Professor at LSE @LSEPublicPolicy. Recovering MEP.

Substack on econ, tech and EU at https://t.co/08wJlO9hUk

"Crisis Cycle" with PUP out in June 2025.

How to get URL link on X (Twitter) App

A general answer before going deep in: firm adoption of GenAI is widespread, but it is shallow, and barely profitable. An often repeated point was that only a small minority of firms are seeing P&L impact. Data from a Deloitte&CAMO survey of 109 top executives: 2/17

A general answer before going deep in: firm adoption of GenAI is widespread, but it is shallow, and barely profitable. An often repeated point was that only a small minority of firms are seeing P&L impact. Data from a Deloitte&CAMO survey of 109 top executives: 2/17

2/10

2/10

Nobody knows who will capture the value created by AI: could be chips (NVIDIA), manufacturing (TSMC/ASML), models (OpenAI), or implementation layer.

Nobody knows who will capture the value created by AI: could be chips (NVIDIA), manufacturing (TSMC/ASML), models (OpenAI), or implementation layer.

2/The economists' core insight, which Epoch misses, is that progress works itself out of a job.

2/The economists' core insight, which Epoch misses, is that progress works itself out of a job.

2/10 Fiscal consequences: QE transforms government debt structure. When central banks buy long-term bonds and pay with overnight reserves, they swap fixed-rate debt for floating-rate debt. The state suddenly owes money at today's rates, not yesterday's.siliconcontinent.com/p/the-hidden-c…

2/10 Fiscal consequences: QE transforms government debt structure. When central banks buy long-term bonds and pay with overnight reserves, they swap fixed-rate debt for floating-rate debt. The state suddenly owes money at today's rates, not yesterday's.siliconcontinent.com/p/the-hidden-c…

Without a banking union, the sovereign-bank doom loop threatens to return to the EU.

Without a banking union, the sovereign-bank doom loop threatens to return to the EU.

Like many, I assumed grid operators, utilities, and industry would intervene if truly catastrophic policies were being implemented. We trusted that leaders like Angela Merkel and Mark Rutte would get sound advice and make sensible decisions. 2/

Like many, I assumed grid operators, utilities, and industry would intervene if truly catastrophic policies were being implemented. We trusted that leaders like Angela Merkel and Mark Rutte would get sound advice and make sensible decisions. 2/

PRICES:

PRICES:

In 2020, Italy launched a program to subsidize 110% of home renovation costs. The objective was to improve energy efficiency and stimulate an economy.

In 2020, Italy launched a program to subsidize 110% of home renovation costs. The objective was to improve energy efficiency and stimulate an economy.

2/ The EU's Habitats Directive required protected nature areas with strict nitrogen thresholds. The Netherlands spread these areas out.

2/ The EU's Habitats Directive required protected nature areas with strict nitrogen thresholds. The Netherlands spread these areas out.

Over the last decade, we've witnessed an unprecedented debt explosion. Just energy crisis measures cost €651bn in 16 months.

Over the last decade, we've witnessed an unprecedented debt explosion. Just energy crisis measures cost €651bn in 16 months.

2/10 Case in point: December 2023's "dunkelflaute" in Europe. No wind, no sun. Result? Electricity prices spiked 20x in Norway, hit record highs in Netherlands, and led Spain's authorities to cut power to factories 🌑

2/10 Case in point: December 2023's "dunkelflaute" in Europe. No wind, no sun. Result? Electricity prices spiked 20x in Norway, hit record highs in Netherlands, and led Spain's authorities to cut power to factories 🌑

The ECB wants to give Europeans direct central bank accounts for payments. Their goal? Compete with Bitcoin and lower transaction costs by cutting out Visa/Mastercard fees. Sounds great... until you see the restrictions.

The ECB wants to give Europeans direct central bank accounts for payments. Their goal? Compete with Bitcoin and lower transaction costs by cutting out Visa/Mastercard fees. Sounds great... until you see the restrictions.

Costs are staggering: Corporate Sustainability Reporting Directive (CSRD) requires 42,000 companies report 1,052 data points (783 mandatory). Cost: €150K-1M per company annually.

Costs are staggering: Corporate Sustainability Reporting Directive (CSRD) requires 42,000 companies report 1,052 data points (783 mandatory). Cost: €150K-1M per company annually.

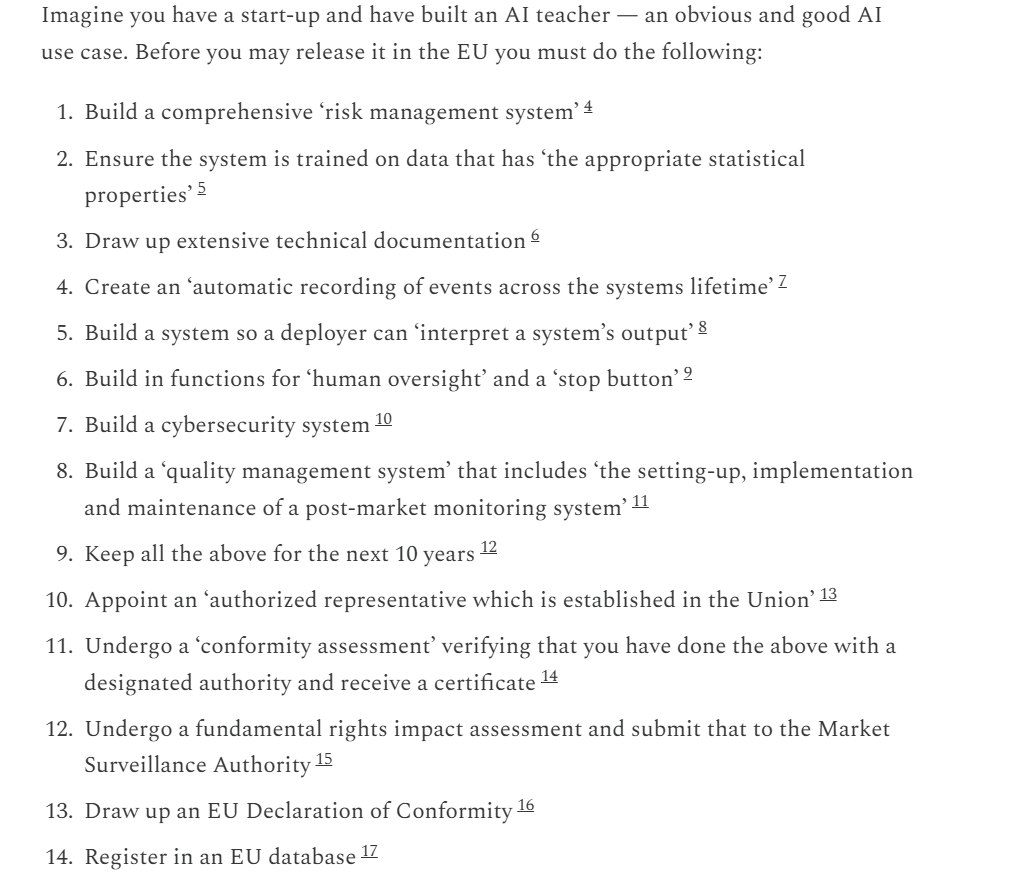

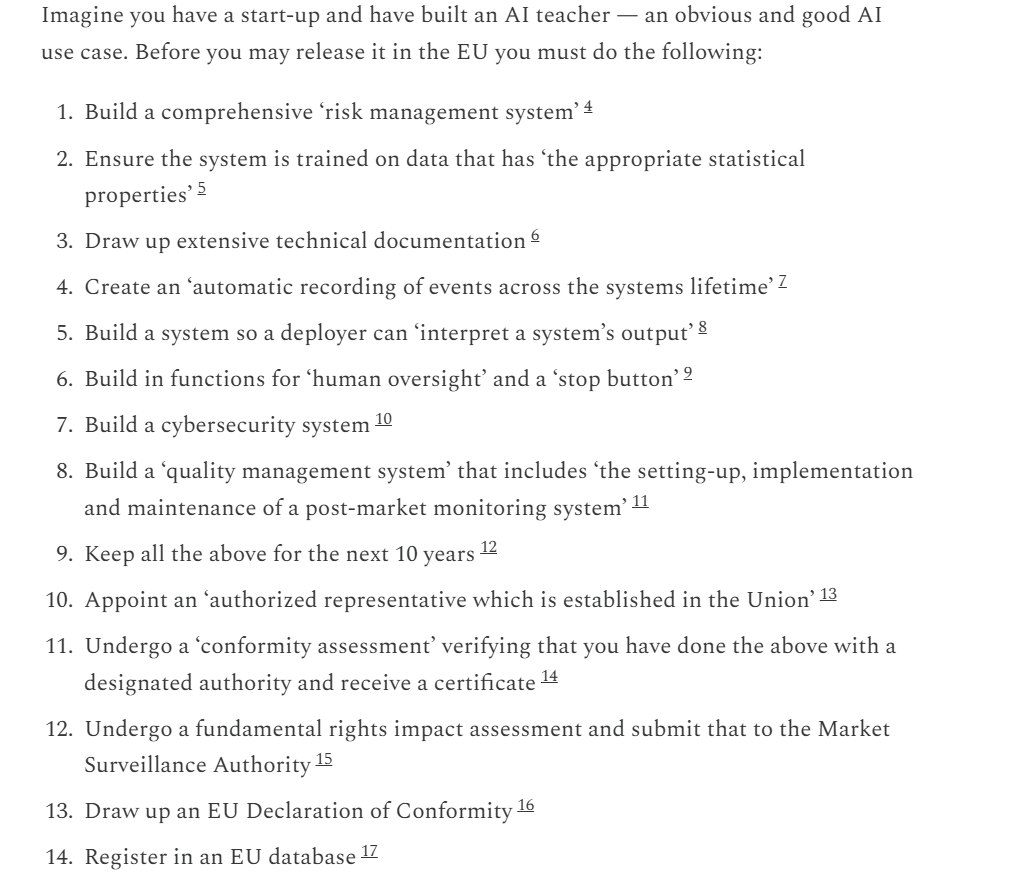

An AI bank teller in the EU would need two humans to oversee it. A startup building an AI tutor faces countless hurdles before launching. The is the reality under the EU AI Act—a well-meaning but flawed attempt to regulate AI.

An AI bank teller in the EU would need two humans to oversee it. A startup building an AI tutor faces countless hurdles before launching. The is the reality under the EU AI Act—a well-meaning but flawed attempt to regulate AI.

As a share of GDP, Europe spends 0.74% on public sector R&D, compared to the U.S. 0.69%.

As a share of GDP, Europe spends 0.74% on public sector R&D, compared to the U.S. 0.69%.

https://twitter.com/lugaricano/status/1708464341991686584La economía crece por demografía o por productividad.