A Crash Course on How To (Properly) Trade Options

90% of investors don’t trade options out of a misunderstanding that they’re “too complicated.”

The system brainwashes us w/ “options are too risky” BS, then spews out shit learning material so that ofc u lose money.

🧵/

👇

90% of investors don’t trade options out of a misunderstanding that they’re “too complicated.”

The system brainwashes us w/ “options are too risky” BS, then spews out shit learning material so that ofc u lose money.

🧵/

👇

Step 1: Why trade options?

Is it to

-🦾get cheap/easy LeVeRaGe?

-⏲️bet on a specific event? (new product release, earnings)

-⚖️bet on asymmetrical risk?

-🪙earn yield?

-📈go long volatility?

- 🦔hedge?

- 🎲YOLO on lotto tix?

Before any trade, u gotta set ur goal(s) straight.

Is it to

-🦾get cheap/easy LeVeRaGe?

-⏲️bet on a specific event? (new product release, earnings)

-⚖️bet on asymmetrical risk?

-🪙earn yield?

-📈go long volatility?

- 🦔hedge?

- 🎲YOLO on lotto tix?

Before any trade, u gotta set ur goal(s) straight.

If ur unsure which of these goals applies to u, let me translate some:

"I wanna make $ fast!" ➡️ u want easy leverage

"Tesla next year is up only" ➡️ u want to express risk asymmetry

"I wish Elon gimme dividend" ➡️ u want yield

"DOCU will crush next quarter" ➡️ specific event

"I wanna make $ fast!" ➡️ u want easy leverage

"Tesla next year is up only" ➡️ u want to express risk asymmetry

"I wish Elon gimme dividend" ➡️ u want yield

"DOCU will crush next quarter" ➡️ specific event

Step 2: Set directionality (🐂/🐻/🤷) & price target (PT)

Time to figure out your VIEW.

Most ppl just think "am i bullish? bearish? neutral?" but that's incomplete.

Set a PT (i.e. threshold where >50% chance the stock exceeds). Some folks use heuristics or P/E-based formulas.

Time to figure out your VIEW.

Most ppl just think "am i bullish? bearish? neutral?" but that's incomplete.

Set a PT (i.e. threshold where >50% chance the stock exceeds). Some folks use heuristics or P/E-based formulas.

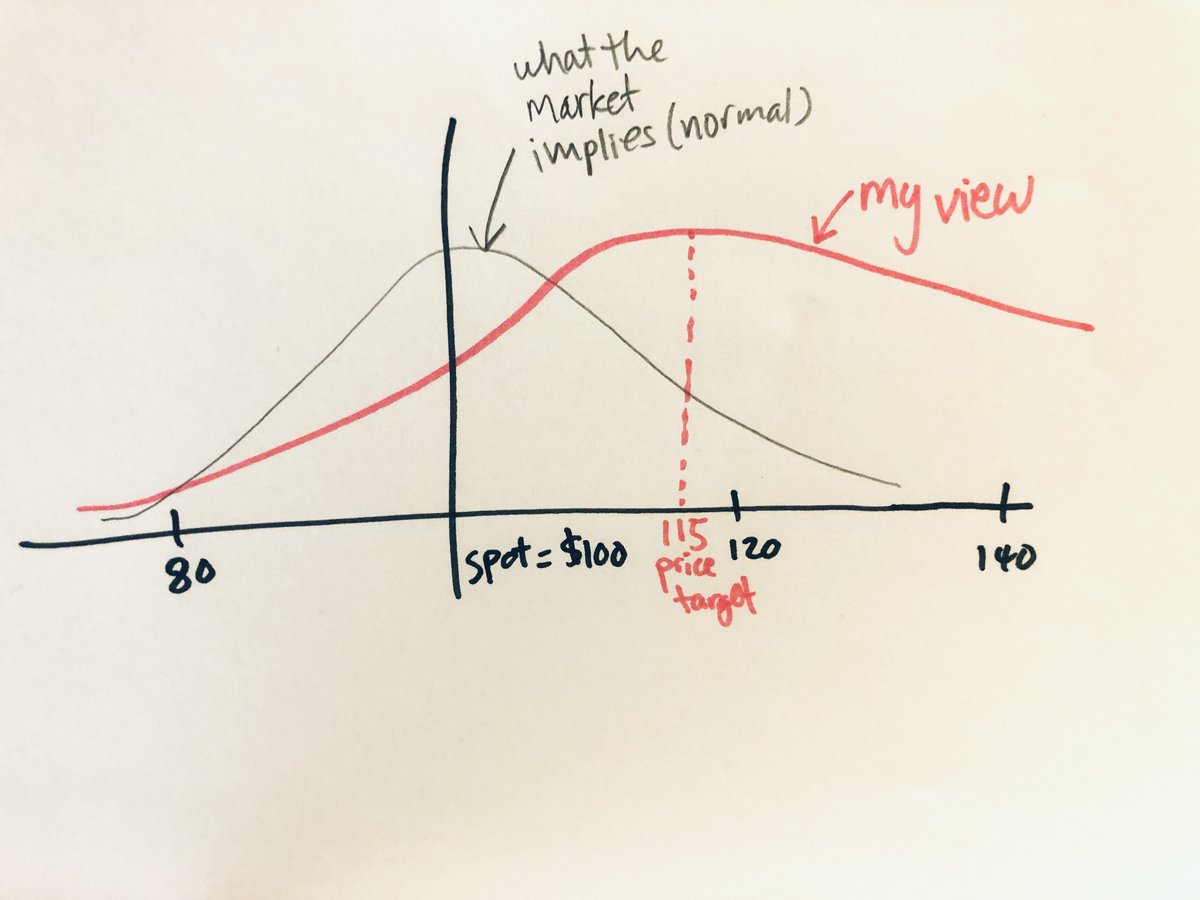

Step 3: Draw your mental probability curve

A lot of value investors just stop at PT. They're like "$TSLA going to 800. Bye."

But wut about 900? 850?

Everyone has some mental picture of a probability distribution per trade, whether conscious or subconscious.

Some of mine.👇

A lot of value investors just stop at PT. They're like "$TSLA going to 800. Bye."

But wut about 900? 850?

Everyone has some mental picture of a probability distribution per trade, whether conscious or subconscious.

Some of mine.👇

Step 4: Decision time. Pick ur option types, strikes & expiry.

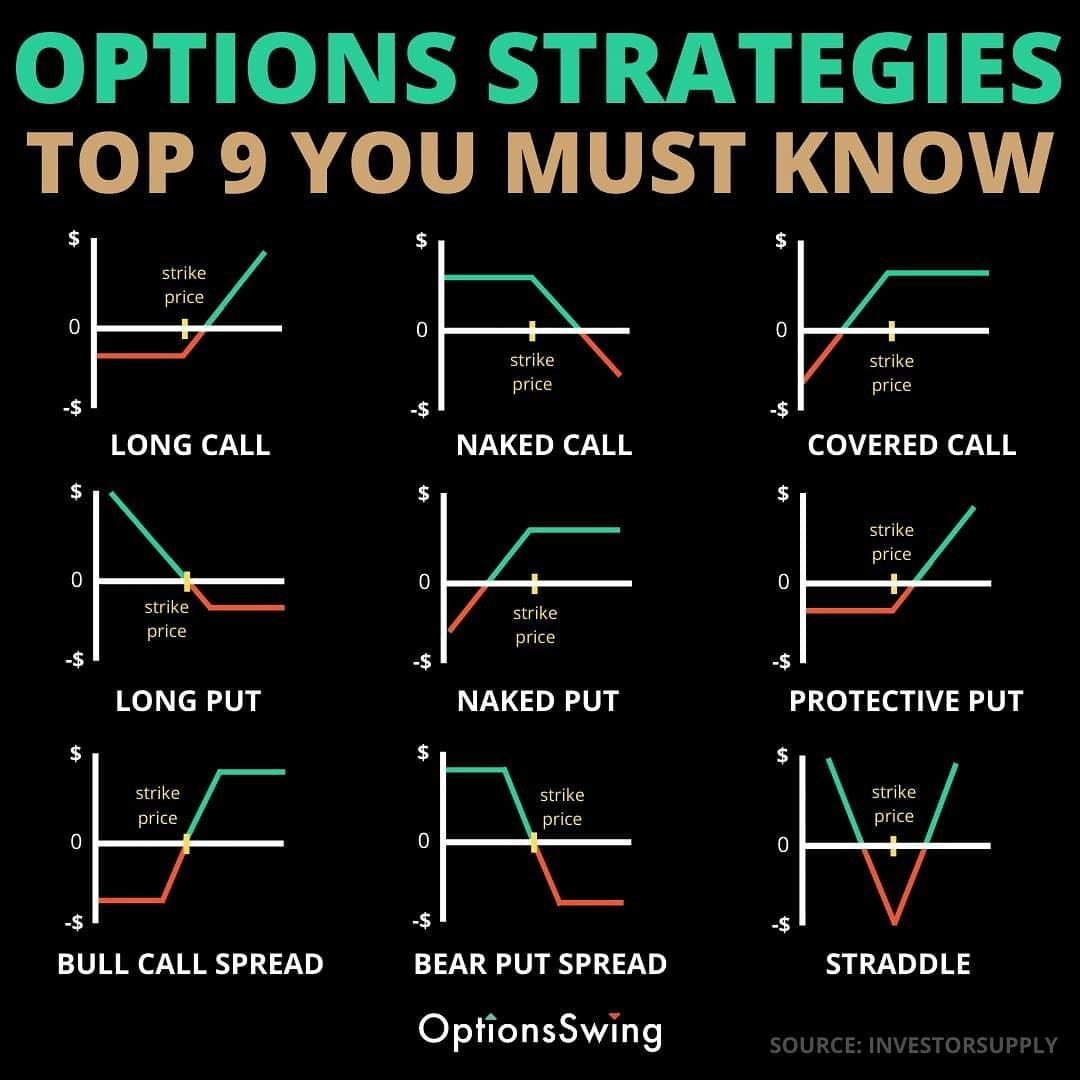

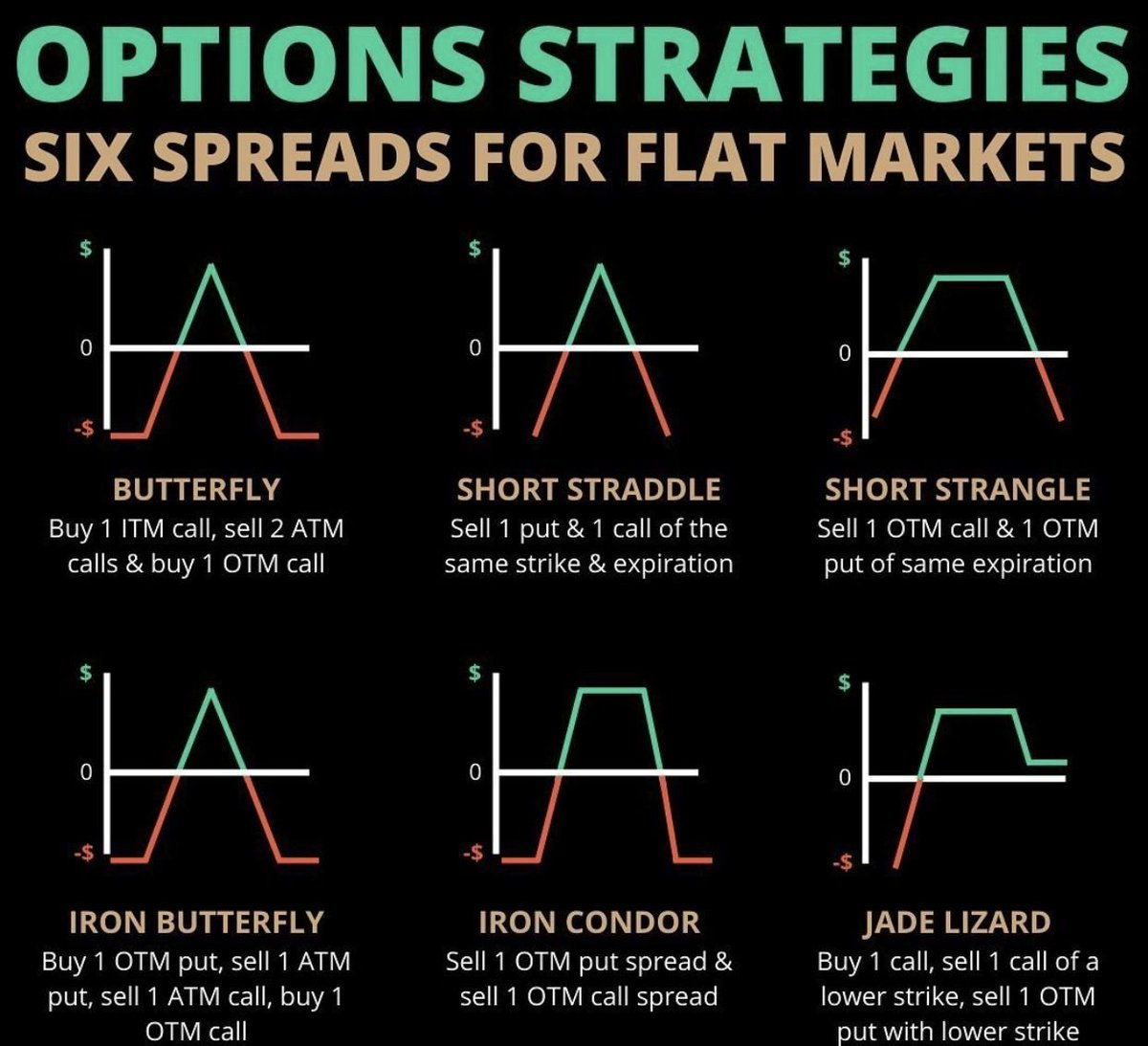

Finally it's time to talk about puts & calls.

(And spreads, straddles, strangles)

99% of tutorials start out with this, as if successful options trading is just passing a memory test of all the "strategies." Wrong.

Finally it's time to talk about puts & calls.

(And spreads, straddles, strangles)

99% of tutorials start out with this, as if successful options trading is just passing a memory test of all the "strategies." Wrong.

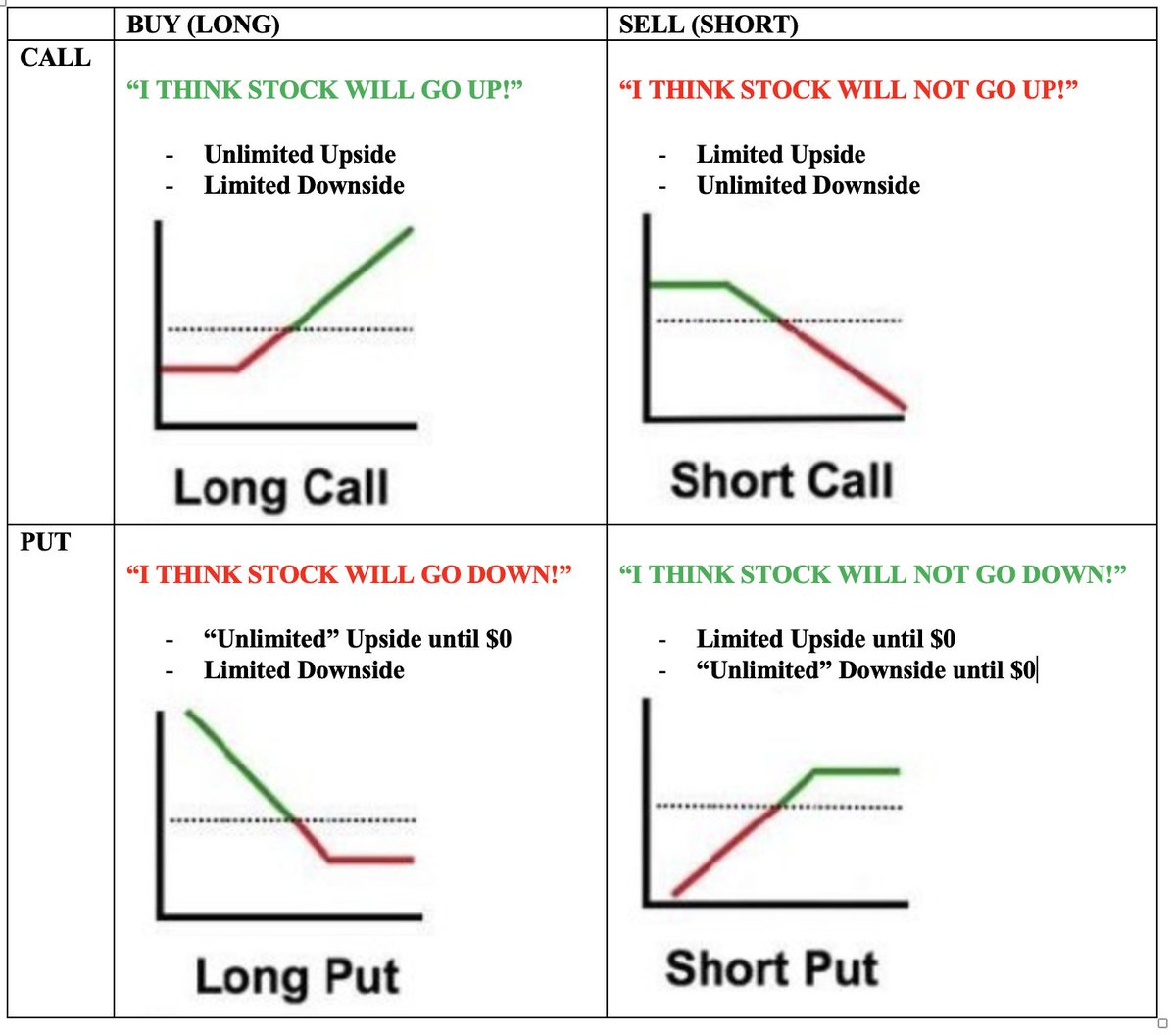

You can make it rain & be an options expert while keeping the chart of different options configurations pulled up on one monitor (see below).

All options trades no matter how fancy (🦋s, condors) boil down to just:

- 2 base components (call, put)

- 2 base actions (buy, sell)

All options trades no matter how fancy (🦋s, condors) boil down to just:

- 2 base components (call, put)

- 2 base actions (buy, sell)

This 2x2 chart is the DNA of options trading.

For beginners, its the ONLY thing to know by heart.

Stop thinking about puts/calls as "the right to buy/sell at __." That definition is confusing & useless as hell.

Just think of em as different views ("going up"/ "going down")

For beginners, its the ONLY thing to know by heart.

Stop thinking about puts/calls as "the right to buy/sell at __." That definition is confusing & useless as hell.

Just think of em as different views ("going up"/ "going down")

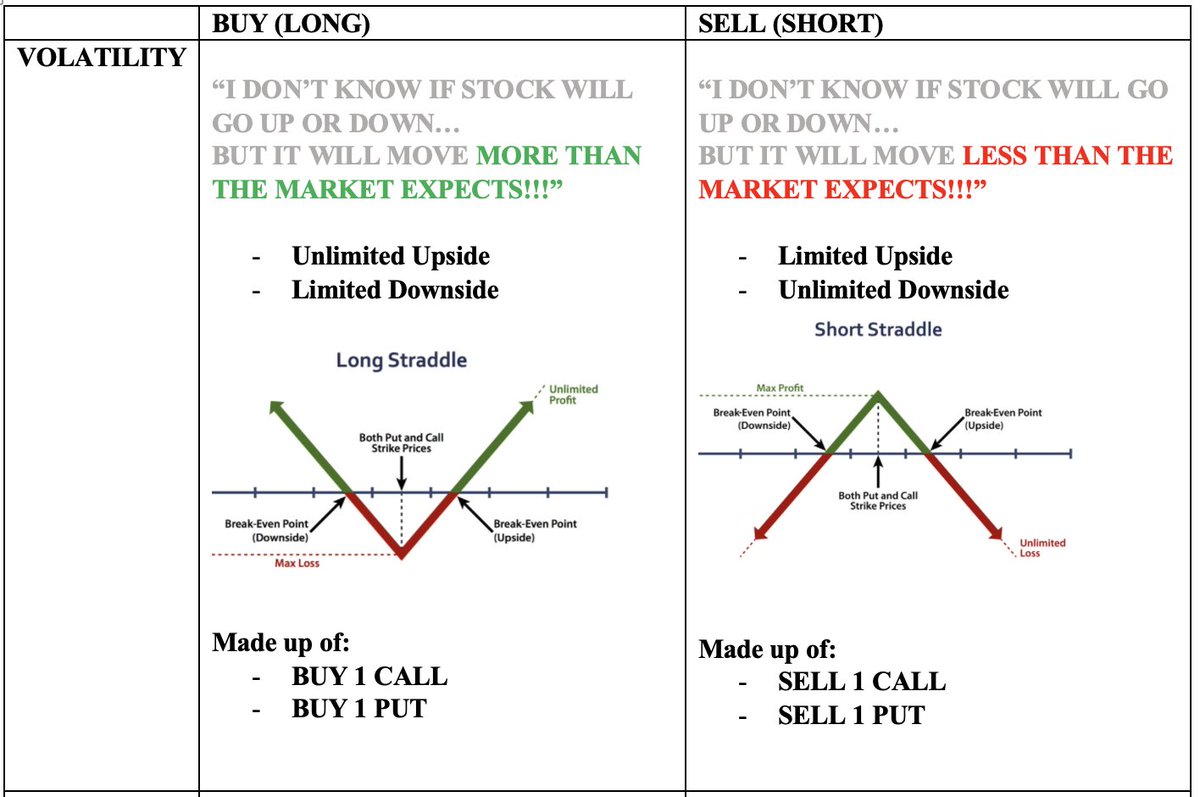

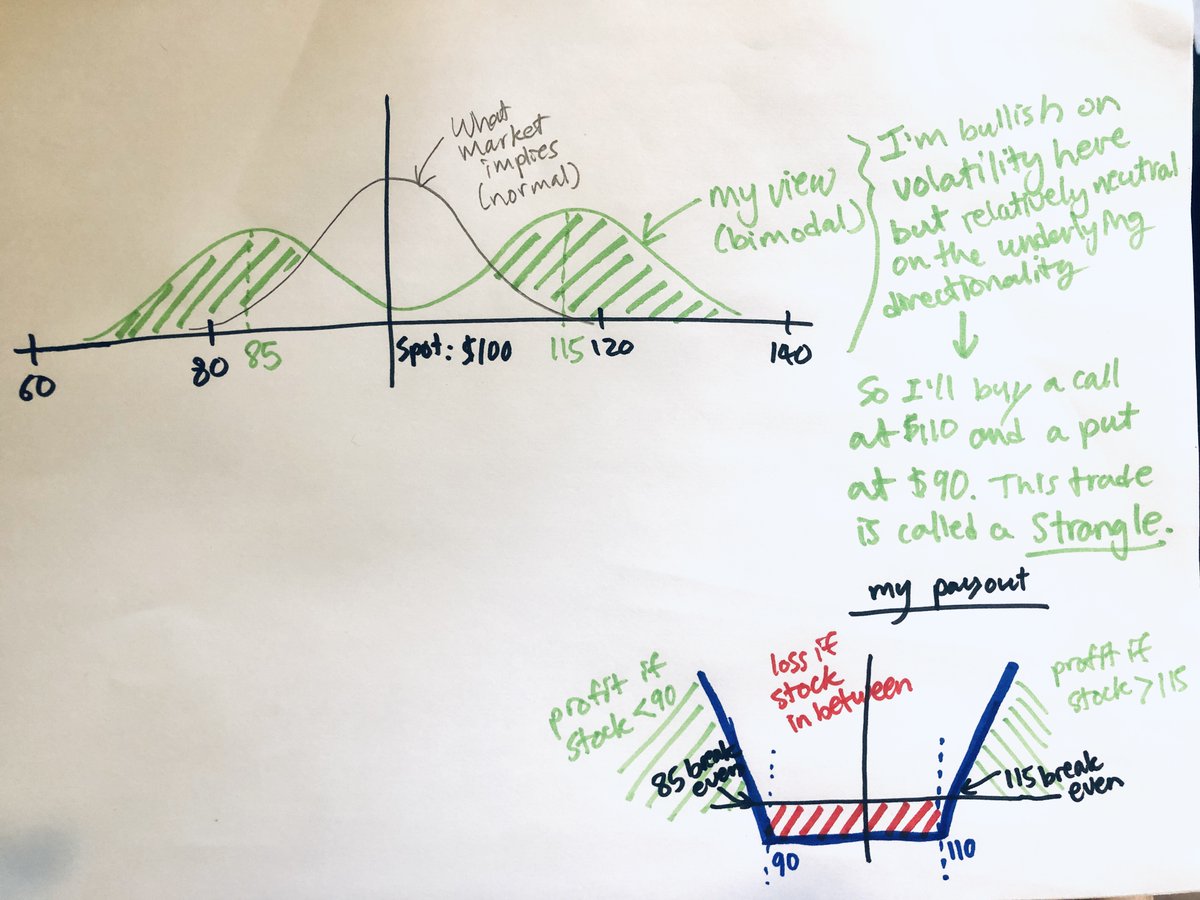

Some other (less common) views require combining multiple calls and puts together. In particular, market neutral views.

e.g.

"Idk if stock will go up or down, but I think move MORE than what market is pricing in!" ➡️ get long volatility by buying both puts and calls

e.g.

"Idk if stock will go up or down, but I think move MORE than what market is pricing in!" ➡️ get long volatility by buying both puts and calls

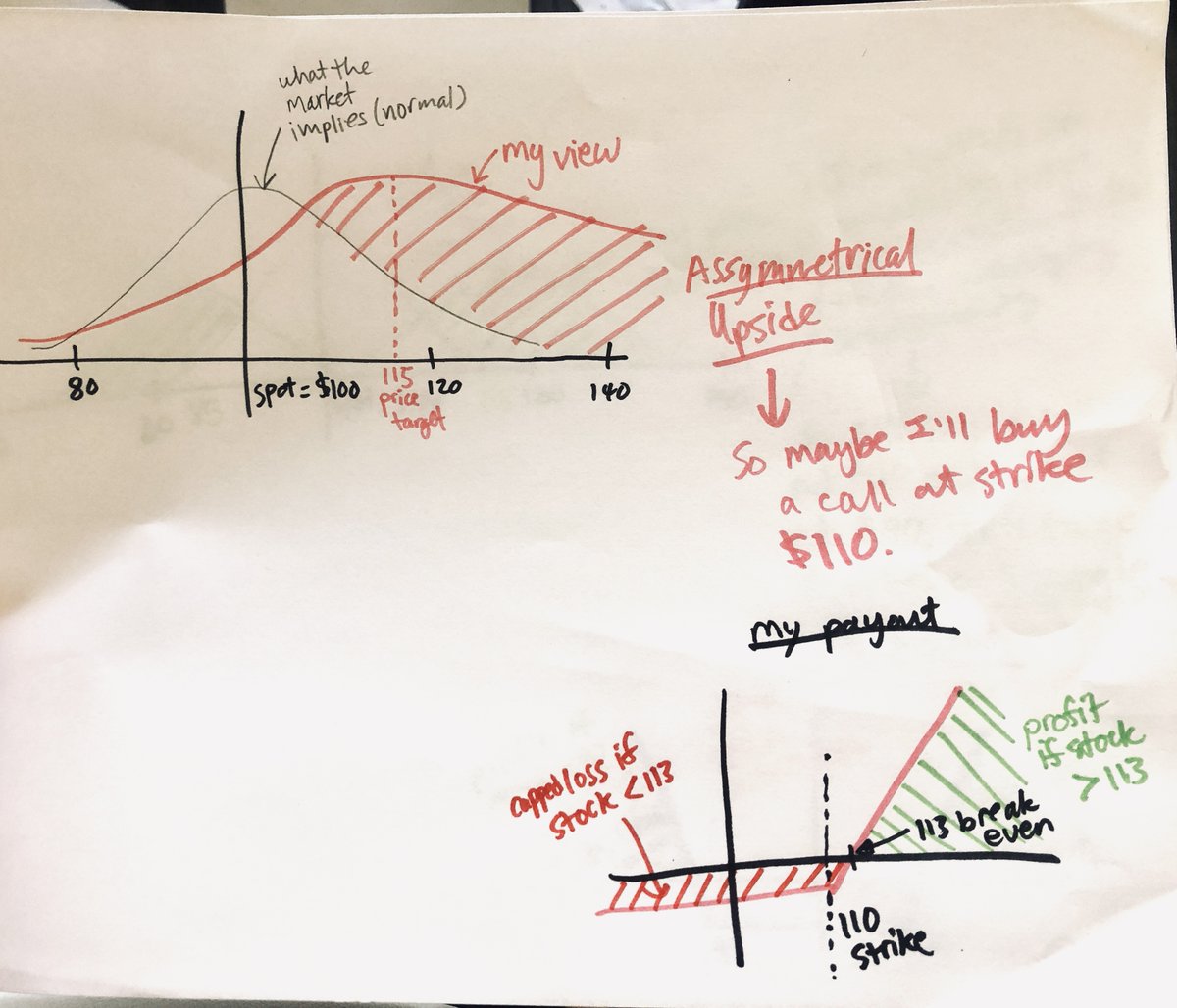

Now, to pick strikes, u want to look at the breakeven associated w/ each strike + the mental probability distribution u drew earlier.

I usually derive a mathematically OPTIMAL strike given my prob distribution but this is overkill.

Let's revisit the examples I drew earlier.

I usually derive a mathematically OPTIMAL strike given my prob distribution but this is overkill.

Let's revisit the examples I drew earlier.

Step 5: Monitor Volatility & Understand Time Value

U placed a trade. Hooray!

But don't think ur done.

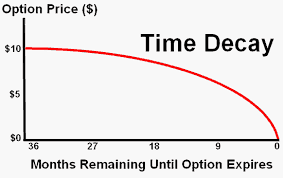

Now u gotta worry about time value decay.

Translation: every stock moves (duh) & the more it moves the likelier it is to hit your strike price in a given time frame. The longer

U placed a trade. Hooray!

But don't think ur done.

Now u gotta worry about time value decay.

Translation: every stock moves (duh) & the more it moves the likelier it is to hit your strike price in a given time frame. The longer

the time frame, the likelier it is to hit your strike price. So over time there's less days/chances for a contract to move in the money. So the price of the contract naturally declines.

When ppl say "TSLA went up, why my calls went down?!" Well here's why. Understand time value.

When ppl say "TSLA went up, why my calls went down?!" Well here's why. Understand time value.

From the moment u BUY an option, ur kinda swimming against the tides of time. (i.e. the market needs to change its mind about XYZ stock in major ways big enough to offset the time value of your option, which you will eventually lose entirely at expiry).

Step 6: Decide on Exit Conditions

Every day ur holding a position, u should reassess whether ur remaining conviction (about the market changing its mind to agree with ur world view) is still greater than ur remaining time til expiry.

If yes, hodl.

If no, sell/unwind to close.

Every day ur holding a position, u should reassess whether ur remaining conviction (about the market changing its mind to agree with ur world view) is still greater than ur remaining time til expiry.

If yes, hodl.

If no, sell/unwind to close.

If ur already in-the-money and/or green (i.e. market consensus has already shifted in agreement w/ u) then u need to consider how much more steam ur position's got.

- Is the market still updating in ur favor?

If yes, hodl.

- Was ur original PT hit?

If yes, sell/unwind to close.

- Is the market still updating in ur favor?

If yes, hodl.

- Was ur original PT hit?

If yes, sell/unwind to close.

Don't ever exercise early because you'd be leaving $ on the table. Whether ur position is -90% in the hole or +400%, that options contract in ur hand still has >0 time value!!! So if u sell/buy to close, u recoup the entire time value. If u early exercise, u lose all of it.

End/

This was a very brief intro (for beginners) on how to correctly think about options & approach trading.

Summary:

- stop memorizing definitions

- options (like any asset) are just tools to express ur market view; knowing clearly ur view is #1 priority

- understand time value

This was a very brief intro (for beginners) on how to correctly think about options & approach trading.

Summary:

- stop memorizing definitions

- options (like any asset) are just tools to express ur market view; knowing clearly ur view is #1 priority

- understand time value

I plan to write a follow-up post tomorrow diving deeper on topics like:

- implied volatility

- my BEST options trades (what went right)

- my WORST trades (what i did wrong)

- corporate options trading

Please DM me if you have additional suggestions / topics u want me to include!

- implied volatility

- my BEST options trades (what went right)

- my WORST trades (what i did wrong)

- corporate options trading

Please DM me if you have additional suggestions / topics u want me to include!

UPDATE: here it is

- 📈my biggest winner

- 📉my biggest loser

- 📈my biggest winner

- 📉my biggest loser

https://twitter.com/FabiusMercurius/status/1472662607832096768

• • •

Missing some Tweet in this thread? You can try to

force a refresh