0/ What’s happening since Friday’s flash crash?

In today’s Delphi Daily, a full post-mortem on the recent volatility. We examine the data on open interest, bid-ask spreads, and funding rates.

For more 🧵👇

In today’s Delphi Daily, a full post-mortem on the recent volatility. We examine the data on open interest, bid-ask spreads, and funding rates.

For more 🧵👇

1/ Leveraged longs took a senseless beating over the last week and it was perhaps overdue.

BTC’s open interest on perps/futures fell from just under $30B in late November to just over $15B today.

Sentiment has taken a turn for the worse.

BTC’s open interest on perps/futures fell from just under $30B in late November to just over $15B today.

Sentiment has taken a turn for the worse.

2/ From the November peak to today, $BTC open interest is down a whopping 50%.

Too many leveraged longs and a lack of spot buying is a sign that a market is peaking. When there’s nobody left to buy/long, price momentum to the upside is severely limited.

Too many leveraged longs and a lack of spot buying is a sign that a market is peaking. When there’s nobody left to buy/long, price momentum to the upside is severely limited.

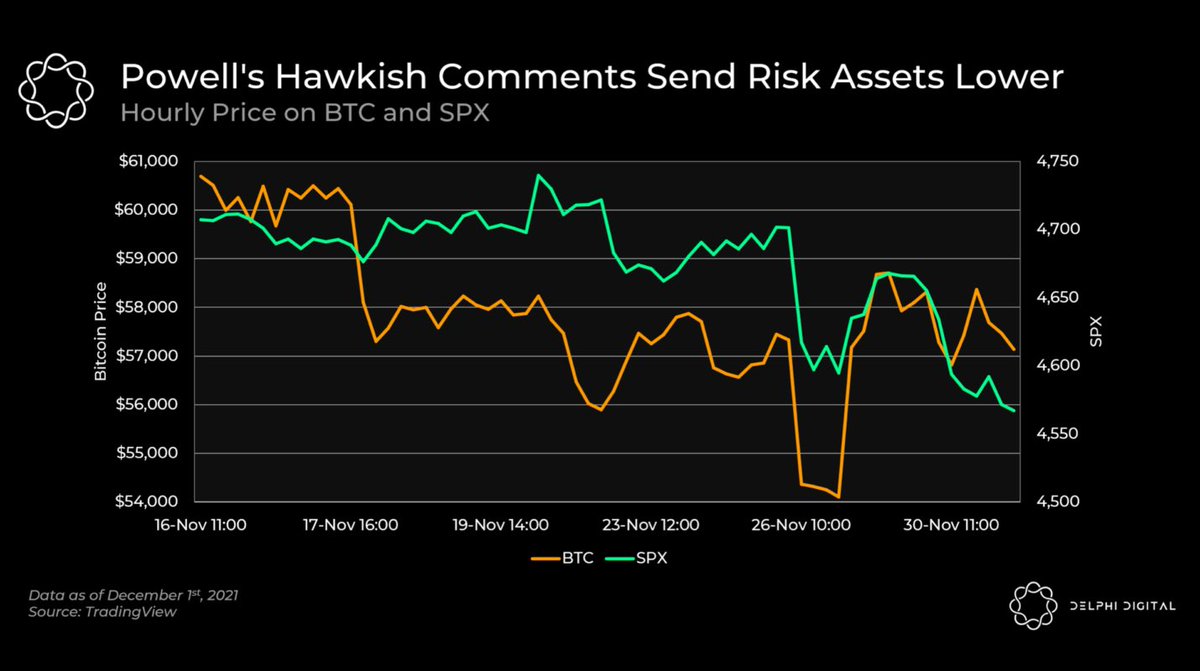

3/ What really caused prices to fall so quickly?

The answer is an utter collapse in market microstructure.

The bid-ask spread for a $5M order in perp markets ranges from 0.1% to 0.5% (on bad days). On this occasion, spreads for a $5M order momentarily rose as high as 2-11%.

The answer is an utter collapse in market microstructure.

The bid-ask spread for a $5M order in perp markets ranges from 0.1% to 0.5% (on bad days). On this occasion, spreads for a $5M order momentarily rose as high as 2-11%.

4/ Funding rates turned negative as levered longs were wiped out, and sentiment has been understandably poor since.

Crypto markets are sensitive to behavioral factors, so a mid-term collapse in sentiment would not be surprising if things don’t pick up soon.

Crypto markets are sensitive to behavioral factors, so a mid-term collapse in sentiment would not be surprising if things don’t pick up soon.

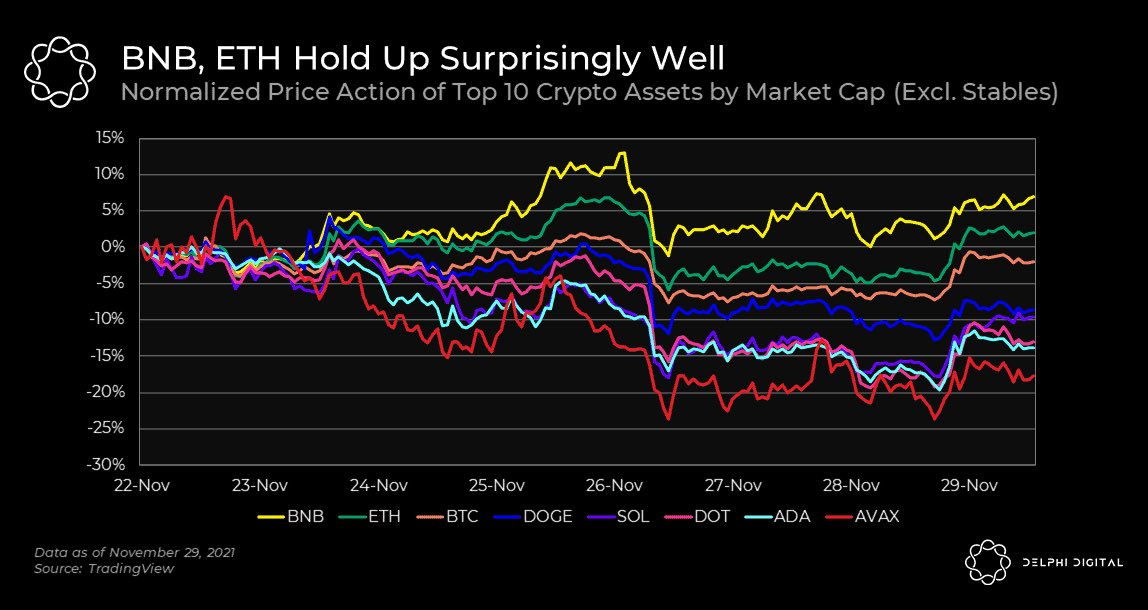

5/ $LUNA looks to be a moon mission as the only top 10 coin in the green over the last two weeks.

Despite erratic performance across the market, $ETH and $BNB are holding much better than other large caps.

Despite erratic performance across the market, $ETH and $BNB are holding much better than other large caps.

6/ Tweets of the day

How to survive crypto winters

How to survive crypto winters

https://twitter.com/santiagoroel/status/1467836164900106245

8/ An interesting read on NFTs, IP ownership, and copyright laws

https://twitter.com/ryder_ripps/status/1467589270017740802

10/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh