My BEST and WORST Options Trades

And the BIGGEST lessons I learned from them in 2021

(Part 2 of A Crash Course on How To Properly Trade Options)

🧵/

👇

And the BIGGEST lessons I learned from them in 2021

(Part 2 of A Crash Course on How To Properly Trade Options)

🧵/

👇

1/ WORST TRADE

March 4, Thursday.

Market been stuck in a 1+ week doldrum.

Some rumblings of sectoral rotation out of tech.

Vaccine rollouts still dubious.

Shipping routes still jammed as hell.

I bought a 40-delta front month put on $SNOW (bellwhether for frothy tech sector)

March 4, Thursday.

Market been stuck in a 1+ week doldrum.

Some rumblings of sectoral rotation out of tech.

Vaccine rollouts still dubious.

Shipping routes still jammed as hell.

I bought a 40-delta front month put on $SNOW (bellwhether for frothy tech sector)

March 8, Monday.

$SNOW plummets 15% to $213 on practically no news, crossing my price target.

My PnL is +90% and I'm like "WOW I'M A GENIUS! What else is a landmark for frothiness?"

Tesla.

😭

I closed out SNOW & rolled into some front-month at-the-money puts on TSLA.

RIP. 🪦

$SNOW plummets 15% to $213 on practically no news, crossing my price target.

My PnL is +90% and I'm like "WOW I'M A GENIUS! What else is a landmark for frothiness?"

Tesla.

😭

I closed out SNOW & rolled into some front-month at-the-money puts on TSLA.

RIP. 🪦

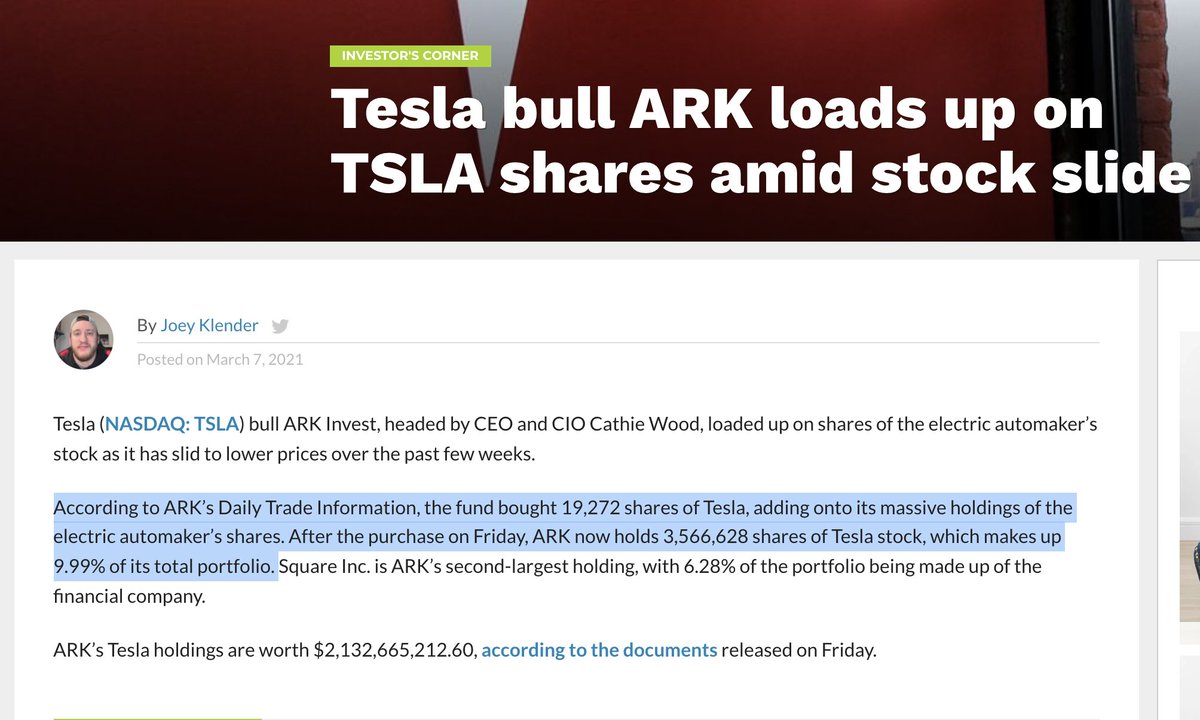

2/ Lesson #1: BEWARE OF WHALES

March 9, Tuesday.

$TSLA jumps $560 -> $660 after a 5-day slide.

I'm -$7K from that ONE FUCKING TRADE!

What happened?

- I'd forgotten about Cathie Wood & her tendency to swoop in with ARKK after a multi-day TSLA bloodbath

- I wasn't whale-tracking

March 9, Tuesday.

$TSLA jumps $560 -> $660 after a 5-day slide.

I'm -$7K from that ONE FUCKING TRADE!

What happened?

- I'd forgotten about Cathie Wood & her tendency to swoop in with ARKK after a multi-day TSLA bloodbath

- I wasn't whale-tracking

3/ LESSON #2: Know what the market has already priced in

Everyone's got that friend ("Joe") & if Joe's talking about It, then It is done.

- When Joe's googling web3, u gotta sell Bitcoin. Like ASAP.

- When Joe's murmuring inflation, the Fed's already hiked rates. Like yesterday.

Everyone's got that friend ("Joe") & if Joe's talking about It, then It is done.

- When Joe's googling web3, u gotta sell Bitcoin. Like ASAP.

- When Joe's murmuring inflation, the Fed's already hiked rates. Like yesterday.

A trader's biggest fear is that HE IS JOE, the village idiot, the last to know!

I was Joe on my last TSLA trade. The fact that it'd already fallen -33% last month (it was trading ~$850 on Feb 9) meant that most bears had already placed their trades.

I was the last bear. 🐻😭

I was Joe on my last TSLA trade. The fact that it'd already fallen -33% last month (it was trading ~$850 on Feb 9) meant that most bears had already placed their trades.

I was the last bear. 🐻😭

So far, none of my lessons are specific to options-trading. That's not a coincidence!

OPTIONS TRADING IS JUST LEVERED STOCK TRADING.

With minor caveats:

- IV

- time value decay

- nonlinear payouts

But at the end of the day everything boils down to expectations investing.

OPTIONS TRADING IS JUST LEVERED STOCK TRADING.

With minor caveats:

- IV

- time value decay

- nonlinear payouts

But at the end of the day everything boils down to expectations investing.

4/ Lesson #3: Understand IV (implied volatility)

Just like stocks can be undervalued/"cheap" or overvalued/"rich", so can options.

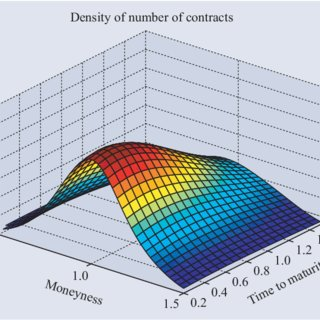

When most people learn options for the 1st time & get to the chapter about implied volatility, they come across something like this:

Gross. 🧮

Just like stocks can be undervalued/"cheap" or overvalued/"rich", so can options.

When most people learn options for the 1st time & get to the chapter about implied volatility, they come across something like this:

Gross. 🧮

As much as I love g(r)eeking out about math, nonsensical integrals are NOT USEFUL for trading.

A USEFUL and SIMPLE way to think about IV is: a proxy for price.

The higher the IV of a stock, the more expensive all of its options series will be. The lower the IV, the cheaper.

A USEFUL and SIMPLE way to think about IV is: a proxy for price.

The higher the IV of a stock, the more expensive all of its options series will be. The lower the IV, the cheaper.

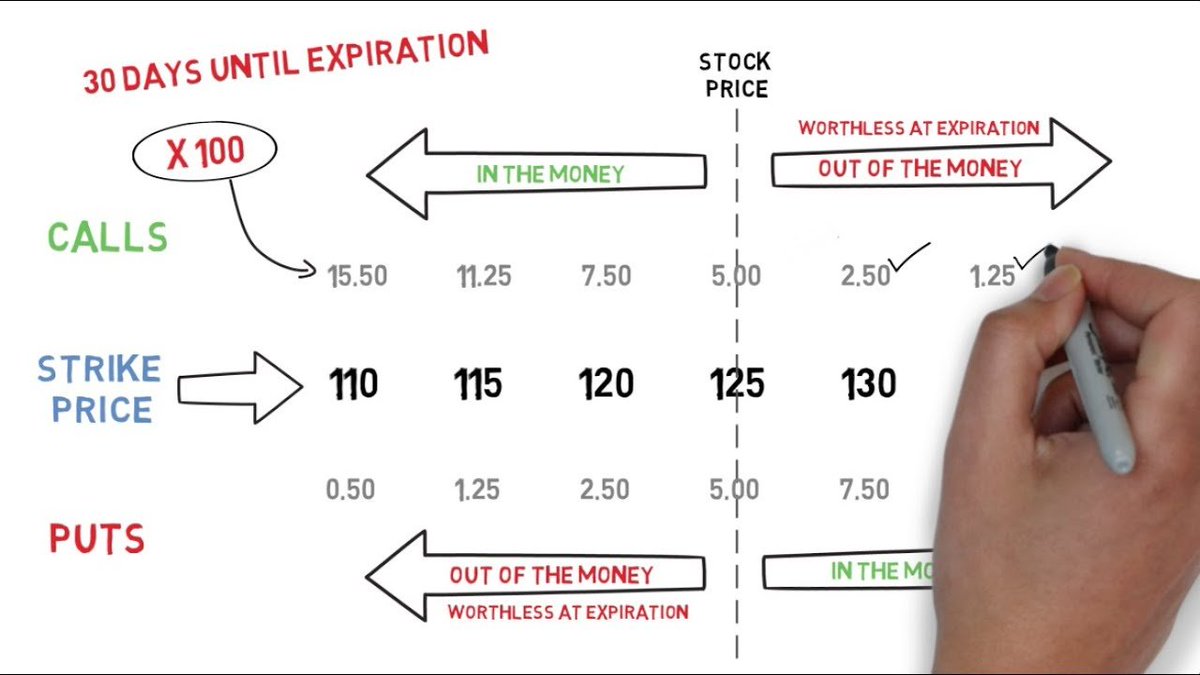

What makes for an expensive (high IV) option?

First, a basic truth:

The more a stock moves the more likely it is to hit any price target above/below current price.

Therefore:

The more a stock moves the more attractive its OTM (out of money) options. Attractive 🔜 expensive.

First, a basic truth:

The more a stock moves the more likely it is to hit any price target above/below current price.

Therefore:

The more a stock moves the more attractive its OTM (out of money) options. Attractive 🔜 expensive.

Factors that lead to expensive (high IV) options:

- "meme-ness" (e.g. $GME, $AMC, $TSLA, $ROKU)

meme stocks' prices moves around a lot so their IV is high; a 15% OTM call/put on any of these names will be more expensive than a 15% OTM call/put on a stable name like JNJ

- news

- "meme-ness" (e.g. $GME, $AMC, $TSLA, $ROKU)

meme stocks' prices moves around a lot so their IV is high; a 15% OTM call/put on any of these names will be more expensive than a 15% OTM call/put on a stable name like JNJ

- news

- catalyst events (e.g. earnings)

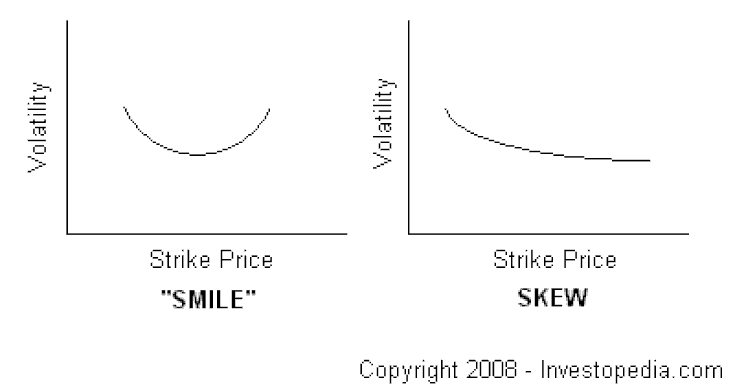

- moneyness

At-the-money options often have lower IV than OTM options because of the market's ambient fear (people consistently demand lower-strike puts for crash protection, so those get bid up). This leads to a "volatility skew" in equities.

- moneyness

At-the-money options often have lower IV than OTM options because of the market's ambient fear (people consistently demand lower-strike puts for crash protection, so those get bid up). This leads to a "volatility skew" in equities.

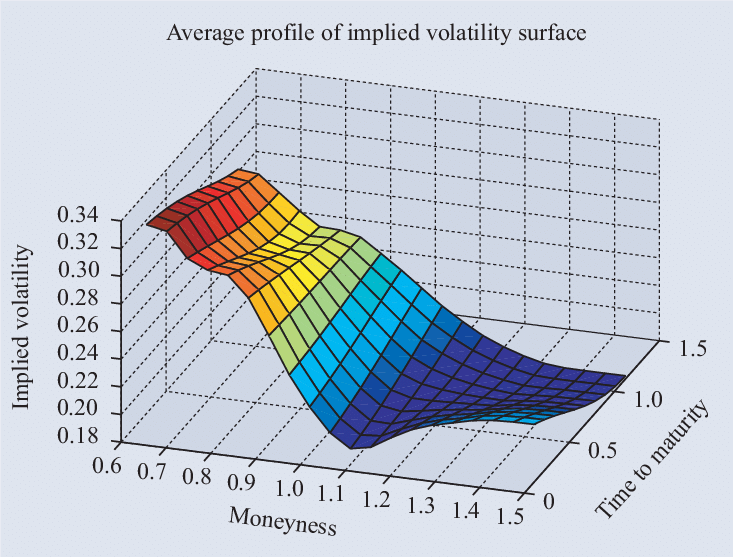

- time to maturity

Longer-dated options (that expire many months out) always have lower IV than near-term options. This is b/c traders trade them less, since they have less info about the far future & thus bet on/ bid up near-term IV.

Graphs below show IV vs time to maturity.

Longer-dated options (that expire many months out) always have lower IV than near-term options. This is b/c traders trade them less, since they have less info about the far future & thus bet on/ bid up near-term IV.

Graphs below show IV vs time to maturity.

5/ Lesson #4: Know your exit conditions & STICK TO THEM.

This one saved my ass on $SNOW. My thesis had been to play on what George Soros calls the "twilight period" in his model of a boom-bust cycles, albeit on a micro-scale & only for one stock.

I set my PT to -15% and exited.

This one saved my ass on $SNOW. My thesis had been to play on what George Soros calls the "twilight period" in his model of a boom-bust cycles, albeit on a micro-scale & only for one stock.

I set my PT to -15% and exited.

For more on George Soros's boom-bust cycle and what defines the "twilight period" as well as each of the other periods, read:

https://twitter.com/FabiusMercurius/status/1387540429520793600

6/ Lesson #5: Don't make emotionally-driven trades

Confession: I bought those TSLA puts b/c I WANTED the stock to go down, not because I had strong fundamental reasons why I thought it would drop further.

When traders lack real reasons, they say "ah, I'm playing on sentiment."

Confession: I bought those TSLA puts b/c I WANTED the stock to go down, not because I had strong fundamental reasons why I thought it would drop further.

When traders lack real reasons, they say "ah, I'm playing on sentiment."

7/ BEST TRADE

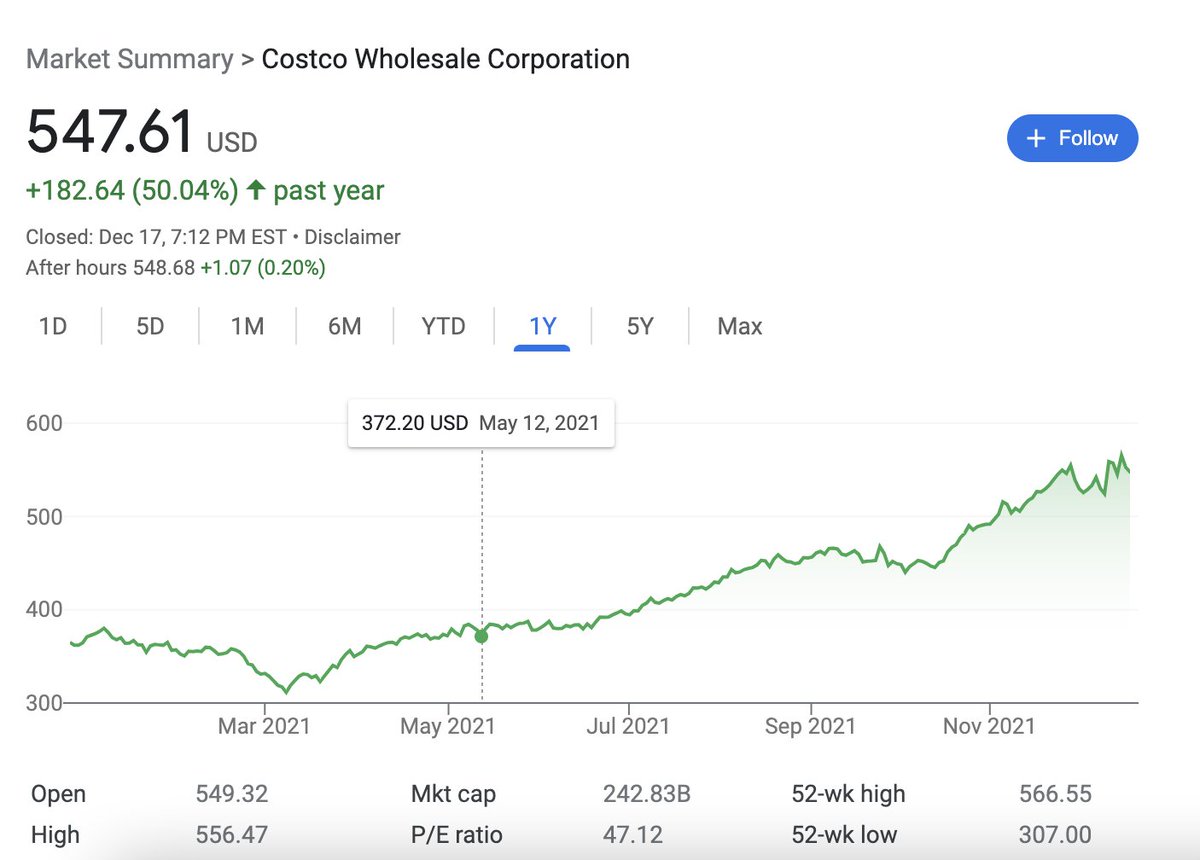

May 12, Wed.

The market is freaking out about INFLATION!

CPI news had just come out. 4.2%!

Consumer discretionary sector slid -3.3% in 1 day.

I wrote an analysis on inflation (below) & at the same time bought some Dec 17 Costco ATM calls.

May 12, Wed.

The market is freaking out about INFLATION!

CPI news had just come out. 4.2%!

Consumer discretionary sector slid -3.3% in 1 day.

I wrote an analysis on inflation (below) & at the same time bought some Dec 17 Costco ATM calls.

https://twitter.com/fabiusmercurius/status/1392652246312128514

$COST is now up >50% since early May.

They're crushing it b/c COVID:

- people stuck @ home gotta buy staple goods in bulk

- deliveries worldwide all jammed up

- inflation means $COST raises prices across the board

I set my PT at +30% ($480) then bought $370-strike calls at $23.2

They're crushing it b/c COVID:

- people stuck @ home gotta buy staple goods in bulk

- deliveries worldwide all jammed up

- inflation means $COST raises prices across the board

I set my PT at +30% ($480) then bought $370-strike calls at $23.2

Summer comes & passes.

Thanksgiving comes & passes.

The stock starts rising steadily, easily crosses my 480 PT, while my calls shoot up 100%, then 200%, 300%...

I was so tempted to take profit.

But I was sure $COST would crush Q1 '22 earnings.

So I revised PT up to $530. HODL.

Thanksgiving comes & passes.

The stock starts rising steadily, easily crosses my 480 PT, while my calls shoot up 100%, then 200%, 300%...

I was so tempted to take profit.

But I was sure $COST would crush Q1 '22 earnings.

So I revised PT up to $530. HODL.

Dec 9, Thurs.

COST reports Q1 '22 earnings.

Total revenues rose 16.5% YoY to $50.3B, beating consensus. Membership fee revenues rose 9.9% YoY.

Stock surges from $520 to $555.

I sold my puts to close at $175 for a +750% gain.

COST reports Q1 '22 earnings.

Total revenues rose 16.5% YoY to $50.3B, beating consensus. Membership fee revenues rose 9.9% YoY.

Stock surges from $520 to $555.

I sold my puts to close at $175 for a +750% gain.

8/ Lesson #6: Know your exit conditions, but also ADAPT THEM WITH NEW INFORMATION

My quant friends tend to "not play catalysts, but instead play their after-effects." This is cuz there's way more data after vs before a major event. And their edge is adapting quickly to new data.

My quant friends tend to "not play catalysts, but instead play their after-effects." This is cuz there's way more data after vs before a major event. And their edge is adapting quickly to new data.

End/

These are the top lessons I learned making my best and worst options trades in 2021.

Stay tuned for more 🧵s on COMMONLY MISUNDERSTOOD principles of options trading like:

- how to (properly) think about Greeks

- how to mind-read market consensus based on options chain data

These are the top lessons I learned making my best and worst options trades in 2021.

Stay tuned for more 🧵s on COMMONLY MISUNDERSTOOD principles of options trading like:

- how to (properly) think about Greeks

- how to mind-read market consensus based on options chain data

• • •

Missing some Tweet in this thread? You can try to

force a refresh