1/13 One of the top ways to earn passive income on your idle #cryptocurrency is to supply them into liquidity pools and earn yields from these #liquiditypools.

Here’s a simple illustration from @Uniswap on how liquidity pool works:

Here’s a simple illustration from @Uniswap on how liquidity pool works:

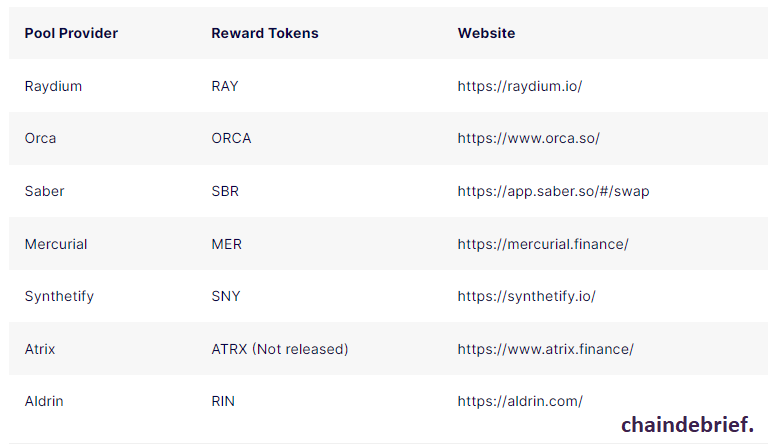

2/13 Here’s a list of #liquiditypool providers or yield farms where you can supply your cryptocurrency into @solana, in order to generate returns on your digital assets.

3/13 A #YieldOptimizer is an automated service that applies algorithmic strategies to obtain maximize yield.

4/13 Here’s a look at the top three farms on the @solana ecosystem with the most Total Value Locked (TVL) 👇

5/13 @RaydiumProtocol

Raydium is the first Automated Market Maker (AMM) on Solana with over US$1.7 billion in TVL and $US 37 billion in trading volume.

Raydium is the first Automated Market Maker (AMM) on Solana with over US$1.7 billion in TVL and $US 37 billion in trading volume.

6/13 It is by far the most established AMM on @solana and is leading by a large margin.

https://twitter.com/SBF_FTX/status/1363733194319622146?s=20

7/13 The issue with traditional AMMs is that users can only trade with the protocol’s native liquidity pool. @RaydiumProtocol is able to solve this issue as it leverages on a decentralised central limit order book.

8/13 As a well-established AMM with high TVL, @RaydiumProtocol's farm is still able to produce attractive APR.

9/13 @orca_so

10/13 Unlike conventional Decentralised Exchanges (DEXs), @orca_so is a human-centred #DEX. It prides itself on being user-friendly through its simple yet informative interface.

11/13 To start, users would just have to deposit a liquidity pair on the #Aquafarms. Liquidity providers would start earning a share of the trading fees and $ORCA.

12/13 @Saber_HQ

Saber started off as a low slippage AMM, StableSwap, and was revamped and transformed into @solana's leading cross-chain AMM.

Saber started off as a low slippage AMM, StableSwap, and was revamped and transformed into @solana's leading cross-chain AMM.

13/13 Its cross-chain liquidity network allows users to transfer assets between @solana and other blockchains.

Read more about Solana Yield Farms on: chaindebrief.com/full-list-of-y…

• • •

Missing some Tweet in this thread? You can try to

force a refresh