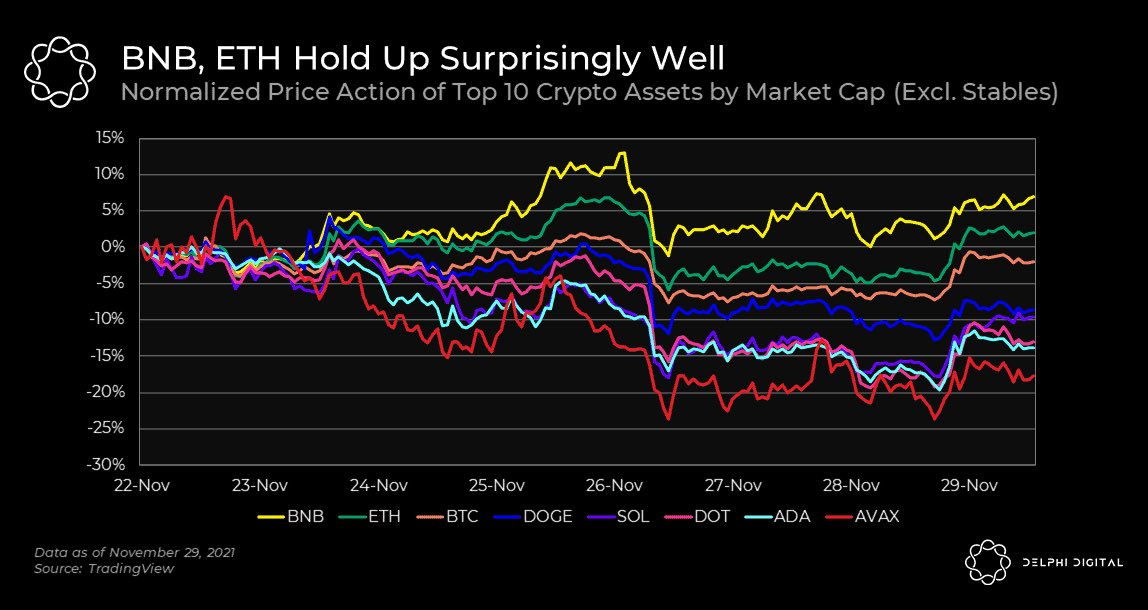

0/ ETH and BNB are weathering the storm.

In today’s Delphi Daily, we examined the price action of the top 10 crypto assets, analyzed options & implied volatility, and looked at recent trading volumes.

For more 🧵👇

In today’s Delphi Daily, we examined the price action of the top 10 crypto assets, analyzed options & implied volatility, and looked at recent trading volumes.

For more 🧵👇

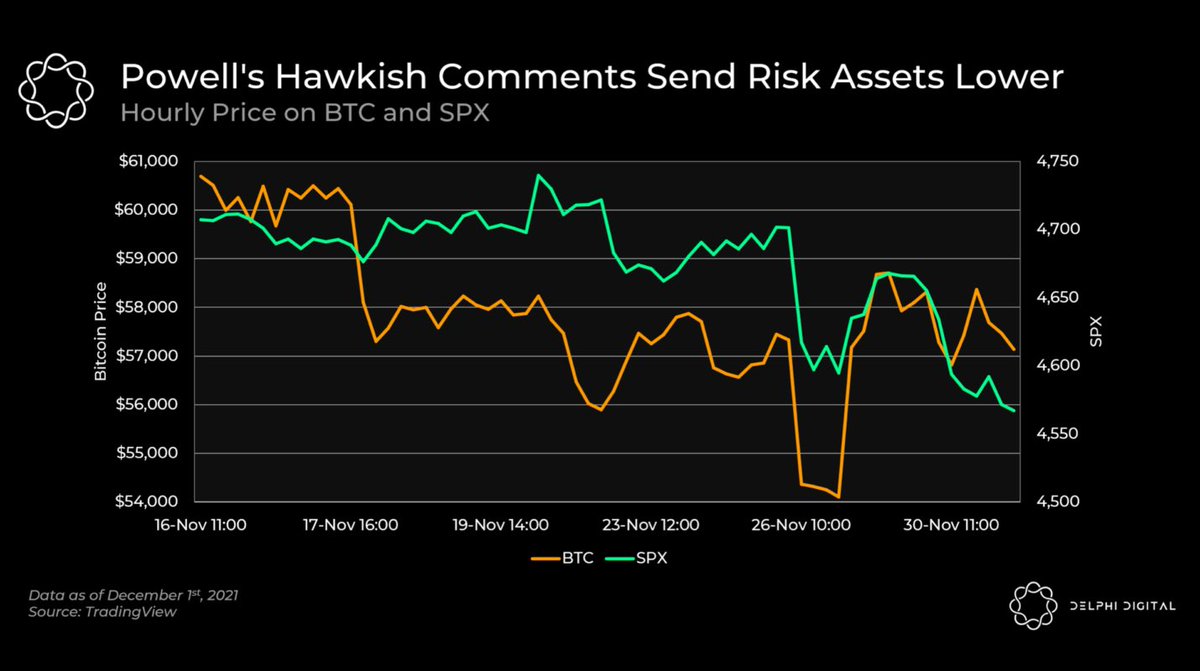

1/ When it rains in crypto, it pours. And while $BTC holding up well isn’t a surprise, seeing $BNB and $ETH find strength during these conditions definitely is.

$AVAX, which was the top performer until a few days ago, has taken quite the beating.

$AVAX, which was the top performer until a few days ago, has taken quite the beating.

2/ The DVOL index, which measures implied volatility (IV) on a 30-day forward basis, has actually gone down in recent days.

IV is a measure of market uncertainty; when things get dicey, it tends to rise, and when things look unidirectional, IV usually falls.

IV is a measure of market uncertainty; when things get dicey, it tends to rise, and when things look unidirectional, IV usually falls.

3/ Everything to the left of $57K measures the IV of puts, while readings above $57K measure call IV.

Fatter, higher tails towards the left side implies puts are getting more expensive as participants turn their focus towards hedging spot or speculating on further downside.

Fatter, higher tails towards the left side implies puts are getting more expensive as participants turn their focus towards hedging spot or speculating on further downside.

4/ Throughout November, we’ve seen @binance’s total spot volume stagnate while spreads for a $5M BTC trade got wider.

All in all, the market doesn’t look too hot here, but taking the long view, we believe any near-term downside volatility will wind up being rather short-lived.

All in all, the market doesn’t look too hot here, but taking the long view, we believe any near-term downside volatility will wind up being rather short-lived.

5/ Tweets of the day!

@LidoFinance is decentralizing

@LidoFinance is decentralizing

https://twitter.com/LidoFinance/status/1465281488409268225

7/ How to get started in the wild world of crypto

https://twitter.com/distorcean/status/1465053543220408323

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh