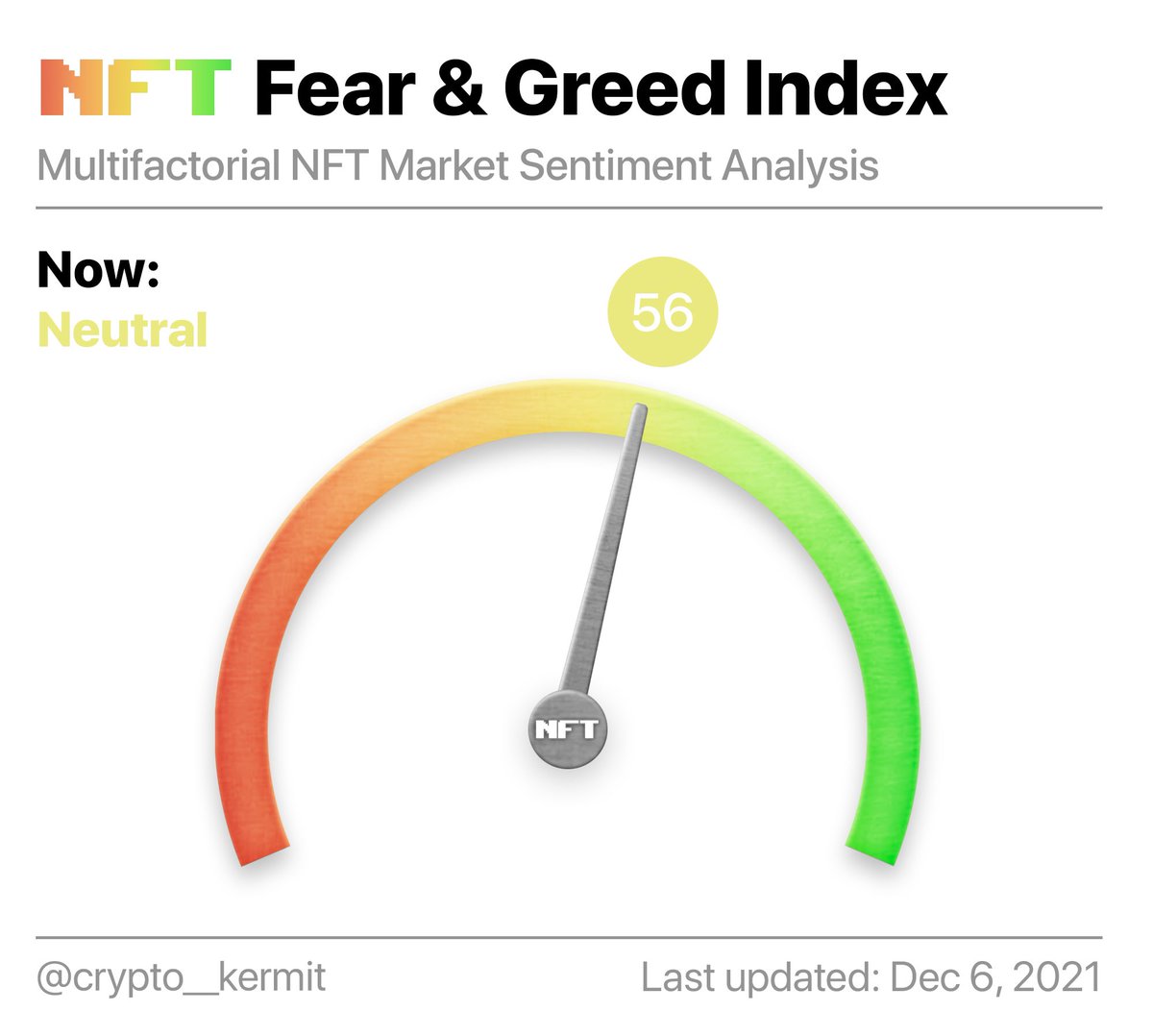

INTRODUCING: ✨The NFT Fear & Greed Index✨

An index inspired by the popular Bitcoin and Ethereum Fear & Greed Indexes.

Today’s Result: Neutral - 56

Let me walk you through how it works through this thread🧵:

#NFT #NFTs #NFTCommmunity

An index inspired by the popular Bitcoin and Ethereum Fear & Greed Indexes.

Today’s Result: Neutral - 56

Let me walk you through how it works through this thread🧵:

#NFT #NFTs #NFTCommmunity

Just like the Bitcoin Fear & Greed Index, the NFT F&G Index uses multiple data sources to reflect sentiment in the NFT Market.👀

Data Sources:

- Volatility (30%)

- Market Momentum (30%)

- Active Wallets (15%)

- Social Media (10%)

- Trend (10%)

- Dominance (5%)

- Volatility (30%)

- Market Momentum (30%)

- Active Wallets (15%)

- Social Media (10%)

- Trend (10%)

- Dominance (5%)

🚀 Volatility:

Here, we take into consideration current market volatility and max. drawdowns.

We compare today’s volatility with the corresponding average values of the last 30 days and 90 days.

We argue that a positive rise in volatility reflects greed, and vice versa.

Here, we take into consideration current market volatility and max. drawdowns.

We compare today’s volatility with the corresponding average values of the last 30 days and 90 days.

We argue that a positive rise in volatility reflects greed, and vice versa.

📈 Volume:

Today’s market volume and momentum is calculated by also comparing it to the average values of the last 30 fays and 90 days’ volume.

Generally, higher daily volume in the NFT market means greed is on the rise, whereas low volume signifies fear.

Today’s market volume and momentum is calculated by also comparing it to the average values of the last 30 fays and 90 days’ volume.

Generally, higher daily volume in the NFT market means greed is on the rise, whereas low volume signifies fear.

📲 Active Wallets:

Here, we look at the daily number of active wallets in the marketplace.

Higher amounts of daily active wallets mean that more people are coming into the space (or FOMOing in). The lower the amount, the less people are currently interested in the market.

Here, we look at the daily number of active wallets in the marketplace.

Higher amounts of daily active wallets mean that more people are coming into the space (or FOMOing in). The lower the amount, the less people are currently interested in the market.

🤳 Social Media:

A twitter analysis of relevant hashtags is taken into account.

We gathered the number of times relevant hashtags were used daily and checked how fast and many interactions they received in certain time frames.

High interaction rate = gorwing public interest

A twitter analysis of relevant hashtags is taken into account.

We gathered the number of times relevant hashtags were used daily and checked how fast and many interactions they received in certain time frames.

High interaction rate = gorwing public interest

📊 Trend:

I’ve pulled Google Trends data for various NFT related search queries and crunched those numbers, especially the change of search volumes as well as recommended other currently popular searches.

I’ve pulled Google Trends data for various NFT related search queries and crunched those numbers, especially the change of search volumes as well as recommended other currently popular searches.

🏠 Dominance:

I think this was the hardest one to factor in as we are SO SO SO very early in the space.

Here, I tried to take into account the dominance of NFT’s market cap over ETH’s.

We’re currently ONLY at 1.5% of ETH’s market cap.👀

I think this was the hardest one to factor in as we are SO SO SO very early in the space.

Here, I tried to take into account the dominance of NFT’s market cap over ETH’s.

We’re currently ONLY at 1.5% of ETH’s market cap.👀

My hope is that this metric will come in very handy to you in assessing Fear and Greed in the NFT Market.

And remember…

And remember…

Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

When investors are getting too greedy, that means the market is due for a correction.

When investors are getting too greedy, that means the market is due for a correction.

• • •

Missing some Tweet in this thread? You can try to

force a refresh