La Comisión Europea ha aprobado el viernes un desembolso de 10.000 millones de euros, correspondientes al primer tramo del plan de recuperación.

¿Quiere decir esto que el Gobierno está haciendo reformas y va a gastar bien el dinero asignado? No, en absoluto.

Abro HILO 1/13

¿Quiere decir esto que el Gobierno está haciendo reformas y va a gastar bien el dinero asignado? No, en absoluto.

Abro HILO 1/13

"La Comisión Europea ha puesto muy buena nota al plan de España".

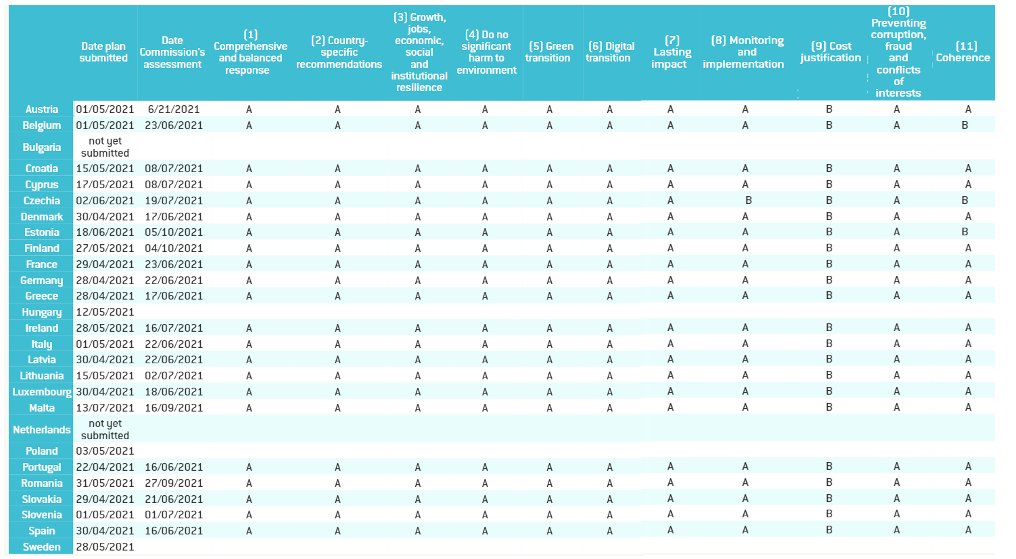

Sí, y a todos los demás. De los 22 planes aprobados, 19 han recibido exactamente la misma nota. España solo ha sacado más nota que Bélgica, Chequia y Estonia. Es un aprobado general, no un sobresaliente. 2/13

Sí, y a todos los demás. De los 22 planes aprobados, 19 han recibido exactamente la misma nota. España solo ha sacado más nota que Bélgica, Chequia y Estonia. Es un aprobado general, no un sobresaliente. 2/13

¿Cuales son los países a los que no le han aprobado todavía el plan?

-Holanda, Suecia y Bulgaria porque llevan varios meses sin Gobierno.

-Polonia y Hungría porque no respetan el Estado de Derecho. La Comisión va a gastar todo su capital político en estos dos países. 3/13

-Holanda, Suecia y Bulgaria porque llevan varios meses sin Gobierno.

-Polonia y Hungría porque no respetan el Estado de Derecho. La Comisión va a gastar todo su capital político en estos dos países. 3/13

Después de la última crisis, la Comisión Europea se ha cansado de ser la mala de la película. Por eso, salvo en el caso de Polonia y Hungría, el dinero llegará sin muchas fricciones a los Estados miembros. La condiciones que ha puesto la Comisión son de mínimos. 4/13

No podemos esperar a que Europa resuelva siempre nuestros problemas, España recibirá el dinero para gastarlo en digital, verde y hacer reformas. Pero que las inversiones y las reformas sirvan para algo es cosa de cada país.

Entonces, ¿qué tal lo está haciendo el Gobierno? 5/13

Entonces, ¿qué tal lo está haciendo el Gobierno? 5/13

Las reformas no van a transformar la economía española. De hecho, en algunos casos pueden dejarla peor.

Lo que conocemos de la reforma de las pensiones es un despropósito que deja un agujero de 42.000 millones de euros. Lo explico aquí 👇6/13

Lo que conocemos de la reforma de las pensiones es un despropósito que deja un agujero de 42.000 millones de euros. Lo explico aquí 👇6/13

La reforma laboral todavía no se ha dado conocer, pero las filtraciones muestran que el Gobierno está trabajando con los sindicatos para que el mercado laboral sea más rígido. Es una pésima idea en un país con 3 millones de parados. 👇7/13

Hay otras reformas de las que se ha hablado menos, pero que son igual de equivocadas. La reforma universitaria que ha propuesto Castells se hace para decir a Europa que hemos reformado las universidades, pero no sirve para nada 👇 8/13

El Gobierno ha elegido fingir reformas para recibir los fondos en vez de resolver los problemas estructurales de la economía española.

Pensaréis "por lo menos vamos a recibir el dinero". Vamos a ver cómo se está ejecutando 👇 9/13

Pensaréis "por lo menos vamos a recibir el dinero". Vamos a ver cómo se está ejecutando 👇 9/13

De los 24.000 millones que el Gobierno ha metido en los presupuestos de 2021 solo hay convocatorias, ya cerradas o abiertas, para 7.800 millones. Estamos a 5 de diciembre. 10/13

Entre las convocatorias que ya se han cerrado está 1 millón de euros ‘para el fomento de la movilidad internacional de autores literarios’.

Parece que para el Gobierno era prioritario pagarle viajes de 10.000€ a 100 escritores con fondos europeos... es lamentable. 11/13

Parece que para el Gobierno era prioritario pagarle viajes de 10.000€ a 100 escritores con fondos europeos... es lamentable. 11/13

How it started (mal plan de recuperación) / how it's going (la única de las grandes economías europeas muy por detrás de su nivel de actividad anterior a la pandemia). 12/13

Hace más de un año pedí una tregua política para pactar el plan, pero me ignoraron. En todas las críticas que hago doy propuestas alternativas, y lo seguiré haciendo porque los españoles se merecen mucho más que las ocurrencias de este Gobierno. 13/13

elpais.com/espana/2020-06…

elpais.com/espana/2020-06…

• • •

Missing some Tweet in this thread? You can try to

force a refresh