In 2020, the entirety of global power generation growth came from renewable sources. It's a first, for many reasons. But, it's also only part of the global story, and what comes next is even more interesting. bloomberg.com/news/articles/…

Despite the Covid-19 pandemic, global power generation fell only two-tenths of a percent for all of 2020. Coal-fired power generation fell 3% year on year; gas-fired power fell 1%, and nuclear power declined 3%. Wind, solar, and hydropower all grew. bloomberg.com/news/articles/…

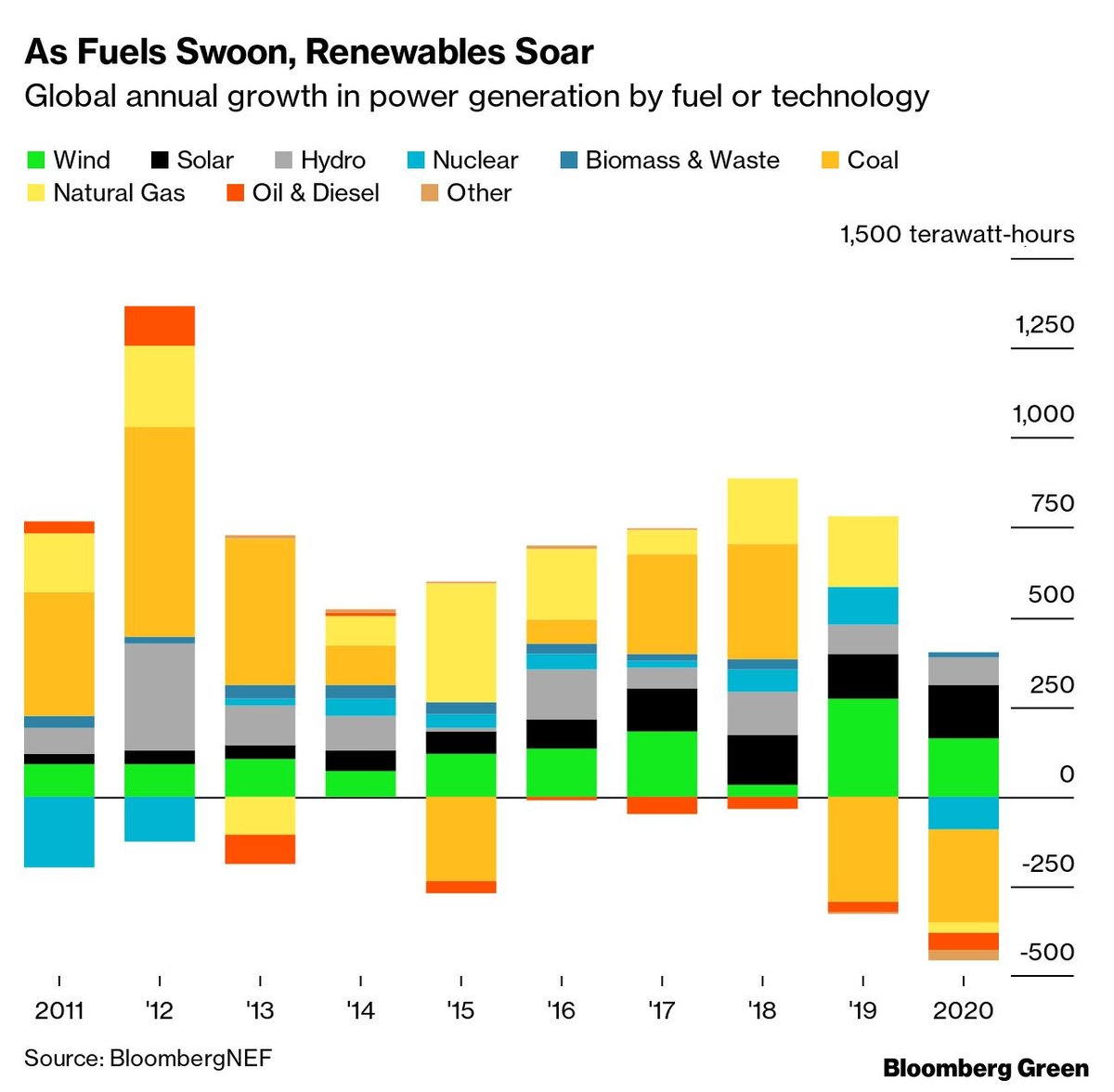

It's worth zooming out on this chart a bit though. coal’s contribution to power generation growth is very evident through 2014 and again in 2017 and 2018. Natural gas power growth is also evident as are the steady additions of wind and solar power. bloomberg.com/news/articles/…

And unfortunately for power sector emissions, nuclear power’s massive post-Fukushima drop in 2011 and 2012 is unmistakable. bloomberg.com/news/articles/…

Aggregate the global growth in power generation by source, and there's something noteworthy. Yes, coal leads, but only barely over gas; and gas is only barely past wind. bloomberg.com/news/articles/…

And - the compound growth rate in generation from these technologies matters. A lot. Big base number, low growth. Smaller base number, higher growth. Coal grew 1.6% per year last decade. Solar grew 38.8% a year. bloomberg.com/news/articles/…

What happens if you carry these generation CAGRs forward? In just one more year (2021) at this rate, wind (not coal or gas) would be biggest contributor to power generation since 2010. In three more years (2023)...it's solar. bloomberg.com/news/articles/…

It may seem imaginative to suggest that in one year’s time wind will be the biggest contributor to power generation growth since 2010, and solar the biggest just two years later. It's not. bloomberg.com/news/articles/…

Seeing wind and solar's dominance of net power generation additions in a few years is the opposite of imaginative: it requires only an assumption that the next few years looks like the last decade /end bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh