“Almost nobody ever liked him. He ends up with more money than I did. So you can say he’s the success. But that’s not the way I look at it.”

Charlie Munger about Sumner Redstone.

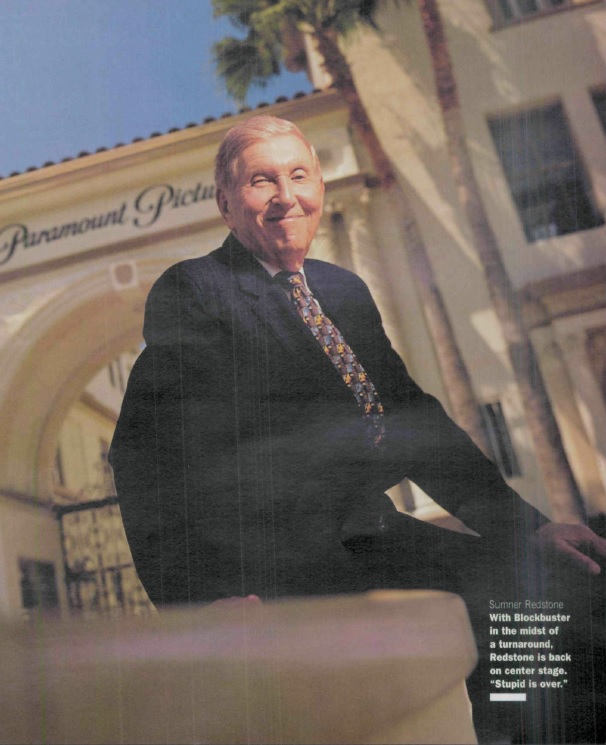

Redstone's story is intense, impressive, and scary. It's the pursuit of winning above all else.

Charlie Munger about Sumner Redstone.

Redstone's story is intense, impressive, and scary. It's the pursuit of winning above all else.

In 1979, he was dangling by from a hotel windowsill. A disgruntled employee at Boston’s Copley Plaza Hotel had set a fire. Redstone was trapped. The man in the room next to him died.

"I was enveloped in flames. The fire shot up my legs. I was being burned alive.”

"I was enveloped in flames. The fire shot up my legs. I was being burned alive.”

“Determination is the key to survival. If I hadn’t learned that lesson before, I knew it well now.”

Redstone was rescued with third-degree burns. His mangled right hand would forever remind him of that night.

Redstone was rescued with third-degree burns. His mangled right hand would forever remind him of that night.

He had always been intensely competitive. But now, at age 56, he looked for a new challenge: Leave the world of movie theaters behind and become number one in content.

"I think I was always driven before, but out of that fire came most of the exciting things I have ever done."

"I think I was always driven before, but out of that fire came most of the exciting things I have ever done."

Redstone was born in 1923 and grew up in Boston. His mother drilled into him the will to be the best:

“The primary lesson I learned at Boston Latin was that life is rough, that tension is frequently crushing, that the only hope is the hope that lies within each individual. ...

“The primary lesson I learned at Boston Latin was that life is rough, that tension is frequently crushing, that the only hope is the hope that lies within each individual. ...

Because, let’s face it, the winners are going to be the people who are committed and competent, and you don’t succeed unless you can deal with and overcome the fiercest competition.”

He broke Japanese codes in WWII and then joined the DOJ where he learned about antitrust law.

“The high stakes appealed to my sense of competition and reward, I was intellectually stimulated every day and I was working to capacity, just the way I liked it.”

“The high stakes appealed to my sense of competition and reward, I was intellectually stimulated every day and I was working to capacity, just the way I liked it.”

In 1954, he returned to Boston to join his father's drive-in theater business. His brother Eddie was already there. Redstone picked new locations and negotiated with the studios.

It didn't take long before he became CEO and took control. Eddie quit in '71

It didn't take long before he became CEO and took control. Eddie quit in '71

But the company was small and the studios had concentrated market power. Redstone relished the fight but he wasn't getting the movies he wanted.

In 1958, he filed a lawsuit. “This was dangerous. We were suing our suppliers, the people from whom we made our livelihood.”

In 1958, he filed a lawsuit. “This was dangerous. We were suing our suppliers, the people from whom we made our livelihood.”

It turned out to be "a giant victory for a little company, putting us on an even plane with the majors.”

Redstone learned that the courtroom could be as important as the board room. In 1979, he sued the studios again, this time against ‘blind bidding.’

Redstone learned that the courtroom could be as important as the board room. In 1979, he sued the studios again, this time against ‘blind bidding.’

Exhibitors had been forced to commit to showing movies before having a chance to see them. If you picked a bad movie, your theater could be stuck with it for weeks or even months and you lost a lot of money.

Again, he argued that this was a violation of antitrust law.

Again, he argued that this was a violation of antitrust law.

"The major distributors, we claimed, didn’t disseminate information; they intentionally suppressed it. The entire industry had adopted blind bidding not only with great rapidity, but almost simultaneously. This was not a situation of mutual dependence recognized; on the contrary,

it was a situation of a previously reached but implicit or explicit understanding.

This was the conspiracy we were alleging. And because the pictures crossed state lines, the distributors’ transgressions affected interstate commerce, making this a federal antitrust case."

This was the conspiracy we were alleging. And because the pictures crossed state lines, the distributors’ transgressions affected interstate commerce, making this a federal antitrust case."

He won again. He was so good at negotiating with the studios that he was sued by his own competitors for alleged collusion (he paid 40% of gross receipts vs the 50-60% that his peers paid)

"Sumner Redstone is a ferocious competitor, and a highly skilled one."

"Sumner Redstone is a ferocious competitor, and a highly skilled one."

Barry Diller, then CEO of Paramount: “The only exhibitor that I ever dealt with in that manner was Mr. Redstone who always complained that he deserved a rebate for all his good work during the year.”

When drive-in theaters faded, Redstone was able to redevelop the land which his family owned. He turned the drive-ins into modern multiplex theaters with abundant parking and good access from the suburbs.

He was an obsessive operator, had a photographic memory, and kept track the box office earnings of all of his locations by calling a special phone number every night.

"It just happens to be so much in my blood that I do it even when I'm on vacation."

"It just happens to be so much in my blood that I do it even when I'm on vacation."

He used this information to his advantage by buying stocks of studios like Disney, Fox, and Columbia when they had box office hits. He made tens of millions and became more familiar with public markets and takeovers.

In the 80s, the rise of cable TV and VHS threatened movie theaters. The days of growth were over. And after the fire, Redstone was ready to compete in a new arena.

When Viacom's management tried to take the company private he made a competing bid.

When Viacom's management tried to take the company private he made a competing bid.

"No one knew who he was. He was just some fellow from Boston operating out of a hotel room. Freston, (later chair of MTV)

"When we acquired Viacom, my friends were telling me that MTV was a fad. Nickelodeon was making maybe $10 million." Redstone

"When we acquired Viacom, my friends were telling me that MTV was a fad. Nickelodeon was making maybe $10 million." Redstone

Redstone borrowed against his theaters, raised his bid, then sent a letter to Viacom's directors who were leaning towards the CEO's lower bid. In a thinly veiled threat of another lawsuit he noted that “neither we nor the shareholders” would stand for choosing the inferior bid.

Next he went up against Diller for control of Paramount Pictures. Diller headed QVC and was backed by cable operators.

Redstone sued John Malone’s TCI, alleging that QVC’s bid for Paramount was “one more step in John Malone’s conspiracy to monopolize” the cable industry.

Redstone sued John Malone’s TCI, alleging that QVC’s bid for Paramount was “one more step in John Malone’s conspiracy to monopolize” the cable industry.

Malone was about to sell TCI and didn't need the distraction. He backed out.

Redstone got additional borrowing capacity by merging Viacom with the (ultimately doomed) Blockbuster. Paramount was his.

Diller: “They won, we lost. Next.”

Redstone got additional borrowing capacity by merging Viacom with the (ultimately doomed) Blockbuster. Paramount was his.

Diller: “They won, we lost. Next.”

Redstone became the 'king of content' just as the internet was about to change everything.

And his tenacity and obsession with control had worn down his relationships. His last years were marred by fights and lawsuits with his children and executives.

And his tenacity and obsession with control had worn down his relationships. His last years were marred by fights and lawsuits with his children and executives.

Redstone successfully fought for control of his destiny. But the price of winning was incalculable.

I wrote about lessons from his life here:

neckar.substack.com/p/sumner-redst…

I wrote about lessons from his life here:

neckar.substack.com/p/sumner-redst…

• • •

Missing some Tweet in this thread? You can try to

force a refresh