Good morning, let's just see what's going on in Omicron infections & deaths. First, apparently they are already 75% of cases.

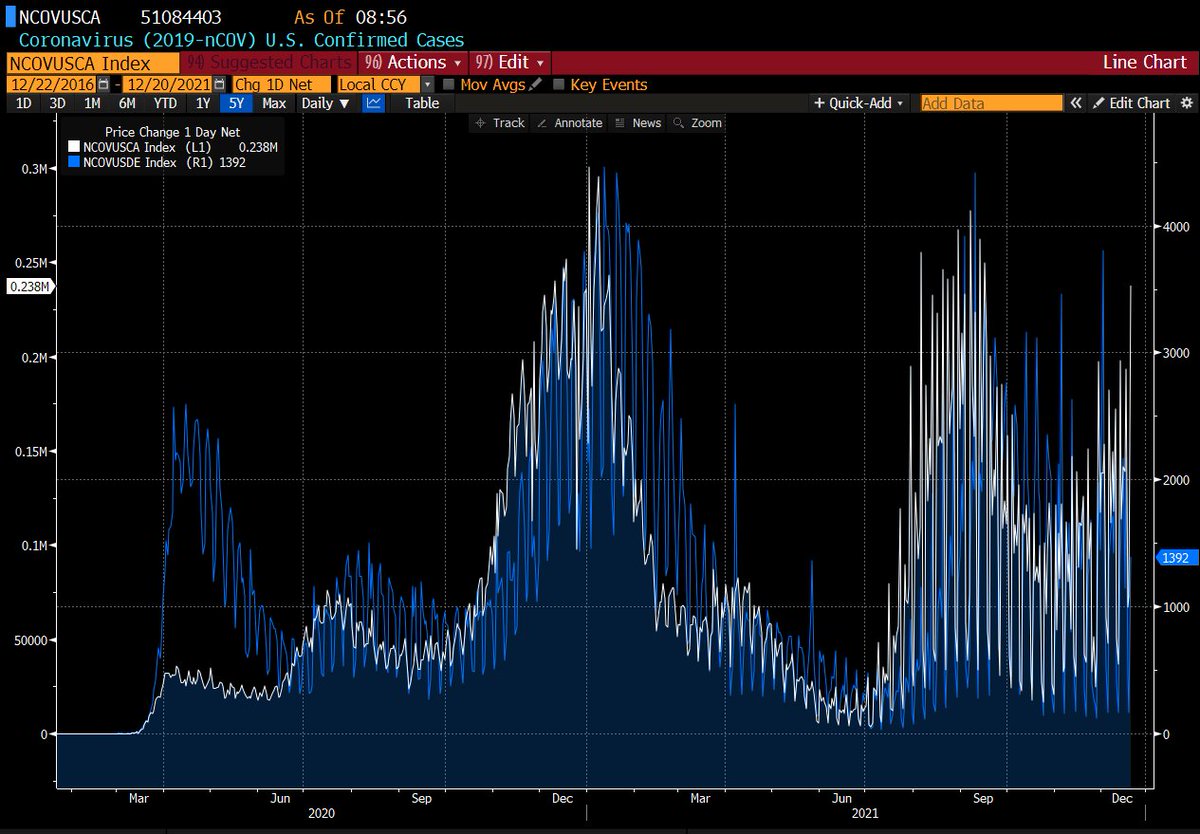

Below is change of US cases & deaths. Note that since end 2020, no lockdowns in the US despite cases/deaths going up & down on Delta and now Omicron.

Below is change of US cases & deaths. Note that since end 2020, no lockdowns in the US despite cases/deaths going up & down on Delta and now Omicron.

The key difference is of course the news coverage of daily cases & deaths: despite being high, the news stops making it a big deal & actually focuses on the vaccinated/unvaccinated.

Meaning, instead of blaming politicians, they now turn on the unvaccinated.

Meaning, instead of blaming politicians, they now turn on the unvaccinated.

Irrespective of who is to blame for this rise of cases (higher infectious nature/seasonality) & deaths, the key point here is this: We will not have lockdown in the US because that is just not the policy flavor at the moment.

There will be targeted shutdowns but no lockdown.

There will be targeted shutdowns but no lockdown.

Note that narrative is important because the data doesn't lie (cases/deaths). What matters is people's APPETITE for such risks. And to manage that, you need to create NORM of what's acceptable. The way to do that is through the news as it creates perception of what's acceptable.

I believe that Omicron is the beginning of the END of Covid-19 because it is so infectious that it will ultimately take over & then we all will either be vaccinated & not get it or the unvaccinated will have antibody from being infected.

That's my silverlining of this chart here

That's my silverlining of this chart here

Here is something for you to be OPTIMISTIC. Look at UK confirmed cases & deaths. Headline: CASES OFF THE CHART. Totally true.

Deaths very low. So no lockdown despite Omicron raging (everyone prolly has it now).

Btw, mobility NOT DOWN that much! Retail is -6% from baseline.

Deaths very low. So no lockdown despite Omicron raging (everyone prolly has it now).

Btw, mobility NOT DOWN that much! Retail is -6% from baseline.

I can't get over how low the deaths are in the UK so far despite the insane case load.

Let me say this again: Omicron is more positive than it seems because it is infectious and not as lethal. This evolution means that we're heading towards the end.

Let me say this again: Omicron is more positive than it seems because it is infectious and not as lethal. This evolution means that we're heading towards the end.

Here is the European Union in case you are interested. Cases & deaths. Trend shows downward momentum. Either way, clearly a surge towards the winter, which has been bad in Europe due to Covid + gas issues.

• • •

Missing some Tweet in this thread? You can try to

force a refresh