1. Weekend Reading (Special Holiday Edition): "When Does USDA Information Have the Most Impact on Crop and Livestock Markets?" Article published in the Journal of Commodity Markets in 2021. sciencedirect.com/science/articl…

2. Back story on this article centers on the argument by some that the rise of "big data" private sector companies made USDA reports redundant. Putting aside the obvious private incentives of people in big data firms making this argument, it is worth taking seriously.

3. Then Chief Economist of the USDA Rob Johansson asked a group of us to undertake a rigorous investigation of the idea that USDA crop and livestock reports had become redundant in the new "big data" era. We decided to do three different types of tests.

4. I reviewed the first of the three tests in my previous weekend reading thread. That article examined market reaction to the "surprise" component of USDA report information. Here is the link to that paper published in Food Policy in 2019 sciencedirect.com/science/articl…

5. In the second paper and subject of this thread, did the most comprehensive price volatility test of USDA report market impact that I have ever seen. Market reaction to all major USDA reports in corn, soybeans, wheat, cotton, live cattle, and lean hogs over 1985-2018.

6. We could be this comprehensive because all we needed to do was compare price volatility on report to non-report days. No need to have data on pre-report expectations to compute market surprises. I love simplicity and this test is definitely simple.

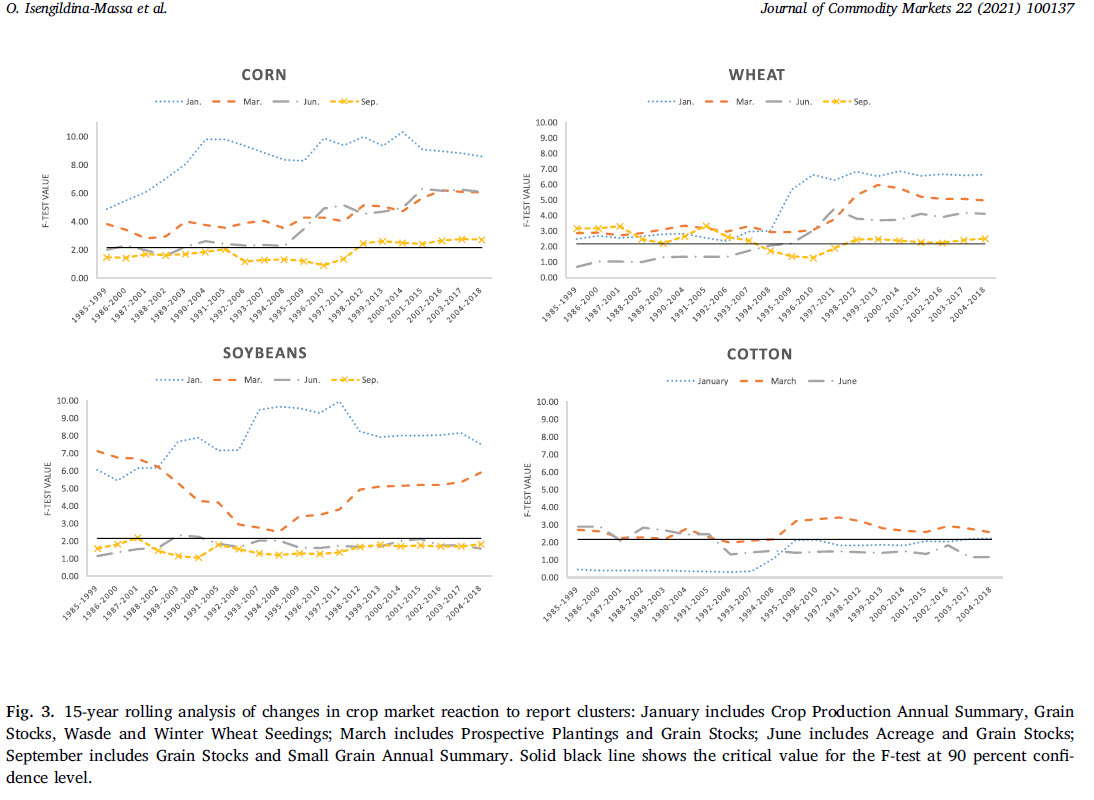

7. Only downside to this method is that some USDA reports released on the same days. So we had to analyze USDA report "clusters" for market impact. This chart summarizes key results nicely. First off, notice how much Jan reports stand out for the grains. Look out Jan 12!

8. Also notice how days with Grain Stock reports and acreage reports in March and June stand out. Big price reactions in grain and cotton markets almost guaranteed on those days.

9. What about declining market reaction to USDA reports over time, which is what the big data people believe? No evidence of declining market price impact over time for USDA grain stocks and acreage reports. If anything, generally INCREASING price impact in recent years.

10. To be fair, some evidence of declining price impact of crop production reports in the four markets. But still a statistically significant price impact in most cases.

11. So, are the big data people right? Are USDA reports redundant? Definitely not true in grains and cotton. Livestock is another story. Take a look and see what you think! sciencedirect.com/science/articl…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh