ETH is well on its way to becoming one of the most productive assets in the world.

Don’t believe me? Just have a look at this thread… 🥐

Don’t believe me? Just have a look at this thread… 🥐

The Ethereum blockchain began in 2015, offering 72M $ETH to over 10,000 #Bitcoin addresses who participated in the ICO.

Fast forward to today, there is now 118M $ETH from block rewards across 135,734,686 recorded wallet addresses.

Fast forward to today, there is now 118M $ETH from block rewards across 135,734,686 recorded wallet addresses.

Of the initial ICO participants:

-81% of these wallets have only 1% of their initial balances or less

-9.5% have an unchanged balance (lost?)

-only 64 have actually increased their ETH holdings

h/t .@ASvanevik

So… where are all of the tokens now?

-81% of these wallets have only 1% of their initial balances or less

-9.5% have an unchanged balance (lost?)

-only 64 have actually increased their ETH holdings

h/t .@ASvanevik

So… where are all of the tokens now?

A large majority of ETH is placed in smart contracts on the network. To be exact, it’s upwards of 26.86% of the supply of ETH.

That’s about 31,825,848 ETH, or $143B.

This is significant not only because of the mere size, but for what they are being used in…

That’s about 31,825,848 ETH, or $143B.

This is significant not only because of the mere size, but for what they are being used in…

These are decentralized applications that power virtual economies, stable coins, and many other things home to Ethereum.

Of that 26.86% in smart contracts, 77% is locked in DeFi.

That’s an astounding 24.5M ETH, representing 20.67% of the total supply.

Of that 26.86% in smart contracts, 77% is locked in DeFi.

That’s an astounding 24.5M ETH, representing 20.67% of the total supply.

Still not impressed? Let’s talk about exchanges next.

The supply of $ETH on exchanges is reaching levels near three year lows, a trend that has been continuing since late 2020.

According to Glassnode, exchange balances for ETH have recently hit as low as just 14,246,767 ETH…

The supply of $ETH on exchanges is reaching levels near three year lows, a trend that has been continuing since late 2020.

According to Glassnode, exchange balances for ETH have recently hit as low as just 14,246,767 ETH…

That’s about 12% the total supply of ETH, a figure down from 17.3% at the start of the year

Low exchange balances suggest that investors do not have any plans to sell, driving illiquidity & volatility further into the mix

Next we can take a look at staking…

Low exchange balances suggest that investors do not have any plans to sell, driving illiquidity & volatility further into the mix

Next we can take a look at staking…

With the ETH 2.0 deposit contract amassing upwards of 8,394,818 ETH, months before launch.

That’s 7.08% of the ETH supply, and this is expected to grow significantly as APY increases following the merge, with transaction fees going to validators.

So… what do we have so far?

That’s 7.08% of the ETH supply, and this is expected to grow significantly as APY increases following the merge, with transaction fees going to validators.

So… what do we have so far?

We’ve covered the amount of ETH in smart contracts, the amount locked in DeFi, ETH held across exchanges, and the total that is staked, combined making up around 45.94% of all ETH in existence.

What’s next? This is where things get even more interesting…

What’s next? This is where things get even more interesting…

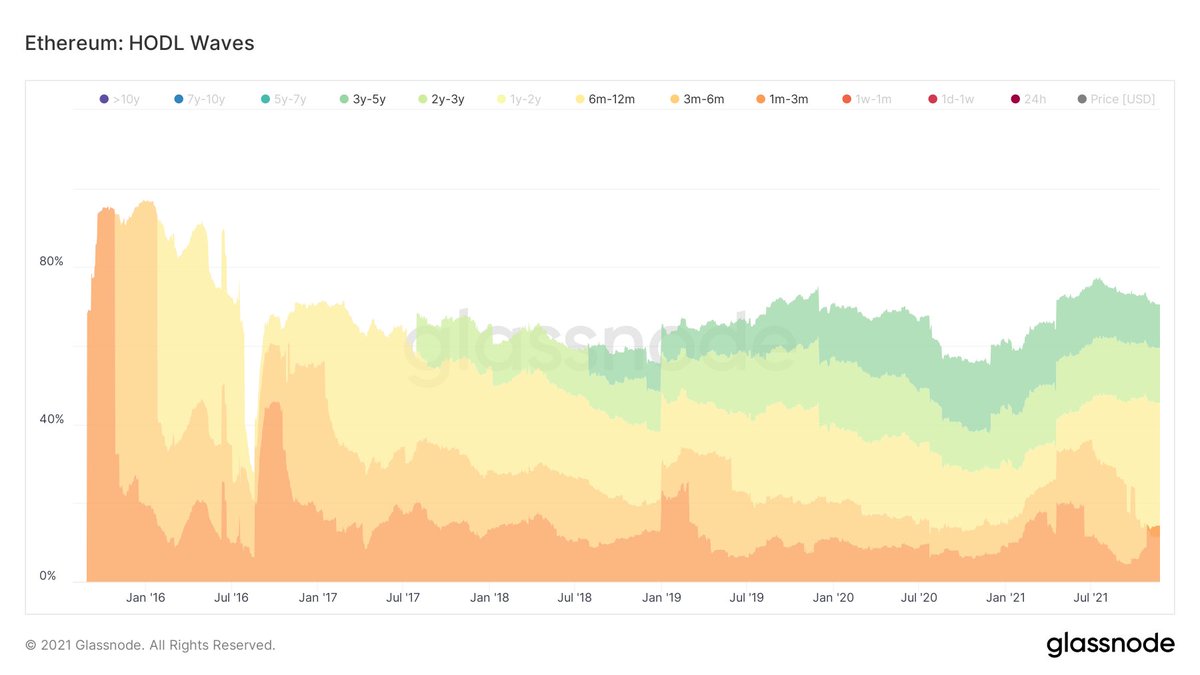

Did you know, more than 50% of the supply of ETH hasn’t moved in over a year?

The further we go back, the smaller this number gets.

As little as 20% of the supply has been recorded as being active since October of 2017

The further we go back, the smaller this number gets.

As little as 20% of the supply has been recorded as being active since October of 2017

It’s fair to say the actual circulating supply of ETH is a lot lower than commonly believed.

This will be even more evident with EIP-1559 burning a mind-blowing 1,016,743 ETH in just three months since being initiated.

That is nearly 1% of the entire total supply burnt.

This will be even more evident with EIP-1559 burning a mind-blowing 1,016,743 ETH in just three months since being initiated.

That is nearly 1% of the entire total supply burnt.

https://twitter.com/croissanteth/status/1424095196363558921

What about layer two?

There’s quite a bit of ETH there, as well. In fact, there is a respectable 5,807,590 ETH bridged on to layer two networks…

which is about 4.9% of the total supply of ETH

As rollups continue to develop we can expect this number to grow exponentially

There’s quite a bit of ETH there, as well. In fact, there is a respectable 5,807,590 ETH bridged on to layer two networks…

which is about 4.9% of the total supply of ETH

As rollups continue to develop we can expect this number to grow exponentially

Let’s now talk about people using Bitcoin on Ethereum.

Bitcoin holders are wrapping their coins on to Ethereum to participate in DeFi at a tremendous rate

As of this writing, there are 312,566 #Bitcoin on Ethereum. That’s a shocking 1.4% the total supply of BITCOIN.

Bitcoin holders are wrapping their coins on to Ethereum to participate in DeFi at a tremendous rate

As of this writing, there are 312,566 #Bitcoin on Ethereum. That’s a shocking 1.4% the total supply of BITCOIN.

& I haven’t even mentioned NFTs yet, which are breaking records every day

If we took just the floor price of bored apes, land in $SAND, and crypto punks we would reach the combined valuation of $6.38B (at current floor price)

That’s roughly 1,409,944 ETH, or 1.18% of all ETH

If we took just the floor price of bored apes, land in $SAND, and crypto punks we would reach the combined valuation of $6.38B (at current floor price)

That’s roughly 1,409,944 ETH, or 1.18% of all ETH

When you also start to consider the fact that there are 13,636 dApps, and more than 300,000 ERC20’s deployed on the network, I think you’ll start to get what I mean by a “𝘱𝘳𝘰𝘥𝘶𝘤𝘵𝘪𝘷𝘦 𝘢𝘴𝘴𝘦𝘵”

Let’s recap…

Let’s recap…

We have:

smart contracts - 26.86%

exchange balance - 6.8% supply decrease

staking - 7.08%

dormant (lost) - ~20%

eip-1559 - 4% (annually)

layer two - 4.9%

btc on eth - 3.45%

nfts - 1.18%

That’s about 74.27% of the supply we can expect to HODL, & likely an underestimate.

smart contracts - 26.86%

exchange balance - 6.8% supply decrease

staking - 7.08%

dormant (lost) - ~20%

eip-1559 - 4% (annually)

layer two - 4.9%

btc on eth - 3.45%

nfts - 1.18%

That’s about 74.27% of the supply we can expect to HODL, & likely an underestimate.

My point of these statistics weren’t to just shill ETH, but to point out the very simple laws of supply & demand at play.

Blockspace on ETH is highly sought after, & new users are joining the network every day.

Layer two will only help to onboard millions of users with low fees

Blockspace on ETH is highly sought after, & new users are joining the network every day.

Layer two will only help to onboard millions of users with low fees

We are very quickly moving from the mindset of “I buy ETH because it appreciates,” to the mindset of “I buy ETH to do things.”

I hope you all enjoyed this thread, expect more from the croissant this week! 🥐

I hope you all enjoyed this thread, expect more from the croissant this week! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh