Over the past decade, I've been blessed with:

✅27% annualized returns

📈That's roughly 1,000% total

One of the keys behind those results: Looking for something that's often ignored by analysts...⤵️

✅27% annualized returns

📈That's roughly 1,000% total

One of the keys behind those results: Looking for something that's often ignored by analysts...⤵️

OPTIONALITY

The practice of TESTING out a new product or service in an effort to fulfill its mission.

🔴If it doesn't work, it's no big deal -- it was just a test.

🟢If it does work, it's a game-changer.

Critically, the company already needs a wide-moat rev stream to count on

The practice of TESTING out a new product or service in an effort to fulfill its mission.

🔴If it doesn't work, it's no big deal -- it was just a test.

🟢If it does work, it's a game-changer.

Critically, the company already needs a wide-moat rev stream to count on

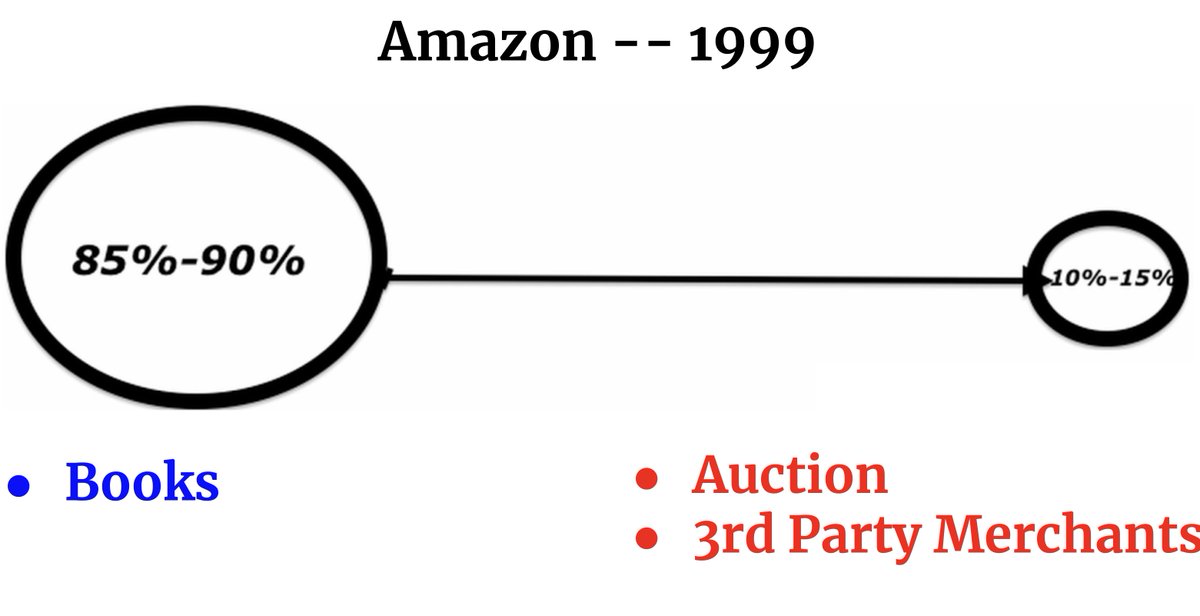

No company is a better example of this than AMAZON $AMZN

In 1999, books and music were the wide moat business. It decided to test:

🔴Amazon Auction (failed)

🟢3rd Party Merchants (huge success)

In 1999, books and music were the wide moat business. It decided to test:

🔴Amazon Auction (failed)

🟢3rd Party Merchants (huge success)

In the next decade, 3rd Party Merchants were so successful, that business line entered the left (wide-moat) side of the business.

Next, it tested:

🔴Fashion Retail (failed)

🟢AWS, Prime, Fulfillment (ENORMOUS success)

Next, it tested:

🔴Fashion Retail (failed)

🟢AWS, Prime, Fulfillment (ENORMOUS success)

Ten years later, those winners were no longer tests, they were wide-moat businesses.

But the innovation didn't stop there:

🔴Quisdi (failed)

🔴Fire Phone (failed)

🔴Amazon Wallet (failed)

🟢Original video content (succeeded)

But the innovation didn't stop there:

🔴Quisdi (failed)

🔴Fire Phone (failed)

🔴Amazon Wallet (failed)

🟢Original video content (succeeded)

The result of all of this:

A simple $10,000 investment at the company's IPO is worth almost $20 MILLION TODAY!

But Amazon isn't alone, there are others you can invest in today.

A simple $10,000 investment at the company's IPO is worth almost $20 MILLION TODAY!

But Amazon isn't alone, there are others you can invest in today.

@BrianFeroldi and I tackled this phenomenon in our recent video on OPTIONALITY.

We introduce

✅One small (~$11B) stock with lots of optionality

✅8 more stocks we're impressed with

✅How to find signs of optionality

We introduce

✅One small (~$11B) stock with lots of optionality

✅8 more stocks we're impressed with

✅How to find signs of optionality

We are busy making videos like this every week.

Why?

Because we want to spread financial wellness and help anyone lead a full, whole life (while not worrying too much about finances).

Our videos are completely free, and you can subscribe here:

youtube.com/brianferoldiyt…

Why?

Because we want to spread financial wellness and help anyone lead a full, whole life (while not worrying too much about finances).

Our videos are completely free, and you can subscribe here:

youtube.com/brianferoldiyt…

To review:

OPTIONALITY is the ability to *test* new products and services that fulfill one's mission.

If they fail, it's not a big deal

If they succeed, it's a game changer

And no one has done this better over the last 20 years than Amazon $AMZN

OPTIONALITY is the ability to *test* new products and services that fulfill one's mission.

If they fail, it's not a big deal

If they succeed, it's a game changer

And no one has done this better over the last 20 years than Amazon $AMZN

• • •

Missing some Tweet in this thread? You can try to

force a refresh