SWING TRADING STRATEGY FOR RANGE BOUND STOCKS

A Thread :

Using Concept of Support and Resistance

Using Minimum StopLoss

Retweet And Share !

1/n

A Thread :

Using Concept of Support and Resistance

Using Minimum StopLoss

Retweet And Share !

1/n

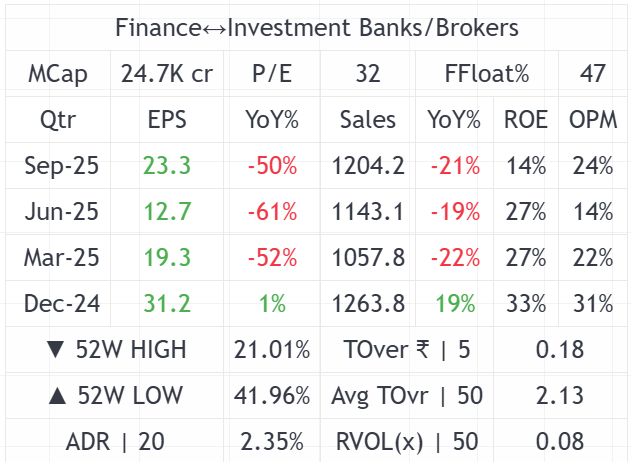

THESIS:

📌We are looking for stocks that are in consolidation

📌These stocks when hit demand zone provide excellent Risk Reward opportunity

📌These will be all key moving averages hence will not be in momentum

2/n

📌We are looking for stocks that are in consolidation

📌These stocks when hit demand zone provide excellent Risk Reward opportunity

📌These will be all key moving averages hence will not be in momentum

2/n

How to draw?

📌Look for stocks that are in consolidation for a very long time

📌Use Rectangle tool to make a range for the box from high to low of the price

⌛️Keep alerts at higher point of support and Buy when the alerts hit .

📌We are using the simple concept of Support.

3/n

📌Look for stocks that are in consolidation for a very long time

📌Use Rectangle tool to make a range for the box from high to low of the price

⌛️Keep alerts at higher point of support and Buy when the alerts hit .

📌We are using the simple concept of Support.

3/n

Entry Rules :

⏫Entry Should be as close to support as possible

⏬To keep Minimum Stoploss Its Advised to Buy Near support and not in between the range

✅Bigger the consolidation , stronger the support

🛑Can be used for Longer form of trading , and not Swing Trades

4/n

⏫Entry Should be as close to support as possible

⏬To keep Minimum Stoploss Its Advised to Buy Near support and not in between the range

✅Bigger the consolidation , stronger the support

🛑Can be used for Longer form of trading , and not Swing Trades

4/n

STOP LOSS

1. Ideally your stoploss should be max 8% from your buy point

2. The closer you buy near support , the smaller the stoploss

3. Do not buy in between the range as you will get stuck in between for a long time

4. Moving Averages dont work as stoploss in sideways

5/n

1. Ideally your stoploss should be max 8% from your buy point

2. The closer you buy near support , the smaller the stoploss

3. Do not buy in between the range as you will get stuck in between for a long time

4. Moving Averages dont work as stoploss in sideways

5/n

TARGETS :

Risk Reward 1:2 will easily be acheived

One can even wait for box breakout

Generally Stoploss in my cases was less than 5% when buy point was accurate hence Reward was > 1:3

6/n

Risk Reward 1:2 will easily be acheived

One can even wait for box breakout

Generally Stoploss in my cases was less than 5% when buy point was accurate hence Reward was > 1:3

6/n

@kuttrapali26 @AnshumanCharts @AmitabhJha3 @Puretechnicals9

@chartworldat @rohanshah619

Join Telegram

t.me/Techno_charts

@chartworldat @rohanshah619

Join Telegram

t.me/Techno_charts

• • •

Missing some Tweet in this thread? You can try to

force a refresh