Investing = 90% psychology, 10% intellect

After being impacted by Mohnish Pabrai and Buffett, @GSpier wrote this book.

Beyond investing, it's a fine masterclass in human psychology!

Here's 10 psychology lessons you must internalize before investing your $$$ in the markets:

After being impacted by Mohnish Pabrai and Buffett, @GSpier wrote this book.

Beyond investing, it's a fine masterclass in human psychology!

Here's 10 psychology lessons you must internalize before investing your $$$ in the markets:

1. When given a choice, always choose INACTION!

Investing is one of the rare fields where doing more results in less optimal results.

Checking stock prices everyday makes you microscopic.

If you focus on price movements, you will have a hard time looking at the big picture.

Investing is one of the rare fields where doing more results in less optimal results.

Checking stock prices everyday makes you microscopic.

If you focus on price movements, you will have a hard time looking at the big picture.

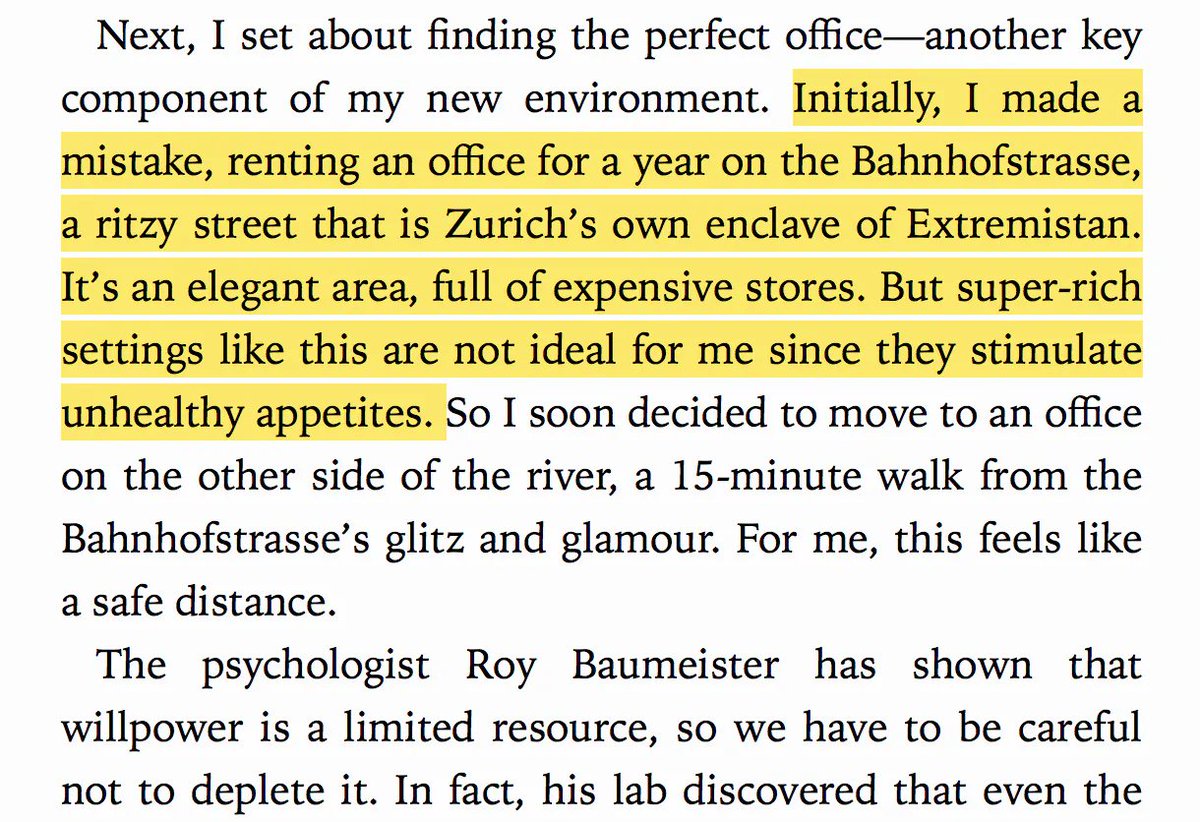

2. Choose an environment that brings you peace

An environment filled with news and updates may not always be a good thing.

Because it overloads your brain with information that have a short shelf life.

Instead, choose surroundings that improve your logic and ability to think.

An environment filled with news and updates may not always be a good thing.

Because it overloads your brain with information that have a short shelf life.

Instead, choose surroundings that improve your logic and ability to think.

3. Investing with borrowed $$ is a sure way to mess with your head

Why?

Because debt creates stress and anxiety.

It increase the risk of you making stupid decisions during major drawdowns.

You end up clouding your judgment with fear!

Why?

Because debt creates stress and anxiety.

It increase the risk of you making stupid decisions during major drawdowns.

You end up clouding your judgment with fear!

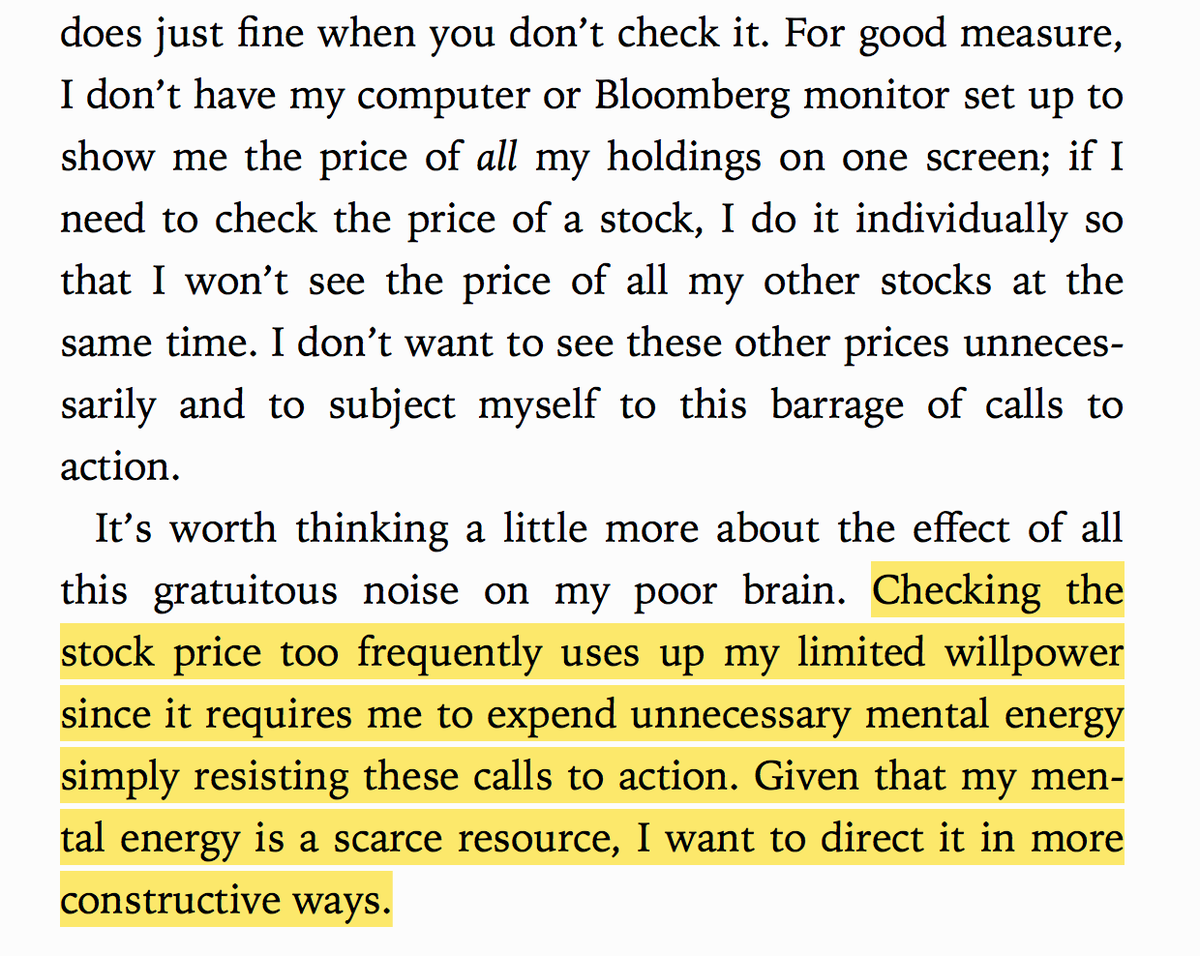

4. Your willpower is NOT enough

Acknowledge your limitations as a human being.

Don't fight it.

• You cant control your emotions

• It takes a lot of effort and discipline

Instead, it's best to create "structures" in your environment that reduce exposure to emotions.

Acknowledge your limitations as a human being.

Don't fight it.

• You cant control your emotions

• It takes a lot of effort and discipline

Instead, it's best to create "structures" in your environment that reduce exposure to emotions.

5. Guard against temptations of extreme wealth and lavishness

They make you greedy.

Even though you may not be that kind of person, they cause you to feel envious of your peers...

So you end up taking more risks than you need to in the markets.

They make you greedy.

Even though you may not be that kind of person, they cause you to feel envious of your peers...

So you end up taking more risks than you need to in the markets.

6. Turn off the latest news in the markets!

They make you irrational and fearful.

But you know what's worse?

They are not even an accurate reflection of what's going on in reality!

They're narratives created to get more eyeballs. End of story.

So tune it out.

They make you irrational and fearful.

But you know what's worse?

They are not even an accurate reflection of what's going on in reality!

They're narratives created to get more eyeballs. End of story.

So tune it out.

7. Look at your role models often

Having photos of people you admire and respect will:

• influence your thoughts

• impact your behaviour positively.

Because you subconsciously model their values and character.

It makes you ask the question "what would xxx do?"

Having photos of people you admire and respect will:

• influence your thoughts

• impact your behaviour positively.

Because you subconsciously model their values and character.

It makes you ask the question "what would xxx do?"

Fun Fact #2:

Munger himself keeps a statue of Ben Franklin in his office as a positive role model.

Look at the left corner of the photo.

Munger himself keeps a statue of Ben Franklin in his office as a positive role model.

Look at the left corner of the photo.

8. Upgrade your portfolio, don't settle.

Always push yourself to raise your standards

Just because an existing investment idea is making you money, doesn't mean that it's the best.

Constantly seek to elevate the quality of businesses you own.

Always push yourself to raise your standards

Just because an existing investment idea is making you money, doesn't mean that it's the best.

Constantly seek to elevate the quality of businesses you own.

9. Stop looking at stock prices everyday

It initiates you to act, when you don't need to.

It uses up your willpower, which could be put to better use.

Worse of all, it tempts you to buy and sell based on emotions and not logic.

It initiates you to act, when you don't need to.

It uses up your willpower, which could be put to better use.

Worse of all, it tempts you to buy and sell based on emotions and not logic.

10. Consume information in the right order

Prioritize primary information first!

Do not let secondary information colour your lens.

You want to form YOUR OWN opinions, before you start reading others' analysis and letting it influence you.

Prioritize primary information first!

Do not let secondary information colour your lens.

You want to form YOUR OWN opinions, before you start reading others' analysis and letting it influence you.

"The Education of a Value Investor" ranks high up as one of my top investing books.

But it's not the only one.

Here are 2 more that I frequently revisit.

1. Richer Wiser Happier by @williamgreen72

2. Joys of Compounding by @Gautam__Baid

You should read them all!

But it's not the only one.

Here are 2 more that I frequently revisit.

1. Richer Wiser Happier by @williamgreen72

2. Joys of Compounding by @Gautam__Baid

You should read them all!

Here's my summary of "Richer, Wiser, Happier" by William Green

https://twitter.com/heymaxkoh/status/1447570632233738240?s=20

And here's the summary of "Joys of Compounding" by Gautam Baid

https://twitter.com/heymaxkoh/status/1458067862266863617?s=20

Recap:

1. Choose inaction

2. Environment matters

3. Don't invest borrowed $$

4. Willpower ain't enough

5. Guard against temptations

6. Turn off the news

7. Look at your role models

8. Upgrade your portfolio

9. Stop looking at prices daily

10. Consume primary information first

1. Choose inaction

2. Environment matters

3. Don't invest borrowed $$

4. Willpower ain't enough

5. Guard against temptations

6. Turn off the news

7. Look at your role models

8. Upgrade your portfolio

9. Stop looking at prices daily

10. Consume primary information first

If you like this, follow me here at @heymaxkoh

I share how I crossed 7 figures before age 30, and achieved my own version of financial freedom.

Stuff I tweet about:

• My investing strategy

• Books that inspire me

• How I built high income skills i.e. public speaking

I share how I crossed 7 figures before age 30, and achieved my own version of financial freedom.

Stuff I tweet about:

• My investing strategy

• Books that inspire me

• How I built high income skills i.e. public speaking

• • •

Missing some Tweet in this thread? You can try to

force a refresh