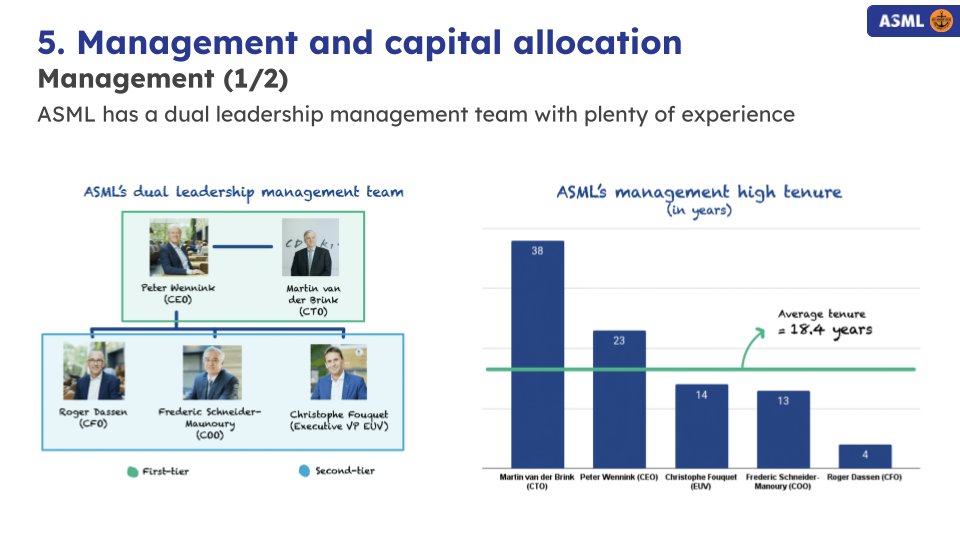

2/ ASML has a very experienced two-layered management team (CEO/CTO - rest). This structure is typically CEO/CFO in other companies but it makes sense for ASML to have the CTO there.

2/ ASML has a very experienced two-layered management team (CEO/CTO - rest). This structure is typically CEO/CFO in other companies but it makes sense for ASML to have the CTO there.

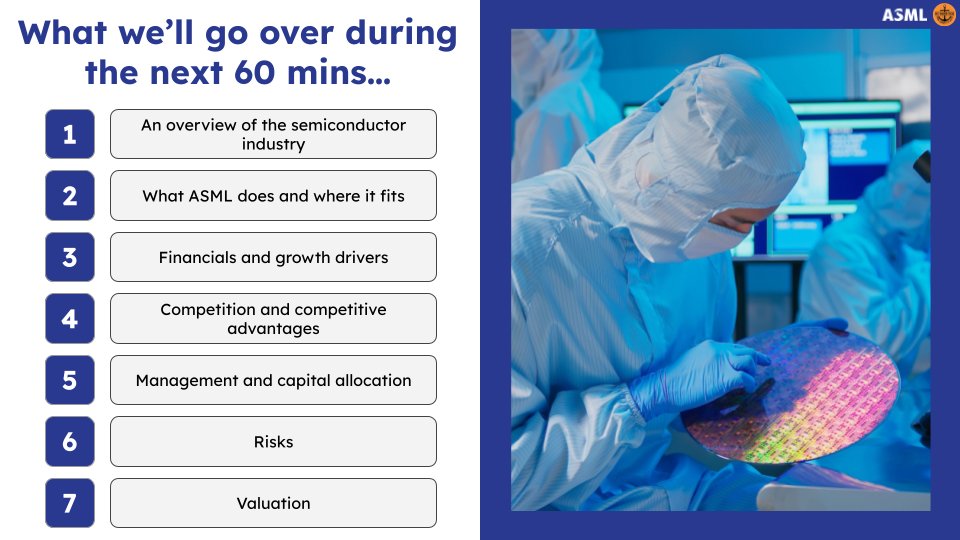

2/ I covered the following topics in the presentation.

2/ I covered the following topics in the presentation.

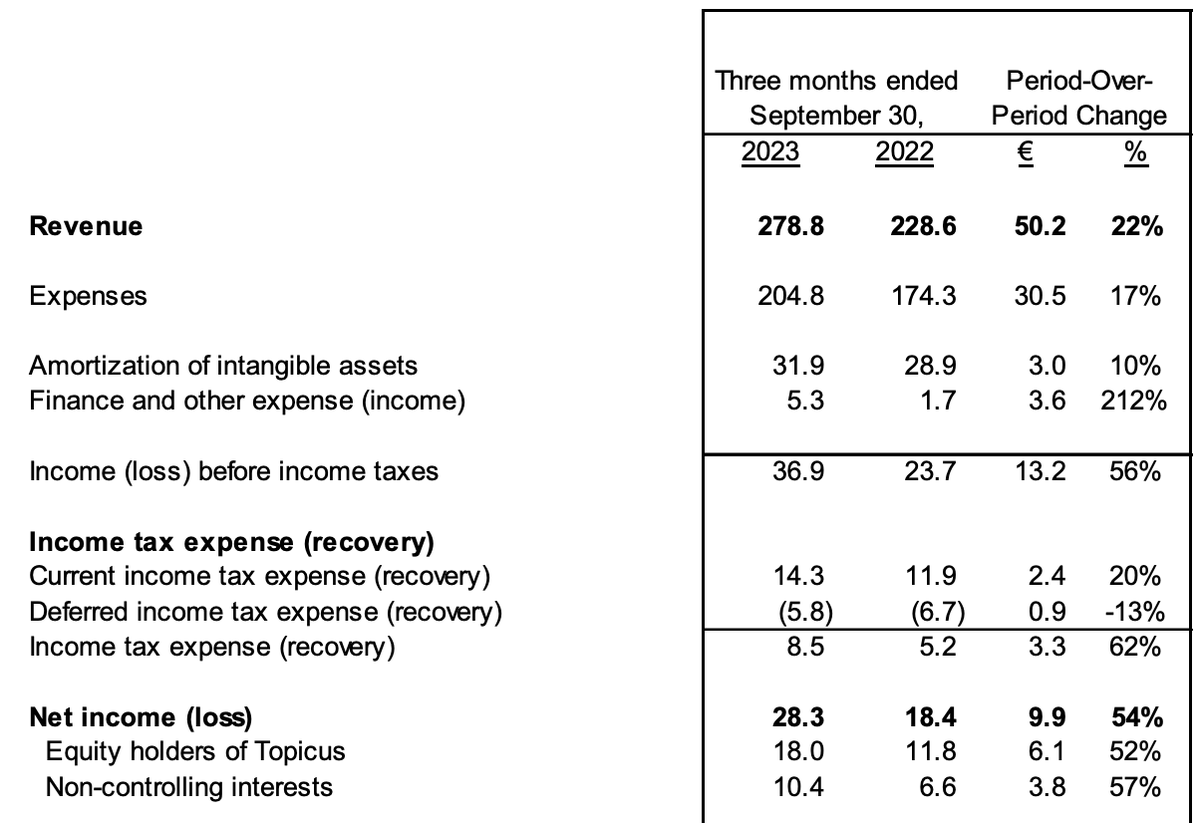

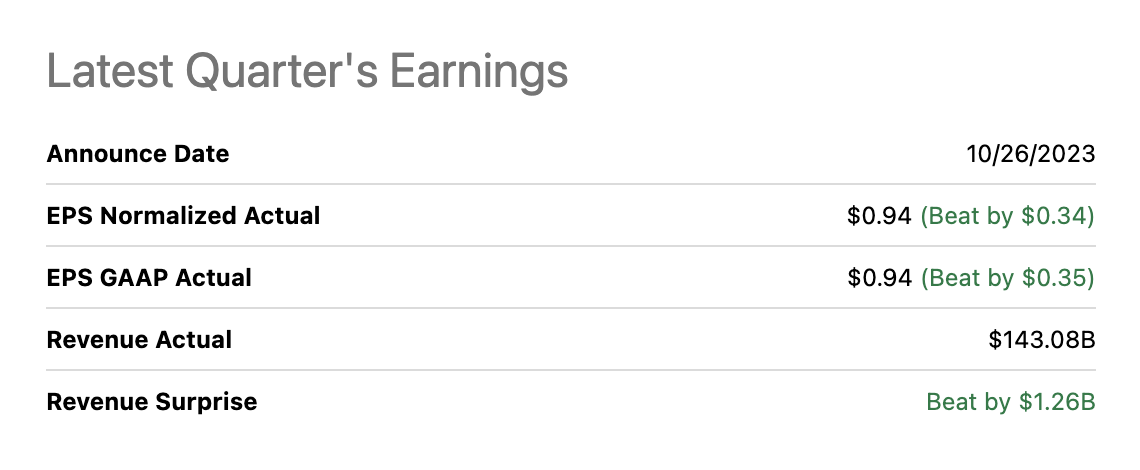

2/ First, the headlines.

2/ First, the headlines.

2/ For yet another quarter the company's beat on the bottom line was much more substantial than on the top line.

2/ For yet another quarter the company's beat on the bottom line was much more substantial than on the top line.

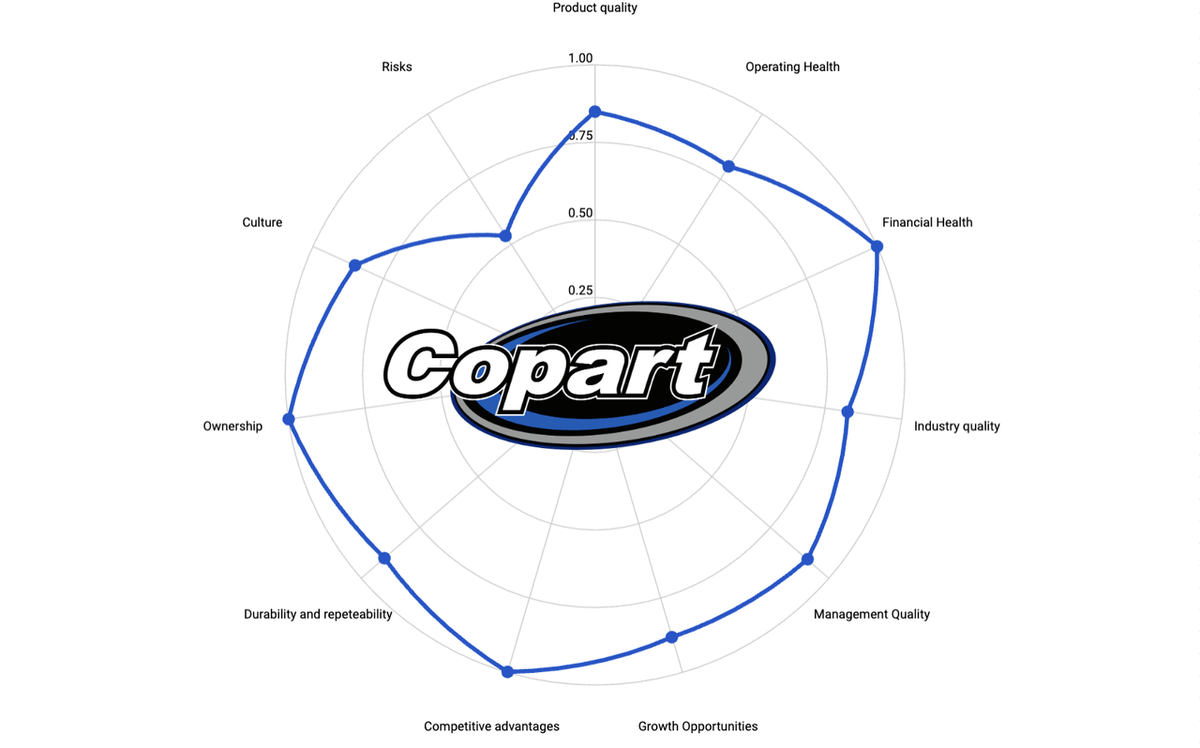

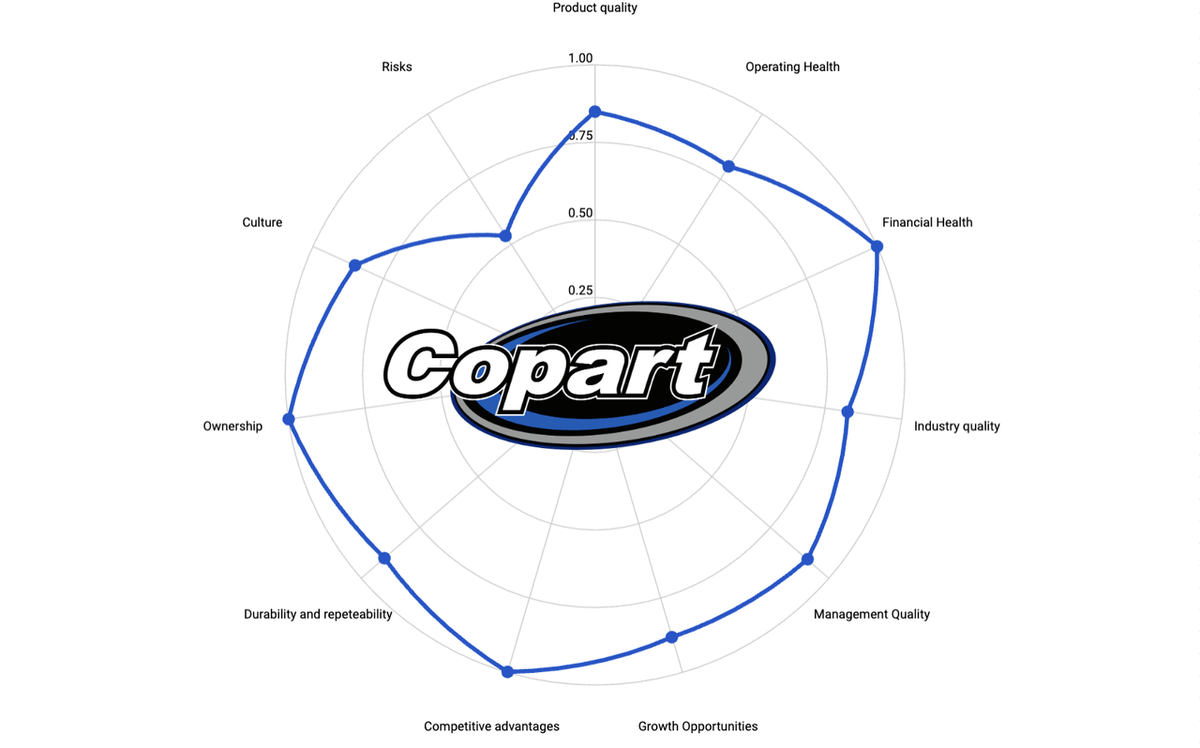

2/ Product Quality (4.3/4.5)

2/ Product Quality (4.3/4.5)

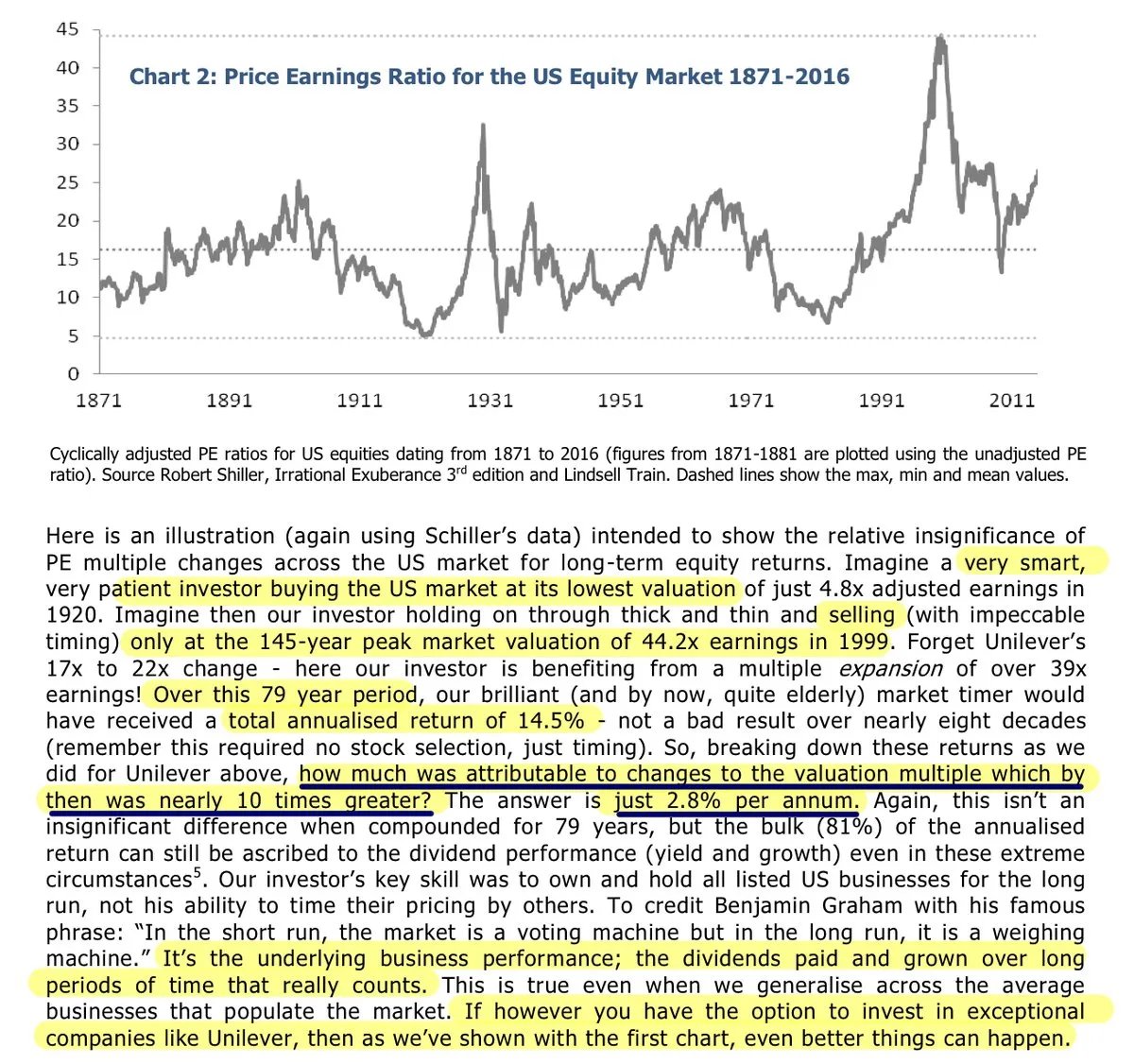

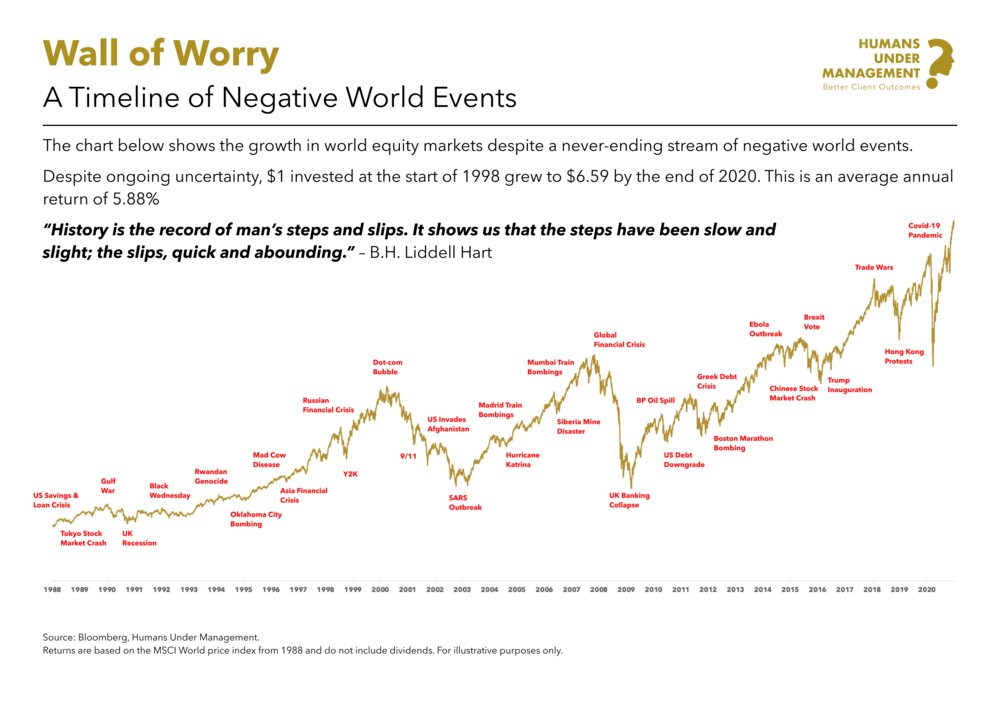

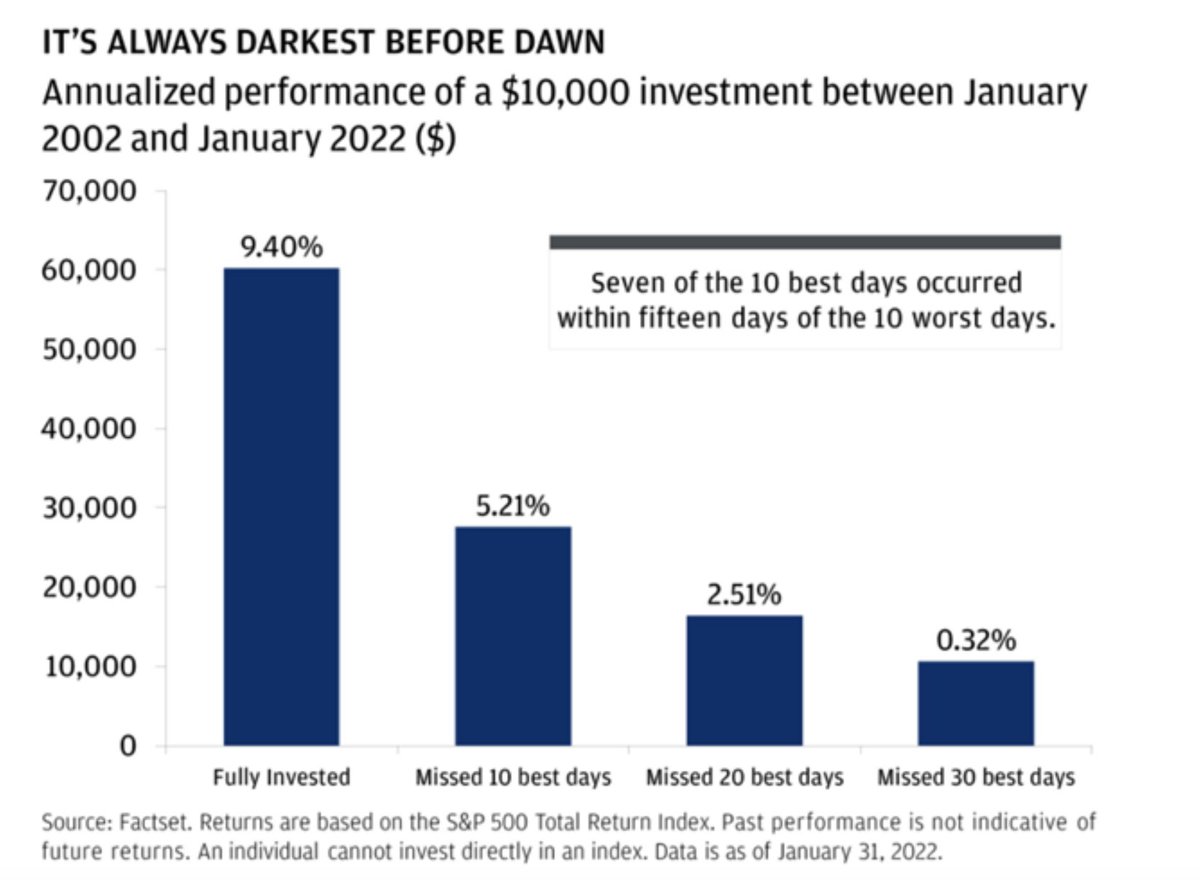

2/ The pandemic period brought quite a bit of volatility, and while many thought of this volatility like a one-off, truth is that volatility has been at the core of financial markets for a long time.

2/ The pandemic period brought quite a bit of volatility, and while many thought of this volatility like a one-off, truth is that volatility has been at the core of financial markets for a long time.

2/ I then decided to do a somewhat more complex visual with some more info on the industry. I tried to condense it one page but found it impossible, so I did a three-pager

2/ I then decided to do a somewhat more complex visual with some more info on the industry. I tried to condense it one page but found it impossible, so I did a three-pager

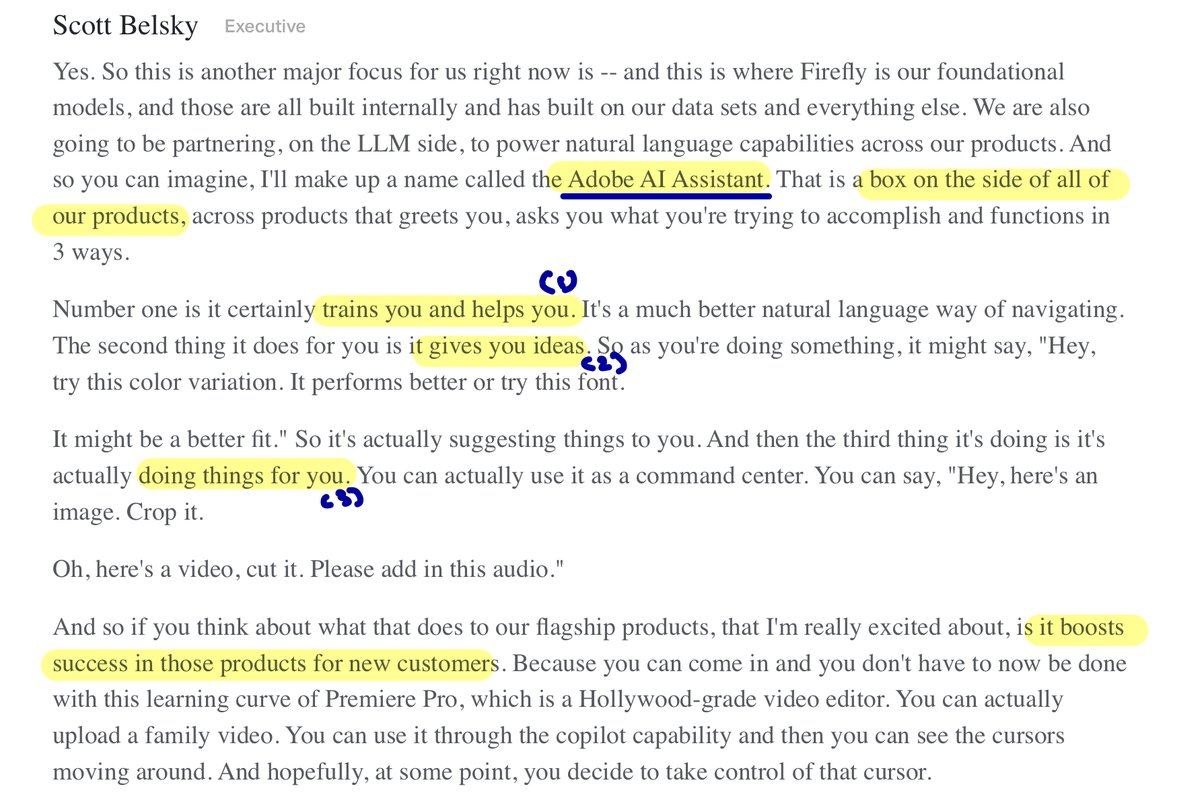

2/ The longer-term vision of the company is to provide customers with an "AI assistant" that does three things:

2/ The longer-term vision of the company is to provide customers with an "AI assistant" that does three things:

2/ Capital Returns by Edward Chancellor

2/ Capital Returns by Edward Chancellor

2/ Trying to forecast earnings and interest rates accurately is a waste of time which will take you more of a gambler than an investor

2/ Trying to forecast earnings and interest rates accurately is a waste of time which will take you more of a gambler than an investor

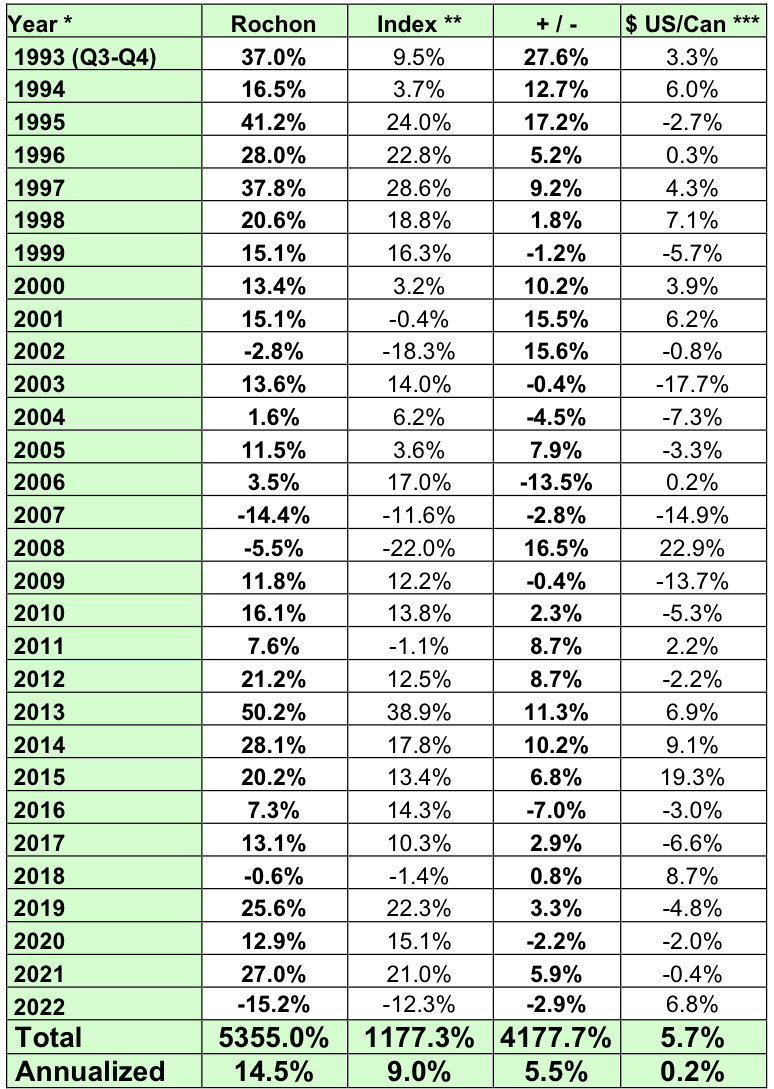

2/ The Rochon Global Portfolio was down 15.2% in 2022, its worst year on record. It was Giverny's second down year since 2008 and its 4th down year overall (30 years)

2/ The Rochon Global Portfolio was down 15.2% in 2022, its worst year on record. It was Giverny's second down year since 2008 and its 4th down year overall (30 years)

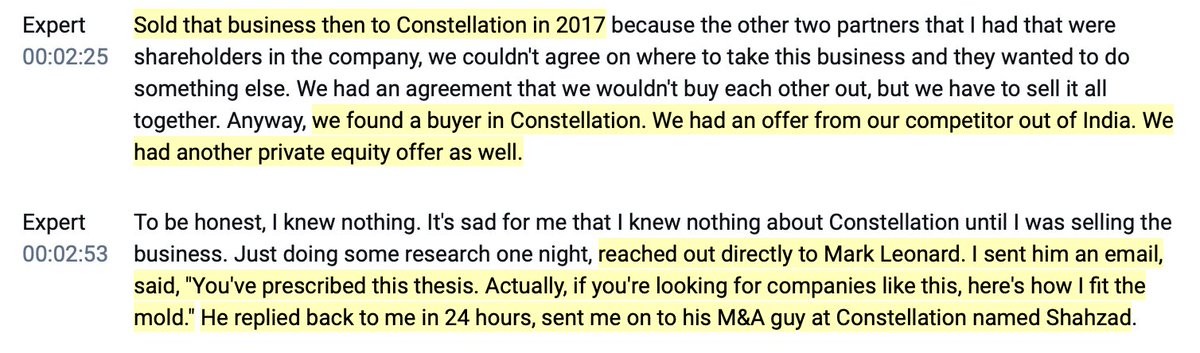

2/ "Reached out directly to Mark Leonard. I sent him an email, said "You've prescribed this thesis. If you're looking for companies like this, here's how I fit the mold."

2/ "Reached out directly to Mark Leonard. I sent him an email, said "You've prescribed this thesis. If you're looking for companies like this, here's how I fit the mold."

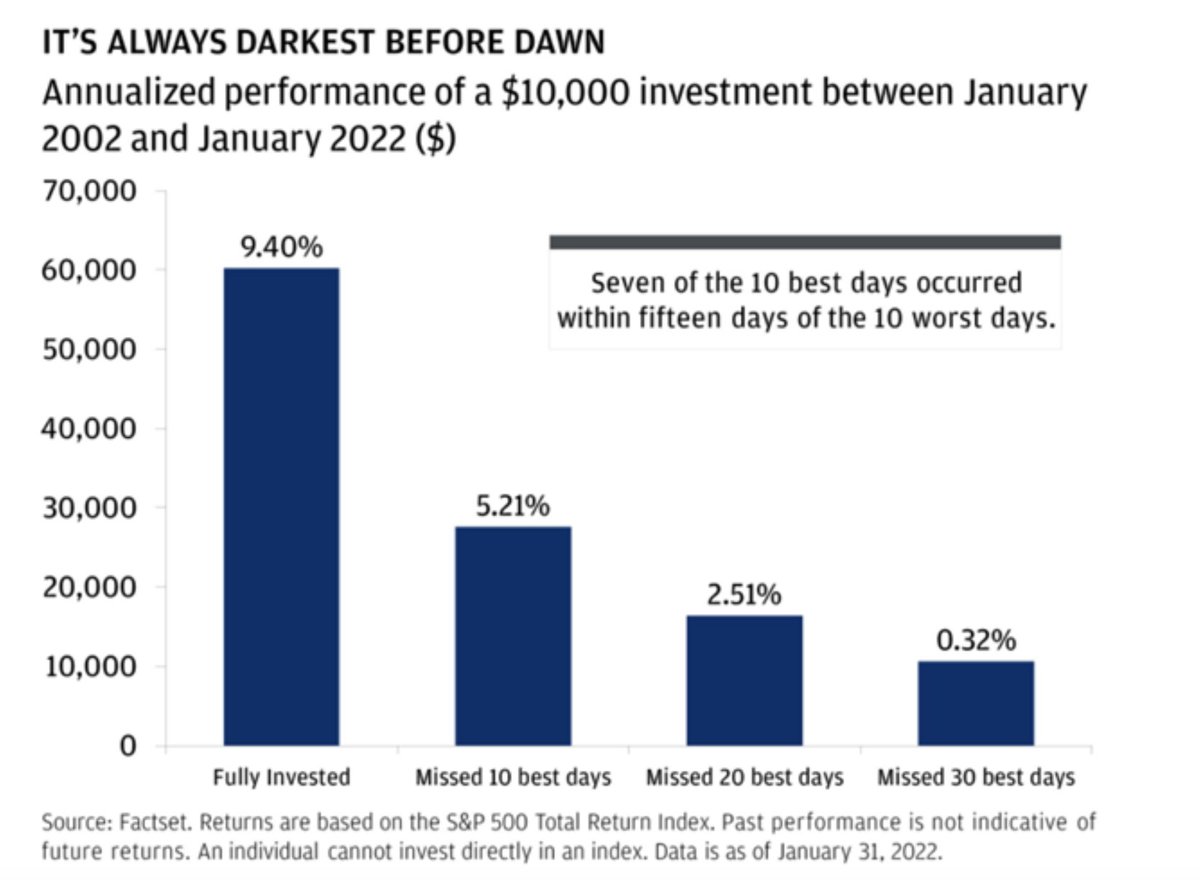

2/ Remaining fully invested means you have to be right "only" once and you can avoid all the hassle that comes with buying and selling constantly

2/ Remaining fully invested means you have to be right "only" once and you can avoid all the hassle that comes with buying and selling constantly

2/ Incremental ad spend will probably slow down now that it's at 10-15% for sellers. Only very high-margin products can justify spending more on Amazon Ads

2/ Incremental ad spend will probably slow down now that it's at 10-15% for sellers. Only very high-margin products can justify spending more on Amazon Ads