Energy systems and information platforms. @Halcyon, and priors @BloombergNEF, @climate, @VoyagerVC.

How to get URL link on X (Twitter) App

🧵 on aggregated US power generation interconnection queues.

🧵 on aggregated US power generation interconnection queues.

🧵2/ New @BloombergNEF Zero-Emission Vehicles report:

🧵2/ New @BloombergNEF Zero-Emission Vehicles report:

"The prices of fossil fuels such as coal, oil, and gas are volatile, but after adjusting for inflation, prices now are very similar to what they were 140 years ago, and there is no obvious long-range trend." cell.com/joule/fulltext…

"The prices of fossil fuels such as coal, oil, and gas are volatile, but after adjusting for inflation, prices now are very similar to what they were 140 years ago, and there is no obvious long-range trend." cell.com/joule/fulltext…

https://twitter.com/NatBullard/status/1544690285615222784?s=20&t=IYnbPgvi6y4Qz87AX4FuKQ🧵1/ I joined New Energy Finance seven weeks before the first iPhone launched

🧵Every year, bp publishes its Statistical Review of World Energy. Every year, there are some striking findings. Here are four, charted.

🧵Every year, bp publishes its Statistical Review of World Energy. Every year, there are some striking findings. Here are four, charted.

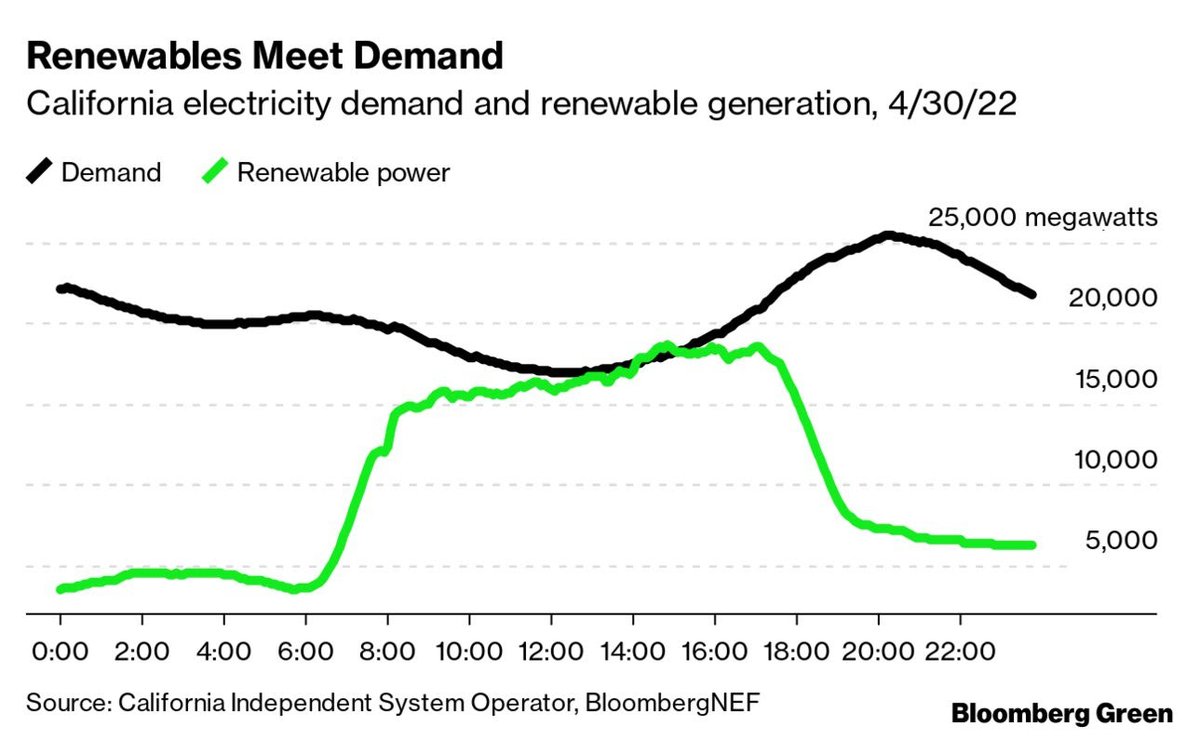

2/ Power systems outside the U.S. have reached this target before (Denmark with wind power and South Australia with solar alone last year). The California Independent System Operator, needless to say, is a slightly bigger power system bloomberg.com/news/articles/…

2/ Power systems outside the U.S. have reached this target before (Denmark with wind power and South Australia with solar alone last year). The California Independent System Operator, needless to say, is a slightly bigger power system bloomberg.com/news/articles/…

🧵/2 Post-WWII, with rural electrification still underway, and electrification of industry still underway, year-on-year power generation growth was 10%+.

🧵/2 Post-WWII, with rural electrification still underway, and electrification of industry still underway, year-on-year power generation growth was 10%+.

Nickel "added more than $10,000 to trade at a 15-year high above $40,000 a ton -- the biggest-ever daily dollar gain in the 35-year history of the contract". Why? Russia supplies 6%, and liquidity evaporated overnight, shorts had to cover bloomberg.com/news/articles/…

Nickel "added more than $10,000 to trade at a 15-year high above $40,000 a ton -- the biggest-ever daily dollar gain in the 35-year history of the contract". Why? Russia supplies 6%, and liquidity evaporated overnight, shorts had to cover bloomberg.com/news/articles/…

2/ Energy transition pulled in $755 billion, a 25% increase over 2020 investment, double what was invested in 2015, and a more than 20-fold increase since 2004. This is deployment money - financing market-ready tech at scale. bloomberg.com/news/articles/…

2/ Energy transition pulled in $755 billion, a 25% increase over 2020 investment, double what was invested in 2015, and a more than 20-fold increase since 2004. This is deployment money - financing market-ready tech at scale. bloomberg.com/news/articles/…

Despite the Covid-19 pandemic, global power generation fell only two-tenths of a percent for all of 2020. Coal-fired power generation fell 3% year on year; gas-fired power fell 1%, and nuclear power declined 3%. Wind, solar, and hydropower all grew. bloomberg.com/news/articles/…

Despite the Covid-19 pandemic, global power generation fell only two-tenths of a percent for all of 2020. Coal-fired power generation fell 3% year on year; gas-fired power fell 1%, and nuclear power declined 3%. Wind, solar, and hydropower all grew. bloomberg.com/news/articles/…

2. But that base is probably too low. And the accelerated case is right around where @BloombergNEF and @solar_chase have our case (~180GW), but as Jenny says, "there's always more solar than you think there is" so maybe that's low

2. But that base is probably too low. And the accelerated case is right around where @BloombergNEF and @solar_chase have our case (~180GW), but as Jenny says, "there's always more solar than you think there is" so maybe that's low https://twitter.com/solar_chase/status/1466085052756934673?s=20

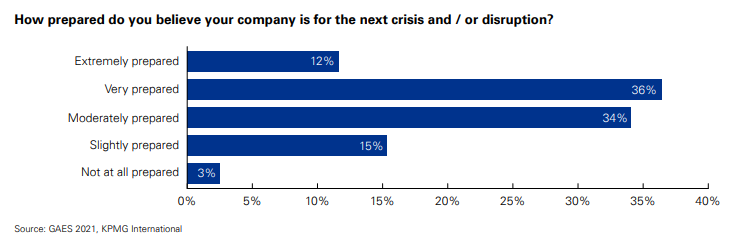

🧵2/ Auto execs are quite concerned about commodity and component supply continuity home.kpmg/xx/en/home/ins…

🧵2/ Auto execs are quite concerned about commodity and component supply continuity home.kpmg/xx/en/home/ins…

🧵/2 Expecting 5.6 million EVs sold this year, up from 3.1 million in 2020 bloomberg.com/professional/d…

🧵/2 Expecting 5.6 million EVs sold this year, up from 3.1 million in 2020 bloomberg.com/professional/d…

2/ What it was: a solar novelty in (literally) multiple dimensions. Cadmium telluride thin-film PV, mounted in a glass tube, with a bespoke racking system only for commercial roofs, needing a special rubber roofing backsheet. Mounted, it looked like this:

2/ What it was: a solar novelty in (literally) multiple dimensions. Cadmium telluride thin-film PV, mounted in a glass tube, with a bespoke racking system only for commercial roofs, needing a special rubber roofing backsheet. Mounted, it looked like this:

2/ Investment in assets actually fell since the first half of 2020 - but let's split that out by technology about.bnef.com/blog/public-ma…

2/ Investment in assets actually fell since the first half of 2020 - but let's split that out by technology about.bnef.com/blog/public-ma…

2/10 Renewable power gen is the cheapest new source of electrons almost anywhere and (related to above) does so with a higher return on equity than most oil supermajors bloomberg.com/opinion/articl…

2/10 Renewable power gen is the cheapest new source of electrons almost anywhere and (related to above) does so with a higher return on equity than most oil supermajors bloomberg.com/opinion/articl…