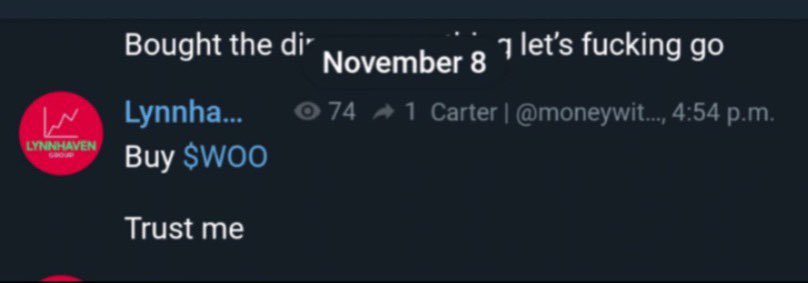

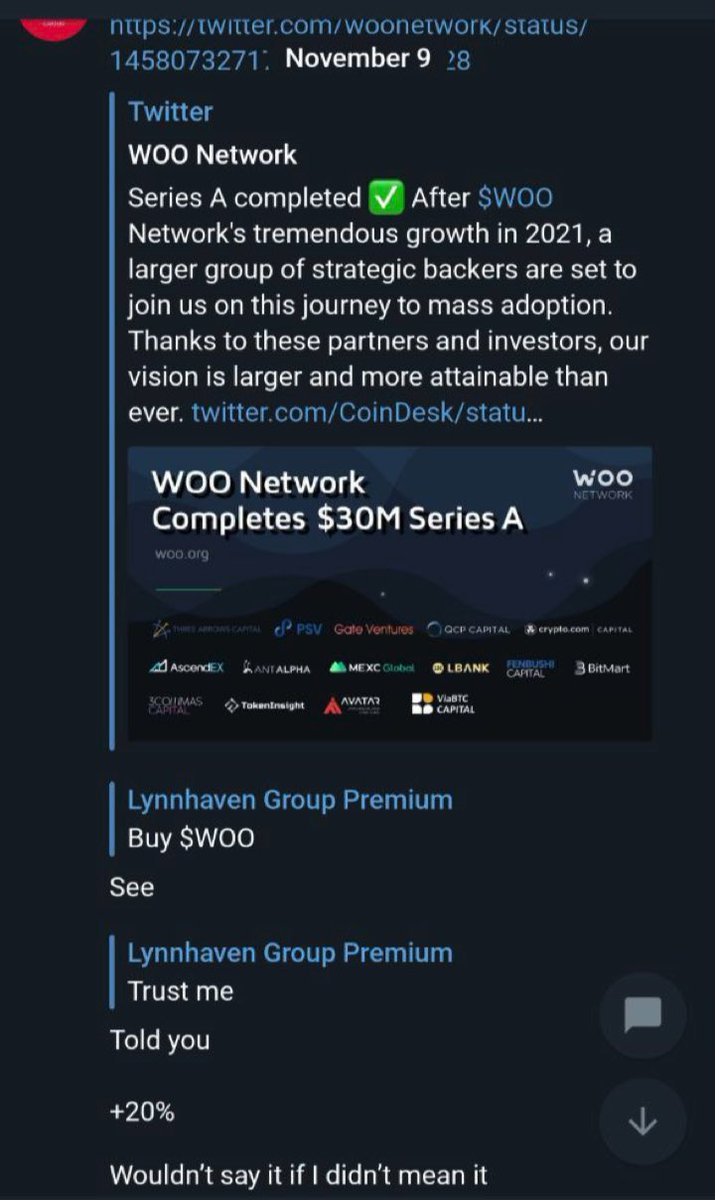

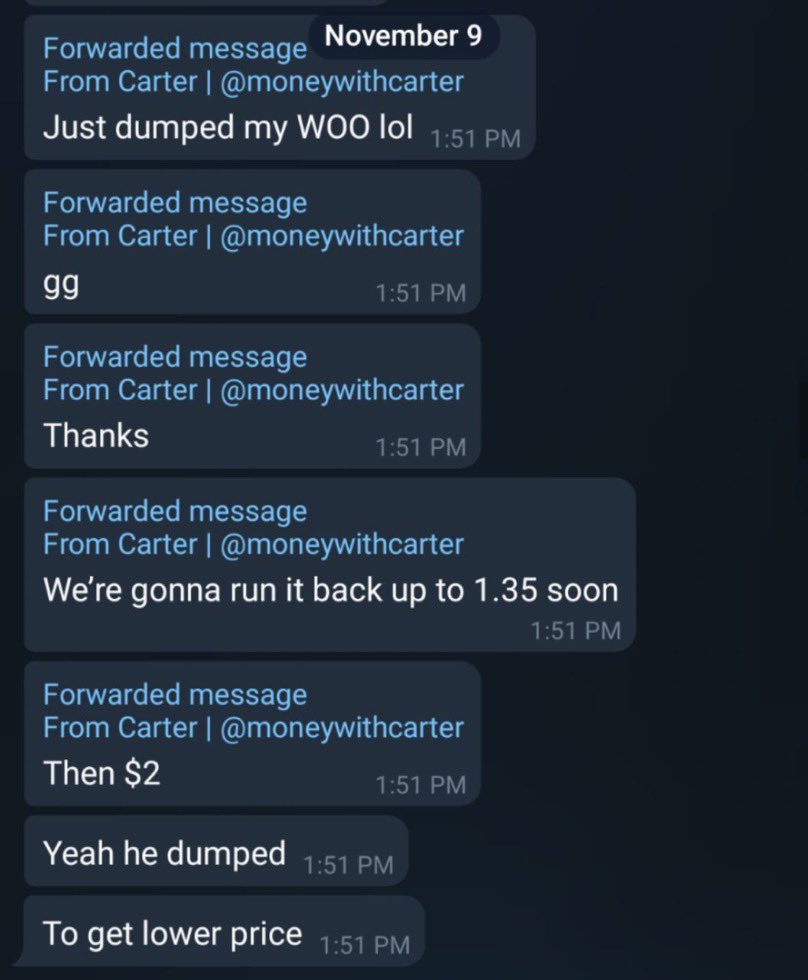

1/ One of the lesser known figures in the space is Darkpool Liquidity a market maker (MM)

After reviewing the pitch deck there were a number of services that are straight market manipulation and not standard at ALL by MMs in the space

They play a role in a lot of the cash grabs

After reviewing the pitch deck there were a number of services that are straight market manipulation and not standard at ALL by MMs in the space

They play a role in a lot of the cash grabs

2/ To summarize the pic above:

-offers washtrading to artifically boost volume

-frontrunning and selling assets w/o affecting the market price

-spoofing

Well the next question is who even uses this MM?

-offers washtrading to artifically boost volume

-frontrunning and selling assets w/o affecting the market price

-spoofing

Well the next question is who even uses this MM?

3/ Well mostly Polkastarter projects use this MM as well as a number of other launchpads on here

One thing a lot of these projects have in common is large unlocks at TGE, vesting for 6 months or less, & a huge % of token supply to the seed/private round & advisors (20-30%+)

One thing a lot of these projects have in common is large unlocks at TGE, vesting for 6 months or less, & a huge % of token supply to the seed/private round & advisors (20-30%+)

4/ After speaking with a few people well versed in the MM space they said it was very surprising this verbiage would be used so openly in a pitch deck

The rest seems to be almost copied from some where since it’s very generic

The rest seems to be almost copied from some where since it’s very generic

5/If you have done 50+ projects you more than likely should have $5m+ in AUM

Unless you’re not the main MM or just are a bad negotiator

Unless you’re not the main MM or just are a bad negotiator

6/ It is pretty clear what is being done here… please stay folks and do proper DD before putting your $$$ into projects

Website:

darkpool.ventures

Rest of deck (left out contact info slide for privacy):

Website:

darkpool.ventures

Rest of deck (left out contact info slide for privacy):

Our buddy from Moonrock sure seems satisfied… I wonder why that might that be?

https://twitter.com/zachxbt/status/1410356530956980226?s=21

They deleted a bunch of slides and try to claim it’s old. When multiple slides talk about 2021 projects lmao

https://twitter.com/DarkpoolMM/status/1465366827354234880

• • •

Missing some Tweet in this thread? You can try to

force a refresh