~ Intraday Algo Options Trader

~ Spreading Knowledge about stocks and finance through YT and X !

(sattebaz according to govt)

Contact :7674007938

23 subscribers

How to get URL link on X (Twitter) App

🔹 Indicator 1: Fundamental Dashboard

🔹 Indicator 1: Fundamental Dashboard

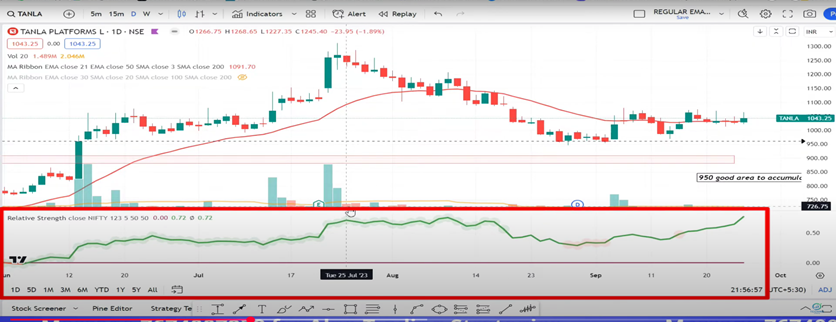

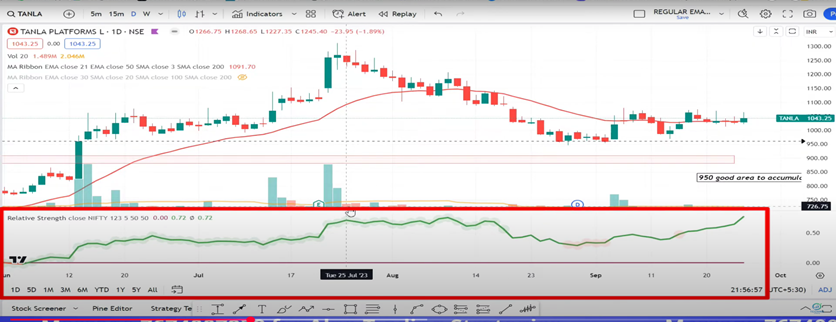

Minervini Trend Template : Filters out sideways or weak stocks.

Minervini Trend Template : Filters out sideways or weak stocks.

📌 What is Relative Strength?

📌 What is Relative Strength?

https://x.com/Mr_Chartist/status/1926639795649794286

We use ATR to calculate the volatility of stock

We use ATR to calculate the volatility of stock