#LevelUp Testimonials 📜

It would have been so easy to write off 2020 & 2021 with everything that’s been going on in the world.

But it’s so amazing to see the many financial strides & wins people have been getting 👏🏾🙌🏾

2022, here we come!

💪🏾🏆😊

>>2

It would have been so easy to write off 2020 & 2021 with everything that’s been going on in the world.

But it’s so amazing to see the many financial strides & wins people have been getting 👏🏾🙌🏾

2022, here we come!

💪🏾🏆😊

>>2

Here are some of the most resilient achievements of the year; among many others from our "Abojani Hidden Gem" community members.

Case 1: Joan (below) hit her December 2021 goals last month 😊

>>3

Case 1: Joan (below) hit her December 2021 goals last month 😊

>>3

Case 2: Sam had only 350K in his @CICGroupPLC MMF account in February 2021. Sheer determination, living on less & finding extra income did it all. Our 12th member to claim the #1MillionChallenge 🚀

>>4

>>4

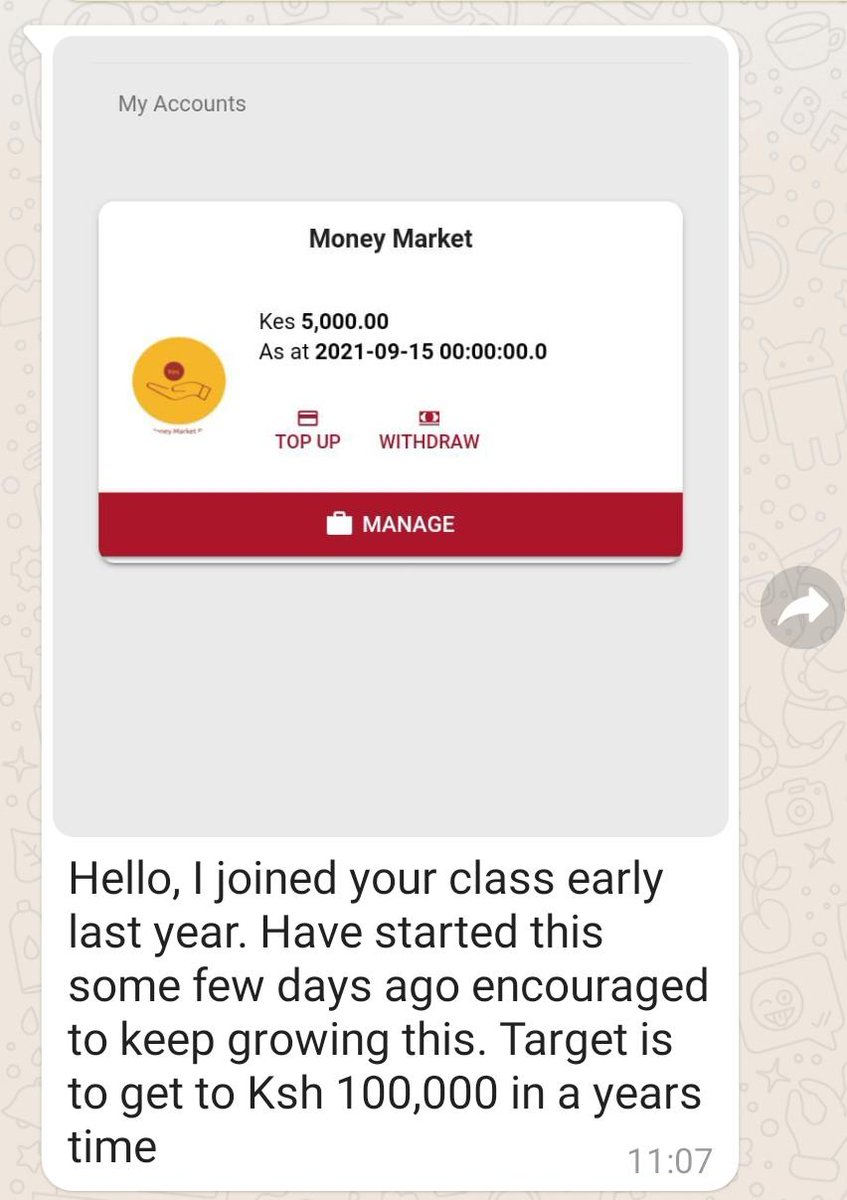

If you thought all our members are not "kawaida" people, you are wrong! Here's James who joined our monthly masterclass last year & didn't take immediate action on his wealth goals.

He started & his eyes are set on the prize, Ksh 100K by mid next year!

>>5

He started & his eyes are set on the prize, Ksh 100K by mid next year!

>>5

What are you waiting for?

Claim your wealth goal in 2022. Subscribe to our "Hidden Gem" community & begin with what you have.

>>6

Claim your wealth goal in 2022. Subscribe to our "Hidden Gem" community & begin with what you have.

>>6

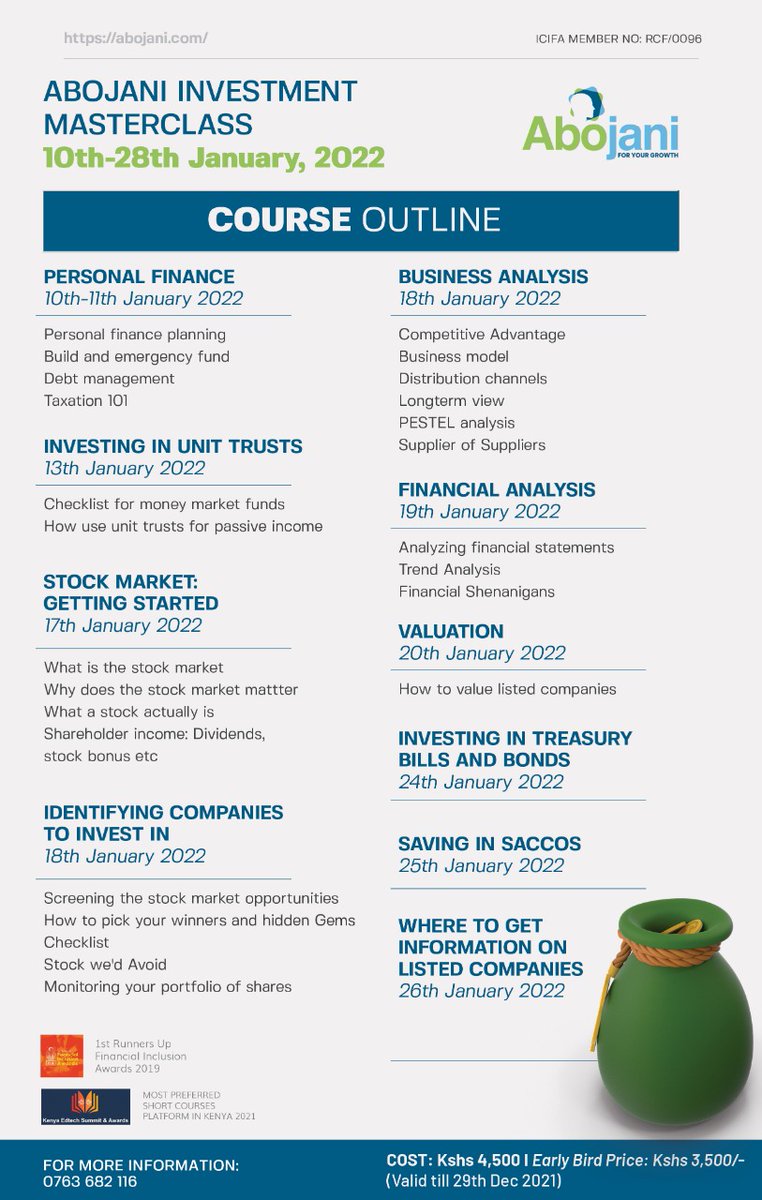

To be a member, it all starts at our flagship entry level program, the Abojani Personal Finance & Investments Masterclass. Join our #January class. We have a Ksh 1000/- discount valid up to 29/12/21. Pay Ksh 3500 to: Lipa na MPESA

Paybill Business No. 469345

Account No. Your Name

Paybill Business No. 469345

Account No. Your Name

• • •

Missing some Tweet in this thread? You can try to

force a refresh