HOW TO FIND STOCKS THAT ARE OUTPERFORMING THE MARKET ( A Thread🧵)

Please Share and Re-Tweet for wider reach

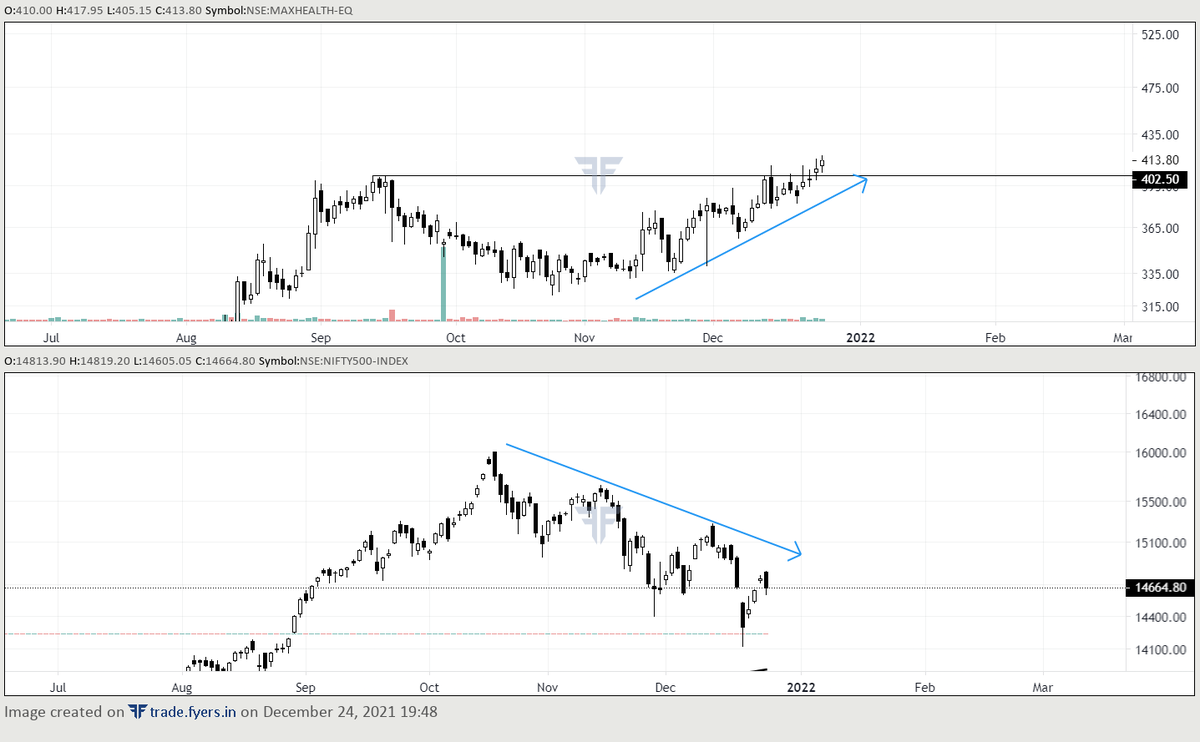

Its very hard to make money in current environment as most of the stocks are down 20-30% and Index itself is making Lower High and Lower Low.

Continued....

Please Share and Re-Tweet for wider reach

Its very hard to make money in current environment as most of the stocks are down 20-30% and Index itself is making Lower High and Lower Low.

Continued....

So we're gonna try to find stocks that are outperforming the market and will help us make some money using the concept of RELATIVE STRENGTH.

So what is Relative Strength?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

So what is Relative Strength?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

So basically in simple terms it means look for stocks that are moving in the opposite direction or not falling as compared to index.

So basically in simple terms it means look for stocks that are moving in the opposite direction or not falling as compared to index.

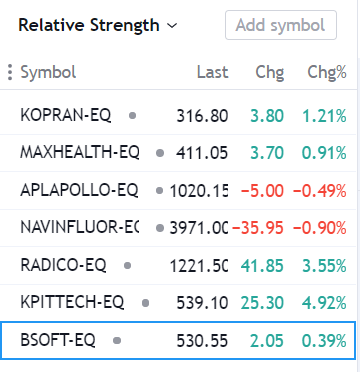

First and the foremost thing I like to do is sort things out.

What do i mean by that? It simply means creating a watchlist.

For example - Make a watchlist of let's say Nifty 50 and place all the stock present in Nifty 50 index in that specific watchlist.

What do i mean by that? It simply means creating a watchlist.

For example - Make a watchlist of let's say Nifty 50 and place all the stock present in Nifty 50 index in that specific watchlist.

It makes it easier for me to filter the stocks that are outperforming the market.

You can make many such playlists like I did.

Next thing you should do is get ready for some hard work.

Open every single chart and compare it against the Index.

You can make many such playlists like I did.

Next thing you should do is get ready for some hard work.

Open every single chart and compare it against the Index.

Just like in this case I've plotted Reliance Industries chart against Nifty 50.

As you can see both have a very similar chart, both are in a downtrend and making LH-LL.

Now next step is just repeat the same process over and over again with different charts.

As you can see both have a very similar chart, both are in a downtrend and making LH-LL.

Now next step is just repeat the same process over and over again with different charts.

Soon you will come across few stocks that are moving in the opposite direction of Index or at least not falling, just consolidating in a range.

Just like this one, While the Index was making LH-LL, the stock was making HH-HL.

Just like this one, While the Index was making LH-LL, the stock was making HH-HL.

Next step is to analyze that stock and look if it's forming a structure or not.

Just like in this case, the stock is forming a Saucer pattern and broke out yesterday. Now trading at ATH, at the same time index is down 10%.

Just like in this case, the stock is forming a Saucer pattern and broke out yesterday. Now trading at ATH, at the same time index is down 10%.

Now repeat it over and over again and place such stocks in a new watchlist and wait for the right structure and right time before entering.

Just like I do.

Merely finding a stock moving in opposite direction won't do the job

Just like I do.

Merely finding a stock moving in opposite direction won't do the job

You need to analyze each and every stock separately and see if it's forming any bullish structure and wait for the stock to reach the right pivot point.

• • •

Missing some Tweet in this thread? You can try to

force a refresh