Abojani for everyday investor. Empowering retail investors through investor education || Contact us: learning@abojani.com

Telegram https://t.co/sK9t9VIeeL

4 subscribers

How to get URL link on X (Twitter) App

1. Your Money Works Harder Than It Does in a Bank

1. Your Money Works Harder Than It Does in a Bank

1⃣ No One Cares About You

1⃣ No One Cares About You

What is a corporate Bond??

What is a corporate Bond??

2) They can borrow using the property as collateral.

2) They can borrow using the property as collateral.

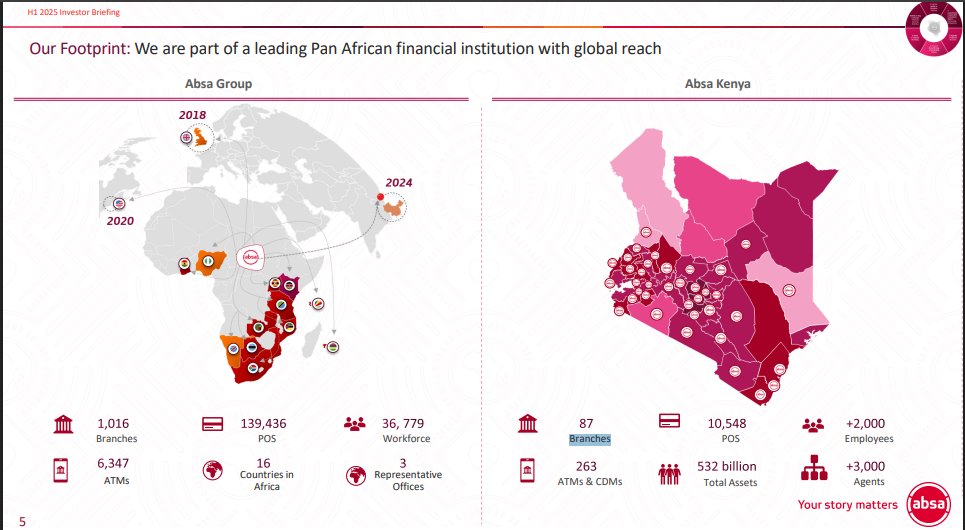

3⃣The bank has an extensive operational network with over 87 branches and over 250 ATMs countrywide, supported by internet and mobile banking channels for customer convenience

3⃣The bank has an extensive operational network with over 87 branches and over 250 ATMs countrywide, supported by internet and mobile banking channels for customer convenience

In simple terms, a Bond Fund is a type of Unit Trust that pools money from different investors and invests it in government treasury bonds and other fixed-income securities. Think of it as a way of lending money to the government and in return, earning interest. The beauty is, you don’t have to go through the hustle of buying or managing individual bonds yourself. The fund manager does that for you.

In simple terms, a Bond Fund is a type of Unit Trust that pools money from different investors and invests it in government treasury bonds and other fixed-income securities. Think of it as a way of lending money to the government and in return, earning interest. The beauty is, you don’t have to go through the hustle of buying or managing individual bonds yourself. The fund manager does that for you.

Stage 1⃣: Financial Battle

Stage 1⃣: Financial Battle

1️⃣ Industrial Parks – Manufacturing & processing

1️⃣ Industrial Parks – Manufacturing & processing

Saving money, in isolation, will not make you rich. It’s a start, but it’s not the endgame. In fact, depending on how you approach it, it can even leave you feeling stuck, frustrated, or disillusioned.

Saving money, in isolation, will not make you rich. It’s a start, but it’s not the endgame. In fact, depending on how you approach it, it can even leave you feeling stuck, frustrated, or disillusioned.