1/33 Retirement age in the NHS & Pension Tax 🧵 - FACT vs FICTION

This is a *really* important thread. Its complicated, please read ALL carefully & share/RT

The graphic below is meant to describe the same doctor, one is (I believe) completely incorrect. Read on find out which

This is a *really* important thread. Its complicated, please read ALL carefully & share/RT

The graphic below is meant to describe the same doctor, one is (I believe) completely incorrect. Read on find out which

2/33 As @TheBMA @BMA_Pensions & others have said, its crucially important we RETAIN the senior experienced workforce. There are a number of important levers to do this, including pay, pensions & pension taxation. My thoughts on how to do this below

3/33 Government are rightly looking at ways to encourage this too... but I thought I would fact check some of the figures they have stated on "late retirement", & make some helpful suggestions for their new website.

england.nhs.uk/looking-after-…

england.nhs.uk/looking-after-…

4/33 They've selected an "edge case", a consultant who is sat just below the LTA (conveniently the numbers they have used show a case affected by LTA but not AA, but more of that later). Their central claim is that it makes financial sense to carry on working past retirement age.

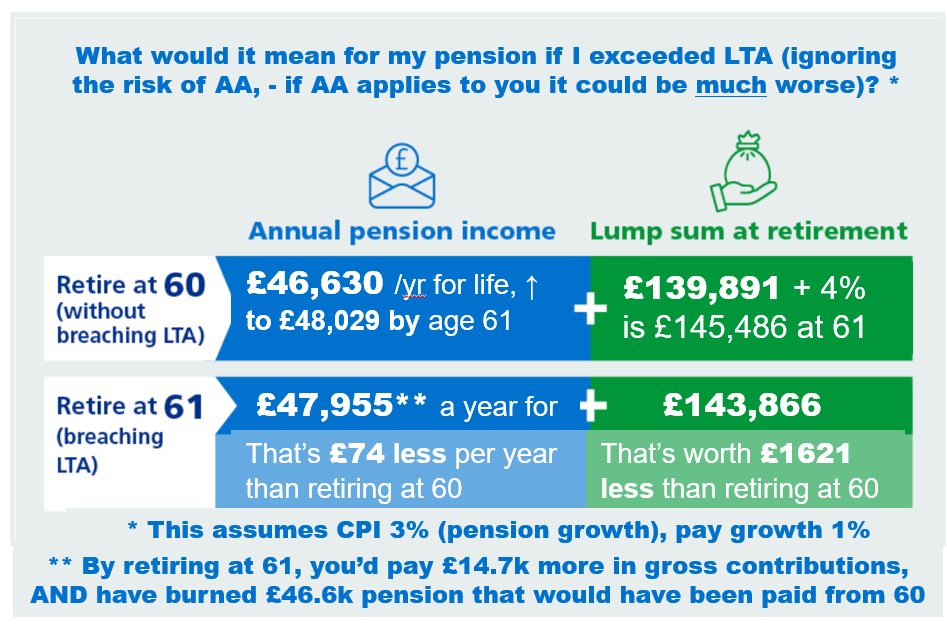

5/33 I think the methodology they have used is flawed (I know they got external actuarial advice on this but here are my thoughts). Their key finding & assumptions are here 👇

If the numbers don't interest you, feel free to skip to my 5 suggestions at the end of the thread

If the numbers don't interest you, feel free to skip to my 5 suggestions at the end of the thread

6/33 I've recreated their claimed numbers (left) & in the interest of transparency I have shown my working. Thanks to @gdcuk for cross checking & agreeing my maths.

Below are the reasons why I think their claimed numbers (i.e. a higher pension of £1676/yr DESPITE LTA) are wrong

Below are the reasons why I think their claimed numbers (i.e. a higher pension of £1676/yr DESPITE LTA) are wrong

7/33 i) The numbers assume if a member delays retirement by 1 year they can get an extra year in 1995. This is incorrect- due to McCloud/remedy, anyone who is NOW delaying retirement will get any new accrual in 2015 (post April 2022) & with that a new later normal pension age

8/33 ii) They have assumed inflation and pay growth are both 2%. History tells a different story with pay less than inflation (more on this below)

iii) Even if we ignore i/ii for now, they have calculated the comparison incorrectly.

iii) Even if we ignore i/ii for now, they have calculated the comparison incorrectly.

9/33 They have shown the effect of inflation on PAY affecting final salary pension by delaying retirement, but ignored the fact that pension would also have been inflated by retiring at 60 (see blue correction)

10/33 So I agree (see calculation) that the consultant would have £46,630 pension (no LTA) going at 60, and agree the pension would be £48,306 at age 61.

11/33 But its *not* correct to say its £1,676 more pension, because that same pension of £46,630 would have inflated to £47,563 by age 61.

And of course by not retiring @ 60 the consultant has literally burned £46,630 in pension they would have been paid at 60. Working attached.

And of course by not retiring @ 60 the consultant has literally burned £46,630 in pension they would have been paid at 60. Working attached.

12/33 Although less relevant for doctors, the've made the same mistake in a band 7 nurse example. Not as bad as the doctor example (as no LTA), but they have overstated the benefit of working to 65, because they failed to inflate the pension had the person retired at 60 @theRCN

13/33 If nothing else this shows another crucial point. COMPLEXITY. The largest DB pension scheme in the UK, with paid professional actuarial advice, can get it wrong. I'm not trying to embarrass anyone, & I can cite many examples of professional advisors, HMRC,

14/33 the people that write tax exams etc getting it wrong too. The point is that it's too complicated for anyone to navigate. Could YOU work this out, & could YOUR ADVISOR do it *correctly*?

15/33 Enough moaning about the figures, what do I & @TheBMA think the govmnt needs to do if they want to really improve retention & encourage people to stay beyond 60. Lots of people will get 7 more years in 1995 thanks to McCloud which will focus minds. Govmnt need to act NOW.

16/33 .

1️⃣ FIX PAY- your final salary pension (consultants not GPs) is linked to your pay. In real terms, your pay has gone down circa 30% in a decade. The longer you wait till retirement, you risk further sub-inflationary pay cuts being baked into your pension.

1️⃣ FIX PAY- your final salary pension (consultants not GPs) is linked to your pay. In real terms, your pay has gone down circa 30% in a decade. The longer you wait till retirement, you risk further sub-inflationary pay cuts being baked into your pension.

17/33 For example, in the consultant example above they have assumed both pay and inflation are both 2%. I politely suggest, based on history (& COVID) it might be more realistic to assume inflation were 3% & pay awards 1% (i.e. another disgraceful below inflation pay cut).

18/33 Lets redo the government example using 3% inflation/1% pay award (using their methodology, which Im not a fan of noting the above). Retire at 60 at your pension increases with inflation. Or stay working & get more cuts to pay (baked into pension). See where this is going?

19/33 Now by staying on at 60, breach LTA & even without AA your pension goes down! Not only do you burn £46.6k pension you would have earned, you pay another £14.7k in contributions to get a lower pension. You can invest your lump sum & watch that grow too. You've been warned!

20/33 .

2️⃣ FIX PENSIONS. There's a serious anomaly in the 1995 section. You have been paying into the pension assuming you draw pension at 60. If you don't retire at 60, under current rules you are BURNING pension.

2️⃣ FIX PENSIONS. There's a serious anomaly in the 1995 section. You have been paying into the pension assuming you draw pension at 60. If you don't retire at 60, under current rules you are BURNING pension.

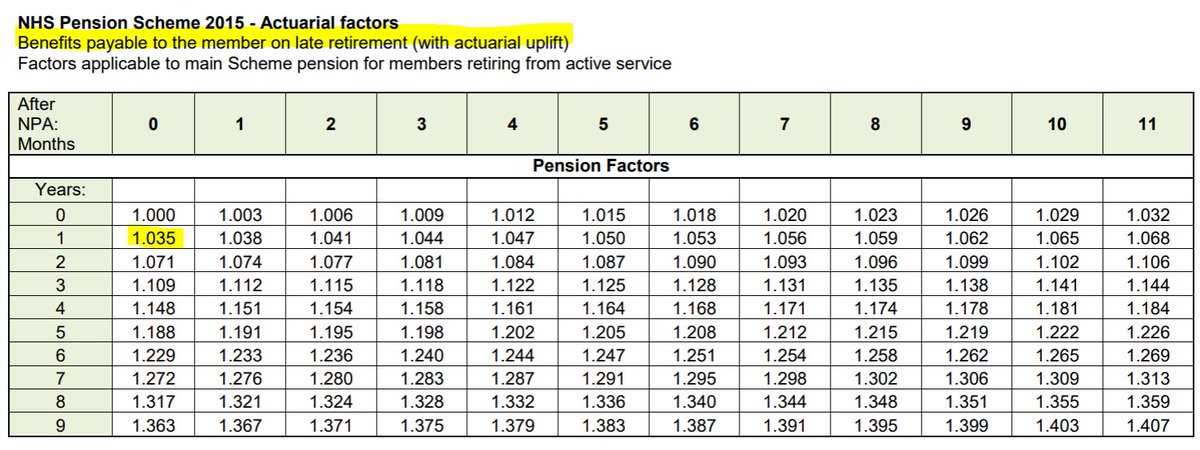

21/33 Yes the final salary link remains, but you should get an ACTUARIALLY INCREASED pension if you retire later. Thats the exact opposite of the 4-5% year reduction you get by going early. Not only is this fair, it is exactly what happens in the 2008 and 2015 sections👇.

22/33 Go later than 60 and you are burning pension unless they introduce "late retirement factors". You have been warned!

23/33 .

3️⃣ FIX PENSION TAX. You might have noticed the @NHSEngland example addresses LTA alone & conveniently ignores AA.

3️⃣ FIX PENSION TAX. You might have noticed the @NHSEngland example addresses LTA alone & conveniently ignores AA.

24/33 If you are affected by BOTH AA & LTA it *seriously* reduces the value of your pension & may make it extremely marginal if you should stay in the scheme / carry on working.

25/33 Government knew this was a problem for judges, who had similar recruitment / retention issues - they fixed it with a tax unregistered scheme. They could do the same for doctors / other high earners in the scheme. Do your sums! You have been warned.

26/33 .

4️⃣ Remember your advisor doesn't have a crystal ball & can only advise about CURRENT tax rules. These rules are ALREADY devastating the workforce & causing early retirement. The only thing you do have is knowledge of past performance by the government.

4️⃣ Remember your advisor doesn't have a crystal ball & can only advise about CURRENT tax rules. These rules are ALREADY devastating the workforce & causing early retirement. The only thing you do have is knowledge of past performance by the government.

27/33 Look at the graphs showing (in real terms correct for inflation) the LTA, (AA is similar). If government don't fix this, & those graphs don't suggest they are in a hurry to fix it, there is a very real risk they will get even worse. You have been warned.

28/33 .

5️⃣ Doctors are not unique & other high earners have solved this with recycling. If you can't give pension due to punitive taxation, give pay instead. At the moment relatively few NHS employers do this, or do it differently.

5️⃣ Doctors are not unique & other high earners have solved this with recycling. If you can't give pension due to punitive taxation, give pay instead. At the moment relatively few NHS employers do this, or do it differently.

29/33

The NHS (in all 4 nations) could overnight, should they wish to, give you the *FULL* employers contribution (i.e. 20.6% not 14.3%, less employers NI) at no additional cost to the taxpayer.

The NHS (in all 4 nations) could overnight, should they wish to, give you the *FULL* employers contribution (i.e. 20.6% not 14.3%, less employers NI) at no additional cost to the taxpayer.

30/33

As @TheBMA have been asking for a couple of years, this needs to be *centrally mandated*, & uniform, not least so employees affected by AA/LTA (& their advisor) understand this.

As @TheBMA have been asking for a couple of years, this needs to be *centrally mandated*, & uniform, not least so employees affected by AA/LTA (& their advisor) understand this.

31/33

There you have it @sajidjavid @RishiSunak @Jeremy_Hunt. If you haven't already, please read this entire thread carefully. I believe there is an existential threat to the NHS. @NHSMillion

There you have it @sajidjavid @RishiSunak @Jeremy_Hunt. If you haven't already, please read this entire thread carefully. I believe there is an existential threat to the NHS. @NHSMillion

32/33

To summarise #saveournhs

1️⃣ FIX PAY - down 30% in a decade

2️⃣ FIX PENSIONS - late retirement factors

3️⃣ FIX PENSION TAX - like you have for judges

4️⃣ Do your sums / understand this

5️⃣ Full & mandated central ♻️ is a quick win at no extra cost to taxpayer

To summarise #saveournhs

1️⃣ FIX PAY - down 30% in a decade

2️⃣ FIX PENSIONS - late retirement factors

3️⃣ FIX PENSION TAX - like you have for judges

4️⃣ Do your sums / understand this

5️⃣ Full & mandated central ♻️ is a quick win at no extra cost to taxpayer

33/33

If you really want to fix retention (& you *really* need to), we don't need smoke & mirrors about the value of your pension for staying, we need an honest conversation about the 5 points above which can solve this existential crisis.

Please share widely / RT / Quote RT

If you really want to fix retention (& you *really* need to), we don't need smoke & mirrors about the value of your pension for staying, we need an honest conversation about the 5 points above which can solve this existential crisis.

Please share widely / RT / Quote RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh