1/ I've seen many of you asking what the heck this is and how to interpret it. So over the course of this brief thread I will explain the basics.⚡️

This is TLDR on Term Structure. 🧵

This is TLDR on Term Structure. 🧵

2/ Term structure simply displays the ATM (at the money) IV (Implied Volatility) of different expirations. In the above example it looks like 17DEC ATM IV is around 78-ish, and 28Jan22 is over 85 IV.

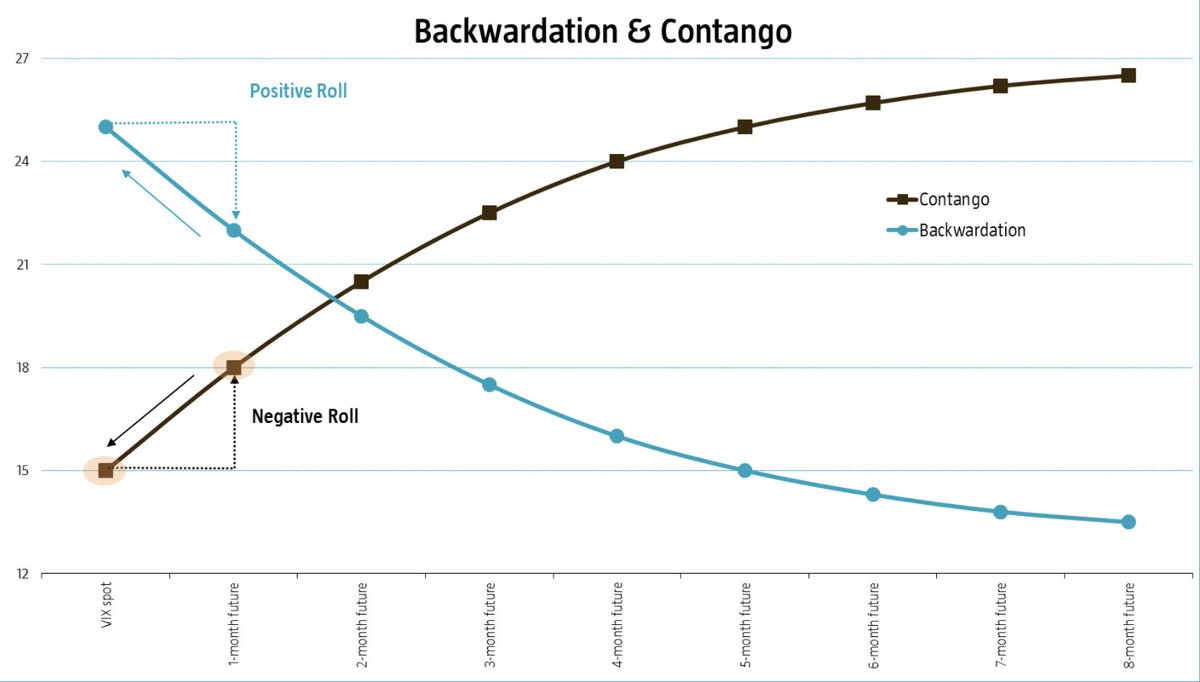

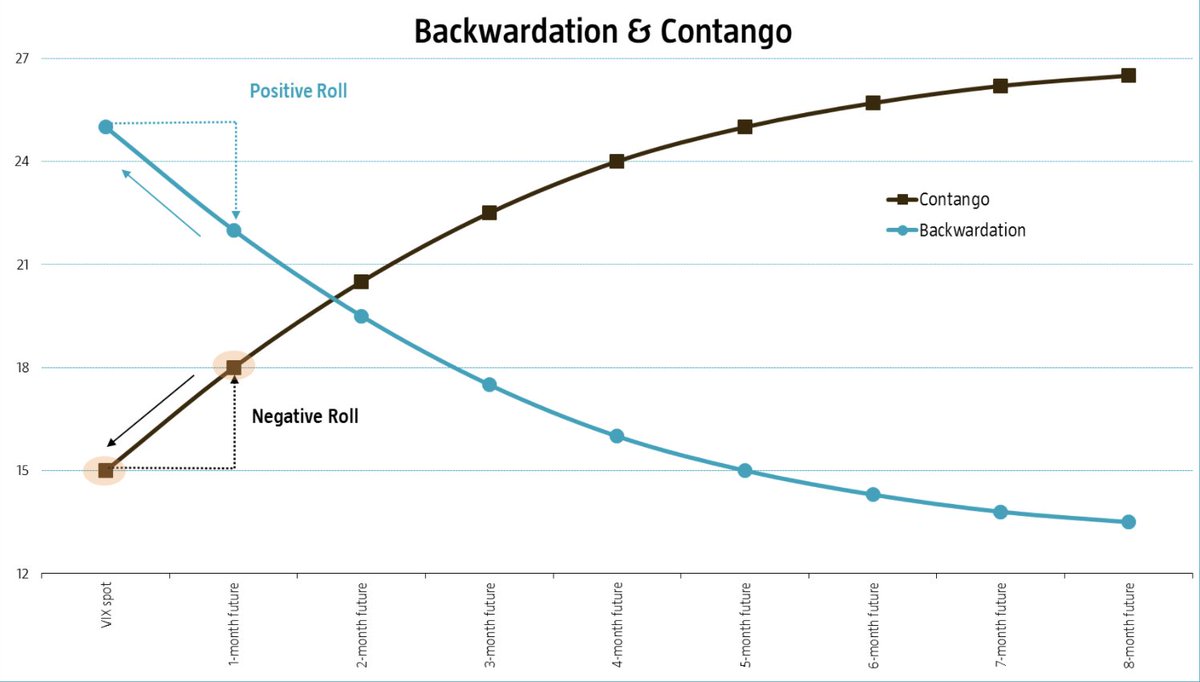

3/ There are two main types of term structure. Backwardation and Contango.

Backwardation is when the near term expirations have a higher IV than the further out expirations. In our case, maybe 15DEC has a 100IV and 28Jan22 has a 70IV, that would be backwardation.

Backwardation is when the near term expirations have a higher IV than the further out expirations. In our case, maybe 15DEC has a 100IV and 28Jan22 has a 70IV, that would be backwardation.

4/ Contango is more common, this is when the near term expiration has a lower IV than the longer dated expiration.

5/ Backwardation has a positive roll, meaning as the near term strike expires the next strike's IV should "roll" up (increase).

Contango has the opposite effect, as the close strike expires the next strike's IV falls off.

Contango has the opposite effect, as the close strike expires the next strike's IV falls off.

6/

Example: Backwardation

14DEC21: IV 80 -> Expires

The same day 31DEC21 becomes the next strike to expire.

31DEC21: Current IV is 75 but as it becomes the nearest strike its IV "rolls up" to 80.

Example: Backwardation

14DEC21: IV 80 -> Expires

The same day 31DEC21 becomes the next strike to expire.

31DEC21: Current IV is 75 but as it becomes the nearest strike its IV "rolls up" to 80.

7/ If we know Vol is a mean reverting asset class we can use term structure to our advantage.

For example if there is a odd hump in term structure, maybe we sell the oddly high vol and buy the low vol. 🤷♂️

NFA so DYOR

For example if there is a odd hump in term structure, maybe we sell the oddly high vol and buy the low vol. 🤷♂️

NFA so DYOR

8/ Ok, that is literally the simplest explanation of term structure I can manage. I hope this helps a little bit, if you have any questions make sure to leave them in the comment section below. 👍

Cheers!

Cheers!

• • •

Missing some Tweet in this thread? You can try to

force a refresh