Jack Dorsey's departure as Twitter's CEO, and the market's positive reaction to it, led me to thinking about founder CEOs and their complex relationships with the companies they run. Are they net pluses or minuses? Is there a prototype for a great CEO? bit.ly/3pKxFQ8

The Harvard Business Review and McKinsey have templates for great CEOs, but I am skeptical that they list only wholesome qualities. Great CEOs are not always nice people, many are over confident, and they come in so many different packages. bit.ly/3pKxFQ8

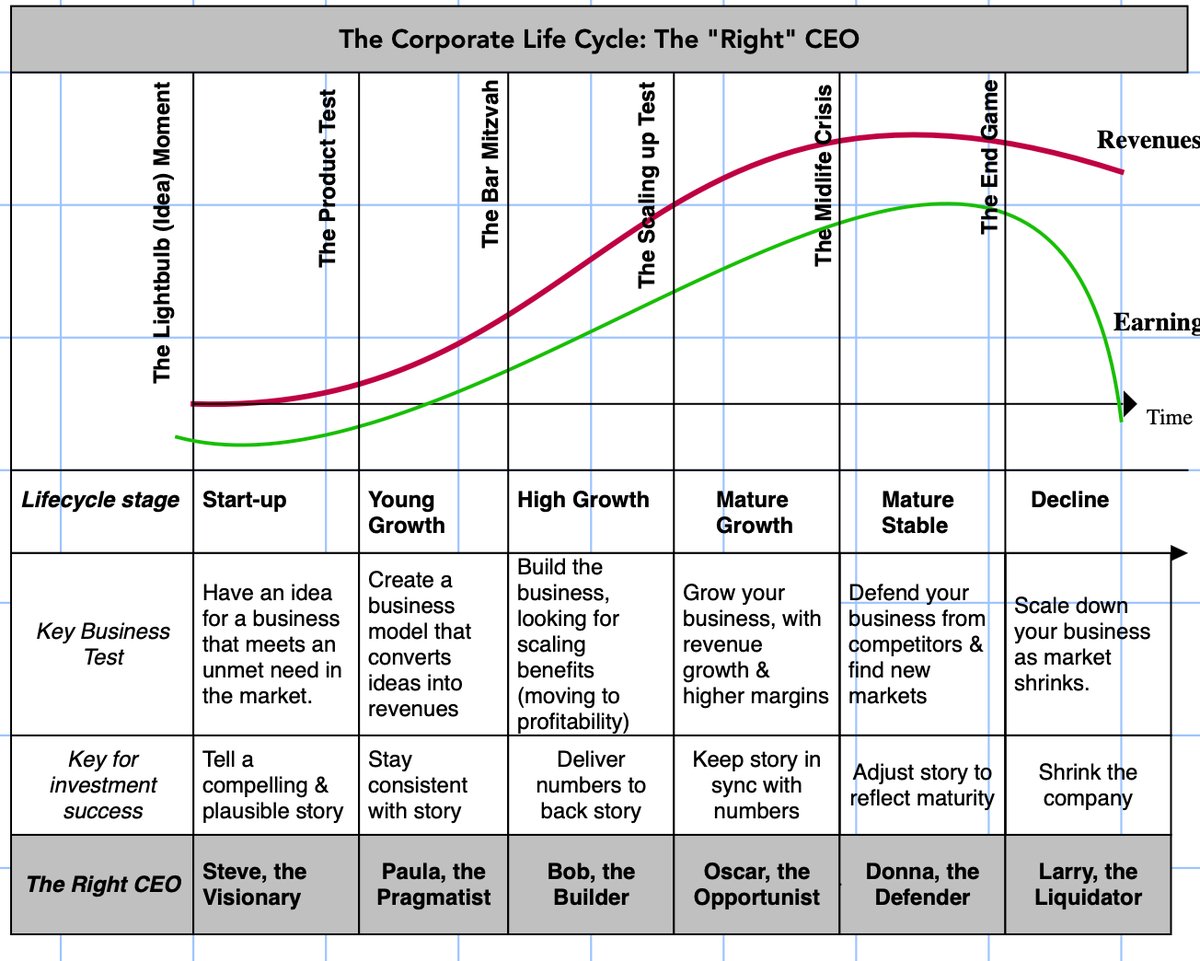

In my opinion, the right CEO for a company reflects where it falls in the corporate life cycle. Young companies need visionaries, growth companies benefit from builders, mature companies crave defenders and declining companies are best run by liquidators. bit.ly/3pKxFQ8

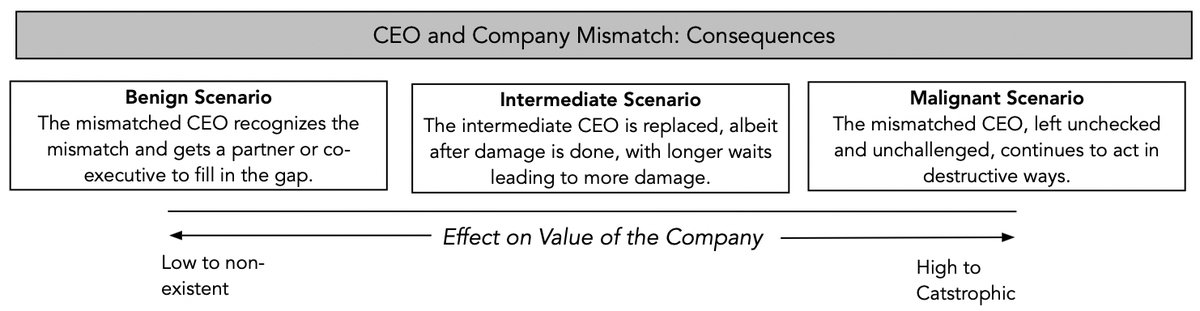

A mismatch between a CEO and a company can arise because of a bad hire, a gamble on corporate rebirth or the company changing, and its consequences can range from benign, if the mismatched CEO is aware & willing to share power, to devastation, if not. bit.ly/3pKxFQ8

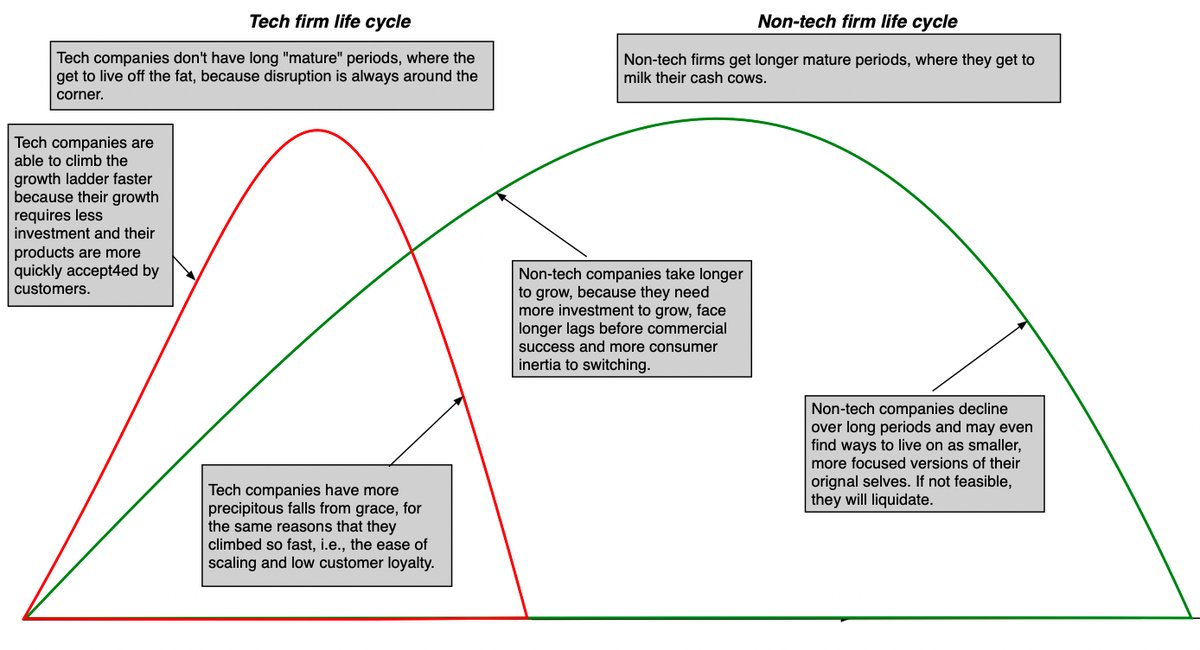

The tech revolution in markets has created companies that age in dog years, with a 20-year tech company resembling a century-old manufacturing firm. Tech companies grow fast, don't stay at the top long and decline just as fast. bit.ly/3pKxFQ8

The compressed life cycles at tech firms will cause mismatches of CEOs and companies to occur earlier, and more often. That should cause more turnover, but shares with divergent voting rights at many of these firms may entrench mismatched CEOs. bit.ly/3pKxFQ8

With family groups that operate in businesses that are spread across the life cycle, the challenges of finding family member CEOs that fit diverse needs will increase. Power sharing and outside CEOs may be needed to fill the gaps. bit.ly/3pKxFQ8

• • •

Missing some Tweet in this thread? You can try to

force a refresh