This Software reviews site by @themotleyfool looks pretty useful for SaaS investors (in the covered categories).

My fav categories

✔️CRM

✔️E-Commerce

✔️HRM

✔️Identity Management

✔️POS

fool.com/the-blueprint/

My fav categories

✔️CRM

✔️E-Commerce

✔️HRM

✔️Identity Management

✔️POS

fool.com/the-blueprint/

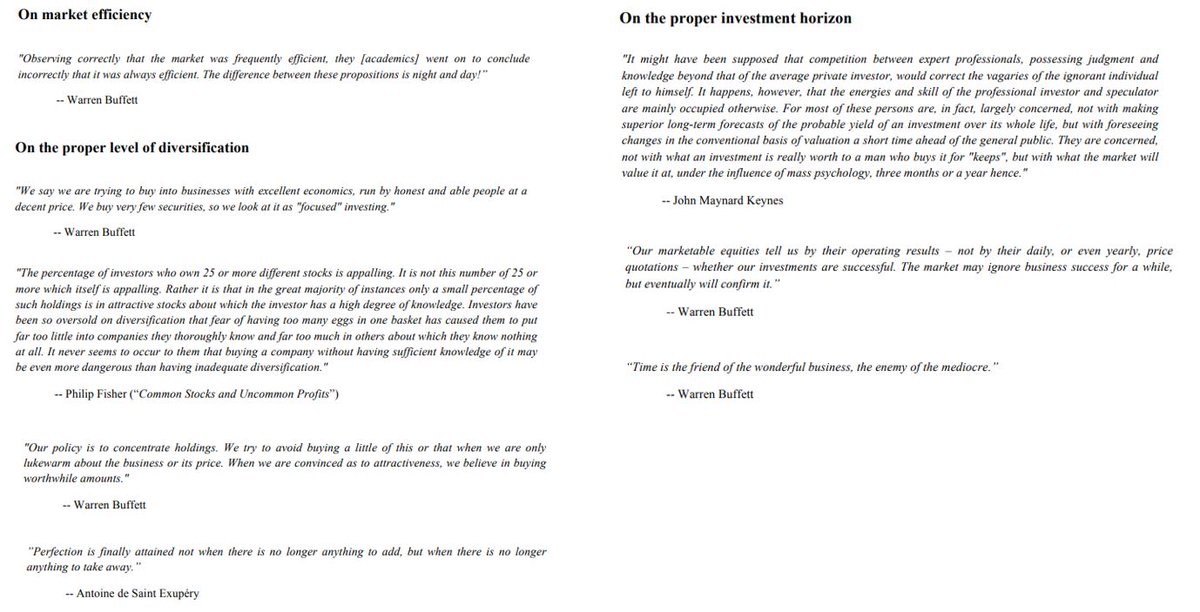

It's good to learn at least the basics of the company's actual products & competitive landscape. The stuff that actually matters way before Financial statements, Valuation & stock prices come into picture.

As much as I love SaaS economics and the dominant companies within, I'm always wary of Co.'s with point solutions (this late into SaaS trend) that haven't yet developed into a full platform or dominating a vertical.

Even if those niche Co.'s look great today (based on their S1 & few qtrly reports), there's always an endless supply of private ones waiting to become public that are chasing those same opportunities. Not to mention the dominant platform Co.'s always adding modules to cross-sell.

Self lesson 1 : We shouldn't let our general love for the SaaS sector or an isolated view of the Co.'s growth and Financials (w/o considering the durability, landscape and outlook) get us into wrong positions, especially when the EV/S are still elevated for many unproven Co.'s.

Self lesson 2 :The multiple can always compress much faster than the company can sustainably grow revenues at rates the Market wants to justify the premiums. That is, if the specific company can even meaningfully grow while keeping up with the trends and withstand competition.

Since I usually buy with the intent of holding for many years and not trade quickly around valuation, at this point, a new SaaS company has to be truly special and also easy enough for me to understand and form a thesis around to start a new position.

If not, I'll just be invested in and keep adding to $CRM $NOW $SHOP $VEEV $PAYC $DOCU $MDB $TWLO $CRWD $DDOG $NET $ZS $OKTA $SNOW (yes yes, until the R/R is justified for me & the Portfolio).

and maybe one day get into $ADBE $TEAM $PLTR $HUBS.

Not recs. DYDD.

/END.

and maybe one day get into $ADBE $TEAM $PLTR $HUBS.

Not recs. DYDD.

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh