🚨 Fed is faced with a 3rd Nuclear Option - It's Bad

The Fed is stuck in the proverbial "Rock n Hard" place. Continue to stimulate and inflation continues 🚀, or pull back and risk massive deleveraging

But there is a 3rd scarier option they are signaling

A Thread 👇

The Fed is stuck in the proverbial "Rock n Hard" place. Continue to stimulate and inflation continues 🚀, or pull back and risk massive deleveraging

But there is a 3rd scarier option they are signaling

A Thread 👇

1/ as the Fed continues to stimulate the markets and keep rates low, asset and price inflation is raging to a 30 year high, and polls are showing a majority of voters say inflation is causing them financial strain

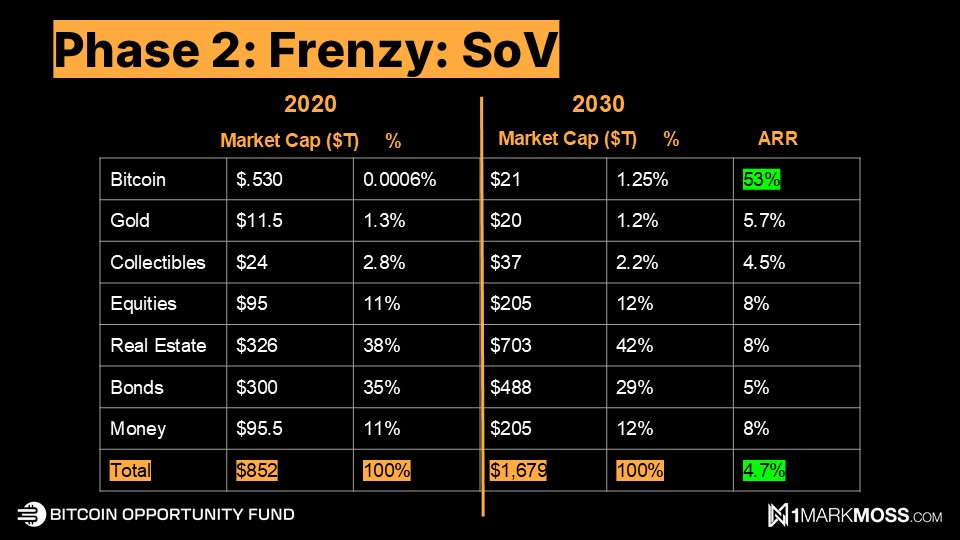

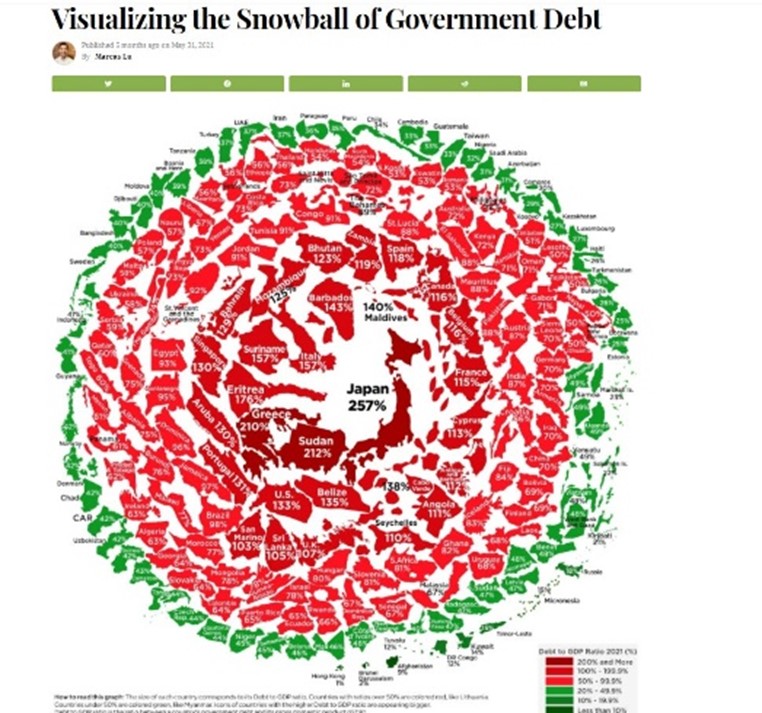

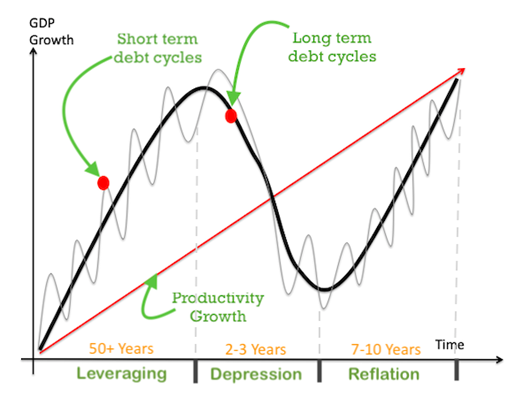

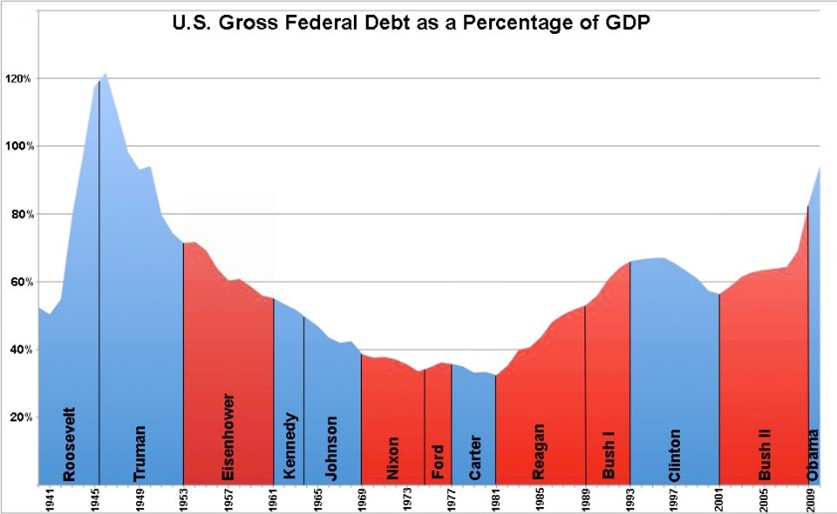

2/ deleveraging is simply not an option. The world has never been more indebted and The Fed is trying to avoid a repeat of the mass deleveraging of the 1930s. The 90% correction in the Dow Jones in 1929 led to the decade-long period known as the great depression.

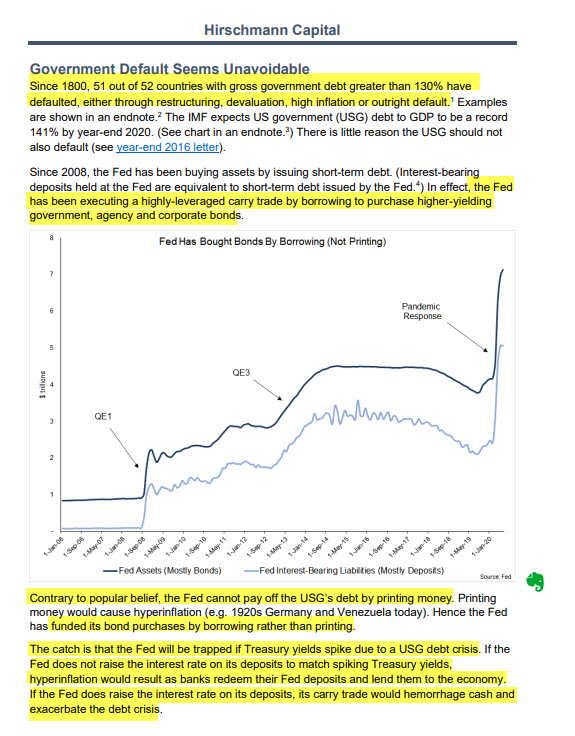

3/ a report by Hirschmann shows since 1800, 51 of 52 countries defaulted on debt within 15yrs reaching debt levels >130% GDP. Default comes through either devaluation, inflation, restructuring, outright nominal default, or an implicit default like 1971 during the Nixon shock.

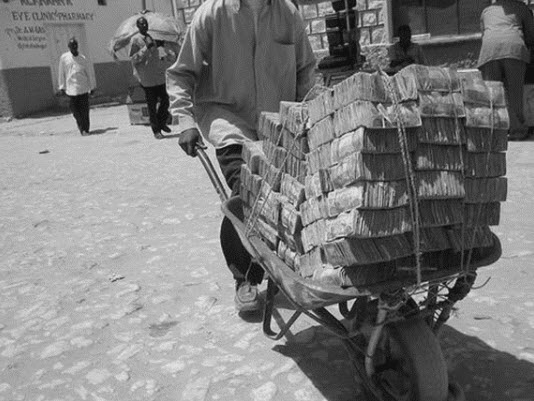

4/ In simple terms, central banks normally choose to default through inflation and currency devaluation. They do this through irresponsible monetary policies, like money printing, which devalues the currency so that they can pay back their massive debts with the devalued dollars

5/ Today the US has appeared to have "Crossed the Rubicon" having just passed 130% debt/GDP. The previous time in history the US had debt levels as high as today was in the 1940s, at the conclusion of the previous 80-year long term debt cycle

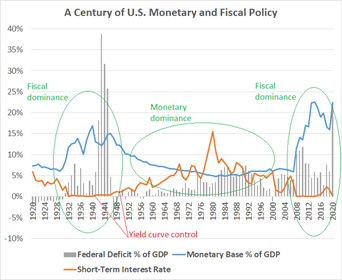

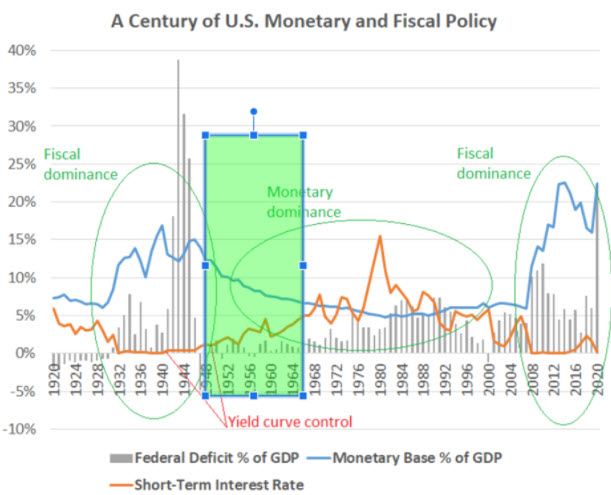

6/ the central bank pegged interest rates to 2.5% for the best part of a decade and broke their independence from the government. This separation of FED and treasury allowed the gov to run large fiscal deficits and enabled them to tackle the enormous debt built up through WW1.

7/ But this inevitably caused significant inflation throughout the 1940’s which devalued the currency and enabled the government to decrease their nominal debt/GDP levels from over 120% in 1945, to below 60% by the 60’s,

8/ The FED is pressured to taper as inflation rages, and Jerome Powell recently announced a plan to taper the $120B/month QE reducing it by a measly $15B/month starting in October, until it reaches 0 in June 2022, where they’d also then look to raise interest rates.

9/ You Can't Taper a Ponzi

The last time Fed tried to taper in 2019 to restore faith in the system, the stock markets reacted and sold off 22% only 2 months into tapering, forcing Jerome Powell to reverse course and prove you ‘’can’t taper a Ponzi scheme’’.

The last time Fed tried to taper in 2019 to restore faith in the system, the stock markets reacted and sold off 22% only 2 months into tapering, forcing Jerome Powell to reverse course and prove you ‘’can’t taper a Ponzi scheme’’.

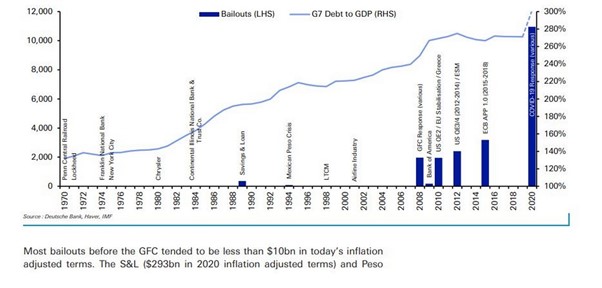

10/ The markets have become reliant on stimulus to remain artificially elevated. The ever-increasing size of bailouts needed and volatility in markets are vital signs that the currency is coming closer to collapse.

11/ I discussed this concept of currency collapses in-depth when talking about the German hyperinflation in this video. 👇

12/ This point of increasing fragility and volatility was further illustrated in early 2020 as the SPY, and stock markets globally had their fastest 30% crash in history.

13/ The 3rd Scary Option:

The surge of Turkey @ Thanksgiving reminded of us the massive inflation, AND IS ALSO THE SIGNAL 🚨 that this 3rd scary option is being considered and could be coming next!

"Sen Warren probes turkey costs soaring"

The surge of Turkey @ Thanksgiving reminded of us the massive inflation, AND IS ALSO THE SIGNAL 🚨 that this 3rd scary option is being considered and could be coming next!

"Sen Warren probes turkey costs soaring"

14/ In the same week Warren has come after corporations over inflation concerns. The FTC is ordering Walmart, Amazon, Kroger and other large wholesalers to turn over information to help study the causes of empty shelves and sky-high prices

15/ At the same time, the media is conditioning us for what comes next. A regular contributor to The Washington Post, Micheline Maynard, has found the solution to the empty shelves.

She says that we have come to expect too much for the economy and "deprivation" is good

She says that we have come to expect too much for the economy and "deprivation" is good

16/ The Gov is signaling they will go with the 3rd more scary option

Its been proven to work 0% of the time, 100% of the time

Its been proven to work 0% of the time, 100% of the time

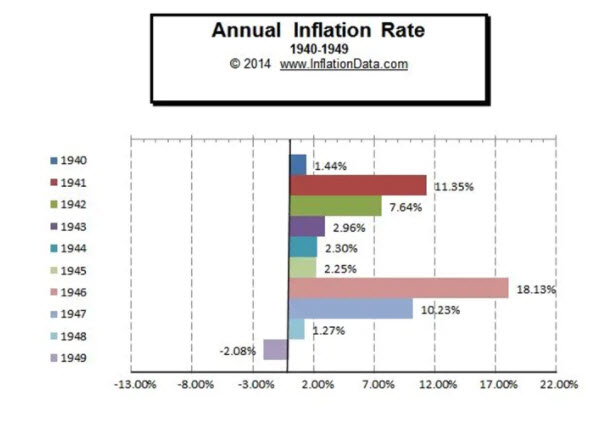

17/ the 1940’s. Policies like YCC and heavy fiscal deficits were tried. 1941 - 1951 inflation across the CPI inflation basket grew 76.4% (5.9% annual) The highest yearly inflation print in that time period was over 18%, felt between 1946-1947.

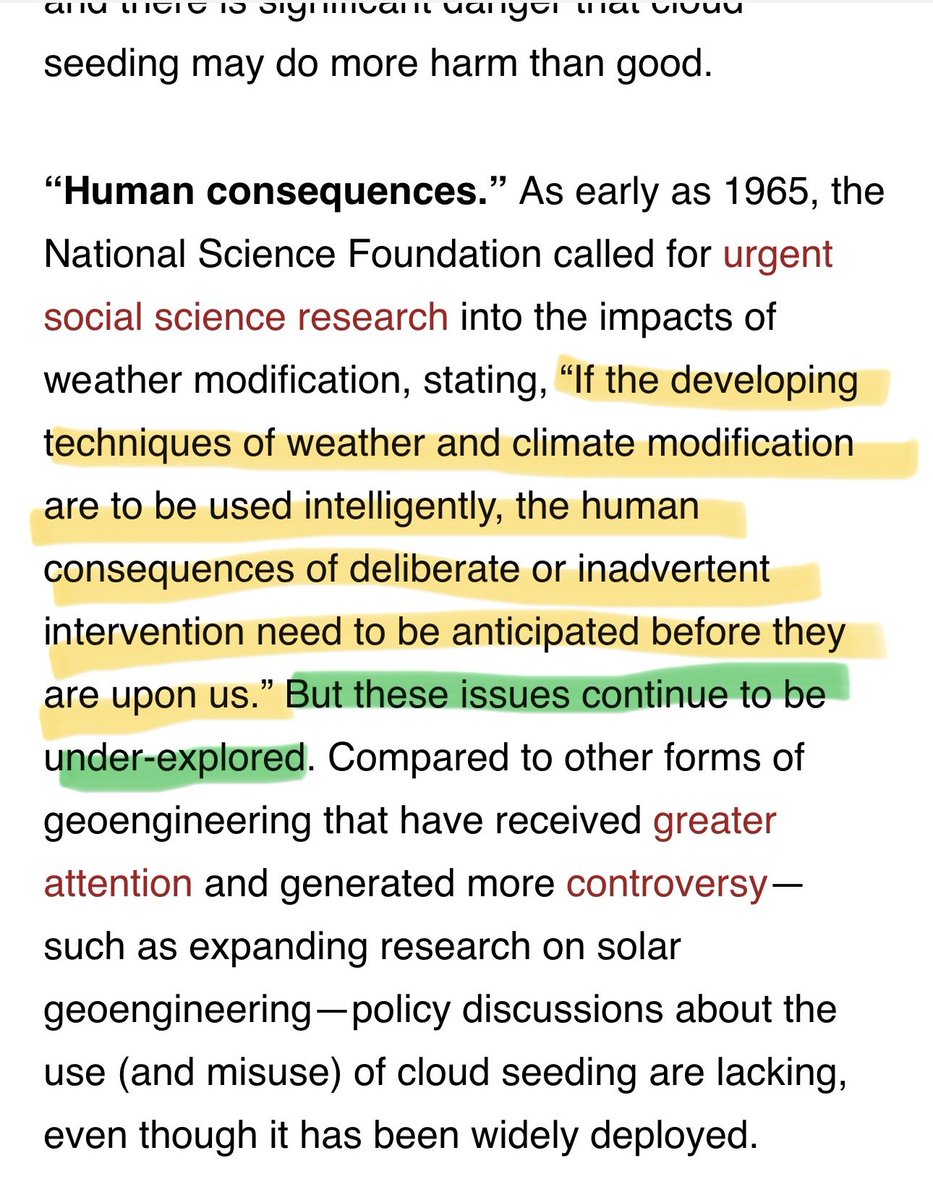

18/ 10% inflation in 1941 led central planners to dp what central planners do. The Office of Price Administration (OPA) was formed to oversee price controls and passed the Emergency Stabilization Act. Many food items and of course gasoline was rationed in the early 1940’s.

19/ The price controls were temporarily lifted in 1946, and used again 1951. Both times price controls led to food shortages as producers had no incentive to produce when their profits were cut. Causing more pain to consumers.

20/ Inflation dissipated in the 1950s as the FED tightened monetary policy. Interest rates were allowed to rise and large fiscal deficits begun to decrease in the early 50’s. This led to 15 years of low inflation, highlighted by the green shaded box

21/ But Fed can't do this again.

Yes #Bitcoin fixes this

to see the full video: 👇

read the article: 👇

bitcoinmagazine.com/markets/2020s-…

please Like and RT

Yes #Bitcoin fixes this

to see the full video: 👇

read the article: 👇

bitcoinmagazine.com/markets/2020s-…

please Like and RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh