Always fascinated by how rapidly Enron unraveled. From $100 billion in reported revenue in 2000 to bankruptcy by December 2001.

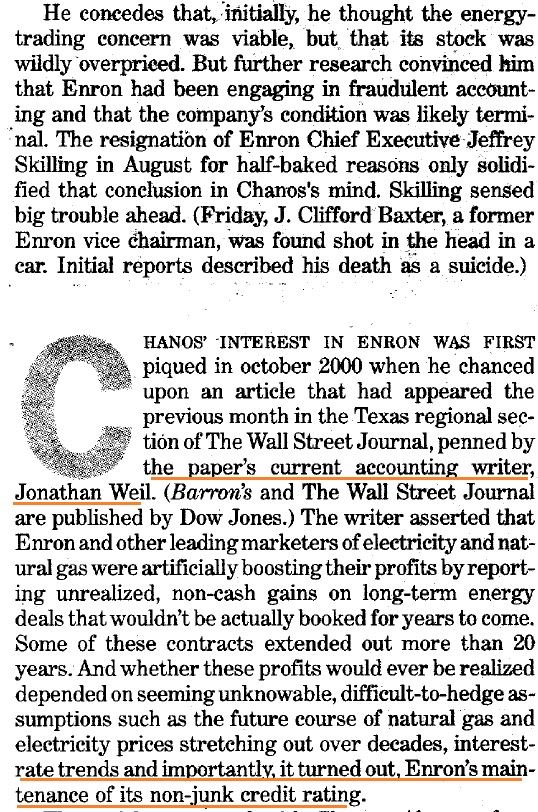

Jonathan Weil’s 2000 Wall Street Journal article that kicked it all off: “Energy Traders Cite Gains, But Some Math Is Missing”

That made @WallStCynic sharpen his pencil.

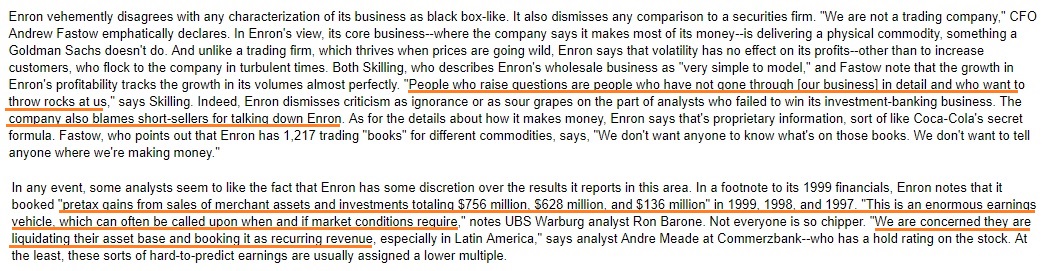

Bethany McLean’s March 2001 article in Fortune: “Is Enron Overpriced?”

“Start with a pretty straightforward question: How exactly does Enron make its money?

‘If you figure it out, let me know,’ laughs credit analyst Todd Shipman at S&P.'”

archive.fortune.com/magazines/fort…

“Start with a pretty straightforward question: How exactly does Enron make its money?

‘If you figure it out, let me know,’ laughs credit analyst Todd Shipman at S&P.'”

archive.fortune.com/magazines/fort…

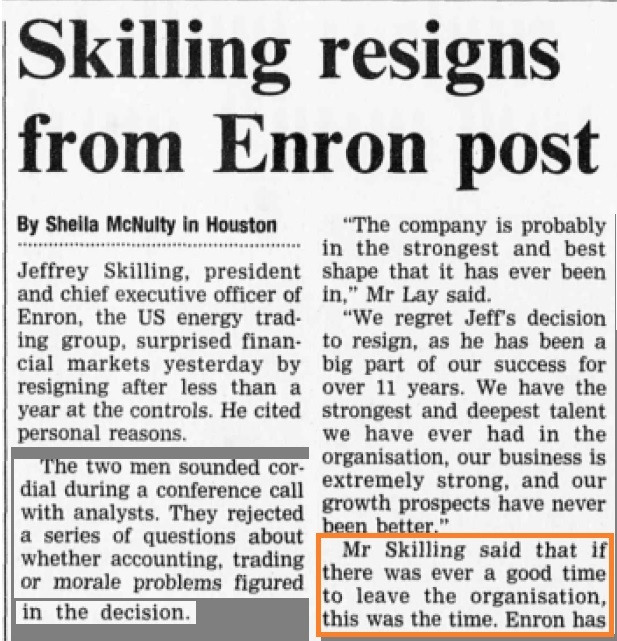

Financial Times August 2001: narrative is about the broadband business; transparency is becoming an issue.

Skilling resigns two weeks later with a great Freudian slip: if there was ever a good time to leave the organization, this was it.

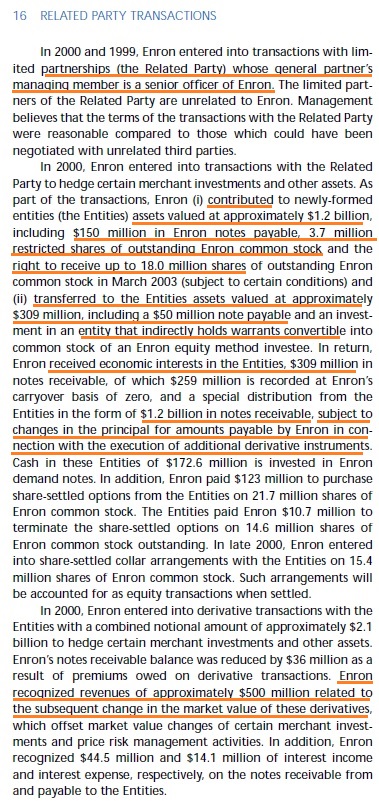

“4,000 off-balance sheet partnerships"

"They seemed to be selling parts of themselves to themselves”

"They seemed to be selling parts of themselves to themselves”

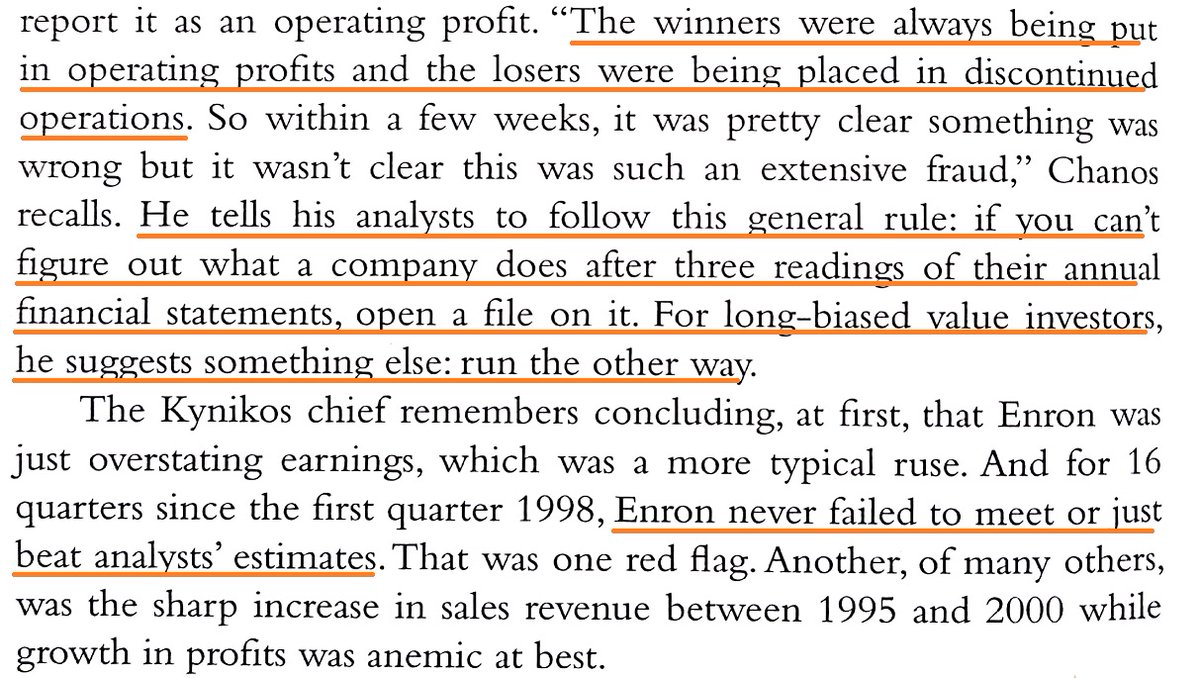

“If you can’t figure out what a company does after three readings of their financial statements, open a file”

If you're a long-biased investor: "run the other way"

If you're a long-biased investor: "run the other way"

• • •

Missing some Tweet in this thread? You can try to

force a refresh