I don't buy stocks once they're over 5% of my portfolio.

But if I did, I'd certainly be buying $AXON today.

Here's why ⤵️

But if I did, I'd certainly be buying $AXON today.

Here's why ⤵️

2) The core business.

If you're unfamiliar, this company makes

* TASER stun guns

* Axon body cameras

* A whole bunch of software that helps save TONS of time for police and other public servants

That last point is the most important for investors

If you're unfamiliar, this company makes

* TASER stun guns

* Axon body cameras

* A whole bunch of software that helps save TONS of time for police and other public servants

That last point is the most important for investors

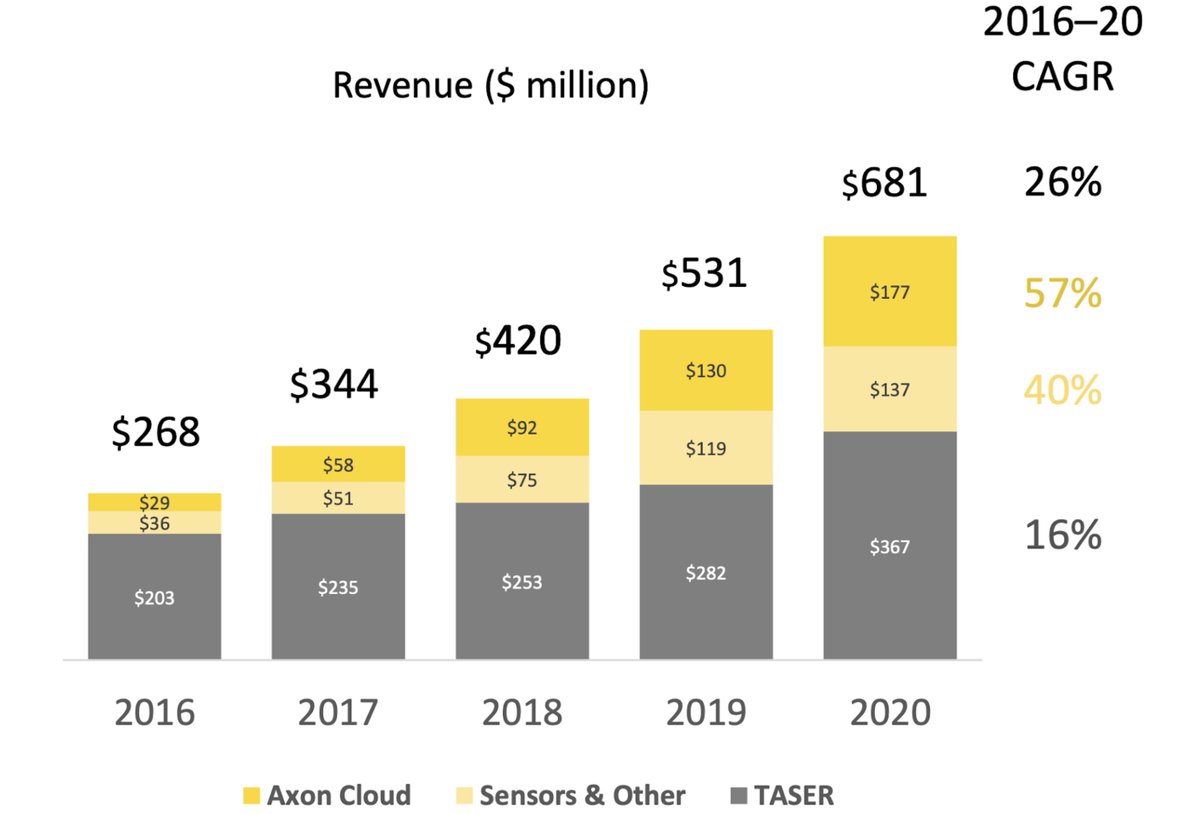

3) Results

As you can see, those physical products drive sales, but its the high-margin recurring revenue from cloud (read: software) products that are the real story

As you can see, those physical products drive sales, but its the high-margin recurring revenue from cloud (read: software) products that are the real story

4) Moat

Not only is this a functional monopoly, but the switching costs are enormous.

Once police forces start using these products, they're customers for the long-haul.

A little proof⤵️

Not only is this a functional monopoly, but the switching costs are enormous.

Once police forces start using these products, they're customers for the long-haul.

A little proof⤵️

6) Founder-led business

Not only did Rick Smith found the company and stay at the helm for two decades, he gave up his salary for equity rewards.

Some might gripe the rewards are *too* rich, but I still appreciate the plan

Not only did Rick Smith found the company and stay at the helm for two decades, he gave up his salary for equity rewards.

Some might gripe the rewards are *too* rich, but I still appreciate the plan

If you like that, subscribe to our Channel, where we publish 3-4 videos -- absolutely free -- every week

youtube.com/brianferoldiyt…

youtube.com/brianferoldiyt…

To review:

$AXON:

1) Has stellar mission

2) Combined hardware with software

3) 📈 results

4) Wide moat

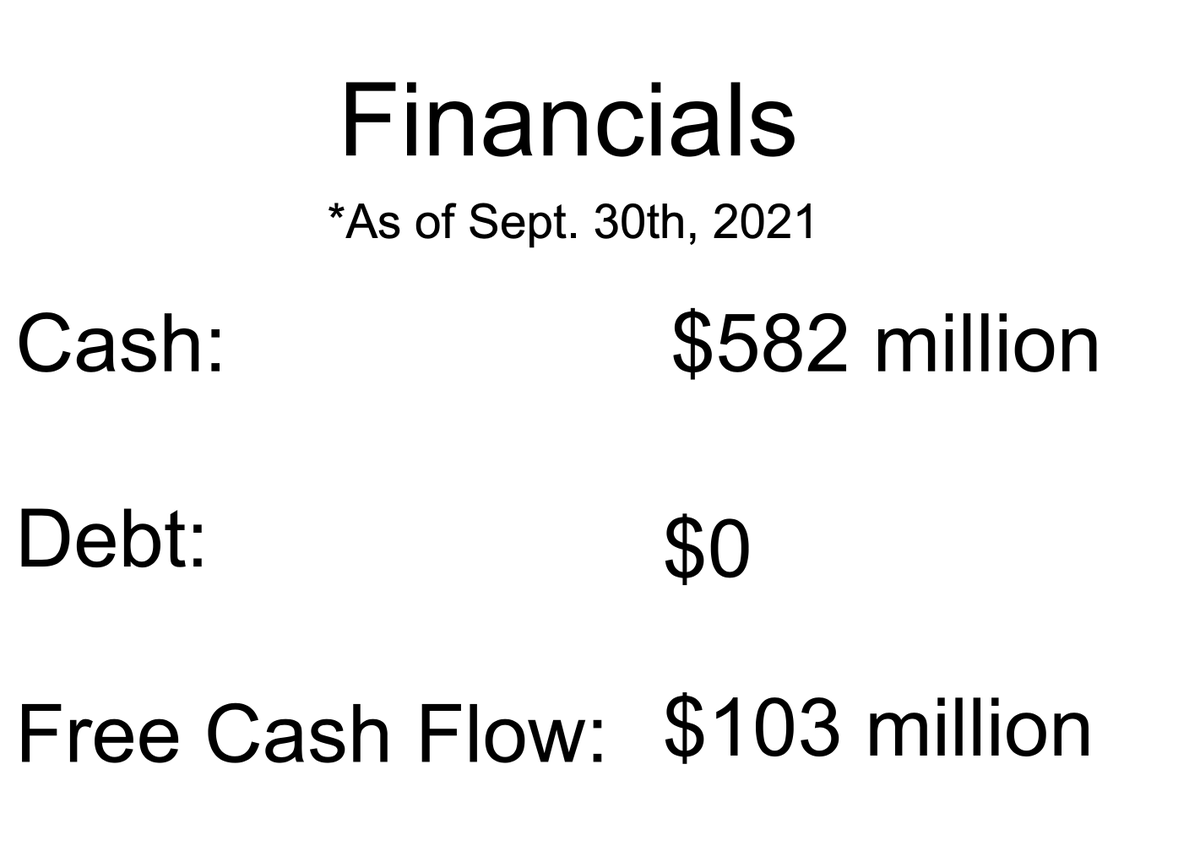

5) 💰Balance Sheet

6) Founder led

It's also down 33% from highs

And it gets this score from @BrianFeroldi and I

$AXON:

1) Has stellar mission

2) Combined hardware with software

3) 📈 results

4) Wide moat

5) 💰Balance Sheet

6) Founder led

It's also down 33% from highs

And it gets this score from @BrianFeroldi and I

• • •

Missing some Tweet in this thread? You can try to

force a refresh