What blockchain maxis & critics both get wrong-- crypto revolution is in fact NOT about tech.

It's a revolution about how we organize the economy. This is tech agnostic & may or may not involve blockchain.

Understanding this will help you make better investments. Here’s how 👇

It's a revolution about how we organize the economy. This is tech agnostic & may or may not involve blockchain.

Understanding this will help you make better investments. Here’s how 👇

Many bitcoin OGs missed Ethereum, not realizing the power of smart contracts.

Many Ethereum OGs missed Solana, Avalanche, etc, not realizing the power of cheap, fast transactions. Many alt L1 OGs—just wait for it— will miss the next big thing, whatever it is.

Many Ethereum OGs missed Solana, Avalanche, etc, not realizing the power of cheap, fast transactions. Many alt L1 OGs—just wait for it— will miss the next big thing, whatever it is.

All these misses have one thing in common— a fundamental misunderstanding of what makes crypto revolutionary.

The crypto revolution is not abt decentralization, cryptography, or resisting censorship.

The crypto revolution is not abt decentralization, cryptography, or resisting censorship.

It’s abt a huge shift in how society organizes its economy & distributes economic outputs.

The value of any technology feature is only proportional to how much it facilitates this shift.

The value of any technology feature is only proportional to how much it facilitates this shift.

Market & corporation are two traditional methods of organizing economic activities & distributing values.

The last major breakthrough in “value distribution technology” happened in the 17th Century when Dutch East India Company invented the 1st “publicly owned” enterprise in history, drastically lowering entry barrier for the mass to get bigger shares of economic pie.

That innovation, among others, triggered increasing diffusion of economic power & more wealth equality. Since then ownership models haven’t changed much.

Yes distribution of economic outputs is more equal than 500 yrs ago, but progress has stalled.

Yes distribution of economic outputs is more equal than 500 yrs ago, but progress has stalled.

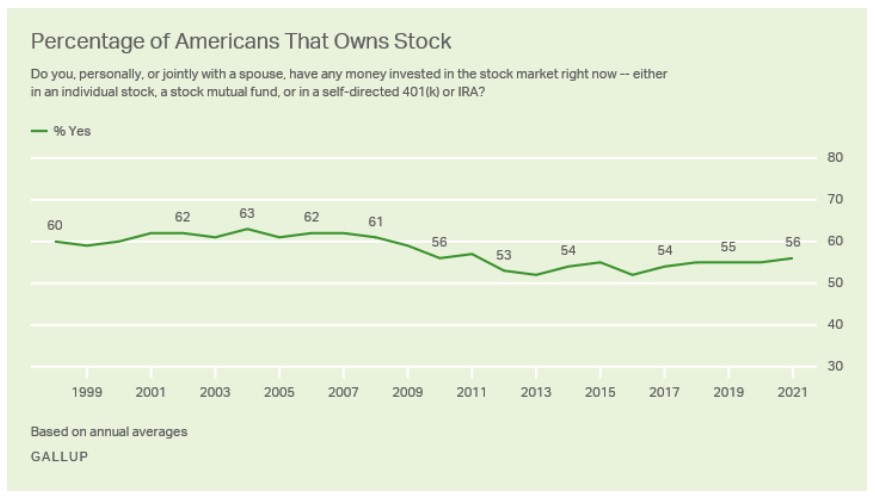

Even in US, country w/ highest share of equity ownership, only half the population owns stocks.

The number has declined since 2008 crisis, esp among younger, lower-income groups.

The number has declined since 2008 crisis, esp among younger, lower-income groups.

Meanwhile wealth inequality is at a generational high for multiple reasons & technology progress has—and will continue to— exacerbate that in many ways.

How to allow more of humanity to participate in & benefit from increasing economic abundance of the world is one of the most pressing problems of our time.

Why is this important to you as an investor?

Why is this important to you as an investor?

Because the real reason that crypto caught on like wild fire is b/c it provided solutions—however tentative— to that problem.

And crypto’s future growth will continue to depend on how well it helps to solve that problem.

And crypto’s future growth will continue to depend on how well it helps to solve that problem.

In other words, the magic power of crypto comes from it being an enabler of *Massive Open Distribution of Economic Values*-- i.e. MODEV.

Bitcoin was the 1st MODEV project in that it allowed a community of people to claim values out of thin air & openly send/receive those values.

Bitcoin was the 1st MODEV project in that it allowed a community of people to claim values out of thin air & openly send/receive those values.

And the censorship resistance / be-your-own-bank meme is brilliant for attracting loyal group of libertarian early adopters.

But if you know that MODEV is the ultimate growth driver, you’d see the bitcoin type of meme has limited mileage— Libertarians are a social minority (7-10% of US adults).

To reach a wider mass you’d need a different message than tech utopian anarchy.

https://twitter.com/TaschaLabs/status/1471651203436085249?s=20

And if you understand MODEV, you’d also see that strong holding is not good for project’s long term growth, as it makes growth benefits disproportionally accrue to OGs— the opposite of more equal value distribution.

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter.)

Similarly, through the MODEV lens you’d see that smart contracts are inevitable cuz they leverage blockchain to allow more ways of MODEV.

You’d see that proof of stake overtaking proof of work is a matter of time, as the former allows economic values of blockchain ecosystems to be distributed to all users w/ the mechanism of staking, i.e. enabling more MODEV, aside from any environmental benefits.

You’d see that projects like Helium, Gala, Render are almost sure bets if executed well, cuz they are essentially MODEV plays in their respective industries.

https://twitter.com/TaschaLabs/status/1471147735965388802?s=20

You’d see that alt L1s were destined to flourish cuz scaling in cost & speed, not decentralization or privacy, is the primary bottleneck right now in enabling more MODEV via blockchain.

Extrapolating forward, you’d see there’re bound to be more waves of exponential MODEV growth & associated investment opportunities to come from new projects.

This is inevitable if crypto is to achieve its historical mission of massive distribution of values to billions of people and bridging old & new economic paradigms.

https://twitter.com/TaschaLabs/status/1471273658941247488?s=20

You’d also see that blockchain is but one of the potential technology vehicles to enable MODEV.

Governments & web2 organizations will employ different techs to leverage MODEV business models once they realize its social benefit & economic power.

Governments & web2 organizations will employ different techs to leverage MODEV business models once they realize its social benefit & economic power.

As an investor evaluating projects, it’s useful to not get carried away by fancy tech claims or clever tokeneconomics.

At the end of day, some of the most important Qs to consider are—

• Does this thing create MODEV in long term?

• Does this thing enable better MODEV than competitors?

• Are there signs that MODEV is happening in this project/platform/protocol & will continue to happen?

• Does this thing create MODEV in long term?

• Does this thing enable better MODEV than competitors?

• Are there signs that MODEV is happening in this project/platform/protocol & will continue to happen?

And if you understand MODEV is the driver, you’d see that being a maxi of anything is overrated.

The industry moves fast and where hyper growth happens will be changing constantly.

You won’t catch every wave but keeping an open mind will allow you to catch more than most others

The industry moves fast and where hyper growth happens will be changing constantly.

You won’t catch every wave but keeping an open mind will allow you to catch more than most others

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts?

Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts?

Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• • •

Missing some Tweet in this thread? You can try to

force a refresh