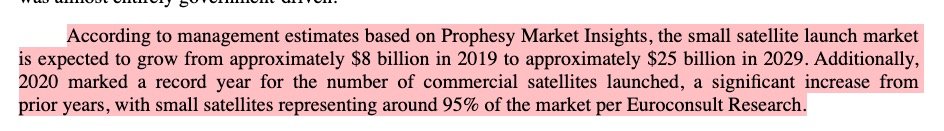

@VirginOrbit #SPAC filings reveal the most insane market assessment ever. IDK who these 'Prophesy' guys are, but in 2019 the total launch market was 8B$ in value. The launch market for satellites <500kg (up to 'Mini') was <1B$/year in the past 5 years. 1/

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

I don't know if anybody will be held accountable for such a blatant overestimate of the small satellite launch market value, but luring investors in believing this business is 8B$/year is incredibly dishonest IMHO, particularly in light of the usual mantra of 'reduced costs'. 2/

If that market value was correct, the average price of launching 42t of mini satellites (<500kg) in 2019 would have been close to 200k$/kg. A preposterous value: we know that small launch is expensive, but not THAT expensive! 3/

If the management of @VirginOrbit really believes it is operating in a small launch market segment worth 8B$ in 2019 I think we should really worry for the company. If management knows this value is #bullshit then we can wonder why it is found in the SEC filings for the SPAC. 4/

Of course if 1B$ can be "approximated" to 8B$ all this is fine. Similarly if by "small satellite" @VirginOrbit management consider any satellite under 15 tons, the statement is also correct. But let us recall that @VirginOrbit can only launch satellites (way) below 500kg. 5/

In view of this I think that $NGCA Shareholders should think twice before approving the merger, and at least raise a few concerns on management ability to estimate the current market, and/or to proof read an important document. 6/

• • •

Missing some Tweet in this thread? You can try to

force a refresh