Nominal retail sales up 0.3% in November, last 2 months revised down. Well below expectations & reflects a reduction in inflation-adjusted sales.

BUT, I always like to step back and focus more on what we know than the new increment. And what we know is retail sales remain high.

BUT, I always like to step back and focus more on what we know than the new increment. And what we know is retail sales remain high.

That last tweet was nominal retail sales. About two-thirds of that increased spending reflects higher prices but one-third reflects people purchasing more. Real sales are converging back to pre-pandemic trends but very slowly. We're way, way, way past pent up demand.

The retail sales release mostly covers goods but it gives us a glimpse of one particular service: food services & drinking places. Nominal sales back on track in this sector but prices are up so real sales are a still a bit off--and have not really risen since Delta emerged.

My favorite in this release is sporting goods, hobby, musical instruments and book stores. Wow that's a lot.

Of course autos are 15X more important for the economy, spending is up in nominal terms but quantities are down.

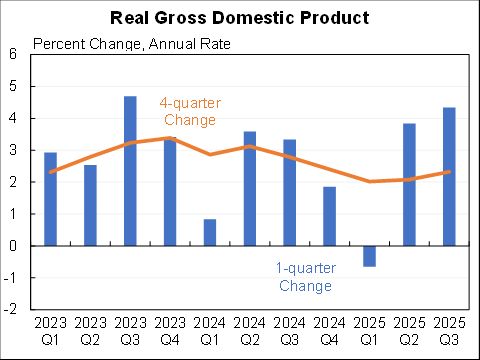

All in the bean counters are expecting about 7 percent GDP growth (annual rate) in Q4. Would be very, very strong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh