Afine Investments (owns 7 petrol service station properties Engen + Sasol) has today listed on the JSE’s Alternative Exchange’s Real Estate Investment Trusts sector (offers investors exposure to real estate properties).

Shares were listed at R3.67/share, market cap of R235m.

Shares were listed at R3.67/share, market cap of R235m.

Afine was incorporated as a private shelf company in 2020 under the name “Domanolor”, which was acquired by Peter Todd (Founder) and name was changed to “Afine Investments (Pty) Ltd” on 10 March 2021.

Afine was converted to a public company on 11 May 2021.

Afine was converted to a public company on 11 May 2021.

Afine was founded by Peter Todd, with strategic input from Mike Watters, both are notable investors and operators in the REIT space, with the purpose of creating a holding company for a REIT focussing on the acquisition of properties that operate in the

petroleum sector in SA.

petroleum sector in SA.

Afine's major and controlling shareholders are;

KSP Offshore - 90%

Black Gold Trust - 10%.

KSP Offshore is incorporated and registered in Mauritius.

KSP Offshore is a family investment vehicle of the Sea View Trust, of which Peter Todd and his family are beneficiaries.

KSP Offshore - 90%

Black Gold Trust - 10%.

KSP Offshore is incorporated and registered in Mauritius.

KSP Offshore is a family investment vehicle of the Sea View Trust, of which Peter Todd and his family are beneficiaries.

KSP Offshore has been active for over a decade in the UK and Europe in real estate.

KSP disposed of all its investments in 2019 as its directors considered them to be mature and is now moving its investment focus to emerging markets.

Initial investment under new focus was Afine

KSP disposed of all its investments in 2019 as its directors considered them to be mature and is now moving its investment focus to emerging markets.

Initial investment under new focus was Afine

KSP Offshore provided a firm undertaking to the JSE that it will make an +5% of its shareholding in Afine available on the open market to public shareholders immediately after listing in order to improve share liquidity, such that its stake in Afine will be retained at 85%.

Black Gold Trust (based in Mauritius) is not related to any director or shareholder of

Afine.

Shareholding was acquired from KSP Offshore ahead of the listing of Afine in order to assist with achieving the minimum required shareholder spread for companies listing on the AltX.

Afine.

Shareholding was acquired from KSP Offshore ahead of the listing of Afine in order to assist with achieving the minimum required shareholder spread for companies listing on the AltX.

Why Mauritius?

It has one of the lowest tax platforms in the world. Both corporate and individual income taxes are at 15%.

Offshore businesses located in Mauritius (Tax Haven) that do not do business with Mauritians nor use Mauritian currency are exempt from Mauritian taxes.

It has one of the lowest tax platforms in the world. Both corporate and individual income taxes are at 15%.

Offshore businesses located in Mauritius (Tax Haven) that do not do business with Mauritians nor use Mauritian currency are exempt from Mauritian taxes.

Tax havens are countries/jurisdictions offering certain tax benefits such as low tax rates, credit mechanisms or deductions resulting in limited or no tax being levied on certain profits.

They offer businesses less red tape, complicated exchange controls and equity requirements.

They offer businesses less red tape, complicated exchange controls and equity requirements.

Tax havens are popular in Europe.

G7 countries are proposing a law which will see companies taxed in any country where they make more than 10% profit on sales.

Companies can choose to put their headquarters in a country with a lower tax rate and take their profits there.

G7 countries are proposing a law which will see companies taxed in any country where they make more than 10% profit on sales.

Companies can choose to put their headquarters in a country with a lower tax rate and take their profits there.

Main objectives of the Listing are to:

provide investors with an opportunity to participate over the

long term in the income streams

enhance the liquidity and tradability of the shares

provide Afine with a platform to raise equity funding to pursue growth and investment

provide investors with an opportunity to participate over the

long term in the income streams

enhance the liquidity and tradability of the shares

provide Afine with a platform to raise equity funding to pursue growth and investment

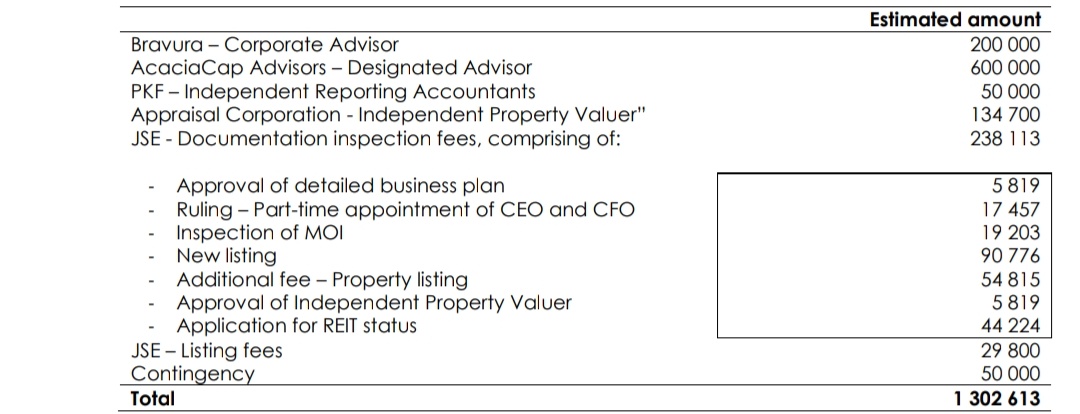

The total costs relating to the Listing, payable in cash, which amount to R1 302 613.

Afine intends declaring a distribution to shareholders at least every 6 months.

An interim gross distribution of R16 000 000 has been declared on 14 October 2021 ahead of the intended listing.

Afine intends declaring a distribution to shareholders at least every 6 months.

An interim gross distribution of R16 000 000 has been declared on 14 October 2021 ahead of the intended listing.

The nature of the revenue of Afine is as follows:

Contracted with oil majors:

Land rental

Development rental

Volumetric rental calculated on fuel sales

Refurbishment Rental being applied when the project needs to be upgraded and

Contracted with oil majors:

Land rental

Development rental

Volumetric rental calculated on fuel sales

Refurbishment Rental being applied when the project needs to be upgraded and

2) Contracted with other parties:

Other rental (income from alternative profit opportunities, which is immaterial, such as ATM rentals, food offerings, E-Toll Offices and car washes).

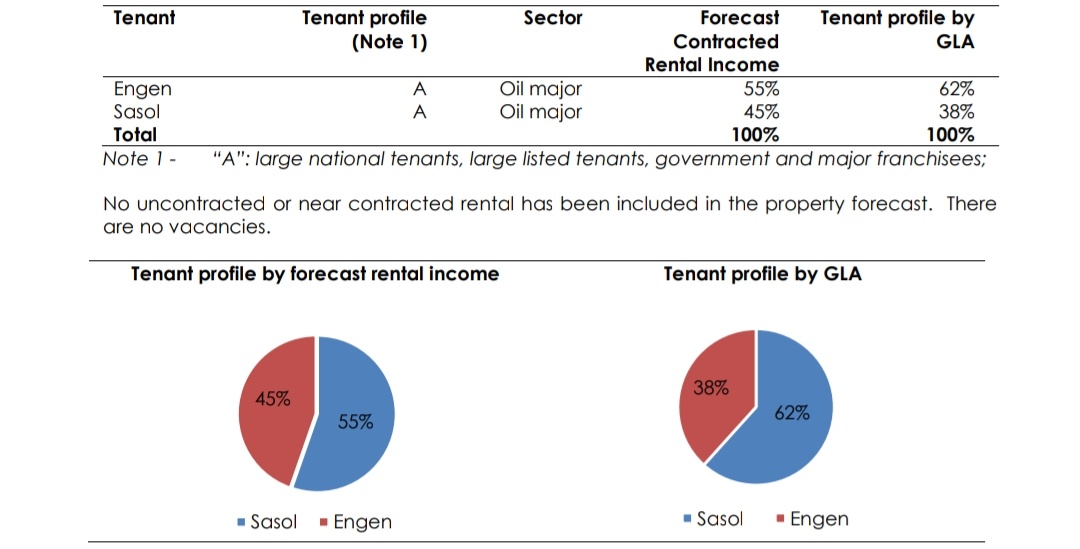

All of the above rental is fully contracted, with 99% being contracted with Engen and Sasol.

Other rental (income from alternative profit opportunities, which is immaterial, such as ATM rentals, food offerings, E-Toll Offices and car washes).

All of the above rental is fully contracted, with 99% being contracted with Engen and Sasol.

Nov 2021, Afine entered into the Petroland Administration Agreement in terms of which Petroland will provide administration services to Afine, also providing Afine with CEO and CFO, who will manage Afine on a part-time basis.

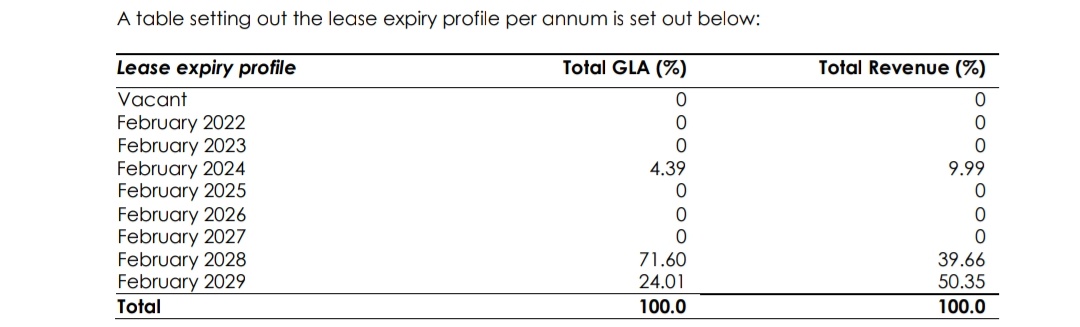

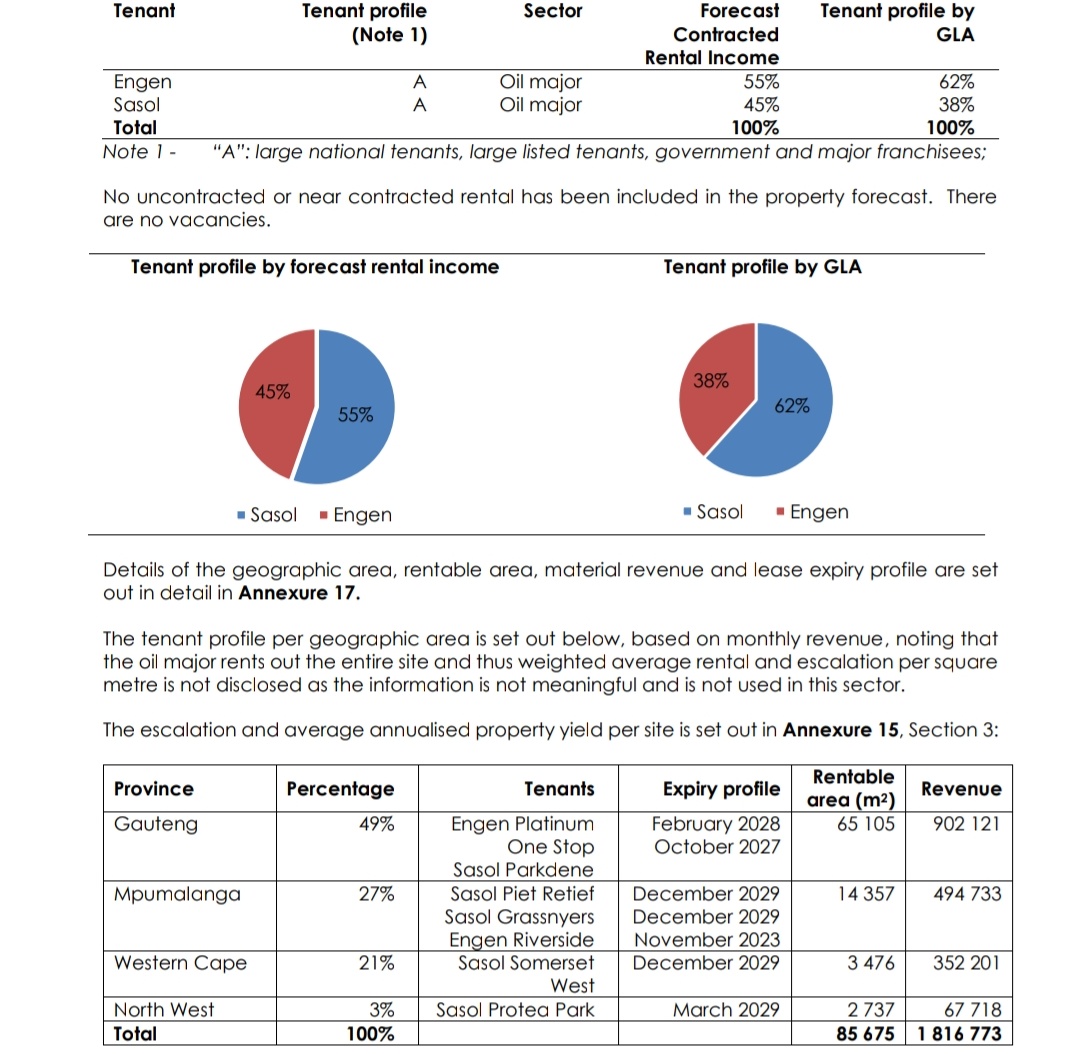

Afine’s lease expiry profiles, based on existing leases are set out in the attached table and totalling a monthly revenue of R1 816 773 over a rentable area of 85 675m2, have a lease expiry profile of between November 2023 to December 2029.

Leases are in the petroleum sector.

Leases are in the petroleum sector.

Afine’s objective is to consolidate ownership through a REIT structure, with an acquisition strategy to grow the business substantially over the next five to 10 years from a solid base and with deep industry knowledge, experience and networks.

Afine is forecasting that the following for 28 Feb 2022;

Rental Income of R37 609 010

Finance costs R4 879 500

Profit for the year R217 112 933

For the 6 months ended

31 Aug 2021, Afine had;

Revenue R21,834,984

Finance costs R2,183,940

Net Profit R175,669,054

Rental Income of R37 609 010

Finance costs R4 879 500

Profit for the year R217 112 933

For the 6 months ended

31 Aug 2021, Afine had;

Revenue R21,834,984

Finance costs R2,183,940

Net Profit R175,669,054

Afine's only non-current asset is the Investment property valued at R307m.

Current assets of R15,276,672 against current liabilities of R51,992,455 (bulk of that was Loans from related parties of R41,471,985)

Afine's borrowings are;

Rand Merchant Bank R39m

KSP Offshore R41m

Current assets of R15,276,672 against current liabilities of R51,992,455 (bulk of that was Loans from related parties of R41,471,985)

Afine's borrowings are;

Rand Merchant Bank R39m

KSP Offshore R41m

Afine's first investments involved the acquisition of an interest in five Petrol Filling Station (PFS) properties from the PFS Vendors in February 2021, namely Sasol Piet Retief, Sasol Somerset West, Sasol

Grassnyers, Sasol Protea Park and Sasol Parkdene.

Grassnyers, Sasol Protea Park and Sasol Parkdene.

Afine acquired an additional 50% interest in Lizalor Investments (holds leasehold rights in Engen Platinum One Stop) thereby changing the Investment from a JV to a wholly-owned subsidiary of the

group. The group obtained the additional 50% at a consideration of R 17 189 688.

group. The group obtained the additional 50% at a consideration of R 17 189 688.

Afine also acquired a 50% interest in Coral Lagoon (holds leasehold rights in Engen Riverside) on 1 March 2021 for R7m.

4 Petrol Filling Station vendors are Investment Facility Company Three Three Six, Katherine Street

Properties, Lyndham Trust and Petroland.

Petroland will continue to assist Afine with the administration of

the various properties.

Properties, Lyndham Trust and Petroland.

Petroland will continue to assist Afine with the administration of

the various properties.

All the properties acquired by Afine are established petrol filling stations with various licences and rights in place.

The responsibility for licencing rests with both the operator of the filling station as well as the property owner.

The responsibility for licencing rests with both the operator of the filling station as well as the property owner.

According to the South African Petroleum Industry Association there are 4 600 service stations in South Africa of which 75% are under the effective control of Oil Companies.

Afine is well positioned to target more than a thousand service stations to add to its current network.

Afine is well positioned to target more than a thousand service stations to add to its current network.

• • •

Missing some Tweet in this thread? You can try to

force a refresh