what does balance sheet of central bank w deeply unconventional approach to financial globalisation look like?

@CentralBank_TR Turkey: no capital controls/interest rates to contain non/resident outflows, instead burn fx reserves and failing to contain TRY depreciation 1/n

@CentralBank_TR Turkey: no capital controls/interest rates to contain non/resident outflows, instead burn fx reserves and failing to contain TRY depreciation 1/n

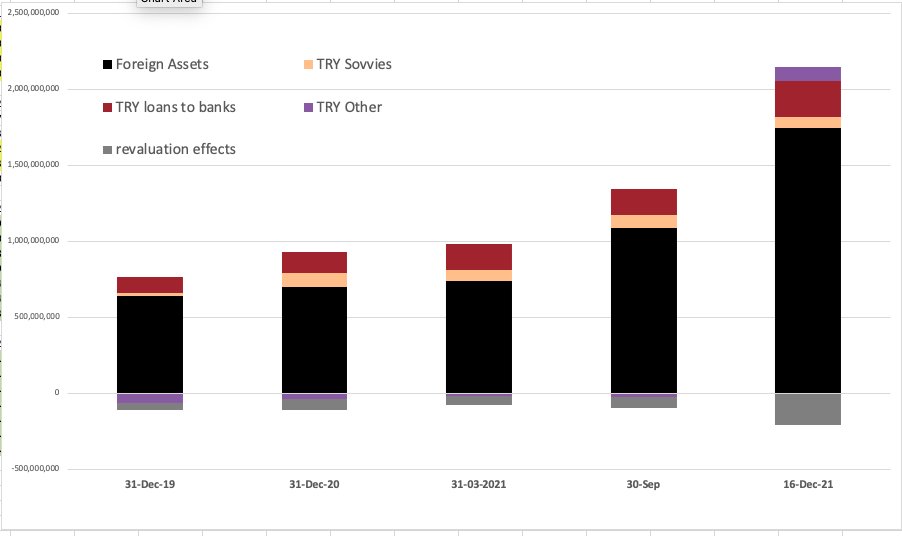

asset side looks familiar to students of EM:

the action in foreign assets, while traditional business of central banks - issuing reserves to banking system - around 15% of assets, and outright ownership of TRY sovvies negligible

the action in foreign assets, while traditional business of central banks - issuing reserves to banking system - around 15% of assets, and outright ownership of TRY sovvies negligible

the 'Foreign Assets' rubric is a big black box:

other EM cbs typically report Net Foreign Assets so things like cb fx swaps are accounted but clearly not here

other EM cbs typically report Net Foreign Assets so things like cb fx swaps are accounted but clearly not here

https://twitter.com/aksoyibrahim/status/1469223639518175232?s=20

any EM central bank w large fx reserves would accumulate them by purchasing USD/EUR from local exporters/banks (large capital inflows) & pay in local cb reserves or base money

so it's liabilities side would have either bank reserves or sterilization instruments

not Turkey cb

so it's liabilities side would have either bank reserves or sterilization instruments

not Turkey cb

Turkey's cb borrows USD/EUR from banks, state and non-residents (unclear if official like Emirates or private).

quite remarkable how much of TRY defence effort is conducted with local banks' fx reserves (and how vulnerable to residents withdrawing deposits CBRT is)

quite remarkable how much of TRY defence effort is conducted with local banks' fx reserves (and how vulnerable to residents withdrawing deposits CBRT is)

if @Brad_Setser were active here he'd clarify mystery of negative open market operations (OMOs) position

really struggling to get my head around negative central bank liability - is it accounting for CBRT's fx swaps?

but why negative if on asset side it increases fx reserves?

really struggling to get my head around negative central bank liability - is it accounting for CBRT's fx swaps?

but why negative if on asset side it increases fx reserves?

OMOs typically conducted to adjust supply of bank reserve:

- repo loan increases reserves

- sterilizations of fx interventions trigger adjustments on liabilities side: lower reserves account, increase reverse repo/cb debt, certificate of deposits etc

but negative OMOs???

- repo loan increases reserves

- sterilizations of fx interventions trigger adjustments on liabilities side: lower reserves account, increase reverse repo/cb debt, certificate of deposits etc

but negative OMOs???

you'll say accounting tricks, but every accounting trick needs some conceptual reasoning behind, and I cannot imagine how I'd explain negative liabilities to my students

a promise to pay that is actually promise to receive but not an asset? one for @i_aldasoro & BIS colleagues

a promise to pay that is actually promise to receive but not an asset? one for @i_aldasoro & BIS colleagues

also, how do counterparties to those negative OMOs record them on their balance balance sheet?

a negative asset?

a negative asset?

of course, balance sheets alone wont tell you much about daily fx management strategy - but it does tell us something about structural vulnerabilities (and crazy accounting)

https://twitter.com/DanielaGabor/status/1471799758004133890?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh