The German financial stability review has lots of other interesting charts. Here are the ones I found the most compelling. A thread to wake you up on a lazy black Friday.

https://twitter.com/jeuasommenulle/status/1464157857331531798

This is the equivalent of the ECB inflation spider chart... but for corporate insolvencies. Buba keeps predicting they'll spike.. but it just does not happen. Tbh this is seriously mysterious and somehow worrying.

And you can't blame Buba for those forecasts because we're really in extremely weird times. Here's how previous crises have looked like in terms of GDP/insolvencies.

This 2020 crisis totally inverts the GDP/insolvency regression line and makes it a >0 slope

🤪

This 2020 crisis totally inverts the GDP/insolvency regression line and makes it a >0 slope

🤪

And Buba is not alone in those forecasts: here's how German banks view the probabilities of defaults on their loan books : sharply going up... and yet, still no genuine defaults.

Interestingly, this rise in probabilities of defaults is entirely driven by corporate loans, because the view on real estate lending (residential AND commercial, which is more surprising) is still a blue sky scenario : PDs keep going down.

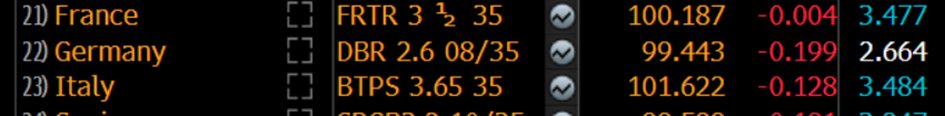

Going back to the earlier topic of rates, Buba has a nice chart about rising rates and the level of danger for insurers: at what point would they face such MtM losses that they would not be able to honour guarantees on policies?

Still plenty of room, but 3% is not a high rate!

Still plenty of room, but 3% is not a high rate!

A fun chart, even if we're clearly in #chartcrime territory: working from home will increase cyber risk. Not a big surprise but nice to have some numbers (even if the regression is crap)

Now maybe to their most controversial chart. Buba has done a climate stress test. NOOO NOT ANOTHER ONE, I can hear you say. But this one is different.

Here's the "asset base" and the outcome: a nothing burger. max 10bps of credit risk, which is not really different from 0.

Here's the "asset base" and the outcome: a nothing burger. max 10bps of credit risk, which is not really different from 0.

Buba even "priced" the uncertainty around this & they're pretty confident climate risk is indeed a nothing burger for banks : 12bps is the max.

This is really a very different take from all the doomsday scenarios we're seeing here and there to justify climate action from the banks. That's why it's going to be controversial.

If you read me often, you know I have sympathy for that approach because ...

If you read me often, you know I have sympathy for that approach because ...

...I also believe the risk for banks is grossly overstated and it's basically a supervisory trick to have banks on board with the climate transition.

But I think we should be honest, admit the risk for banks is minimal, and still convince them that they must do the right thing!

But I think we should be honest, admit the risk for banks is minimal, and still convince them that they must do the right thing!

• • •

Missing some Tweet in this thread? You can try to

force a refresh