TymeBank South Africa and Tyme Global have concluded their series B capital raising round.

Raised $70m and sees Tencent (yes Tencent) and CDC Group (UK’s development finance institution) being new shareholders in Tyme.

Who are TymeBank’s shareholders and how is it performing?🧵

Raised $70m and sees Tencent (yes Tencent) and CDC Group (UK’s development finance institution) being new shareholders in Tyme.

Who are TymeBank’s shareholders and how is it performing?🧵

Brief history.

TymeDigital was 90% owned by the Commonwealth Bank of Australia with ARC owning 10%.

In 2018, ARC acquired the 90% stake for an undisclosed consideration.

The transaction comprised TymeDigital in South Africa and the related intellectual property and patents.

TymeDigital was 90% owned by the Commonwealth Bank of Australia with ARC owning 10%.

In 2018, ARC acquired the 90% stake for an undisclosed consideration.

The transaction comprised TymeDigital in South Africa and the related intellectual property and patents.

Quick nuggets.

Factory for manufacturing facility for proprietary hardware innovations is in South Africa.

Headquarters of Tyme, business development, strategy, international partnerships and data analytics are in Singapore.

Factory for manufacturing facility for proprietary hardware innovations is in South Africa.

Headquarters of Tyme, business development, strategy, international partnerships and data analytics are in Singapore.

ARC got the necessary regulatory approvals from The Prudential Authority of the South African Reserve Bank.

TymeDigital then changed its name to TymeBank.

TymeBank South Africa

was the first full greenfield digital bank deployment with ~200 staff.

TymeDigital then changed its name to TymeBank.

TymeBank South Africa

was the first full greenfield digital bank deployment with ~200 staff.

1) Ethos Private Equity.

in 2019, Ethos Artificial Intelligence (AI) Fund invested ~R200 million in TymeBank.

The investment by the Ethos AI Fund in TymeBank resulted in the Ethos (Fund) being an 8% shareholder in the bank.

This valued TymeBank at ~R1bn in 2019.

in 2019, Ethos Artificial Intelligence (AI) Fund invested ~R200 million in TymeBank.

The investment by the Ethos AI Fund in TymeBank resulted in the Ethos (Fund) being an 8% shareholder in the bank.

This valued TymeBank at ~R1bn in 2019.

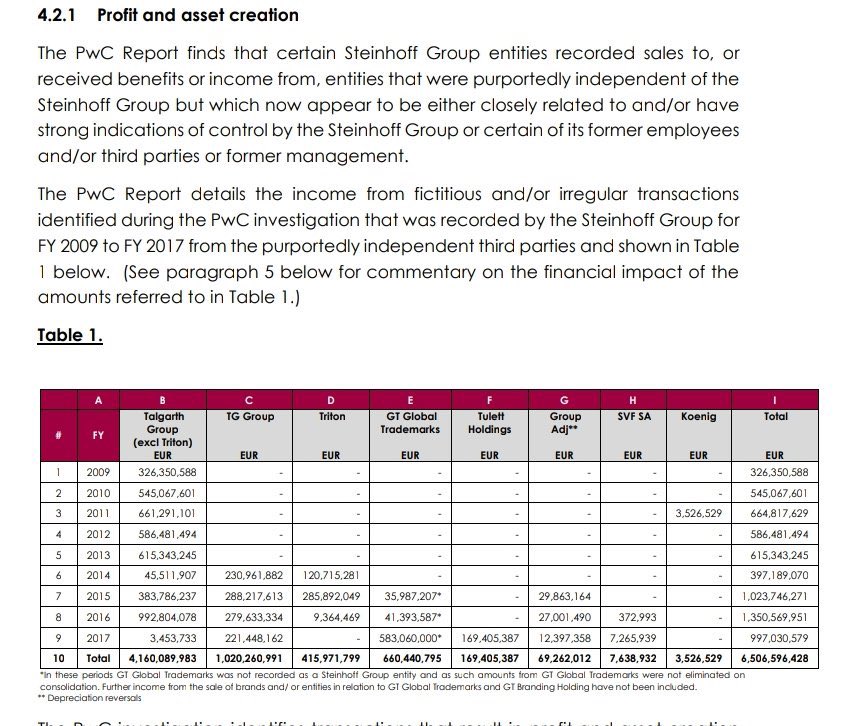

2) Series B

In 2021, ARC introduced new shareholders in TymeBank

SA and Tyme Global.

Combined capital raise amounts to R1.6billion, structured as two tranches;

Tranche 1 ~R1,163bn

Tranche 2 ~R436m.

This capital raise gave Tyme a value of R8bn.

In 2021, ARC introduced new shareholders in TymeBank

SA and Tyme Global.

Combined capital raise amounts to R1.6billion, structured as two tranches;

Tranche 1 ~R1,163bn

Tranche 2 ~R436m.

This capital raise gave Tyme a value of R8bn.

The new investors in Tyme via tranche 1 are Apis Growth Fund II, a private equity fund managed by Apis Partners

and JG Summit Holdings.

1st tranche of R1.2bn was concluded in April 2021.

Apis (14,9%) and JG Summit (5,13%) will become minority shareholders in Tyme.

and JG Summit Holdings.

1st tranche of R1.2bn was concluded in April 2021.

Apis (14,9%) and JG Summit (5,13%) will become minority shareholders in Tyme.

3) Tencent (leading internet and technology company) and CDC Group (UK’s development finance

institution) were added as shareholders after the conclusion of the series B round of funding.

You can't speak about Tencent and not mention Naspers.

institution) were added as shareholders after the conclusion of the series B round of funding.

You can't speak about Tencent and not mention Naspers.

https://twitter.com/MaanoMadima/status/1462705170605920266?t=pGcnKUv0GffmfxjGDajmNA&s=19

Why did Tyme raise $180m?

To enable Tyme to use its digital infrastructure to accelerate the rollout of financial services.

The two investors’ capital and expertise will be used to strengthen Tyme’s ability to manage risk and support Tyme’s expansion into emerging markets.

To enable Tyme to use its digital infrastructure to accelerate the rollout of financial services.

The two investors’ capital and expertise will be used to strengthen Tyme’s ability to manage risk and support Tyme’s expansion into emerging markets.

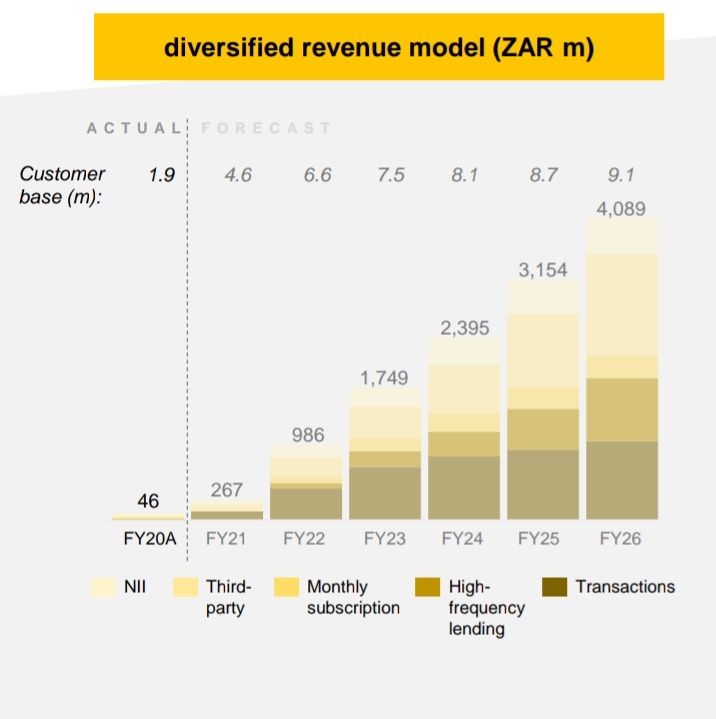

TymeBank was launched to the public in February 2019 and

reached one million customers in November 2019. So 9 months

post-launch (>100,000 customer acquired per month).

TymeBank has also partnered with Hollard to provide affordable micro-

insurance.

See revenue mix below.

reached one million customers in November 2019. So 9 months

post-launch (>100,000 customer acquired per month).

TymeBank has also partnered with Hollard to provide affordable micro-

insurance.

See revenue mix below.

Early 2021, TymeBank announced that it has signed it 3-millionth customer.

In 2020, TymeBank entered into a partnership with ZCC, which will see TymeBank become the financial services partner of choice for the members of the church.

ZCC's membership stands at ~12million.

In 2020, TymeBank entered into a partnership with ZCC, which will see TymeBank become the financial services partner of choice for the members of the church.

ZCC's membership stands at ~12million.

Of the 12m ZCC members, it was estimated that 6m were economically active in SA.

Partnership will work as follows:

TymeBank debit card that doubles as the official ZCC membership card

Opportunity to assist with digitising cash-based donations insurance premium collections.

Partnership will work as follows:

TymeBank debit card that doubles as the official ZCC membership card

Opportunity to assist with digitising cash-based donations insurance premium collections.

TymeBank’s high-tech high-touch model compares well with other digital banks despite its early stage.

TymeBank is forecasting to breakeven in 2022 with a set of rapidly growing revenue streams and expecting to reach monthly profitability before Jun 2022.

TymeBank is forecasting to breakeven in 2022 with a set of rapidly growing revenue streams and expecting to reach monthly profitability before Jun 2022.

The Covid-19 outbreak was good to TymeBank.

TymeBank acquired 1.4 million new customer, with increased active customer base from 50% to 60%.

TymeBank acquired 1.4 million new customer, with increased active customer base from 50% to 60%.

TymeBank currently had 3.45m customers as at 30 Jun 2021.

How does TymeBank fare against others?

Let's compare apples and oranges.

Discovery Bank ~ 300000 customers with 556,000 accounts

Capitec ~15 million,

Standard Bank ~9.1 million

Absa ~ 9.7 million.

How does TymeBank fare against others?

Let's compare apples and oranges.

Discovery Bank ~ 300000 customers with 556,000 accounts

Capitec ~15 million,

Standard Bank ~9.1 million

Absa ~ 9.7 million.

Tyme is entering the Philippines next.

Tyme partnered with the JG Summit, which operates a diversified portfolio of businesses with 8 million loyalty members, to apply for a digital banking license and expand financial access to underbanked and under-served Filipinos.

Tyme partnered with the JG Summit, which operates a diversified portfolio of businesses with 8 million loyalty members, to apply for a digital banking license and expand financial access to underbanked and under-served Filipinos.

The Philippines has;

Population of 108m,

Adoption of digital financial services has accelerated in the Philippines,

GDP per capita growth (2020-23) 6.9%,

smartphone penetration - 52%,

underbanked or unbanked - 78%.

Population of 108m,

Adoption of digital financial services has accelerated in the Philippines,

GDP per capita growth (2020-23) 6.9%,

smartphone penetration - 52%,

underbanked or unbanked - 78%.

TymeBank says that it has a sustainable structural advantage over incumbents.

Exibit A:Retail ops expenses per customer (ZAR)

Exibit B: comparison of retail cost-to-income ratio

Exibit C: comparison of average Jaws ratio (Revenue growth rate net of expenses growth rate).

Exibit A:Retail ops expenses per customer (ZAR)

Exibit B: comparison of retail cost-to-income ratio

Exibit C: comparison of average Jaws ratio (Revenue growth rate net of expenses growth rate).

It seems like customers are depositing into their TymeBank accounts.

See below for monthly gross inflow of deposits

See below for monthly gross inflow of deposits

If you look at the quarterly operating expenses vs customer base, TymeBank’s operating costs are reducing as the bank continues to scale.

TymeBank’s operating expenses (excluding depreciation and amortisation) in 2020 were ~R1.06 billion.

TymeBank’s operating expenses (excluding depreciation and amortisation) in 2020 were ~R1.06 billion.

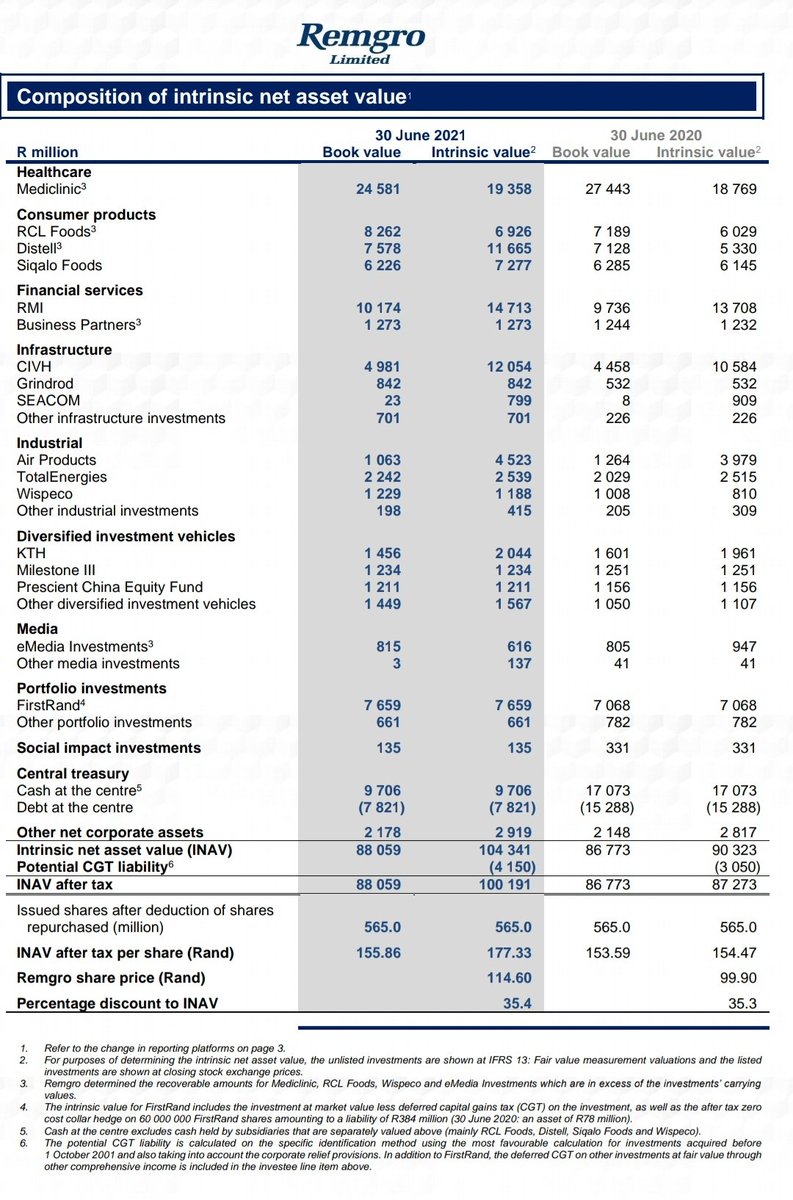

Trading at a discount to the sum-of-the-parts is common for holding companies.

For example, African Rainbow Capital Investments believes that its net assets are worth R12.3 bn for FY21 vs R10.6bn in FY20.

Market participants, however value the net assets at ~R5.1bn.

For example, African Rainbow Capital Investments believes that its net assets are worth R12.3 bn for FY21 vs R10.6bn in FY20.

Market participants, however value the net assets at ~R5.1bn.

What 'complicates' things with holding companies that have unlisted investments is the difficulty in valuing those unlisted investments (lack of proper disclosure).

Valuing listed investments within holding companies (Remgro) is often easier than valuing unlisted investments.

Valuing listed investments within holding companies (Remgro) is often easier than valuing unlisted investments.

Example of the mystery of valuing an unlisted entity.

African Rainbow Capital’s stake in Rain has been constant at ~20%.

For year ended 30 Jun 2021, ARC revealed that it values Rain at R16.357bn which is a ⬇️ from R17.15bn at end of Dec 2020.

First time that Rain’s value ⬇️.

African Rainbow Capital’s stake in Rain has been constant at ~20%.

For year ended 30 Jun 2021, ARC revealed that it values Rain at R16.357bn which is a ⬇️ from R17.15bn at end of Dec 2020.

First time that Rain’s value ⬇️.

ARC uses the DCF method (sensitive to changes) to value Rain.

Using DCF, ceteris paribus, a decrease discount rate will give a higher valuation.

1% ⬆️ in WACC = fair value ⬇️ of R366m.

1% ⬇️ in WACC = fair value ⬆️ of R435m.

FY20 - 17.25%

FY21 - 15.26%

Using DCF, ceteris paribus, a decrease discount rate will give a higher valuation.

1% ⬆️ in WACC = fair value ⬇️ of R366m.

1% ⬇️ in WACC = fair value ⬆️ of R435m.

FY20 - 17.25%

FY21 - 15.26%

https://twitter.com/MaanoMadima/status/1374405515678150656?t=pGcnKUv0GffmfxjGDajmNA&s=19

At 30 June 2021 the ARC Fund had an effective interest of ~28.8% in TymeBank, being its ~49.9% of the 57.7% interest held by African Rainbow Capital Financial Services in TymeBank.

ARC Investments’ share in TymeBank’s FY21 fair value amounts to R1.17bn vs R927m in FY20 (10%⬆️)🤷🏾♂️

ARC Investments’ share in TymeBank’s FY21 fair value amounts to R1.17bn vs R927m in FY20 (10%⬆️)🤷🏾♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh